- Home

- »

- Homecare & Decor

- »

-

Student Accommodation Market Size & Share Report, 2030GVR Report cover

![Student Accommodation Market Size, Share & Trends Report]()

Student Accommodation Market (2025 - 2030) Size, Share & Trends Analysis Report By Accommodation Type (Purpose-Built Student Accommodation, University-Managed Accommodation), By Education Grade, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-437-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Student Accommodation Market Summary

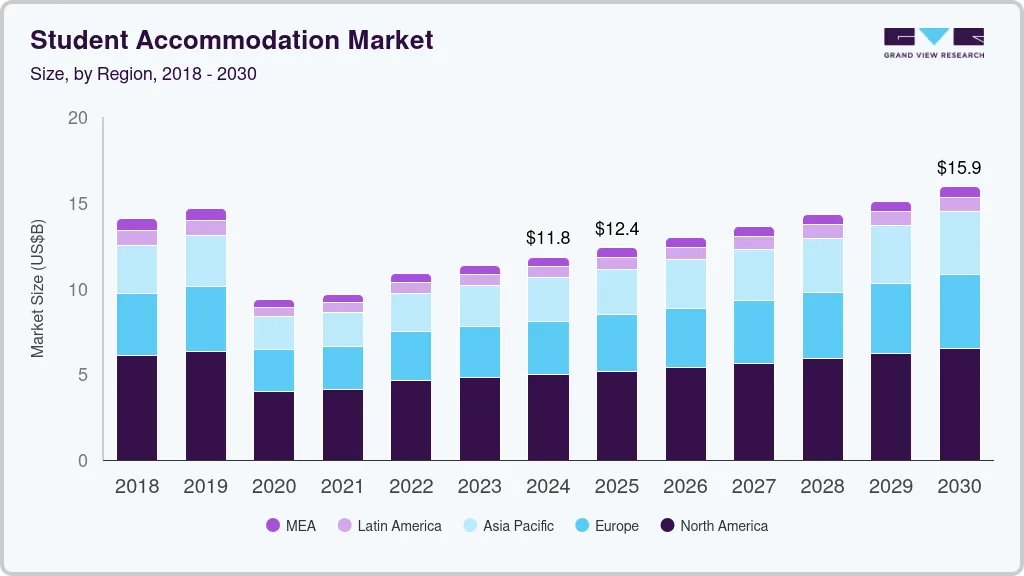

The global student accommodation market size was estimated at USD 11.83 billion in 2024 and is projected to reach USD 15.94 billion by 2030, growing at a CAGR of 5.2% from 2025 to 2030. The continuous rise in the global student population, particularly international students, is a significant driver of growth in the market.

Key Market Trends & Insights

- North America dominated the student accommodation market with a share of over 42.31% in 2023.

- The student accommodation market in the U.S. is expected to grow at a CAGR of 5.1% from 2024 to 2030.

- According to accommodation type, purpose-built student accommodation (PBSA) accounted for a market share of 43.9% in 2023.

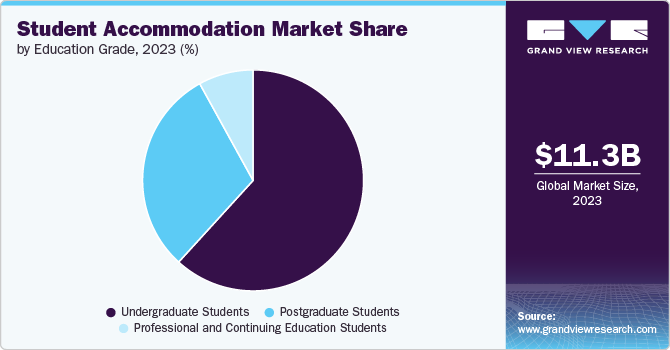

- According to education grade, the demand for student accommodations among undergraduate students held a market share of 61.7% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 11.83 Billion

- 2030 Projected Market Size: USD 15.94 Billion

- CAGR (2025-2030): 5.2%

- North America: Largest market in 2023

With more students pursuing higher education abroad, the demand for quality, safe, and convenient housing has surged. Countries such as the U.S., the UK, Australia, and Canada remain top destinations for international students, leading to increased pressure on existing accommodation infrastructure. Universities, while expanding their intake, are often unable to meet the housing demands of the growing student population, thereby creating opportunities for private developers and investors to step in with PBSA. This trend is expected to continue as the pursuit of global education becomes increasingly popular, fueled by the expanding middle class in developing countries and the growing importance of obtaining international qualifications.

