- Home

- »

- Next Generation Technologies

- »

-

Stevedoring And Marine Cargo Handling Market Report, 2030GVR Report cover

![Stevedoring And Marine Cargo Handling Market Size, Share & Trends Report]()

Stevedoring And Marine Cargo Handling Market (2024 - 2030) Size, Share & Trends Analysis Report By Cargo Type (Bulk Cargo, Containerized Cargo), By Service (Stevedoring, Cargo Handling & Transportation), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-470-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

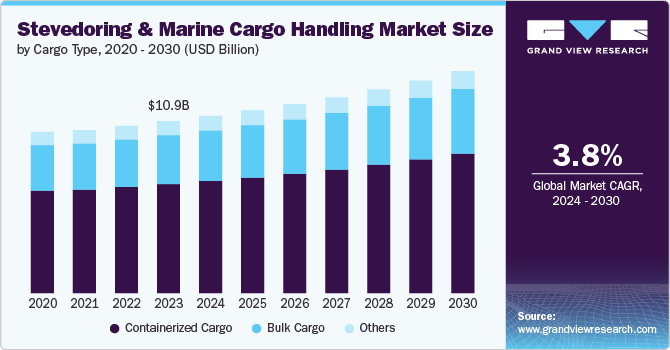

The global stevedoring and marine cargo handling market size was estimated at USD 10.91 billion in 2023 and is projected to grow at a CAGR of 3.8% from 2024 to 2030. The market growth is attributed to the continued expansion of global trade and the increasing volume of cargo transported via sea. With the rise of e-commerce, globalization, and expanding international trade agreements, there is an increasing demand for efficient port and cargo handling services. Moreover, various countries are investing heavily in port infrastructure development to accommodate the increasing volume of cargo. Large scale projects such as China’s Belt and Road Initiative (BRI) and India’s Sagarmala Project, are designed to modernize port infrastructure, improve connectivity, and enhance cargo handling capacities.

The adoption of advanced technologies such as Artificial Intelligence (AI), Internet of Things (IoT), and machine learning is enabling port operators and stevedoring companies to optimize cargo handling operations. AI-driven data analytics also allows ports to forecast demand, reduce downtime, and plan cargo operations more efficiently. The increasing reliance on automation is a major factor driving the market growth during the forecast period. Furthermore, the integration of automated cranes, automated guided vehicles, and robotic sorting systems has resulted in faster and more efficient cargo handling processes.

Sustainability is gaining prominence across industries, along with the marine cargo handling sector. Ports are adopting greener practices, including electrification of cargo handling equipment, reducing emissions, and increasing energy efficiency. Several ports are aiming to become carbon neutral. For instance, the Port of Los Angeles is implementing the Clean Air Action Plan, focusing on using electric and hydrogen-powered equipment. Additionally, the Port of Antwerp in Europe is exploring the use of alternative fuels for cargo handling machinery.

The demand for large vessels, such as ultra-large container vessels, has pushed ports to expand and upgrade their infrastructure. Larger ships require enhanced cranes and deeper ports to handle the increased cargo volume efficiently. The surge in containerization has also contributed to the growth of intermodal transport, where cargo is transferred seamlessly between different transportation modes, such as ships, trains, and trucks. As the demand for containerization cargo grows, ports are investing in expanding their container handling capacities.

Regulatory initiatives aimed at improving port efficiency and safety are also driving the growth of stevedoring and marine cargo handling market. Governments across the globe are implementing stricter regulations to ensure the smooth flow of goods while minimizing environmental impacts. For instance, the IMO’s regulations on emissions and ballast water treatment have pushed ports to adopt cleaner technologies and more sustainable practices.

Cargo Type Insights

In terms of cargo type, the market is classified into bulk cargo, containerized cargo, and others. The containerized cargo segment dominated the market in 2023 and accounted for more than 63.0% share of global revenue. The rapid growth of e-commerce has driven up demand for containerized shipping. As global consumers continue to shop online, companies require more efficient ways to ship consumer goods, electronics, and other products. The pandemic further accelerated this trend, with ports handling higher volumes of containerized cargo. Moreover, containerized shipping offers a more efficient and cost-effective way to transport goods compared to traditional bulk shipping. Standardized containers can be easily transferred between ships, trucks, and trains, reducing the overall transit time. This seamless integration with multimodal transport systems has made containerization the preferred choice for shippers.

The bulk cargo segment is projected to witness the fastest CAGR of 4.2% from 2024 to 2030. Economic growth in developing regions and the expansion of industrial activities are key factors driving the demand for bulk cargo segment. Demand for commodities like coal, iron, ore, and grains has increased as countries ramp up infrastructure development, construction projects, and manufacturing. The use of advanced bulk handling equipment, such as automated cranes, conveyor systems and sensors, has become more prevalent in recent years. These technologies help improve operational efficiency, reducing time spent at ports and optimizing the flow of goods. Such automation is anticipated to drive the growth of bulk segment over the forecast period.

