- Home

- »

- Medical Devices

- »

-

Subdermal Contraceptive Implants Market Size Report, 2030GVR Report cover

![Subdermal Contraceptive Implants Market Size, Share & Trends Report]()

Subdermal Contraceptive Implants Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Etonogestrel Implant, Levonorgestrel Implant), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-848-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The global subdermal contraceptive implants market size was estimated at USD 1.12 billion in 2024 and is expected to grow at a CAGR of 7.61% from 2025 to 2030. The factors driving market growth include rising demand for reliable contraceptives, unintended pregnancies, and increasing awareness of sexual health and family planning. The rise in unintended pregnancies is a major driver for the increasing demand for subdermal contraceptive implants. According to the United Nations Population Fund (UNFPA) data published in March 2022, an estimated 121 million unintended pregnancies highlight the need for long-term contraceptives to prevent such cases, driving the growth and emphasizing the importance of accessible and effective family planning methods.

Women and healthcare providers are opting for implants due to their long-term effectiveness, convenience, and minimal maintenance compared to daily pills or barrier methods. Initiatives by governments and NGOs to promote family planning and reduce unplanned pregnancies further enhance product demand. In addition, awareness campaigns targeting rural and underserved areas are also expanding the user base. For instance, in October 2023, Karnataka's Health and Family Welfare Minister, Dinesh Gundu Rao, introduced two new contraceptive options: Subdermal Single Rod Implants and SC-MPA Injectable Contraceptives. The launch took place during the State Family Planning Summit, themed “New Choices, New Horizons.” However, the limited availability of implants in low-resource settings remains a challenge.

Furthermore, advancements in technology have significantly enhanced the safety, efficacy, and usability of subdermal contraceptive implants, transforming them into a preferred option for long-term birth control. Innovations such as smaller-sized implants and the use of advanced biocompatible materials have improved comfort and reduced potential side effects. Additionally, advancements in insertion and removal techniques have simplified the procedures, ensuring greater convenience for both healthcare providers and users. These improvements make implants more accessible to a diverse audience, including women who may have concerns about hormonal side effects or invasive procedures. However, despite these advancements, the need for skilled healthcare professionals to administer and remove implants remains a challenge, particularly in resource-limited areas where access to trained personnel is scarce.

Market Concentration & Characteristics

The subdermal contraceptive implants industry showcases a high degree of innovation, driven by advancements in biocompatible materials, miniaturization, and simplified insertion/removal techniques. These innovations enhance safety, efficacy, and user comfort while reducing side effects. Additionally, developments in non-hormonal and longer-lasting implant options aim to cater to diverse needs, making this contraceptive method increasingly accessible and appealing to a broader population.

The market has seen a moderate level of M&A activity, as key players focus on expanding their product portfolios and market reach. Collaborative efforts between pharmaceutical companies and biotech firms aim to develop innovative implants, while strategic acquisitions help enhance manufacturing capabilities and global distribution networks to meet growing demand.

Regulations play a pivotal role in modeling the subdermal contraceptive implants, ensuring product safety, efficacy, and accessibility. Regulators such as the FDA and EMA safeguard user health but can increase the time-to-market for new products. Additionally, government policies promoting family planning and reproductive health significantly influence growth. For instance, the family planning division Ministry of health and Family Welfare, Government of India has launched two new contraceptive methods- subdermal single rod implant and subcutaneous injectable contraceptive in March 2023 as part of a pilot project in select states, including Karnataka. The initial rollout includes 10 states, with specific areas designated for each method's introduction. The launch of these new subdermal contraceptive implants represents a proactive approach to enhancing reproductive health services in India, providing women with more effective and convenient options for family planning.

Product expansion in the market is driven by continuous advancements in technology and increasing demand for long-acting reversible contraceptives (LARCs). Companies are introducing innovative solutions, such as smaller, more effective implants with improved biocompatibility and extended duration. Additionally, manufacturers are expanding their product offerings to cater to diverse needs across different regions, ensuring greater accessibility and affordability. These efforts are expected to enhance adoption rates and meet the growing demand for safe, reliable, and convenient contraceptive methods.

