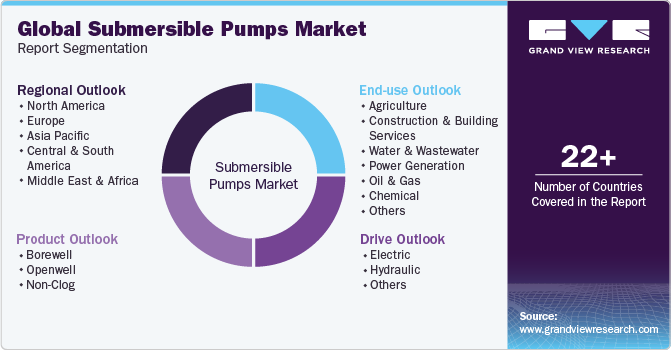

Submersible Pumps Market Size, Share & Trends Analysis Report By Product (Borewell, Openwell), By Drive (Electric, Hydraulic), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-135-5

- Number of Report Pages: 169

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Submersible Pumps Market Size & Trends

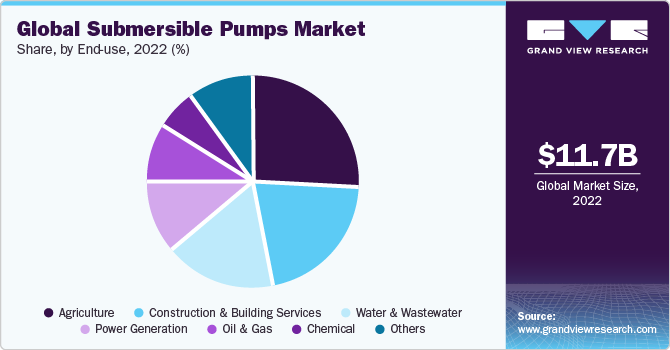

The global submersible pumps market size was estimated at USD 11.70 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. The positive outlook for the oil and gas sector is expected to drive demand for pumps over the forecast period. Increased investments in exploration and production activities by oil & gas companies are expected to increase the demand for submersible pumps in the oil & gas industry. Furthermore, technological developments in pump manufacturing, as well as new product launches focused on improved pump performance, durability, and lower energy usage, are projected to drive market growth. Submersible pumps are well-suited for harsh conditions, such as flooding or areas prone to waterlogging. Their ability to operate underwater without risk of damage makes them essential in challenging environments.)

The economic growth and stability can impact construction and industrial activities, influencing the demand for submersible pumps. Economic developments globally can have a cascading effect on the market. These aforementioned factors are expected to drive the demand for the market over the forecast period. The demand for submersible pumps is closely tied to infrastructure development, especially in water supply and wastewater treatment. Investments in upgrading or expanding water systems can drive the demand for submersible pumps. Growth in infrastructure projects, including water supply systems, wastewater treatment plants, and construction activities, typically drives the demand for submersible pumps. These pumps are essential for dewatering construction sites and managing water in various infrastructure projects.

For instance, the House Transportation and Infrastructure Committee authorized a USD 50 billion investment over the next five years for wastewater management, flood control, and other water-related infrastructure in September 2021. As a result, rising investment in wastewater management and infrastructure is likely to drive up demand for submersible pumps even further.

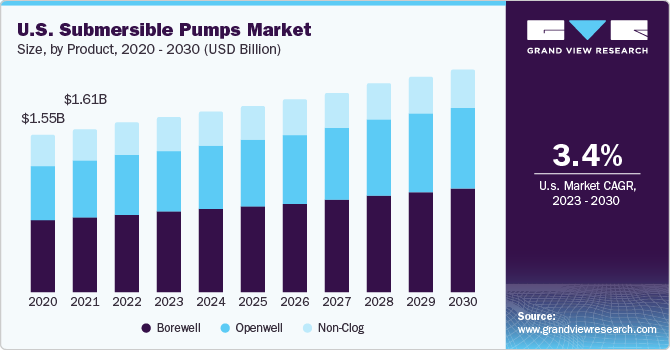

The U.S. construction industry focuses on the development of sustainable and energy-efficient buildings. Furthermore, Leadership in Energy and Environmental Design is a green building certification system developed by the U.S. Green Building Council that focuses on increasing energy consumption to lessen the environmental impact of excessive energy usage. These factors are expected to drive the demand for the market in the U.S.

Dewatering pumps, including submersible pumps, play a crucial role in construction projects. The level of construction activity and infrastructure development in the U.S. can influence the demand for these pumps. Furthermore, increasing awareness and regulations related to environmental conservation and energy efficiency may drive demand for more energy-efficient and environmentally friendly pump solutions.

Product Insights

In terms of product, the borewell segment led the market in 2022 with a revenue share of 46.4%. Borewell submersible pumps are extensively used in agriculture to extract water from deep wells for irrigation purposes. As agriculture is a significant sector in many regions, the demand for borewell submersible pumps is closely tied to agricultural practices. Moreover, in areas where surface water sources are limited or unreliable, borewell submersible pumps are essential for extracting groundwater from deep aquifers. This is critical for providing a reliable and continuous water supply for various uses.

