- Home

- »

- Conventional Energy

- »

-

Storage Tank Market Size, Share And Growth Report, 2030GVR Report cover

![Storage Tank Market Size, Share & Trends Report]()

Storage Tank Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Aboveground, Underground), By Product (Hazardous, Non-hazardous), By Material, By End-use (Oil & Gas, Chemicals), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-371-4

- Number of Report Pages: 181

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Storage Tank Market Summary

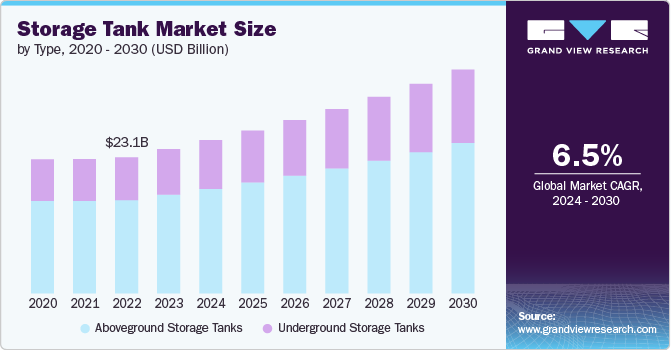

The global storage tank market size was estimated at USD 24.49 billion in 2023 and is projected to reach USD 37.98 billion by 2030, growing at a CAGR of 6.52% from 2024 to 2030. The market is diverse, with different types of tanks, including aboveground, underground, and mobile storage tanks, each catering to specific needs and applications.

Key Market Trends & Insights

- North America dominated the global storage tank market with the largest revenue share in 2023.

- The storage tank market in the U.S. accounted for the largest market revenue share in North America in 2023.

- By type, the aboveground storage tanks segment led the market with the largest revenue share of 68.31% in 2023.

- By product, the hazardous tanks segment led the market with the largest revenue share of 64.30% in 2023.

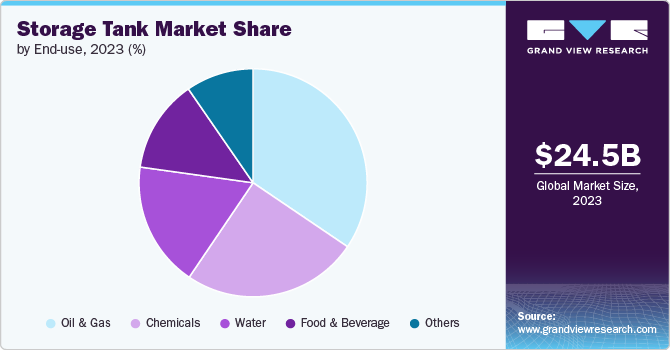

- By end use, the oil & gas segment led the market with the largest revenue share of 34.47% in 2023.

- By material, the concrete storage tanks segment is expected to register at the fastest CAGR during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 24.49 Billion

- 2030 Projected Market Size: USD 37.98 Billion

- CAGR (2024-2030): 6.52%

- North America: Largest market in 2023

The demand for storage tanks is further propelled by stringent environmental regulations and safety standards that mandate secure and efficient storage solutions.

In recent years, advancements in material technology and manufacturing processes have led to the development of more durable, corrosion-resistant, and cost-effective storage tanks. The adoption of high-performance materials such as fiberglass-reinforced plastic (FRP), stainless steel, and polyethylene has enhanced the longevity and reliability of storage tanks, thereby reducing maintenance costs and improving overall operational efficiency. Moreover, the integration of smart monitoring systems has enabled real-time tracking and management of storage tanks, offering better control and optimization of resources.

Drivers, Opportunities & Restraints

Several factors are driving the growth of the storage tanks market. One of the primary drivers is the rising demand for energy, which has led to increased exploration and production activities in the oil and gas sector. This, in turn, has created a substantial need for storage solutions to manage crude oil, refined products, and natural gas. Additionally, the growing emphasis on water conservation and management has spurred the demand for water storage tanks in both residential and industrial applications. The chemical industry also contributes to market growth, requiring specialized storage tanks for various hazardous and non-hazardous chemicals.

The market presents numerous opportunities for growth, particularly in the renewable energy sector. With the global shift towards sustainable energy sources, there is an increasing need for storage solutions for biofuels, hydrogen, and other renewable energy products. Companies that can innovate and provide specialized storage tanks for these emerging sectors are well-positioned to capitalize on this growing demand. Furthermore, the expanding infrastructure in developing countries offers significant opportunities for the installation of new storage tanks, driven by the need for efficient water and waste management systems.