Regional expansion in the subdermal contraceptive implants industry is driven by increasing awareness and government initiatives promoting family planning. Countries in Asia, Latin America, and Africa are seeing higher adoption rates due to improved accessibility, affordability, and support for reproductive health programs. Expanding distribution networks and local manufacturing are also contributing to growth for products in these regions.

Product Insights

Etonogestrel implants dominated the market and accounted for a share of 64.73% in 2024. The driving factors are rising unintended pregnancies and unsafe abortions. According to the United Nation’s report published in 2022, it was estimated that 164 million women wish to delay or avoid pregnancy. The implant is suitable for patients seeking long-term efficiency against pregnancies and is less expensive compared with other contraceptives in case of long-term usage. Similarly, according to data from the University of Iowa published in October 2023, the implant can prevent pregnancy 99% of the time, with the effect lasting up to four years. The long-term impact and lower probability of causing failure than other contraceptives boost the segment growth. Some etonogestrel implants available in the market are Implanon and Nexplanon.

The levonorgestrel implant segment is expected to grow significantly during the forecast period. The factors primarily driving the segment growth are the need for family planning and unintended pregnancies, leading to the rising number of unsafe abortions. The levonorgestrel implant is used to prevent pregnancy for up to five years through continuous hormone release. The lower rate of failure and efficacy of up to five years make it a suitable choice of contraceptive for women who wish to delay their pregnancy, driving the segment market. Jadelle is the levonorgestrel implant available in the market.

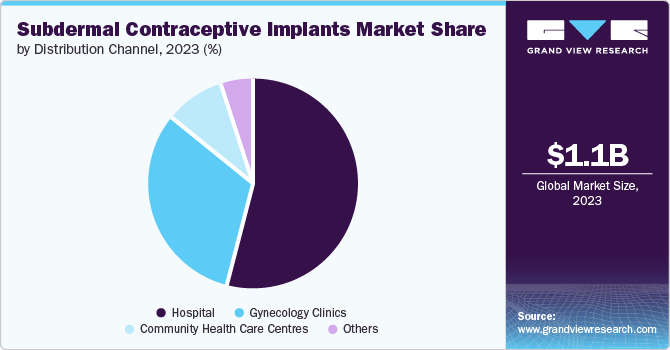

Distribution Channel Insights

Hospital dominated the market and accounted for a share of 54.37% in 2024. Hospitals provide a comprehensive environment for patients, offering a wide range of services including tests, consultations, and procedures, which drive segment growth. Equipped with advanced medical technologies, hospitals ensure high-quality care. Moreover, hospitals offer integrated healthcare services, including examinations, counseling, and subdermal contraceptive implant procedures, all under professional supervision, further supporting the segment’s expansion.

The gynecology clinics segment is anticipated to experience the fastest growth during the forecast period. Key factors driving this growth include the increasing number of abortions and healthcare consultations available at these clinics. Gynecology clinics are essential in providing specialized consultations for advanced contraceptives. They offer comprehensive services, including expert consultations, gynecological exams, abortion procedures, contraceptive implant placements, and follow-up care. These clinics ensure that the implant procedure is conducted by skilled professionals, reducing the risk of complications. These benefits are expected to fuel the segment's growth throughout the forecast period.

Regional Insights

North America subdermal contraceptive implants market dominated the market with a market share of 64.91% in 2024. The market growth factors include the rise in unintended pregnancies, the increasing number of gynecology clinics, and government initiatives. According to data from the government of Canada, from August 2022, nearly 257 million women wish to avoid pregnancy. The government of Canada is taking initiatives to reduce these numbers and create sexual health awareness. Under this plan, the government plans on making contraceptive medications and devices free of cost, including birth control pills, IUDs, and contraceptive implants. Such initiatives are expected to drive market growth.

