- Home

- »

- Renewable Energy

- »

-

Sucrose Esters Market Size, Share And Growth Report, 2030GVR Report cover

![Sucrose Esters Market Size, Share & Trends Report]()

Sucrose Esters Market (2024 - 2030) Size, Share & Trends Analysis Report By Form (Powder, Liquid, Pellet), By Application (Food, Personal Care, Detergents & Cleaners, Pharmaceuticals) By Region, And Segment Forecasts

- Report ID: GVR-4-68040-459-1

- Number of Report Pages: 60

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sucrose Esters Market Summary

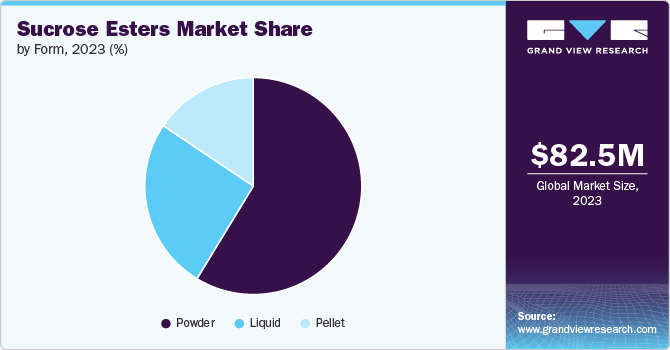

The global sucrose esters market size was estimated at USD 82.50 million in 2023 and is projected to reach USD 116.09 million by 2030, growing at a CAGR of 5.0% in terms of revenue from 2024 to 2030. The sucrose esters market is mainly driven by increasing demand from various industries such as food, personal care, cosmetics, and pharmaceuticals, where it is a crucial component used in their production processes.

Key Market Trends & Insights

- Asia Pacific dominated the market and accounted for a 45.6% share in 2023.

- China dominated the market and accounted for a market share of 38.70% in 2023.

- Based on form insights & trends, the powder segment dominated the market with a market and accounted for a revenue share of 59.1% in 2023.

- In terms of application insights & trends, food products dominated the market with a market and accounted for a revenue share of 69.20% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 82.50 Million

- 2030 Projected Market Size: USD 116.09 Million

- CAGR (2024-2030): 5.0%

- Asia Pacific: Largest market in 2023

Sucrose esters are a type of food additive made from sucrose and fatty acids. They are utilized as emulsifiers, stabilizers, and surfactants in various food and beverage products. Sucrose esters are created by esterifying sucrose with fatty acids derived from vegetable oils such as palm, soybean, and coconut. The esterification of sucrose with fatty acids or glycerides produces non-natural surfactants known as sucrose fatty acid esters.

Drivers, Opportunities & Restraints

The increasing consumer demand for processed and convenient foods is a major driving force for the sucrose esters market. Sucrose esters act as emulsifiers in various food products, improving texture, stability, and shelf life.

Despite their many benefits, the high production costs and technical challenges associated with sucrose esters significantly hinder market growth. The synthesis of sucrose esters involves complex chemical processes that require expensive catalysts and strict reaction conditions, leading to higher production costs.

The growing pharmaceutical sector offers a profitable opportunity for the sucrose esters market. Sucrose esters are increasingly used in pharmaceutical formulations as excipients, stabilizers, and drug delivery agents. Their capacity to improve the solubility and bioavailability of poorly soluble drugs makes them invaluable for developing advanced drug formulations.

Form Insights & Trends

“Powder segment emerged as the fastest growing application with a CAGR of 5.2%”

The powder segment dominated the market with a market and accounted for a revenue share of 59.1% in 2023. Powdered sucrose esters are convenient for handling, storage, and mixing with other ingredients. This form is easy to process and manufacture, allowing for uniform mixing with other components. Powdered sucrose esters are versatile and widely used in bakeries, confectionery, dairy, and other food applications. They are widely used in food formulations because they blend well with different ingredients. Sucrose esters in powder form are more stable and last longer than liquid or pellet forms.