The increasing number of students is one of the major growth drivers in the global market. As more students pursue higher education abroad, particularly in popular destinations such as the U.S., UK, Australia, and Canada, the demand for suitable housing has surged. According to the 2023 report released by the Institute of International Education and the U.S. Department of State's Bureau of Educational and Cultural Affairs, new international student enrollment witnessed a significant increase of 14% in the 2022 - 2023 academic year, building on the substantial 80% growth recorded the previous year. International students often seek accommodations that provide a secure, convenient, and community-oriented living environment, making them a significant consumer segment for PBSAs.

This growing demographic not only drives the need for more student housing but also encourages the development of high-quality, amenity-rich properties that cater specifically to their preferences. As universities continue to attract global talent, the student housing market is poised for sustained expansion to meet this rising demand.

Investment in PBSA has seen significant growth, particularly from institutional investors and real estate developers who recognize the market’s resilience and long-term potential. For instance, in August 2024, Far East Orchard Limited, Singapore's largest private property developer established its private fund in Singapore and completed its initial closing of £70 million ($120 million) on August 22. The fund, named FE UK Student Accommodation Development Fund was created to invest in development opportunities for PBSA in the UK.

The attractive yields, coupled with the relatively low volatility of the student housing sector compared to other real estate segments, make it an appealing investment. The increasing preference among students for accommodation that offers a blend of convenience, community, and modern amenities is driving the demand for PBSAs. These properties often feature integrated facilities such as gyms, study areas, and social spaces, enhancing the student experience and creating a competitive edge over traditional housing options. As a result, the expansion of PBSA developments is contributing substantially to the overall growth of the student housing market.

Government policies and support play a crucial role in driving the growth of the market. Many governments, particularly in developed countries, actively promote their educational institutions to attract international students, which indirectly boosts the demand for student housing. Additionally, in some regions, governments offer incentives to private developers to invest in student housing and related properties, such as tax breaks or subsidies, to help meet the housing demand. Urban planning policies also increasingly incorporate provisions for student housing, recognizing its importance in supporting the educational infrastructure. This supportive regulatory environment encourages investment and development in the sector, ensuring that student accommodation keeps pace with the growing demand.

The integration of technology into student accommodation is emerging as a strong growth driver, catering to the tech-savvy student population. Smart living features, such as automated climate control, keyless entry, high-speed internet, and digital communication platforms, are becoming standard in modern student housing. These technological advancements not only enhance the living experience but also address safety, security, and convenience concerns, which are top priorities for students and their families. Additionally, using data analytics and property management software allows for more efficient operations and maintenance, further attracting students and investors to the market. As students increasingly seek out accommodation that meets their digital lifestyle needs, the demand for technologically advanced living spaces continues to grow, fueling the expansion of the market.

The evolving preferences and lifestyle changes among students are significantly influencing the growth of the market. Today’s students are increasingly are support housing options that offer more than just a place to sleep; they desire spaces supporting their academic, social, and personal development. This shift has led to a greater demand for accommodation that provides a balanced mix of private and communal spaces, fostering a sense of community while allowing for individual privacy. Amenities such as fitness centers, study lounges, social event spaces, and sustainable living features are becoming crucial determinants of students' housing choices. The preference for high-quality, experience-oriented living environments is driving developers and property managers to innovate and upgrade their offerings, thereby accelerating growth in the market.

Accommodation Type Insights

Purpose-built student accommodation (PBSA) accounted for a market share of 43.9% in 2023. The momentum in student housing investments significantly accelerated in the early 21st century, driven by the rise in global student mobility. As international students increasingly sought quality education at prestigious institutions worldwide, the demand for reliable and high-quality housing grew. For example, students from countries such as India or China, pursuing higher education in the U.S. or UK, often lacked familiarity with the local housing market and the support of a local guardian. This made them an attractive target market for PBSAs, offering a secure and convenient living environment tailored to their specific needs.