U.S. Subdermal Contraceptive Implants Market Trends

The U.S. subdermal contraceptive implants market accounted for largest revenue share of the global market in 2024. The market growth in the country is attributed to the rising number of abortions and unintended pregnancies. The Healthy People 2030 initiative focuses on decreasing the number of unintended pregnancies and abortions by promoting the use of contraceptives. Such initiatives are further expected to add to the market growth.

Europe Subdermal Contraceptive Implants Market Trends

Europe held a substantial market share in the subdermal contraceptive implants market in 2024. Key factors driving this growth include higher abortion rates resulting from unintended pregnancies and proactive government measures to address the issue. For instance, the Luxembourg Government announced full reimbursement for contraceptives in March 2023. Moreover, the Contraceptive Policy Atlas Europe 2024 reported that approximately 22 countries include coverage for long-acting reversible contraceptives like implants, IUDs, and injectables in their national health systems.

The growth of the market in the UK is driven by a high rate of unintended pregnancies. For instance, research from University College London (UCL) in October 2021 revealed that cases of unplanned pregnancies doubled during the COVID-19 pandemic lockdown. Furthermore, the UK government, under its Women’s Health Strategy for England published in August 2022, aims to enhance access to long-acting reversible contraceptives, including implants and IUDs. These initiatives are anticipated to significantly drive market growth.

The Germany market is growing due to increasing awareness of long-acting reversible contraceptives and government support for family planning initiatives. Comprehensive insurance coverage for contraceptive methods and public health campaigns promoting safe contraception contribute to the market's expansion. Additionally, Germany’s focus on reproductive health education enhances the adoption of subdermal implants among women.

Asia Pacific Subdermal Contraceptive Implants Market Trends

The subdermal contraceptive implants market in Asia Pacific is expected to register the fastest CAGR over the forecast period. The factors driving the market growth in the region are attributed to the growing number of unintended pregnancies, leading to unsafe abortions. For instance, Shanghai Dahua Pharmaceutical Co., Ltd. offers subdermal contraceptives and implants such as sino-implant II, available under the brand name Levoplant and registered in about 40 countries. Such government policies and companies offering products are expected to drive market growth.

The subdermal contraceptive implants market in China is experiencing growth driven by its large population and the increasing focus on family planning and reproductive health. The government's efforts to address population management, coupled with growing awareness about modern contraceptive methods, are propelling market demand. Additionally, urbanization and improved access to healthcare services are expanding the availability of subdermal implants, making them a viable choice for women seeking long-term, reliable contraception.

The growth of subdermal contraceptive implants market in Japan is driven by advancements in technology, including improved implant design, enhanced biocompatibility, and more efficient insertion/removal procedures. These innovations make implants more accessible, user-friendly, and effective, encouraging greater adoption among women seeking long-term contraceptive solutions in Japan.

Latin America Subdermal Contraceptive Implants Market Trends

The growth of the subdermal contraceptive implants market in Latin America is fueled by increased awareness and cost-effectiveness. A March 2024 NCBI study highlighted that the etonogestrel-releasing subdermal implant (IMP-ETN) offers a cost-effective alternative to levonorgestrel-releasing intrauterine systems (LNG-IUSs) for women in Brazil. The study strongly recommends that policymakers, decision-makers, and health professionals collaborate to promote long-acting reversible contraceptive (LARC) technologies as an affordable and effective contraception method.

The subdermal contraceptive implants market in Brazil is expected to grow in coming years, driven by increasing awareness of reproductive health, the need for effective long-term contraceptive options, and favorable government initiatives. Etonogestrel-releasing implants, particularly, are gaining traction as a viable alternative to traditional contraceptive methods. The Brazilian government is increasingly focusing on reproductive health initiatives that include providing subsidized or free access to effective contraceptive methods for low-income women. This approach aims to reduce unintended pregnancies and improve maternal health outcomes across the country

Middle East & Africa Subdermal Contraceptive Implants Market Trends

The growth of the subdermal contraceptive implants market in the Middle East & Africa is driven by improved healthcare infrastructure and increasing awareness about family planning. Efforts to educate the population on the benefits of long-acting reversible contraceptives (LARCs) and better access to healthcare services are supporting market expansion.

