- Home

- »

- Advanced Interior Materials

- »

-

Strontium Market Size, Share & Growth Analysis Report 2030GVR Report cover

![Strontium Market Size, Share & Trends Report]()

Strontium Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Strontium Carbonate, Strontium Nitrate), By Application (Pyrotechnics & Signals, Medical), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-463-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Strontium Market Summary

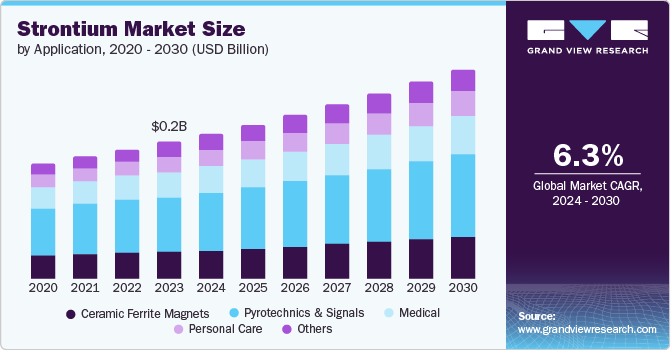

The global strontium market size was estimated at USD 248 million in 2023 and is projected to reach USD 378.7 million by 2030, growing at a CAGR of 6.3% from 2024 to 2030. Its growing usage in the production of ceramic ferrite magnets, and the medical industry for the prevention and treatment of bone related disorders are anticipated to drive the demand for strontium over the forecast period.

Key Market Trends & Insights

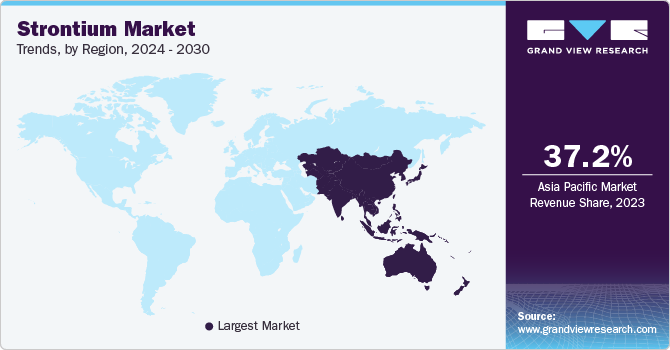

- Asia Pacific dominated the market with a revenue share of 37.2% in 2023.

- The market for strontium in the U.S. is anticipated to be driven by rising military spending.

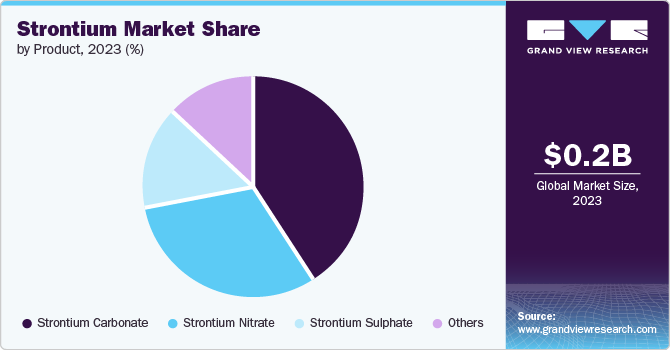

- Based on product, the strontium carbonate segment held the largest revenue share of over 41.0% in 2023.

- Based on application, the personal care segment is anticipated to register the highest revenue CAGR of 7.0% over the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 248 Million

- 2030 Projected Market Size: USD 378.7 Million

- CAGR (2024-2030): 6.3%

- Asia Pacific: Largest market in 2023

The growth of the market is anticipated to be largely driven by the usage of bright and colorful fireworks in the entertainment and event management industries, and this is further contributing to the market.

According to the American Pyrotechnics Association, display fireworks consumption in the U.S. was 27.1 million lbs. in 2023, which was an increase of 7% y-o-y. This growth of public fireworks display indicates its growing consumption in the fireworks industry.