The demand for private rental student accommodations is projected to grow at a CAGR of 6.1% from 2024 to 2030. The demand for private rental student accommodation is witnessing robust growth globally, driven by several key factors. The rising number of students pursuing higher education abroad, particularly from emerging economies, has created an unprecedented demand for quality housing that offers both flexibility and independence. Unlike traditional university-managed accommodations, private rentals cater to students' desire for a more personalized living experience, with better amenities, privacy, and proximity to urban centers.

The trend is further amplified by the limitations of university housing, which often cannot keep pace with the growing student population, especially in major educational hubs. This shortage has driven students to seek alternatives, where private rentals offer not only availability but also the possibility of a higher standard of living. Additionally, the flexibility of lease terms in private rentals, often allowing for short-term stays, appeals to both domestic and international students who may not need year-round housing.

Education Grade Insights

The demand for student accommodations among undergraduate students held a market share of 61.7% in 2023. The continuous growth in undergraduate enrollment, particularly in prominent academic institutions, has significantly escalated the demand for student housing. As more students pursue higher education, universities are facing increased pressure to provide adequate accommodation options to meet this expanding population. According to statistics published by the National Student Clearinghouse, undergraduate enrollment in the U.S. increased by 2.5% (+359,000) in spring 2024, representing the second consecutive semester of growth after years of pandemic-induced decline. This upward trend in student enrollment is expected to significantly boost demand for additional accommodation, further fueling market expansion in the student housing sector.

Universities are increasingly expanding their campuses and attracting students from diverse geographical regions, both domestically and internationally. This trend has led to heightened demand for student accommodation in urban areas where these institutions are typically located. The proximity to academic facilities and the convenience of living close to campus are key drivers of this demand.

The demand for accommodations among post-graduate students is anticipated to grow with a CAGR of 6.0% from 2024 to 2030. The increasing enrollment in higher education, particularly among international students pursuing advanced degrees, has driven demand for quality housing solutions that offer convenience, safety, and a conducive environment for academic pursuits. Post-graduates often seek accommodation that is well-connected to academic institutions and equipped with amenities that support both study and lifestyle needs.

The competitive nature of graduate programs and the demands of research-oriented courses necessitate an environment that minimizes distractions and supports academic excellence. As a result, post-graduates have a growing preference for accommodations that offer a balanced combination of privacy, comfort, and proximity to academic resources. The rise in global mobility and the trend of pursuing education abroad has led to an increased need for reliable and secure housing solutions for post-graduate students, particularly in urban areas with high concentrations of educational institutions. This trend is further reinforced by the increasing recognition of the role of well-designed student accommodation in enhancing the overall academic experience, thereby attracting and retaining top-tier talent.

Regional Insights

The student accommodation market in North America held a share of 42.3% of the global revenue in 2023. Across North America, particularly in Canada, the expansion of university and college programs, coupled with the influx of international students, is significantly driving the demand for student housing. Institutions are increasingly partnering with private developers to address the shortage of on-campus accommodations, resulting in the growth of off-campus housing projects that offer modern amenities and proximity to academic facilities. This trend is bolstered by the region's focus on attracting global talent, necessitating the development of high-quality housing options that meet international standards.

U.S. Student Accommodation Market Trends

The student accommodation market in the U.S. is expected to grow at a CAGR of 5.1% from 2024 to 2030. The rising preference for PBSH reflects the need for secure, well-located, and amenity-rich living spaces that cater to the diverse lifestyle and academic needs of students. Additionally, the increasing investment from private equity firms and real estate developers in the student housing sector is further enhancing the availability and quality of accommodations, making it a lucrative market.

Asia Pacific Student Accommodation Market Trends

Asia Pacific accounted for a revenue share of 21.0% in the year 2023. Countries like China, India, and Australia are witnessing a surge in purpose-built student housing developments, driven by the need to accommodate large student populations and the increasing expectations for quality living environments. Moreover, government initiatives aimed at promoting education as a key economic driver are further accelerating the growth of student housing infrastructure.

Europe Student Accommodation Market Trends

The European market is projected to grow at a CAGR of 5.6% from 2024 to 2030. The rise of international student exchanges, such as the Erasmus program, along with the influx of non-EU students, has led to a heightened need for accommodations that offer both comfort and cultural integration. The trend towards urbanization and the concentration of educational institutions in key cities are also contributing to the strong demand for well-located, purpose-built student accommodations that cater to the diverse and evolving needs of the student population. According to statistics from the European Association of International Education (EAIE), 7% of European universities are expected to see increased international student enrollment in the 2023/24 academic year. This anticipated surge is likely to drive significant demand for student accommodations, particularly among international students, thereby contributing to substantial growth in the regional market.

