- Home

- »

- Consumer F&B

- »

-

Still Bottled Water Market Size, Share & Trends Report, 2030GVR Report cover

![Still Bottled Water Market Size, Share & Trends Report]()

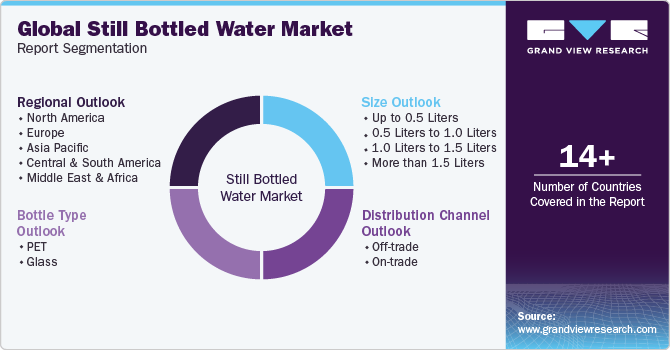

Still Bottled Water Market (2024 - 2030) Size, Share & Trends Analysis Report By Size (Up to 0.5 Liter, 0.5 Liter to 1.0 Liter), By Bottle Type (PET, Glass), By Distribution Channel (On-trade, Off-trade), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-269-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Still Bottled Water Market Summary

The global still bottled water market size was estimated at USD 261.32 billion in 2023 and is projected to reach USD 380.53 billion by 2030, growing at a CAGR of 5.6% from 2024 to 2030. Increasing health consciousness among consumers has driven a shift towards healthier beverage choices, with still bottled water being a preferred, calorie-free option.

Key Market Trends & Insights

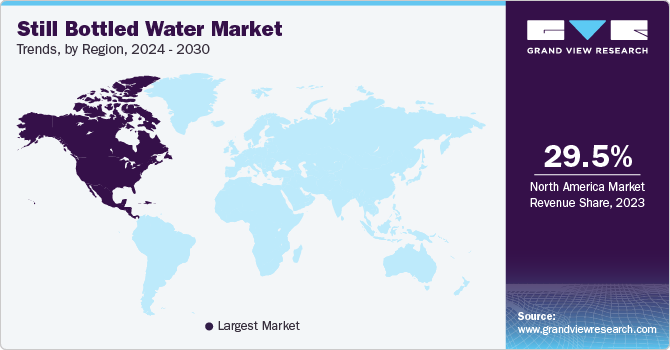

- North America still bottled water market accounted for a share of 29.5% of the global market in 2023.

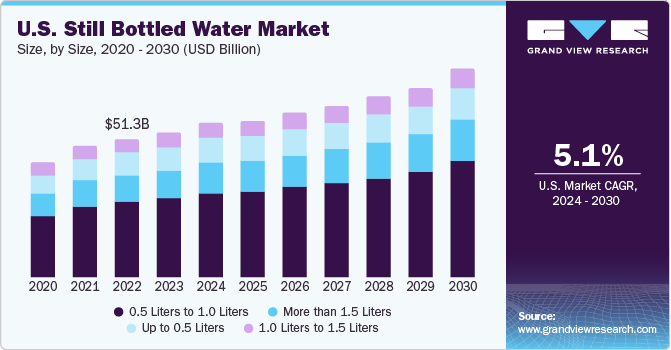

- The still bottled water market in the U.S. is expected to grow at a CAGR of 5.1% from 2024 to 2030.

- The still bottled water market in Europe is expected to grow at a CAGR of 4.8% from 2024 to 2030.

- Based on size, the 0.5 liters to 1.0 liters segment dominated the market with the largest revenue share of 55.9% in 2023.

- Based on type, the PET segment dominated the market with the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 261.32 Billion

- 2030 Projected Market Size: USD 380.53 Billion

- CAGR (2024-2030): 5.6%

- North America: Largest market in 2023

The convenience of on-the-go hydration aligns with modern lifestyles, contributing to a rising demand for portable water solutions. Environmental awareness has fueled a demand for sustainable packaging options, prompting manufacturers to adopt eco-friendly materials. Preimmunization and the introduction of specialty waters cater to evolving consumer preferences, further propelling the expansion of the still-bottled water market on a global scale. The fast-paced, on-the-go lifestyles prevalent in society have fueled the demand for convenient and portable hydration solutions, with bottled water still meeting this need effectively.

Moreover, a growing environmental consciousness among consumers has led manufacturers to embrace sustainable packaging materials like glass or PET. Glass, known for its recyclability and inert properties preserving water purity, appeals to those prioritizing environmental concerns. PET, on the other hand, offers lightweight and portable options coupled with recyclability, aligning with the convenience and sustainability preferences of today's consumers. This dynamic interplay of health, convenience, and sustainability trends contributes to the continuous expansion of the water market.