Drivers, Opportunities & Restraints

The largest driver for the market is its usage in pyrotechnics & signals applications. It is a vital raw material that imparts a deep red hue to fireworks. In addition, it has a high oxygen content, and helps in ignition of the firework mixture. In addition, its usage in the production of ceramic ferrite magnets is driven by its utilization in electronics.

Its potential applications in the medical industry presents lucrative opportunities. Ongoing research and studies on the effectiveness of the product usage in the treatment of bone and teeth related disorders is anticipated to drive the market in future.

While strontium and its compounds are extensively being used in end user segments such as electronics and medical industries, it can be restrained by the development of new technology that has the potential to replace existing products and equipment. For instance, the need for strontium-based goods may decline due to the move towards other technologies and materials, such as OLEDs, LED displays, and alternative alloys. However, the pace of adoption of such new technology implies that the substitution potential of the product is low and can take many years to become a formidable threat to the market.

Price Trends of Strontium

The product has been met with mixed levels of interest in the global market. This is because of its lower importance in the critical mineral list published by countries worldwide, the varying pace of consumption amongst its key applications, and its relatively lower value as compared to other minerals of commercial importance. This mineral, however, is subject to strong influences from end user demand, which has resulted in consistency in global pricing.

Strontium pricing is influenced by various factors and may fluctuate based on market conditions. The key factors include cost of ore, energy cost, labor & production cost, the dynamic market demand, currency exchange rates, technology advancements, environmental regulations, and the geopolitical environment. Over the historic period, global pricing trends indicate low volatility, owing to robust demand across applications. However, based on market demand factors, there have been instances of price volatility across regional markets.

For instance, in the U.S., the predominant application for strontium is historically attributed to pyrotechnics & signals, ceramic ferrite magnet production and as additives in drilling fluids. Demand witnessed a marked decrease in drilling fluid applications in 2023 y-o-y, because of decreased drilling activity. This resulted in a marked price decline in 2023 y-o-y.

The demand for electronic, medical and personal care applications witnessed steady growth from 2022, owing to the recovery of economic activity across the world. Hence, the demand is anticipated to reflect upon pricing over the forecast period, and result in steady levels over the forecast period.

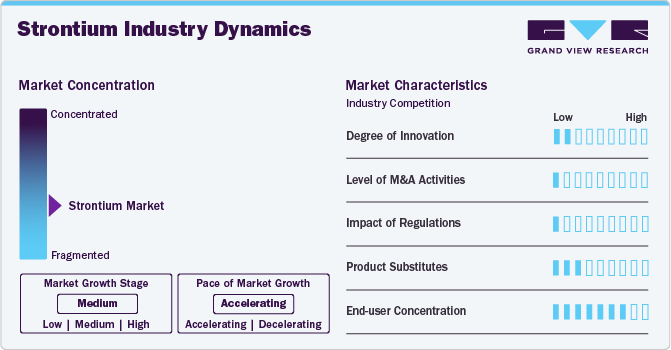

Market Concentration & Characteristics

The strontium market is at a medium stage of industry growth, indicating an accelerated pace of growth. The market is fragmented, with high concentration of producers located in China.

The degree of innovation in technology and product type is moderate and is characterized by established technology that is affordable and easily accessible, such as the direct conversion method, and the reduction process. Currently, companies are focused on sustainable production, wherein their objective is to achieve a low-carbon footprint and incur minimal cost.

The level of M&A activities has remained low over 2023. The price volatility of ore has resulted in varying levels of profitability amongst producers, who are now resorting to enhancing production efficiency and adopting cost optimization measures in order to remain competitive.

The industry has a low regulatory impact. Producers are governed by laws for mining licenses, environmental clearance and socio-economic impact. Laws regarding treatment of waste and effluents and worker safety according to international standards exist within the industry.