Key Student Accommodation Company Insights

The competitive landscape of the student accommodation market is characterized by the presence of both established players and emerging entrants vying for market share in a rapidly expanding sector. Established operators, including global real estate investment trusts (REITs) and specialized student housing providers, dominate the market with extensive portfolios of PBSAs that offer premium amenities and prime locations near academic institutions. These companies leverage their scale, brand reputation, and operational expertise to attract and retain students.

Emerging competitors, often backed by private equity or institutional investors, are aggressively entering the market by developing innovative housing solutions that cater to evolving student preferences, such as flexible lease terms, smart technology integration, and sustainability features. Additionally, universities are increasingly forming partnerships with private developers to expand their on-campus housing options, adding another layer of competition.

Key Student Accommodation Companies:

The following are the leading companies in the student accommodation market. These companies collectively hold the largest market share and dictate industry trends.

- American Campus Communities (ACC)

- Global Student Accommodation Group

- Campus Living Villages

- The Student Hotel (TSH)

- The Unite Group

- Harrison Street

- Greystar Real Estate Partners

- APG Asset Management

- Kohlberg Kravis Roberts & Co. L.P.

- Mapletree Investments Pte Ltd

Recent Developments

-

In May 2024, KKR, a leading global investment firm, announced the acquisition of high-quality PBSA assets from TPG Angelo Gordon in Greater Copenhagen. The PBSA assets, completed in three phases between 2020 and 2023, comprised 494 units featuring modern, furnished accommodations with differentiated on-site amenities. Located in a well-established residential area with excellent transportation links to Copenhagen’s city center, these properties catered to the growing demand for student housing, particularly near major universities like Copenhagen Business School. All properties held an EPC rating of A and were in the process of obtaining DGNB certification. KKR made this investment through its European Core+ Real Estate strategy, with Keystone serving as the local operating partner and The Mark handling property management.

-

In March 2024, Harrison Street entered into a joint venture with The Dinerstein Companies to complete the sale of The Parker, a 484-bed student housing community in Tucson, Arizona, which serves the University of Arizona. The asset was acquired by an affiliate of Inland Real Estate Group for $132.5 million, as indicated by public records.

Student Accommodation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.37 billion

Revenue forecast in 2030

USD 15.94 billion

Growth rate

CAGR of 5.2% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Accommodation type, education grade, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

American Campus Communities (ACC); Global Student Accommodation Group; Campus Living Villages; The Student Hotel (TSH); The Unite Group; Harrison Street; Greystar Real Estate Partners; APG Asset Management; Kohlberg Kravis Roberts & Co. L.P.; Mapletree Investments Pte Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Student Accommodation Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global student accommodation market report based on accommodation type, education grade, and region:

-

Accommodation Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Purpose-Built Student Accommodation (PBSA)

-

University-Managed Accommodation

-

Private Rental Accommodation

-

Others (Homestays, etc.)

-

-

Education Grade Outlook (Revenue, USD Billion, 2018 - 2030)

-

Undergraduate Students

-

Postgraduate Students

-

Professional and Continuing Education Students

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global student accommodation market was estimated at USD 11.34 billion in 2023 and is expected to reach USD 11.83 billion in 2024.

b. The global student accommodation market is expected to grow at a compound annual growth rate of 5.1% from 2024 to 2030 to reach USD 15.94 billion by 2030.

b. North America dominated the student accommodation market with a share of over 42.31% in 2023. The regional demand is driven by the expansion of university and college programs and the influx of international students.

b. Some of the key players operating in the student accommodation market include American Campus Communities (ACC), Global Student Accommodation Group, Campus Living Villages, The Student Hotel (TSH), The Unite Group, Harrison Street, Greystar Real Estate Partners, APG Asset Management, Kohlberg Kravis Roberts & Co. L.P., and Mapletree Investments Pte Ltd.

b. The growth of the global student accommodation market is majorly driven by The continuous rise in the global student population, particularly international students, along with the growing demand for quality, safe, and convenient housing among students.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.