For instance, in February 2023, BE WTR marked a significant milestone in its sustainability strategy by unveiling the 'Big 1500,' the first fully automated bottling site in the UAE. This advanced solution, located at Destination Mina Seyahi, represents phase two of their collaborative sustainability initiative with locally filtered water available in reusable, encapsulated glass and stainless-steel bottles, offered in both still and sparkling options. The on-site bottling facility serves prominent establishments such as W Dubai - Mina Seyahi, Le Meridien Mina Seyahi Beach Resort & Waterpark, and The Westin Dubai Mina Seyahi Beach Resort & Marina.

Market Concentration & Characteristics

Regulations significantly shape the market by establishing stringent standards across various facets of production, labeling, and distribution. These regulations ensure the safety and quality of bottled water through mandatory testing, hygiene standards, and transparent labeling practices. Environmental concerns are also addressed, with regulations encouraging sustainable packaging and responsible sourcing to minimize the industry's ecological footprint.

In the still bottled water market, various product substitutes cater to diverse consumer preferences and needs. One notable substitute is flavored water, offering hydration with added taste sensations.

Sports drinks and enhanced water beverages enriched with electrolytes or vitamins provide alternatives for those seeking additional benefits. Functional beverages like coconut water or aloe vera drinks also compete in this space, promoting unique health attributes. Additionally, consumers may opt for tap water with portable filtration solutions as a cost-effective and environmentally friendly substitute.

Size Insights

Based on size, the 0.5 liters to 1.0 liters segment dominated the market with the largest revenue share of 55.9% in 2023. The compact size of bottles ranging from 0.5 to 1.0 liters caters to consumers with busy, on-the-go lifestyles. These smaller bottles are easily portable, making them convenient for activities such as commuting, exercising, and other daily routines.

The more than 1.5 liters segment is expected to grow at a CAGR of 5.5% from 2024 to 2030. Larger bottles offer convenience by reducing the frequency of purchases, catering to consumers who prefer having a longer-lasting supply of water readily available. This is particularly appealing in situations where frequent refills may be inconvenient.

Bottle Type Insights

Based on type, the PET segment dominated the market with the largest revenue share in 2023. PET bottles are lightweight, making them easy to carry and convenient for on-the-go consumers. The portability of PET bottles aligns with the modern, fast-paced lifestyle, making them a preferred choice for those who value convenience.

Glass bottles are often associated with a premium and upscale image, conveying a sense of luxury and sophistication. Brands using glass packaging capitalize on this association, attracting consumers willing to pay a premium for a perceived higher-quality product. For instance, in July 2022, Asia Brewery Inc. (ABI) addressed sustainability concerns by introducing a groundbreaking initiative in the Philippines - the launch of Summit Glass, the first locally produced still and sparkling water available in recyclable glass bottles. The Summit Glass range, crafted with natural drinking water sourced from high-quality aquifers and thoughtfully filtered, offers a refreshing and eco-conscious choice.

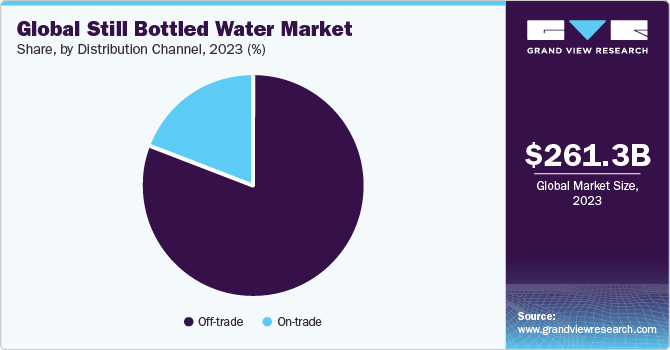

Distribution Channel Insights

Sales through off-trade channel dominated the market with the largest revenue share in 2023. Off-trade channels provide consumers with convenient access to still water in a variety of retail locations, enabling them to purchase and consume water whenever needed, without the constraints of a specific venue. Supermarkets and retail outlets offer a diverse selection of still water brands, sizes, and packaging options. Consumers can choose from various products, including different mineral content, bottle sizes, and packaging materials, catering to individual preferences.

Sales through on-trade is expected to grow at a significant rate from 2024 to 2030. Restaurants and upscale establishments often use still water as an opportunity to enhance the overall dining experience. Premium and artisanal still water brands are gaining popularity, contributing to the expansion of the on-trade channel as a platform for showcasing such upscale options.

Regional Insights

North America still bottled water market accounted for a share of 29.5% of the global market in 2023. Consumers in North America are increasingly adopting healthier lifestyles, with a focus on making better beverage choices. Still water, perceived as a pure and natural option, aligns with the health and wellness trends that emphasize hydration without added sugars or calories.

Countries such as the U.S. and Canada, play pivotal roles in the still bottled water market in the region.These countries have witnessed the emergence of premium and specialty water products. Consumers are increasingly interested in unique water sources, mineral compositions, and premium packaging. Brands offering distinct and upscale still water options contribute to the diversification and expansion of the market.

U.S. Still Bottled Water Market Trends

The still bottled water market in the U.S. is expected to grow at a CAGR of 5.1% from 2024 to 2030. The on-the-go lifestyle prevalent in the U.S. has driven the demand for convenient and portable hydration options. Still bottled water provides a convenient and easily transportable solution, catering to the needs of busy individuals who seek hydration during various activities.