Service Insights

In terms of service, the market is classified into stevedoring, cargo handling & transportation, and others. The stevedoring segment dominated the market in 2023 and accounted for more than 47.0% share of global revenue. The continuous growth of international trade is a major factor driving the growth of the stevedoring segment. As global demand for goods increases, the need for efficient loading and unloading services growth proportionally. With many ports expanding to handle larger vessels and increased cargo volumes, the demand for stevedoring services is on the rise.

The cargo handling & transportation segment is projected to register a significant CAGR from 2024 to 2030. The need for integrated, efficient supply chains is a major driving force for cargo handling and transportation services. As companies strive to streamline operations and reduce costs, the demand for comprehensive logistics solutions that cover the entire cargo handling and transportation process has increased. Government and private investors are heavily investing in port and transport infrastructure to accommodate rising cargo volumes. Such investment drives the need for advanced cargo handling services and seamless transport links between ports and inland destinations.

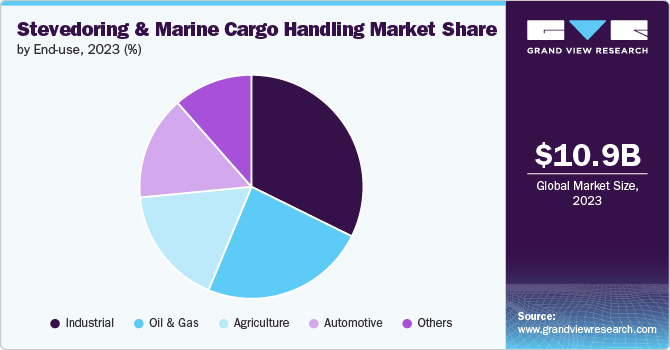

End-use Insights

In terms of end use, the market is classified into industrial, oil & gas, agriculture, automotive, and others. The industrial segment dominated the market in 2023 and accounted for more than 32.0% share of global revenue. Growing number of large-scale infrastructure projects, particularly in developing countries, have increased the need for industrial goods such as construction machinery, steel, and cement. This in turn drives the need for efficient stevedoring services to handle these goods at ports. Furthermore, the adoption of technologies like automation and AI in cargo handling processes is improving operational efficiency, making ports more efficient for handling industrial goods.

The oil & gas segment is projected to register a significant CAGR from 2024 to 2030. The ongoing exploration of new oil & gas reserves, particularly in deepwater and Arctic regions, has spurred the need for specialized cargo handling services. Stevedoring companies must be equipped to handle the heavy and hazardous equipment required for these operations. Furthermore, the shift towards liquefied natural gas (LNG) as a cleaner alternative to traditional fuels has had a profound impact on the stevedoring industry. LNG terminals are being developed at ports worldwide, and cargo handlers are investing in new infrastructure to handle this specialized cargo is anticipated to drive the market growth.

Regional Insights

The North America stevedoring and marine cargo handling market is expected to grow at a CAGR of 3.2% from 2024 to 2030. Ports in North America are continuously upgrading to accommodate larger vessels due to their increasing popularity of mega-ships in global trade. This modernization is essential for maintaining competitiveness in the global market. Furthermore, the rise in e-commerce is leading to higher demand for efficient marine cargo handling to keep up with the rapid delivery times expected by consumers.

U.S. Stevedoring and Marine Cargo Handling Market Trends

The stevedoring and marine cargo handling market in the U.S. is expected to grow at a CAGR of 3.0% from 2024 to 2030. The growing adoption of smart ports technology, which includes integrating IoT devices, sensors, and data analytics into cargo handling operations is anticipated to drive the market growth.

Europe Stevedoring and Marine Cargo Handling Market Trends

The stevedoring and marine cargo handling market in Europe is expected to register a considerable growth rate from 2024 to 2030. The growth of international trade agreements and the region’s proximity to key markets like Asia and Africa continue to drive the demand for efficient stevedoring services. The stringent environmental regulations in the region are pushing ports to integrate renewable energy sources and adopt eco-friendly cargo handling equipment.

Asia Pacific Stevedoring and Marine Cargo Handling Market Trends

Asia Pacific dominated the stevedoring and marine cargo handing market in 2023 and accounted for more than 40%. Rapid industrialization in countries like China, India, and Vietnam is increasing the volume of exports, necessitating the development of advanced cargo handling capabilities. Furthermore, governments in the region are prioritizing the development of port infrastructure to support economic growth and enhance trade routes is anticipated to drive the market growth over the forecast period.