There are very few substitutes to the product, because of its preferred properties of high oxygen content, calcium absorption capability, and high magnetic properties. Presently, barium and calcium are used interchangeably to replace strontium.

There is a high concentration of end users for the market. The product is extensively used in industries such as electronics, entertainment & event management, medical, personal care and paints & coatings. Being a widely available product, it has been traditionally used in these industries over the historic period.

Product Insights

“Strontium carbonate held the largest revenue share of over 41.0% in 2023.”

Strontium carbonate is utilized in the production of fireworks to impart a deep red color. It is used in the manufacturing of luminescent and bright paint, and in medications to treat bone-related disorders such as osteoporosis. In fireworks, it imparts a deep red color. It is also used in the production of hard ceramic/ferrite magnets that is further used in the electrical and electronics industries.

Strontium carbonate helps in improving properties of hardness and scratch resistance, reduction of micro-cracks, increased brightness, ease of polishing, etc. Hence, it is also used in the manufacture of glass substrate for LCD displays, as well as numerous glass applications used in optics, glassware, lighting, fiber glass, laboratory, and pharmaceutical glass, etc.

Strontium nitrate is used in signal lights, railroad flares and pyrotechnics. Strontium sulfate is used as a raw material for the production of other strontium compounds. It is also used in the production of ceramic magnets and pyrotechnics. It is used interchangeably with strontium carbonate as a pigment and filler in the paints & coatings industry.

Application Insights

“Personal care is anticipated to register the highest revenue CAGR of 7.0% over the forecast period.”

Strontium is used in the production of personal care products used for oral care and skin conditioning. In oral care products, it is used to clean, deodorize and protect the oral cavity. For skin conditioning, it helps relieve skin discomfort such as itching. The personal care industry is being driven by increasing consumer awareness on enhancing personal appearance. Amongst millennials, products related to skincare and hair care have gained popularity as essential components of their daily grooming routine.

The medical industry is anticipated to witness steady growth owing to the increasing requirement for treatment of bone-related disorders such as osteoporosis. A rise in awareness about disease and available treatment options has influenced the adoption of osteoporosis treatment across the globe. Therefore, the adoption of osteoporosis treatment has resulted in the study and development of products containing strontium.

Pyrotechnics accounted for the highest revenue share of the market in 2023. The growing demand for colorful firework displays at sporting events, concerts, weddings and theme parks have been traditionally driving the market. In addition, the increasing demand of signals for border patrolling, military operations, search operations and other defense related requirements have been driving the consumption in pyrotechnics & signals applications.

The product is also widely used in the production of ceramic ferrite permanent magnets owing to its high magnetic properties. These are further used in electronic applications such as smart phones, tables and laptops. Other applications of include its usage as a pigment extender or filler in the paints & coatings industry.

Regional Insights

North America is anticipated to be driven by production in the U.S. of permanent magnets and pyrotechnics in fireworks and military signaling applications. Further, the rising need for strontium compounds in corrosion-resistant paints, which are used for coating aircraft parts, is another growth driver for the market.

U.S. Strontium Market Trends

The market for strontium in the U.S. is anticipated to be driven by rising military spending. For instance, in 2023, the country spent USD 820.3 billion, around 13% of the federal budget, on military and defense spending. High defense expenditures in the U.S. aid the growth of pyrotechnics and signaling applications, which benefit strontium demand.

Asia Pacific Strontium Market Trends

“China accounted for over 65.0% revenue share of the Asia Pacific market.”

Asia Pacific dominated the market with a revenue share of 37.2% in 2023. Growth can be attributed to the increasing growth of pyrotechnics & signals, and its usage in ceramic ferrite magnets. Countries like China, Japan, South Korea, and India have a strong electronics manufacturing sector, and demand for strontium compounds is high in the production of display panels, CRTs, and other electronic devices.

China strontium market experienced steady growth in 2023. This can be attributed to product usage in pyrotechnics in the production of fireworks and signaling applications. The country is the largest fireworks exporter in the world, and Liuyang in the Hunan province is the largest global production hub.