In rural and remote areas where centralized water supply systems may be lacking, borewell submersible pumps serve as a practical solution for accessing groundwater for domestic and agricultural needs. Furthermore, borewell submersible pumps are used in construction projects and industries that require water from deep sources. They play a role in dewatering during excavation and are used for various industrial processes that require substantial water supply.

Openwell segment is anticipated to witness the fastest CAGR of 5.7% over the forecast period. The demand for openwell submersible pumps is influenced by various factors, reflecting their role in providing water supply from open wells or reservoirs. Open well submersible pumps are widely used in agriculture to lift water from open wells for irrigation purposes. The efficiency and reliability of these pumps are crucial for sustaining agricultural practices.

Moreover, open well submersible pumps are adaptable to fluctuations in the water table. During periods of low rainfall or drought, the ability to extract water efficiently from open wells becomes crucial. In addition, increasing population and urbanization contribute to higher water demand. Open well submersible pumps are employed to address the water supply needs of growing communities, both in urban and rural areas.

Drive Insights

Based on drive, the electric drive segment led the market with a revenue share of 72.6% in 2022. The demand for electric drive submersible pumps is influenced by several factors, reflecting their use in various applications for efficient water extraction.Electric drive submersible pumps are often chosen for their energy efficiency. As there is a growing emphasis on sustainable and energy-efficient technologies, pumps that consume less energy are favored, especially in regions with concerns about electricity consumption.

Moreover, stringent environmental regulations and a focus on reducing carbon footprints encourage the adoption of electric drive submersible pumps. These pumps typically have lower emissions compared to some alternative power sources. Furthermore, electric drive submersible pumps can be easily integrated into automated systems and controlled remotely. This automation capability is beneficial in various applications, including agriculture, industry, and water management.

Electric drive systems often require less maintenance compared to some alternative power systems. This factor can be crucial, especially in applications where frequent maintenance would be impractical or costly. Moreover, advances in electric motor technology, control systems, and materials contribute to the development of more efficient and durable electric drive submersible pumps. These technological improvements drive the adoption of newer pump models.

Hydraulic drive submersible pumps are powered by hydraulic systems, and their demand is influenced by various factors, reflecting their application in different industries. Hydraulic drive submersible pumps can be powered by various sources, including hydraulic power units, excavators, or hydraulic systems on heavy machinery. This versatility makes them suitable for applications in different industries. For instance, the construction industry often utilizes hydraulic drive submersible pumps for dewatering construction sites. Their adaptability to various construction equipment makes them valuable in temporary dewatering applications.

End-use Insights

In terms of end-use, the agriculture segment led the market in 2022 with a revenue share of 25.9%. Submersible pumps play a crucial role in agriculture, providing an efficient and reliable means of water supply for various farming activities.Some agricultural setups utilize submersible pumps in conjunction with drip irrigation systems. These systems deliver water directly to the base of plants, minimizing water wastage and ensuring efficient water use.

Moreover, submersible pumps are commonly used to extract water from wells or boreholes for agricultural purposes. They can efficiently lift water from considerable depths, providing a reliable water source. Further, these can be used to boost water pressure in irrigation systems, ensuring that water reaches all parts of the field evenly. This is especially important in areas with varying terrain.

The construction & building services segment is anticipated to witness a CAGR of 4.7% over the forecast period. Submersible pumps are frequently used for dewatering construction sites. These pumps are placed in excavations, foundations, or trenches to remove accumulated groundwater and maintain a dry working environment. Moreover, in urban construction, managing stormwater is crucial to prevent flooding. Submersible pumps are used in stormwater pumping stations to remove excess rainwater from basements, underground parking lots, or other low-lying areas.

Submersible pumps play a vital role in the water and wastewater industry, providing efficient and reliable solutions for various applications. Submersible pumps are used to lift raw sewage from collection pits to treatment processes in wastewater treatment plants. After treatment, submersible pumps are used to discharge treated effluent to water bodies or for other purposes. These aforementioned factors are anticipated to propel the demand for submersible pumps over the forecast period. For instance, Xylem offers the Flygt Concertor, a submersible pump that saves up to 70% more energy than conventional pumping systems and is part of a suite of high-efficiency technologies that support the company's goal of reaching net-zero emissions.

