Stevia Market Size, Share & Trends Analysis Report By Application (Beverages, Food, Pharmaceutical, Tabletop Sweeteners), By Region (North America, Asia Pacific, Europe, Latin America, Middle East and Africa), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-118-4

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Stevia Market Size & Trends

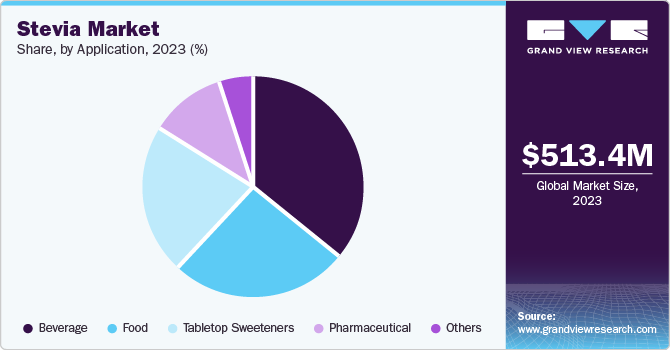

The global stevia market size was valued at USD 513.4 million in 2023 and is projected to grow at a CAGR of 11.9% from 2024 to 2030. Primary factors driving market growth include the growing demand for healthy eating and increasing health consciousness among consumers. As a natural alternative to artificial sweeteners, stevia has gained popularity, particularly among individuals seeking to reduce calorie intake or manage blood sugar levels, thereby creating a significant market opportunity.

Consumers are increasingly seeking natural, low-calorie sweeteners as alternatives to sugar and artificial sweeteners, leading to higher demand for stevia products. This trend is particularly evident in the food and beverage sector, where manufacturers are reformulating products to reduce sugar content while maintaining sweetness, thereby propelling the adoption of stevia as a preferred ingredient.

Regulatory support is also a significant driver of the stevia market, as regulatory initiatives aimed at reducing sugar intake in diets encourage manufacturers to adopt healthier alternatives such as stevia. Moreover, natural ingredient trends are driving demand for stevia, as consumers become more interested in clean-label products and natural ingredients. The zero-calorie profile of stevia makes it particularly appealing to those looking to manage their weight without sacrificing taste.

Finally, technological advancements in extraction and processing technologies are improving the taste profile and affordability of stevia products, making it more appealing to a broader audience. The market is also expanding in emerging regions, such as Asia-Pacific and South America, where increasing health consciousness and rising disposable incomes are driving demand for natural sweeteners.

Application Insights

Beverage accounted for the largest market revenue share of 36.8% in 2023, owing to the growing demand for natural sweeteners. As consumers increasingly opt for natural alternatives over artificial sweeteners, stevia-based beverages have become more popular. This surge in demand has led to a rise in the availability of stevia-sweetened beverages and a corresponding increase in consumer demand.

The food segment is expected to grow significantly with a CAGR of 12.2% during the forecast period. The escalating demand for functional food is driven by the growing need for ingredients such as stevia, which provide health benefits without compromising taste or quality. Urbanization, increased living standards, and busy lifestyles have led consumers to opt for safe and convenient food options. As consumer awareness and internet access expand, stevia is increasingly utilized in the food sector, catering to this demand.

Regional Insights

Asia Pacific stevia market dominated the market with a revenue share of 48.8% in 2023. The Asia Pacific region is driving the market for alternative sweeteners, with the growing health concerns of obesity and diabetes fueling demand. China is the leading producer, while Japan is a major consumer, accounting for nearly 40% of the sweetener market, with stevia being a key component.

China Stevia Market Trends

The stevia market in China is propelled by consumers’ growing health awareness, seeking natural and low-calorie alternatives to sugar. The food and beverage industry’s rapid growth, particularly in functional beverages and health-focused products, fuels demand. Regulatory support, clean-label trends, and China’s position as a leading producer and exporter also drive the market.

Europe Stevia Market Trends

Europe stevia market is projected to grow at the fastest CAGR of 12.8% over the forecast period, with demand increasing following regulatory approval. Consumers have embraced stevia, driving demand for products containing this natural sweetener. Meanwhile, European producers import stevia leaves from foreign markets, processing them into pure stevia sweeteners, which has impacted regional prices. This development has contributed to the growth of the European stevia market.

The stevia market in Germany is driven by growing health awareness and demand for natural sweeteners as alternatives to sugar. The country’s largest food and beverage industry, combined with consumer preferences for low-calorie, clean-label products, particularly in soft drinks and dairy, boosts stevia’s appeal. Regulatory support, organic food trends, and consumer familiarity also contribute to its growth.

North America Stevia Market Trends

North America stevia market is anticipated to witness significant growth in the Stevia market. The increase in this market is due to consumers’ preference for natural ingredient products, new offerings from both local and global companies, and stevia-based products gaining more exposure in the region. Moreover, rising healthcare expenditures and greater awareness of low-calorie foods are also fueling market growth.

The stevia market in the U.S. is driven by growing health awareness and demand for natural, low-calorie sweeteners as alternatives to sugar. Rising obesity and diabetes rates have prompted consumers to seek healthier options, leading to increased adoption of stevia in food and beverages. The beverage industry, particularly soft drinks and flavored waters, is a key contributor to this growth.

Key Stevia Market Company Insights

Some of the key companies in the stevia market include Ingredion; Tate & Lyle; Archer Daniels Midland Company; and others. Key players are leveraging strategic initiatives such as mergers, acquisitions, and partnerships to expand their customer base and gain market advantage.

-

Ingredion partners with customers to develop innovative, consumer-preferred products that offer exceptional eating experiences and on-trend benefits, while leveraging sustainable practices and regenerative agriculture to drive industry-leading sustainability results.

-

HOWTIAN is a supplier of high-quality plant-based ingredients and natural sweeteners, serving over 80 countries across industries, with a focus on Pyrroloquinoline Quinone and Baicalin root extracts, and offering vertically integrated agriculture and large-scale manufacturing capabilities.

Key Stevia Companies:

The following are the leading companies in the stevia market. These companies collectively hold the largest market share and dictate industry trends.

- Ingredion

- Tate & Lyle

- Archer Daniels Midland Company

- Cargill, Incorporated.

- HOWTIAN

- Evolva Holding SA

- GLG Life Tech Corp.

- Stevia First Corporation

View a comprehensive list of companies in the Stevia Market

Recent Developments

-

In June 2024, Ingredion Incorporated announced that UK food safety regulators have approved the use of PureCircle by Ingredion’s steviol glycosides, produced through bioconversion, expanding access to the most flavorful stevia molecules for food and beverage applications.

-

In May 2024, HOWTIAN introduced SoPure Andromeda, a new addition to its top-rated SoPure line of stevia products, featuring exclusive stevia combinations specially formulated and improved for various beverage applications.

Stevia Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 569.7 million |

|

Revenue forecast in 2030 |

USD 1.12 billion |

|

Growth rate |

CAGR of 11.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Brazil, Argentina, South Africa, Saudi Arabia |

|

Key companies profiled |

Ingredion; Tate & Lyle; Archer Daniels Midland Company; Cargill, Incorporated.; HOWTIAN; Evolva Holding SA; GLG Life Tech Corp.; Stevia First Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Stevia Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global stevia market report based on application, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Beverage

-

Food

-

Pharmaceutical

-

Tabletop Sweeteners

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."