Sucrose esters are unique emulsifiers derived from the esterification of sucrose, which is ordinary table sugar with fatty acids. The liquid form of sucrose esters combines the typical sweet, sugar-derived backbone with fatty acid chains, providing versatile solubility and excellent emulsifying properties. This form is particularly valued in the food, cosmetics, and pharmaceutical industries for its ability to improve product texture, stability, and mouthfeel. The liquid variant is sought after for its ease of incorporation into formulations, requiring a smooth, homogeneous blend without compromising the final product's quality or stability.

Application Insights & Trends

“Food Products emerged as the fastest growing application with a CAGR of 6.2%”

Food products dominated the market with a market and accounted for a revenue share of 69.20% in 2023. The food segment is important because of its various uses in the food industry. Sucrose esters act as emulsifiers, stabilizers, and functional agents. They mix water and oil effectively to create stable emulsions crucial for texture, mouthfeel, and quality in bakery, dairy, sauces, and beverages. Apart from emulsification, these esters also improve aeration, protect proteins, control sugar crystallization, and interact with starch, benefiting various food formulations.

Sucrose esters are versatile ingredients used in the personal care industry due to their exceptional emulsifying properties and skin-friendly nature. They are crucial in producing various products, including creams, lotions, and shampoos. Their ability to modify product texture and sensory characteristics enhances the end-user experience by providing a luxurious, silky feel. In addition, sucrose esters are biodegradable and considered safe for sensitive skin, making them preferable for natural and organic personal care formulations. Their multifunctionality also supports the development of stable, aesthetically pleasing, and effective personal care products.

Regional Insights & Trends

The North America market is expected to grow due to the food industry in the region. This growth will lead to a rise in demand for the product which is used in the food industry to prevent food borne diseases in the region. Due to the rising population and to meet the demand of the growing population, sucrose esters play an important role in the food industry.

U.S. Sucrose Esters Market Trends

The U.S. market is expected to grow due to the growing pharmaceutical industry in the region. This growth will lead to a rise in demand for the product which is used in the pharmaceutical industry primarily as emulsifiers and solubilizers due to their amphiphilic nature. This had led to increased demand for product market in the U.S. as pharmaceutical industry is one of the growing industries in the country.

Europe Sucrose Esters Market Trends

Europe plays a significant role in the sucrose esters market, with countries such as Germany, the UK, France, Italy, Spain, Russia, Netherlands, and Belgium being key contributors to the market. The region's market dynamics are influenced by factors such as the rise in demand for food industry in the region leading to increased demand for product market.

Asia Pacific Sucrose Esters Market Trends

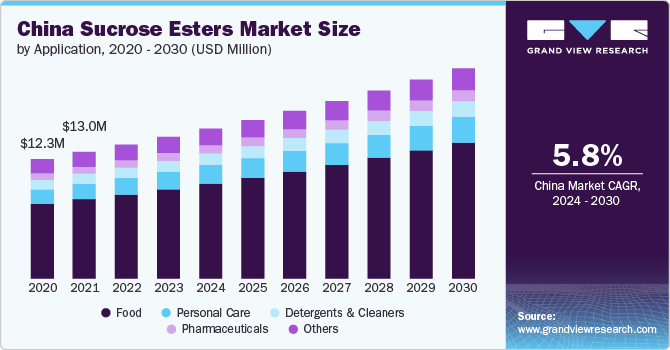

“China emerged as the fastest growing region in Asia Pacific with a CAGR of 5.8% in 2030”

Asia Pacific dominated the market and accounted for a 45.6% share in 2023. The increasing demand for product markets from the food industry is expected to drive the demand for sucrose esters in this region.

China dominated the market and accounted for a market share of 38.70% in 2023. This growth is attributed to increasing demand for the food in the country. Mexico is one of the regions with highest food consumption country, leading to a rise in demand for product market in the region.

Key Sucrose Esters Company Insights

Some of the key players operating in the global sucrose esters market include

-

BASF SE is a globally recognized German chemical company that operates as the largest chemical producer in the world. The company operates through six main business segments, namely, industrial solutions, chemicals, materials, surface technologies, agricultural solutions, and nutrition and care. Its diverse portfolio encompasses a wide array of chemical products such as performance products, plastics, functional solutions, and others. One of the company’s main areas of expertise is the production of sucrose esters and its related products, which are utilized in the food and beverages, pharmaceuticals, and animal feed industries.