Europe Still Bottled Water Market Trends

The still bottled water market in Europe is expected to grow at a CAGR of 4.8% from 2024 to 2030. The European market for still bottled water has seen a rise in premium and specialty products. Consumers are increasingly interested in unique water sources, specific mineral content, and premium packaging options. Brands offering differentiated and upscale still water products contribute to the diversification and expansion of the market.

Key Still Bottled Water Company Insights

PepsiCo, FIJI Water Company LLC, The Coca-Cola Company, and Nestlé are some of the dominant players operating in still bottled water market.

-

PepsiCo, a global beverage and food company, markets still bottled water under the brand name Aquafina. This line of purified water emphasizes clarity and purity, offering consumers a refreshing and convenient hydration option, Aquafina caters to individuals seeking a clean and crisp water experience, aligning with PepsiCo's commitment to providing quality beverages.

-

FIJI Water, known for its artesian water sourced from the Yaqara Valley in Fiji, has a global presence. The company distributes its bottled water to various regions worldwide, including North America, Europe, Asia, and the Middle East and Africa.

Primo Water Corporation, Nongfu Spring, Mountain Valley Spring Water, and DANONE are some of the emerging market players functioning in still bottled water market.

-

Danone, the parent company of Evian, distributes its premium mineral water globally. Evian is known for its source in the French Alps and is available in numerous countries, with a strong presence in Europe, North America, and Asia.

-

Nongfu Spring offers a variety of still bottled water products, sourced from natural springs and aquifers across China. The brand is recognized for its commitment to high-quality and natural water sources, appealing to consumers seeking a reliable and refreshing hydration option.

Key Still Bottled Water Companies:

The following are the leading companies in the still bottled water market. These companies collectively hold the largest market share and dictate industry trends.

- PepsiCo

- FIJI Water Company LLC

- Nestlé

- DANONE

- VOSS

- The Coca-Cola Company

- Nongfu Spring

- Mountain Valley Spring Water

- Primo Water Corporation

- National Beverage Corp.

Recent Developments

-

In February 2023, Hong Kong's leading bottled water brand, bonaqua, has been a longstanding advocate for sustainable development. In line with its commitment to exploring eco-friendly solutions, bonaqua sponsored this year's "ReThink Sustainable Development Business Forum and Solutions Expo" (ReThink Expo). Simultaneously, bonaqua introduced its mineralized water in returnable glass bottles, marking an innovative B2B collaboration with the hotel industry. This pioneering partnership underscores bonaqua's sustainability vision, showcasing a 100% returnable glass bottle design.

-

In June 2022, Malaysian bottled water provider Spritzer introduced a sustainable initiative by launching label-free bottles for its silica-rich Natural Mineral Water product. The company has transitioned to 100% recyclable bottles without labels for its 1.25-liter and 550ml Natural Mineral Water ranges. This eco-friendly approach aims to minimize environmental impact without altering the water's quality or taste. Spritzer sources its water from the town of Taiping and utilizes recycled plastics in the production of these innovative, label-free bottles.

Still Bottled Water Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 273.88 billion

Revenue forecast in 2030

USD 380.53 billion

Growth Rate (Revenue)

CAGR of 5.6% from 2024 to 2030

Base Year

2023

Historical Data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Size, bottle type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; Spain; Italy; France; China; India; Japan; South Korea; Australia; Brazil; South Africa

Key companies profiled

PepsiCo; FIJI Water Company LLC; Nestlé; DANONE; VOSS; The Coca-Cola Company; Nongfu Spring; Mountain Valley Spring Water; Primo Water Corporation; National Beverage Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Still Bottled Water Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global still bottled water market report based on size, bottle type, distribution channel, and region:

-

Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Up to 0.5 Liters

-

0.5 Liters to 1.0 Liters

-

1.0 Liters to 1.5 Liters

-

More than 1.5 Liters

-

-

Bottle Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

PET

-

Glass

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Off-trade

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Grocery Stores

-

Others

-

-

On-trade

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global still bottled water market size was estimated at USD 261.32 billion in 2023 and is expected to reach USD 273.88 billion in 2024.

b. The global still bottled water market is expected to grow at a compounded growth rate of 5.6% from 2024 to 2030 to reach USD 380.53 billion by 2030.

b. PET bottle type is growing at a significant rate with a share of 94.4% in 2023. PET bottles are lightweight, making them easy to carry and convenient for on-the-go consumers. The portability of PET bottles aligns with the modern, fast-paced lifestyle, making them a preferred choice for those who value convenience.

b. Some key players operating in the still bottled water market include PepsiCo, The Coca-Cola Company, Primo Water Corporation, National Beverage Corp., FIJI Water Company LLC, Nestlé, and DANONE

b. Key factors that are driving the market growth include the rising adoption in the healthy and clean drinking water, and growing premiumization and the introduction of specialty waters

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.