The subdermal contraceptive implants market in Saudi Arabia is expected to grow significantly during the forecast period. A study published by the National Library of Medicine in March 2023, found that in Jeddah approximately 65.84% of were satisfied with their Implanon implants. The most frequently reported side effect was weight gain (54.76%), followed by menstrual irregularities (39.29%). Many women opted to remove the implant at the end of its effective period rather than due to side effects.

Key Companies & Market Share Insights

Key emerging players in the market for the market include BContraline, Inc., Shanghai Dahua Pharmaceutical Co., Ltd., Theramex, and Gerresheimer AG. These firms are engaged in strategic activities such as developing innovative products, collaborating with academic institutions and other sectors, and forming partnerships.

Key Subdermal Contraceptive Implants Companies:

The following are the leading companies in the subdermal contraceptive implants market. These companies collectively hold the largest market share and dictate industry trends.

- Merck & Co., Inc.

- Shanghai Dahua Pharmaceutical Co., Ltd.

- Bayer AG

- Baxter

- BD

- Gerresheimer AG

- Pfizer, Inc.

- Novartis AG

- SCHOTT

- Lilly

Recent Developments

-

In February 2024, Bayer AG and DARÉ BIOSCIENCE collaborated to expand an innovative hormone-free monthly contraceptive.

“As a recognized leader in Women’s Health, the collaboration with Daré Bioscience represents an excellent strategic fit with our vision to continue to offer differentiated contraceptive choices to women.”

- Dr. Marianne de Backer, Member of the Executive Committee and EVP, Head of Business Development & Licensing, Pharmaceuticals Division of Bayer AG

-

In December 2023, the Odisha state government in India launched two new contraceptive options for women alongside the Family Planning Roadmap-2030. Four districts in Odisha are among 40 across 10 states chosen for the pilot implementation of subdermal implants (single flexible rod) and the subcutaneous injectable contraceptive Antara.

-

In April 2022, ProMed announced the initialization of preclinic evaluation of resorbable contraceptive implants, a project funded by the Bill & Melinda Gates Foundation.

“The implant designs have shown promising mechanical integrity and drug release profiles based on in vitro tests to date and have a form factor which is similar if not superior to other implants on the market.”

- Dr. James Arps, Director of Business Development at ProMed

Subdermal Contraceptive Implants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.20 billion

Revenue forecast in 2030

USD 1.74 billion

Growth Rate

CAGR of 7.61% from 2025 to 2030

Actual Data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Merck & Co., Inc.; Shanghai Dahua Pharmaceutical Co., Ltd.; Bayer AG; Baxter; BD; Gerresheimer AG; Pfizer, Inc.; Novartis AG; SCHOTT; Lilly

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Subdermal Contraceptive Implants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global subdermal contraceptive implant market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Etonogestrel Implant

-

Levonorgestrel Implant

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Gynecology Clinics

-

Community Health Care Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global subdermal contraceptive implants market size was estimated at USD 1.12 billion in 2024 and is expected to reach USD 1.20 billion in 2025.

b. The global subdermal contraceptive implants market is expected to grow at a compound annual growth rate of 7.61% from 2025 to 2030 to reach USD 1.73 million by 2030.

b. North America dominated the subdermal contraceptive implants market in 2024. High disposable income, increased awareness about contraceptives, and technological advancements as well as supportive government schemes in the field are some of the key factors responsible for the dominance of this region.

b. Some of the key players operating in the market are Bayer AG; Merck & Co. Inc.; and Shanghai Dahua Pharmaceutical Co., Ltd.

b. Key factors that are driving the market growth include an increase in the use of modern contraceptive methods, rising awareness about sexual health and family planning, and an increase in government initiatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.