-

Evonik Industries AG five business divisions include specialty additives, nutrition & care, smart materials, performance materials, and technology & infrastructure. The company’s products are used in various industries including agriculture, pharmaceuticals, polymer, and animal feed, among others. It has a presence in more than 100 countries.

Croda International and Mitsubishi Chemicals Holding Corporation are some of the emerging market participants in the global sucrose esters market.

-

Croda International offers its products to various markets such as agriculture, food, pharmaceutical, fragrances, water treatment, lubricant, wood & furniture, textile, electronics, automotive, and beauty & personal care, among others. The company also offers crop protection products, adjuvants, chemical biostimulants, seed enhancement products, specialty additives for agricultural films, and animal health products. It has 30 manufacturing sites globally and has several sales offices and laboratories across the globe.

-

Mitsubishi Gas Chemical Co. is a Japanese company that produces a wide range of chemicals, including natural gas, aromatic, specialty, and information & advanced materials. The company has a strong global presence, using its upstream and downstream products. Mitsubishi has methanol production facilities in various locations, including Trinadad & Tobago, Saudi Arabia, Venezuela, and Brunei.

Key Sucrose Esters Companies:

The following are the leading companies in the sucrose esters market. These companies collectively hold the largest market share and dictate industry trends.

- Evonik Industries AG

- Sisterna

- Croda International

- Alfa Chemicals

- P&G Chemicals

- Dai-Ichi Kogyo Seiyaku

- Mitsubishi Chemical Holdings Corporation

- BASF SE

- Stearinerie Dubois

- FELDA IFFCO

Recent Developments

-

In March 2024, Mitsubishi Chemical will expand its sugar ester emulsifier capacity production by installing a new production line capable of producing 1,100 tons annually. The new line, located at the Mitsubishi Chemical Kyushu Plant in Fukuoka Prefecture, is expected to be fully operational by March 2024 and will increase the total production capacity to 2,000 tons annually.

-

In March 2021, Croda International announced the acquisition of Alban Muller International, a France-based company, to expand its range of natural active and cosmetic components. This acquisition has enabled Croda to enhance its offering of environmentally active ingredients to clients in the personal care sector. Additionally, Croda will now have access to cutting-edge technologies in the botanicals industry, including Zeodration, a method that preserves even the most fragile active components.

Sucrose Esters Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 86.63 million

Revenue forecast in 2030

USD 116.09 million

Growth rate

CAGR of 5.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2024 to 2030

Report coverage

Volume and Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, application, and region

Regional scope

North America, Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Evonik Industries AG; Sisterna; Croda International; Alfa Chemicals; P&G Chemicals; Dai-Ichi Kogyo Seiyaku; Mitsubishi Chemical Holdings Corporation; BASF SE; Stearinerie Dubois; FELDA IFFCO

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sucrose Esters Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sucrose esters market report based on form, application and region.

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Powder

-

Liquid

-

Pellet

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food

-

Personal Care

-

Detergents & Cleaners

-

Pharmaceuticals

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global sucrose esters market size was estimated at USD 82.50 million in 2023 and is expected to reach USD 86.63 million in 2024

b. The global sucrose esters market is expected to grow at a compound annual growth rate of 5.0% from 2024 to 2030 to reach USD 116.09 million by 2030.

b. Asia Pacific dominated the sucrose esters market with a share of 45.6% in 2023. The increasing demand for product markets from the food industry is expected to drive the demand for sucrose esters in this region.

b. Some key players in the sucrose esters market include Evonik Industries AG, Sisterna, Croda International, Alfa Chemicals, P&G Chemicals, Dai-Ichi Kogyo Seiyaku, Mitsubishi Chemical Holdings Corporation, BASF SE, Stearinerie Dubois, and FELDA IFFCO

b. The increasing consumer demand for processed and convenient foods is a major driving force for the sucrose esters market. Sucrose esters act as emulsifiers in various food products, improving texture, stability, and shelf life.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.