Key Stevedoring And Marine Cargo Handling Company Insights

Some of the key companies operating in the market include CMA CGM Group, Irish Continental Group, The Cooper Group, Newcastle Stevedores Pty Ltd, and CJ Logistics Corporation.

-

The Cooper Group a U.S. based company engaged in maritime transportation. The company offers a comprehensive range of services, including stevedoring, terminal operations, and marine cargo handling. These services allow the company to cater to a wide variety of clients, from container ships to bulk carriers. The company invests in modern infrastructure and advanced cargo-handling equipment, which enhances productivity and reduces turnaround time, making them a reliable partner for shipping companies.

Texas Stevedoring Services, LLC, DP World, and Enstructure LLC are some of the emerging companies in the target market.

-

Texas Stevedoring Services, LLC is engaged in providing cargo handling services located at Port of Houston. The company offers stevedoring services such as containerized, heavy-lift cargo, and break-bulk. The company serves as gateway for international trade, especially for energy, chemicals, and agricultural products.

Key Stevedoring And Marine Cargo Handling Companies:

The following are the leading companies in the stevedoring and marine cargo handling market. These companies collectively hold the largest market share and dictate industry trends.

- Blue Water Group

- Bothra Group

- Carver Companies

- Charleston Stevedoring Company, LLC

- CJ Logistics Corporation

- CMA CGM Group

- Enstructure LLC

- Irish Continental Group

- Jones Stevedoring Company

- Newcastle Stevedores Pty Ltd

- The Cooper Group

Recent Developments

-

In May 2024, Associated Terminals, a provider of stevedoring services acquired S.H. Bell Company and its subsidiaries. The acquisition helps the former company to optimize operations and provide end-to-end services to the customers.

-

In March 2023, LOGISTEC Stevedoring Inc., a subsidiary of LOGISTEC Corporation announced the acquisition of Fednav, a shipping company. The company acquired Fednav’s logistics division and marine terminal business unit. Through the acquisition the former company expanded its presence in the U.S. and Canada.

Stevedoring And Marine Cargo Handling Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.23 billion

Revenue forecast in 2030

USD 14.07 billion

Growth rate

CAGR of 3.8% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Cargo type, service, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Blue Water Group; Bothra Group; Carver Companies; Charleston Stevedoring Company LLC; CJ Logistics Corporation; CMA CGM Group; Enstructure LLC; Irish Continental Group; Jones Stevedoring Company; Newcastle Stevedores Pty Ltd.; The Cooper Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

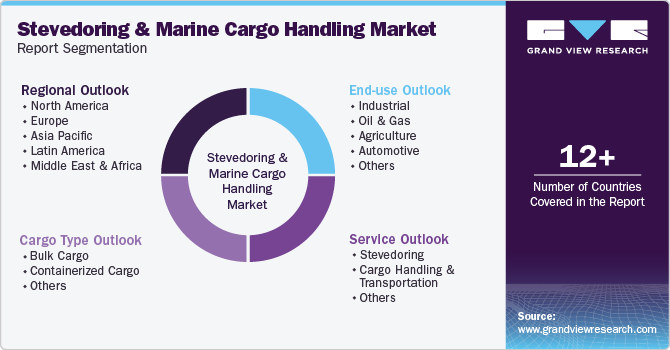

Global Stevedoring And Marine Cargo Handling Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global stevedoring and marine cargo handling market report based on cargo type, service, end-use, and region:

-

Cargo Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Bulk Cargo

-

Containerized Cargo

-

Others

-

-

Service Outlook (Revenue, USD Million, 2017 - 2030)

-

Stevedoring

-

Cargo Handling & Transportation

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Industrial

-

Oil & Gas

-

Agriculture

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global stevedoring and marine cargo handling market size was estimated at USD 10.91 billion in 2023 and is expected to reach USD 11.23 billion in 2024.

b. The global stevedoring and marine cargo handling market is expected to grow at a compound annual growth rate of 3.8% from 2024 to 2030 to reach USD 14.07 billion by 2030.

b. The containerized cargo segment dominated the market in 2023 and accounted for more than 63.0% share of global revenue. The rapid growth of e-commerce has driven up demand for containerized shipping. As global consumers continue to shop online, companies require more efficient ways to ship consumer goods, electronics, and other products. The pandemic further accelerated this trend, with ports handling higher volumes of containerized cargo.

b. Some of the companies operating in the stevedoring and marine cargo handling market include CMA CGM Group, Irish Continental Group, The Cooper Group, Newcastle Stevedores Pty Ltd, and CJ Logistics Corporation.

b. The market growth can be attributed to the continued expansion of global trade and the increasing volume of cargo transported via sea. With the rise of e-commerce, globalization, and expanding international trade agreements, there is an increasing demand for efficient port and cargo handling services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.