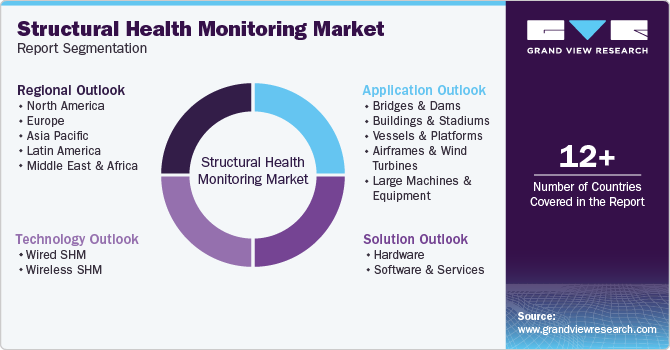

Structural Health Monitoring Market Size, Share, & Trends Analysis Report By Solution (Hardware, Software & Services), By Technology, By Application, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-587-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Structural Health Monitoring Market Trends

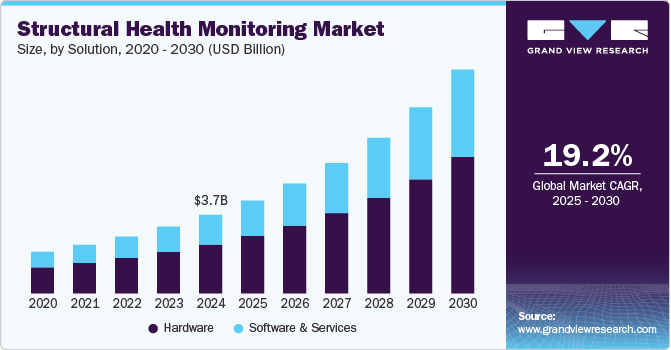

The global structural health monitoring market size was estimated at USD 3.68 billion in 2024 and is anticipated to grow at a CAGR of 19.2% from 2025 to 2030. The market growth can be attributed to the stringent public safety regulations, the subsequent emphasis on maintaining aging infrastructure, and the aggressive investments in smart infrastructure projects. Government initiatives aimed at standardizing SHM systems as part of the broader efforts to boost overall public safety also bode well for the growth of the market. The continued rollout of smart infrastructure projects is driving the adoption of new, innovative SHM systems based on the latest technologies, thereby propelling the market growth.

The rapid growth of urbanization and infrastructural development stands as a significant driver fueling the growth of the Structural Health Monitoring (SHM) market. With global agendas such as the Sustainable Development Goals and the aim for net zero emissions by 2050 emphasizing the need for sustainable infrastructure, there is a growing need for substantial investments. The OECD estimates an annual requirement of USD 6.9 trillion for infrastructure investments until 2050 to achieve development goals and foster a low-carbon, climate-resilient future. Despite this, a considerable gap exists in the required investments, with most allocations directed toward conventional infrastructure projects, according to the Global Infrastructure Hub. In response to this, structural health monitoring systems are witnessing increasing adoption, particularly in the construction of vital infrastructures such as buildings, bridges, and dams. The following chart highlights the number of total dams across the globe as of 2023.

Government regulations and policies for sustainable infrastructure serve as a significant driver for the Structural Health Monitoring (SHM) market, propelled by the need to address climate change impacts and enhance resilience in infrastructure networks. According to OECD ENVIRONMENT POLICY PAPER NO. 14, infrastructure networks are highly vulnerable to the physical effects of climate variability and change, with extreme events highlighting the potential exposure and vulnerabilities. For instance, OECD modeling of a major flood in Paris demonstrated that 30%-50% of direct damages would be suffered by the infrastructure sector, emphasizing the need for climate-resilient infrastructure to mitigate losses and reduce disruption costs.