Regional Insights

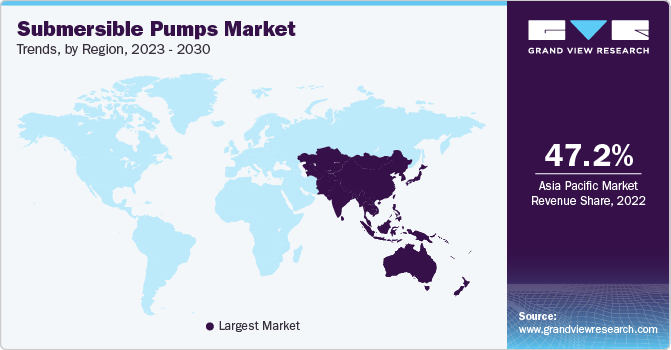

Asia Pacific region dominated the market in 2022 with the largest revenue share of 47.2%. Given the significant presence of agriculture in many Asia Pacific countries, submersible pumps are extensively used for irrigation purposes. The demand for these pumps is closely tied to the agricultural sector's water requirements. Asia Pacific faces diverse water management challenges, including water scarcity and flooding. Submersible pumps are utilized for water extraction, flood control, and managing water resources efficiently.

Replacement and upgrading of aging water and wastewater infrastructure in North America contribute to the demand for submersible pumps. These pumps are used in municipal water supply systems and wastewater treatment plants. Moreover, submersible pumps play a crucial role in construction activities, including dewatering construction sites, foundations, and tunnels. The real estate and construction sectors' health directly impacts the demand for submersible pumps.

Given the significant mining activities in some countries in Central & South America, submersible pumps are employed for dewatering purposes in mines. They help control water levels in excavations and maintain safe working conditions. Submersible pumps are utilized in various industrial processes for managing water, wastewater, and fluids. Their efficiency and reliability make them suitable for diverse industrial applications.

Key Companies & Market Share Insights

The manufacturers adopt several strategies, including geographical expansions, product launches, and mergers & acquisitions, to enhance market penetration and cater to the changing technological requirements. For instance, in 2023, Holland Pump Co, a provider of specialty pump rental and dewatering solutions, purchased BPR Pumping & Vacuum Solutions, a pump rental company based in the U.S. Some prominent players in the global submersible pumps market include:

-

Xylem

-

Sulzer Ltd.

-

KSB SE & Co. KGaA

-

Grundfos Holding A/S

-

Atlas Copco

-

Flowserve

-

Wilo SE

-

Homa Pump Technology

-

LEO GROUP PUMP(ZHEJIANG)CO., LTD.

-

VANSAN Water Technologies

-

Grindex

-

HCP PUMP MANUFACTURER CO., LTD.

-

EBARA International Corporation

-

Schlumberger Limited

-

ITT INC.

Submersible Pumps Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 12.24 billion |

|

Revenue forecast in 2030 |

USD 17.50 billion |

|

Growth rate |

CAGR of 5.2 from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, drive, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Middle East & Africa; Central & South America |

|

Country Scope |

U.S.; Canada; Mexico; Germany; France; Italy; U.K.; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

Xylem; Sulzer Ltd.; KSB SE & Co. KGaA; Grundfos Holding A/S; Atlas Copco; Flowserve; Wilo SE; Homa Pump Technology; LEO GROUP PUMP(ZHEJIANG)CO., LTD.; VANSAN Water Technologies; Grindex; HCP PUMP MANUFACTURER CO. LTD.; EBARA International Corporation; Schlumberger Limited; ITT INC. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Submersible Pumps Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global submersible pumps market report based on product, drive, end-use, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Borewell

-

Openwell

-

Non-Clog

-

-

Drive Outlook (Revenue, USD Billion, 2018 - 2030)

-

Electric

-

Hydraulic

-

Others

-

-

End-use Outlook (Revenue, USD Billion; 2018 - 2030)

-

Agriculture

-

Construction & Building Services

-

Water & Wastewater

-

Power Generation

-

Oil & Gas

-

Chemical

-

Others

-

-

Regional Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

Germany

-

France

-

Italy

-

U.K.

-

Spain

-

Asia Pacific

-

China

-

Japan

-

Australia

-

India

-

South Korea

-

Central & South America

-

Brazil

-

Argentina

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

Frequently Asked Questions About This Report

b. The global submersible pumps market size was estimated at USD 11.70 billion in 2022 and is expected to be USD 12.24 billion in 2023.

b. The global submersible pumps market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.2% from 2023 to 2030 to reach USD 17.50 billion by 2030.

b. Asia Pacific region dominated the market in 2022 by accounting for a share of 47.2% of the market. Given the significant presence of agriculture in many Asia Pacific countries, submersible pumps are extensively used for irrigation purposes. The demand for these pumps is closely tied to the agricultural sector's water requirements.

b. Some of the key players operating in the submersible pumps market include Xylem, Sulzer Ltd., KSB SE & Co. KGaA, Grundfos Holding A/S, Atlas Copco, Flowserve, Wilo SE, Homa Pump Technology, LEO GROUP PUMP(ZHEJIANG)CO., LTD., VANSAN Water Technologies, Grindex, HCP PUMP MANUFACTURER CO., LTD., EBARA International Corporation, Schlumberger Limited, ITT INC.

b. Increased investments in exploration and production activities by oil & gas companies are expected to increase the demand for submersible pumps in the oil & gas industry. Furthermore, technological developments in pump manufacturing, as well as new product launches focused on improved pump performance, durability, and lower energy usage, are projected to drive pump market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."