Europe Strontium Market Trends

The demand for strontium is anticipated to increase in Europe owing to the flourishing beauty & personal care industry. The region also leverages domestic production of strontium in Spain, which suffices the need for the product in majority of European region.

Germany strontium market growth is anticipated to be driven by growth in industries such as medical and personal care. Large-scale utility of personal care products in the country aids market growth. For instance, the market for cosmetic products in Germany was valued at EUR 15.9 billion in 2023.

Central & South America Strontium Market Trends

Central & South America is projected to witness growth on account of factors such as industrial expansion, cultural festivals, and a rise in population. The region's vibrant cultural festivals and celebrations drive demand for pyrotechnics that use strontium-based compounds. Further, the region is also rich in reserves and mining activities, which supports the product’s supply.

Brazil strontium market growth anticipated to be sustained by the production of fireworks. The country is a key exporter of fireworks to the global market. According to the World Bank, Brazil exported fireworks worth USD 2.6 million (536.2 tons) in 2023.

Key Strontium Company Insights

Some of the key players operating in the market include Basstech International and Solvay.

-

U.S. based Basstech International was established in 1994 and is headquartered in New Jersey. It produces strontium nitrate and mainly caters to the North American market.

-

Belgium-based Solvay was established in 1863 and is headquartered in Brussels. It is a producer of a wide range of strontium compounds such as high-purity strontium carbonate and high-purity strontium hydroxide. It caters to the global market.

Key Strontium Companies:

The following are the leading companies in the strontium market. These companies collectively hold the largest market share and dictate industry trends.

- ABASSCO

- Basstech International

- Canteras Industriales, S.L.

- Joyieng Chemical LTD.

- ProChem

- Quimica Del Estroncio, S.A.

- Sakai Chemical Co., LTD.

- Solvay

Recent Developments

-

In July 2023, Australia-based Dateline Resources Limited announced its intention to acquire an 80% interest in the Argos Strontium Project in San Bernadino, California, U.S. The Argos deposit is the largest-known strontium deposit in the U.S.

-

In November 2020, Solvay announced the sale of its technical-grade strontium business in Germany, Spain and Mexico to France-based Latour Capital as a part of its product line focus strategy. It now concentrates on the production of high-purity strontium products only.

Strontium Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 262.8 million

Revenue forecast in 2030

USD 378.7 million

Growth rate

CAGR of 6.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East, Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Turkey; Russia; China; India; Japan; South Korea; Brazil

Key companies profiled

ABASSCO; Basstech International; Canteras Industriales, S.L.; Joyieng Chemical LTD.; ProChem; Quimica Del Estroncio, S.A.; Sakai Chemical Co., LTD.; Solvay

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Strontium Market Report Segmentation

This report forecasts revenue and volume growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Strontium market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Strontium Carbonate

-

Strontium Nitrate

-

Strontium Sulphate

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Ceramic Ferrite Magnets

-

Pyrotechnics & Signals

-

Medical

-

Personal Care

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Turkey

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global strontium market size was estimated at USD 248 million in 2023 and is expected to reach USD 262.8 million in 2024.

b. The global strontium market is expected to grow at a compound annual growth rate of 6.4% from 2024 to 2030 to reach USD 378.7 million by 2030.

b. By product, strontium carbonate accounted for the largest revenue share of over 41.0% in 2023 owing to its usage in the production of ceramic ferrite magnets and pyrotechnics & signals.

b. Some of the key players of the global strontium market are ABASSCO, Basstech International, Canteras Industriales, S.L., Joyieng Chemical LTD., ProChem, Quimica Del Estroncio, S.A., Sakai Chemical Co., LTD., Solvay, among others.

b. The key factors driving the growth of the global strontium market are its increasing usage in pyrotechnics & signals, in the production of ceramic ferrite magnets, in the treatment of bone-related disorders in the medical industry, and in oral care in personal care applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.