In alignment with these efforts, annual green public infrastructure investments emphasize the commitment toward sustainable infrastructure development. These investments are channeled across various sectors, such as transportation, energy, water, and telecommunications, aiming to foster infrastructure resilience and sustainability. The following chart depicts the annual green public infrastructure investments in different sectors as a percentage of the GDP.

Complex data processing and management pose significant restraints in the Structural Health Monitoring (SHM) market. The challenge primarily stems from the high volume of data generated by large structures, making it cumbersome to handle with conventional solutions. There is a growing need for efficiently managing vast datasets to extract meaningful insights that are crucial for structural health assessment. Moreover, ensuring the robustness and reliability of installed sensors presents an additional challenge, as manual monitoring may be necessary in the event of sensor failures.

Solution Insights

The hardware segment accounted for the largest revenue share of over 62% in 2024. The structural health monitoring system relies heavily on hardware components such as sensors, data acquisition systems, and communication devices. These components monitor numerous physical parameters of any structure, such as strain, deformation, and tilt, and make structure-specific decisions based on the data obtained from various hardware equipment. Thus, the increasing adoption of structural health monitoring systems for detecting structural damage, ensuring safety and integrity, and estimating performance deterioration of civil infrastructures is a major factor behind the growth of the segment. In addition, increasing urbanization in countries such as India and China is further expected to drive the demand for SHM hardware such as sensors and data acquisition systems.

The software & services segment is expected to grow at a significant CAGR from 2025 to 2030. The segment is growing at a rapid pace due to its ability to provide real-time access to the information of the structural quality check parameters. Structural health monitoring supports continuous monitoring, data collection, alert of any impending damage, and data acquisition even in adverse conditions. Growing urbanization and industrialization across the globe are expected to drive the demand for SHM software and services. Furthermore, the increasing preference for wireless technology has led to an increased demand for efficient software that offers rapid analysis and data acquisition speed, along with real-time presentation of information on the end-user's portal.

Technology Insights

The wired SHM segment accounted for the largest revenue share in 2024. Many structures, such as bridges, buildings, and dams, already have wired monitoring systems to analyze their basic condition. The wired SHM system refers to the communication technique used to connect sensors, the data acquisition system, and other communication devices via lead wires, coaxial cables, optical fibers, and other wired technologies. SHM systems are frequently installed using wired procedures as they do not encounter any network disruption.

The wireless SHM segment is expected to grow at a significant CAGR from 2025 to 2030. Increasing demand for wireless sensors for structural health monitoring applications is driving the segment’s growth. Wireless sensors have the potential to catapult advancements in the field of structural monitoring. The benefits of wireless sensor networks over wired monitoring technologies include rapid deployment, minimal interference with the environment, autonomy, and flexibility. In addition, advancements in wireless sensing technologies have significantly led to developments in the field of SHM, especially when deploying equipment on large and complex structures.

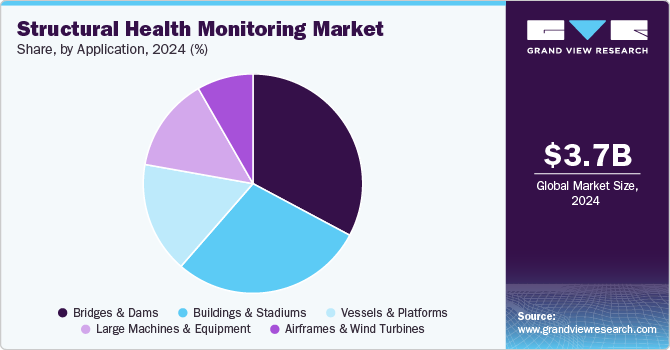

Application Insights

The bridges & dams segment accounted for the largest revenue share of over 32% in 2024. SHM is used to monitor various conditions of bridges and dams, such as tilting angle, load capacity, and safety factors for material strength to ensure regular maintenance. Certain defects of such structures cannot be detected by visual inspection. Therefore, sensors are used to detect inconspicuous damage caused by factors such as wind, temperature, vibration, and traffic to alert for timely maintenance.