Despite the positive outlook, the market faces certain restraints that could hinder its growth. One of the primary challenges is the high initial investment required for the installation and maintenance of storage tanks. This can be a significant barrier, especially for small and medium-sized enterprises. Additionally, fluctuations in raw material prices, such as steel and plastic, can impact the overall cost of storage tanks, making them less affordable for end-users. Environmental concerns and stringent regulations regarding the disposal of old or damaged tanks also pose challenges, as companies must adhere to strict guidelines to avoid penalties and ensure environmental safety.

Type Insights

Based on type, aboveground storage tanks held the largest revenue share of 68.31% in 2023. Aboveground storage tanks (ASTs) are widely utilized due to their ease of installation, maintenance, and inspection. They are visible, making it easier to detect and address leaks or damages promptly. These tanks are commonly used in applications such as fuel storage, chemical processing, and water treatment, where accessibility and regular monitoring are crucial.

Underground storage tanks (USTs) are preferred for applications where space constraints are a significant concern. USTs are typically used for storing hazardous materials such as petroleum products and chemicals, minimizing the risk of environmental contamination and providing a safer option for densely populated areas. The installation of USTs requires meticulous planning and adherence to stringent regulatory standards to prevent leakage and ensure long-term integrity. Despite the higher initial costs associated with their installation and maintenance, the space-saving advantage of USTs makes them a viable option for many industries.

Product Insights

Based on product, hazardous tanks held the largest revenue share of 64.30% in 2023. Hazardous storage tanks are designed to safely contain materials that pose significant risks to health, safety, and the environment. These tanks are equipped with advanced safety features and are constructed using robust materials to withstand the corrosive and reactive nature of hazardous substances. Industries such as oil and gas, chemicals, and waste management rely heavily on these tanks to ensure regulatory compliance and minimize potential hazards.

Non-hazardous storage tanks, while subject to less stringent regulatory oversight, still require careful design and construction to maintain the quality and safety of the stored products. These tanks are commonly used in industries such as food and beverage, water treatment, and agriculture. The primary focus for non-hazardous storage tanks is to prevent contamination and ensure the integrity of the stored materials. Innovations in material technology and manufacturing processes have led to the development of more cost-effective and durable solutions for non-hazardous storage applications.

Material Insights

Based on material, steel tanks held the largest revenue share of 57.39% in 2023. Steel tanks are known for their strength, durability, and resistance to extreme temperatures and pressures. They are widely used in industries such as oil and gas, chemicals, and water treatment, where robust and reliable storage solutions are essential. The ability to fabricate steel tanks in various shapes and sizes adds to their versatility and broad applicability.

Concrete storage tanks are preferred for their longevity and resistance to environmental factors such as corrosion and UV radiation. They are commonly used for water storage, wastewater treatment, and bulk storage applications. The inherent strength of concrete makes these tanks suitable for both aboveground and underground installations, providing a cost-effective and durable solution for large-scale storage needs. Additionally, concrete tanks offer excellent thermal insulation properties, making them ideal for storing temperature-sensitive materials.

End-use Insights

Based on end use, oil & gas held the largest revenue share of 34.47% in 2023. The oil and gas industry is one of the largest consumers of storage tanks, utilizing them for storing crude oil, refined products, and natural gas. The need for secure and efficient storage solutions in this industry is driven by the growing demand for energy and the expansion of exploration and production activities.

The chemical industry relies on specialized storage tanks to handle hazardous and non-hazardous chemicals, ensuring safe containment and preventing environmental contamination. These tanks are designed to withstand the corrosive nature of chemicals and comply with stringent safety regulations. The increasing production and consumption of chemicals globally have spurred the demand for advanced storage solutions in this sector.

Regional Insights

North America storage tank market holds a significant share of the global market, driven by the robust industrial base and extensive infrastructure development. The region's thriving oil and gas industry, particularly in the United States, necessitates advanced storage solutions for crude oil, refined products, and natural gas. Additionally, stringent environmental regulations and safety standards enforce the adoption of high-quality storage tanks, ensuring safe containment and minimizing environmental risks. Innovations in material technology and the increasing focus on renewable energy storage further bolster the market in North America.

U.S. Storage Tank Market Trends

The storage tanks market in the U.S. is expected to grow. The country's expansive oil and gas industry, coupled with the need for efficient water management and chemical storage, drives the market growth. The US government’s emphasis on infrastructure development and environmental sustainability also supports the adoption of advanced storage solutions. Additionally, the presence of leading storage tank manufacturers and technological advancements in monitoring systems enhance the market’s competitiveness and innovation.