The buildings & stadiums segment is expected to grow at a significant CAGR from 2025 to 2030. High-rise buildings and stadiums are complex structures that require structural health monitoring systems to evaluate and assess their health, strengthen safety, and optimize operational and maintenance activities. They require reliable and accurate data to improve operations, maintenance, and repair of complex structures when obsolete. Hence, fiber-optic technology and data acquisition systems are preferred to detect performance degradation of these structures to help save lives and prevent critical property damage. Moreover, rapid urbanization and the need for sustainable infrastructure across the globe, coupled with the development of smart cities, are expected to fuel the segment’s growth.

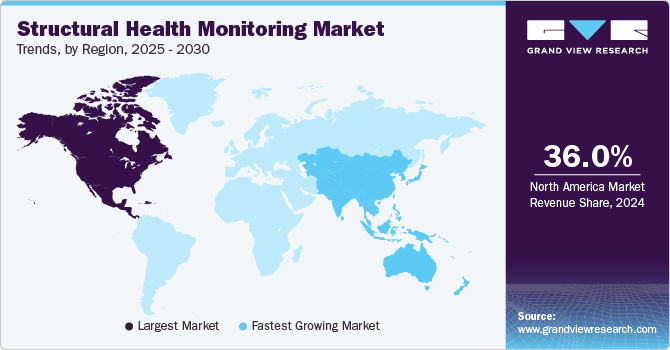

Regional Insights

North America structural health monitoring market held the major revenue share of over 36% in 2024. The growth of the market in North America can be attributed to the high investments undertaken by countries such as the U.S. and Canada for infrastructure development. Both government and private sectors support these large-scale infrastructure development activities.

U.S. Structural Health Monitoring Market Trends

The structural health monitoring market in the U.S. is expected to grow significantly from 2025 to 2030. Due to the aging condition of the country’s navigation infrastructure, government and private authorities need accurate and real-time information on the condition of infrastructure, such as dams, locks, and bridges operating beyond their lifespan. To tackle this challenge, the U.S. Army Corps of Engineers (USACE) developed sensors that provide real-time, constant information on structural conditions. SHM can provide an estimate of the remaining life and reliability of the infrastructure component or systems and warn of impending failure. Such government initiatives are propelling the Structural Health Monitoring (SHM) market growth in the U.S.

Europe Structural Health Monitoring Market Trends

Europe structural health monitoring market is growing significantly at a CAGR of over 20% from 2025 to 2030. European countries are witnessing significant investments to improve their existing infrastructure. For instance, in October 2022, Italian authorities announced EUR 3.9 billion (USD 3.85 billion) in funding to improve the country’s water infrastructure and reduce leaks in agricultural areas and cities. Approximately 60% of the total funding was allotted to projects in southern Italy, which required urgent maintenance of aqueducts, agricultural water networks, reservoirs, and irrigation channels.

Asia Pacific Structural Health Monitoring Market Trends

The structural health monitoring market in the Asia Pacific is growing significantly at a CAGR of over 21% from 2025 to 2030. The Asia Pacific Structural Health Monitoring (SHM) market growth can be attributed to the growing government regulations in countries such as China and South Korea, requiring SHM for critical infrastructures such as bridges and buildings. In addition, increased awareness of the benefits of SHM, such as improved safety, lower maintenance costs, and a longer lifespan of structures, is contributing to the regional market growth.

Key Structural Health Monitoring Company Insights

The market key players include Acellent Technologies, Inc., Campbell Scientific, Inc., COWI A/S, Digitexx Data Systems, Inc., Geocomp, Inc., GEOKON, GeoSIG Ltd., Hottinger Brüel & Kjaer (HBK), James Fisher and Sons plc, Kinemetrics, National Instruments Corp, Nova Ventures, SIXENSE, Structural Monitoring Systems Plc., and Xylem, Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Structural Health Monitoring Companies:

The following are the leading companies in the structural health monitoring market. These companies collectively hold the largest market share and dictate industry trends.

- Acellent Technologies, Inc.

- Campbell Scientific, Inc.

- COWI A/S

- Digitexx Data Systems, Inc.

- Geocomp, Inc.

- GEOKON

- GeoSIG Ltd.

- Hottinger Brüel & Kjaer (HBK)

- James Fisher and Sons plc

- Kinemetrics

- National Instruments Corp

- Nova Ventures

- SIXENSE

- Structural Monitoring Systems Plc.

- Xylem, Inc.

Recent Developments

-

In April 2024, Acellent Technologies, Inc. announced that Korea Aerospace Industries (KAI) has awarded the company a contract to supply Structural Health Monitoring (SHM) systems for KAI's KF-21 aircraft. Recognized as a 4.5-generation fighter, the KF-21 is expected to replace South Korea's aging fleet of fighter jets.

-

In June 2023, Campbell Scientific, Inc. introduced TempVue 10, an innovative analog temperature sensor that set a new standard for air temperature measurement by surpassing all World Meteorological Organization (WMO) recommendations for accuracy, providing users with exceptionally stable and reliable temperature data over extended periods. The TempVue 10's adaptable design, featuring two or four wires, was aimed at facilitating seamless integration with existing systems while saving time and ensuring compatibility.

Structural Health Monitoring Report Scope

|

Report Attribute |

Details |

|

Market Revenue size in 2025 |

USD 4.35 billion |

|

Revenue forecast in 2030 |

USD 10.48 billion |

|

Growth rate |

CAGR of 19.2% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Solution, technology, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany;, France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Acellent Technologies, Inc.; Campbell Scientific, Inc.; COWI A/S; Digitexx Data Systems, Inc.; Geocomp, Inc.; GEOKON, GeoSIG Ltd.; Hottinger Brüel & Kjaer (HBK); James Fisher and Sons plc; Kinemetrics; National Instruments Corp; Nova Ventures; SIXENSE; Structural Monitoring Systems Plc.; Xylem, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Structural Health Monitoring Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global structural health monitoring market report based on solution, technology, application, and region:

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Sensors

-

Data Acquisition Systems

-

Others

-

-

Software & Services

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wired SHM

-

Wireless SHM

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Bridges & Dams

-

Bridges

-

Rails

-

Dams

-

-

Buildings & Stadiums

-

Vessels & Platforms

-

Airframes & Wind Turbines

-

Airframes

-

Wind Turbines

-

-

Large Machines & Equipment

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global structural health monitoring market size was estimated at USD 3.68 billion in 2024 and is expected to reach USD 4.35 billion in 2025

b. The global structural health monitoring market is expected to grow at a compound annual growth rate of 19.2% from 2025 to 2030 to reach USD 10.48 billion by 2030

b. North America region dominated the structural health monitoring market with a share of over 36% in 2024. The growth of the Structural Health Monitoring (SHM) market in North America can be attributed to the high investments undertaken by countries such as the U.S. and Canada for infrastructure development. Both government and private sectors support these large-scale infrastructure development activities.

b. Some key players operating in the structural health monitoring market include Acellent Technologies, Inc., Campbell Scientific, Inc., COWI A/S, Digitexx Data Systems, Inc., Geocomp, Inc., GEOKON, GeoSIG Ltd., Hottinger Brüel & Kjaer (HBK), James Fisher and Sons plc, Kinemetrics, National Instruments Corp, Nova Ventures, SIXENSE, Structural Monitoring Systems Plc., and Xylem, Inc.

b. The growth of the market can be attributed to the stringent public safety regulations, the subsequent emphasis on maintaining aging infrastructure, and the aggressive investments in smart infrastructure projects. Government initiatives aimed at standardizing SHM systems as part of the broader efforts to boost overall public safety also bode well for the growth of the market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."