Europe Storage Tank Market Trends

Europe’s well-established industrial base, particularly in chemicals, pharmaceuticals, and food and beverage sectors, drives the demand for reliable and safe storage solutions. The European Union’s regulations on waste management and water treatment further contribute to the market’s growth. Additionally, the increasing adoption of renewable energy sources and the corresponding need for specialized storage tanks present significant opportunities for market expansion in Europe.

Asia Pacific Storage Tank Market Trends

The Asia-Pacific region is experiencing rapid growth in the storage tanks market, fueled by robust industrialization, urbanization, and infrastructural development. Countries such as China, India, and Japan are witnessing substantial investments in oil and gas, chemicals, and water treatment industries, driving the demand for advanced storage solutions. The region’s focus on expanding its industrial base and improving water management systems further propels the market. Moreover, the increasing adoption of renewable energy technologies and the need for efficient storage solutions present lucrative opportunities for storage tank manufacturers in APAC.

Key Storage Tank Company Insights

The storage tanks market is highly competitive, with key players such as CST Industries, McDermott, and PermianLide dominating the landscape. These companies focus on innovations in materials and technologies to enhance tank durability and efficiency. Strategic partnerships, mergers, and acquisitions are common strategies to expand their market share and global presence.

Key Storage Tank Companies:

The following are the leading companies in the storage tank market. These companies collectively hold the largest market share and dictate industry trends.

- TOYO KANETSU K.K

- Ishii Iron Works Co., Ltd

- Pfaudler MEKRO Sp. Z O.O

- CST Industries, Inc.

- McDermott

- PERMIANLIDE

- Highland Tank & Manufacturing Co. Inc.

- Fox Tank Company

- F Warren Group Inc.

- Superior Tank Co. Inc.

Recent Developments

-

In June 2024, Hypro unveiled a new range of cryogenic storage tanks designed for the global market, enhancing its portfolio with advanced, high-capacity solutions. These tanks cater to the increasing demand for safe and efficient cryogenic storage, ensuring reliability and performance.

-

In March 2024, 3M and HD Hyundai KSOE announced a collaborative research project to develop advanced insulation technologies for liquid hydrogen storage tanks. This partnership aims to enhance storage efficiency and safety, addressing the growing needs of the hydrogen economy.

-

In September 2023, Utkarsh Pipes launched a new product line, Utkarsh Water Tanks. These tanks offer durable and efficient water storage solutions, reinforcing Utkarsh’s commitment to quality and innovation in the storage tank market.

Storage Tank Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 26.01 billion

Revenue forecast in 2030

USD 37.98 billion

Growth rate

CAGR of 6.52% from 2024 to 2030

Actual data

2018 - 2023

Base Year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Type, product, material, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Toyo Kanetsu K.K.; Ishii Iron Works Co., Ltd.; Pfaudler MEKRO Sp. Z O.O; CST Industries, Inc.; McDermott; PERMIANLIDE; Highland Tank & Manufacturing Co. Inc.; Fox Tank Company; F Warren Group Inc.; Superior Tank Co. Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Storage Tank Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented global storage tank market report on the basis of type, material, product, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Aboveground Storage Tanks

-

Underground Storage Tanks

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hazardous

-

Non-hazardous

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Steel

-

Concrete

-

Polyethylene

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Chemicals

-

Water

-

Food And Beverage

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global storage tank market size was estimated at USD 24.49 billion in 2023 and is expected to reach USD 26.01 billion in 2024

b. The global storage tank market is expected to grow at a compounded annual growth rate of 6.25% from 2024 to 2030 to reach USD 37.98 billion by 2030.

b. Based on type, aboveground storage tanks held the market with the largest revenue share of 68.31% in 2023. Aboveground storage tanks (ASTs) are widely utilized due to their ease of installation, maintenance, and inspection. They are visible, making it easier to detect and address leaks or damages promptly.

b. Some key players operating in the storage tank market include Toyo Kanetsu K.K., Ishii Iron Works Co., Ltd., Pfaudler MEKRO Sp. Z O.O, CST Industries, Inc., McDermott, PERMIANLIDE, among others.

b. Advancements in material technology and manufacturing processes have led to the development of more durable, corrosion-resistant, and cost-effective storage tanks are the key factors driving the storage tank market over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.