Stem Cells Market Size, Share & Trends Analysis Report By Product (Adult Stem Cells, Human Embryonic Stem Cells), By Application (Regenerative Medicine), By Technology, Therapy, End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-130-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Stem Cells Market Size & Trends

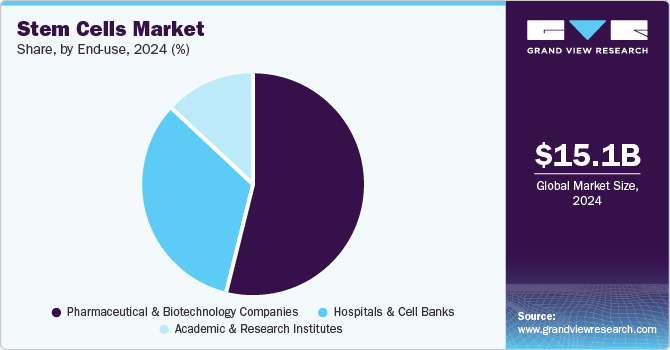

The global stem cells market size was estimated at USD 15.10 billion in 2024 and is expected to grow at a CAGR of 11.41% from 2025 to 2030. The growing development of precision medicine, increase in the number of cell therapy production facilities, and rising number of clinical trials are expected to be major driving factors of the market. Recent advances in stem cells therapeutics and tissue engineering hold the potential to draw attention to the treatment of several diseases. Furthermore, increasing demand for stem cells banking and a rise in research activities about stem cells production, storage, and characterization are also expected to fuel the revenue growth for the market. Technological improvements in the parent and ancillary market for stem cells usage are some of the other factors that reinforce the expected growth in demand for stem cells over the forecast period.

The COVID-19 pandemic had a positive impact on the market. The product applications in the novel coronavirus treatments has increased the interest of medical researchers, increasing clinical trials. Regenerative medicine based on cellular therapies may be a treatment option for patients, resulting in a reduction in mortality and infection rates. Companies and research institutes are collaborating to develop novel treatment options for the disease. For example, Infectious Disease Research Institute and Celularity, announced in April 2020 that the U.S. FDA had approved a clinical trial application to develop cell-based therapy for COVID-19. Hence, growing applications for clinical trials are expected to boost the demand for stem cells during the forecast period.

Moreover, researchers are increasingly attempting to develop stem cells therapies for targeting COVID-19. For instance, in January 2020, researchers from the University of Miami administered two stem cells infusions to COVID-19 patients that were suffering from lung damage. The results concluded that there were no significant side effects, and the therapy was reliable. Growing demand for regenerative medicines is expected to fuel market growth. Regenerative medicines have extensive applications in the treatment of various diseases including neurology, oncology, hepatology, diabetes, injuries, hematology, and orthopedics. In addition, the growing geriatric population and increasing demand for regenerative medicines for early detection and prevention of diseases are some of the factors contributing to market growth.

Regenerative medicines help restore normal functioning of cells. Rapid advancements in this field are anticipated to provide effective therapies for chronic conditions. For instance, in March 2022, Wipro Ltd, and Pandorum Technologies, announced a long-term partnership. Together the companies plan to aim at the development of technologies that will reduce the time-to-market and boost patient outcomes during clinical trials and research and development of regenerative medicine. Biotech Pandorum will use Wipro’s AI facilities for the development of regenerative medicine and advanced therapeutics to enhance patient outcomes.

There is wide global anticipation for stem cell-based therapies as they are safe and effective. Stem cells are gaining attention for the development of regenerative medicine. Regenerative cell therapies have the potential for healing and replacing damaged tissues and organs. For these therapies, stem cells represent a great promising cell source and hence are receiving increasing attention from researchers, clinicians, and scientists. Several factors contribute to the market growth such as increasing collaborations, robust funding, government initiatives, and extensive R&D. For instance, in May 2020, the CiRA Foundation and CGT Catapult launched a new collaborative research project aimed at induced pluripotent stem cell characterization. The companies will combine their competence to investigate novel methods to characterize pluripotent stem cells for the manufacturing of regenerative medicine products.

Significant R&D expenditures are one of the major contributors to market growth. Furthermore, another factor contributing to the increase is the increased need for effective therapeutics to reduce the disease burden during the forecast period. For instance, Celavie Biosciences' 5-year exploratory study on Parkinson's disease progressed in May 2020. The company is working on regenerative stem cell therapies to treat Parkinson's disease and other central nervous system disorders. Celavie Biosciences announced that their preliminary clinical trials utilizing OK99 stem cells for Parkinson's disease were successful.

Moreover, the increasing recognition of precision medicines is further promoting market growth. Scientists are finding new procurement methods that can be further utilized for the development of personalized medicines. For instance, induced pluripotent stem cells therapies are developed by utilizing a small amount of sample from a patient’s skin or blood cell which is later reprogrammed to form new tissue and cells for transplant. Moreover, in September 2022 Century Therapeutics and Bristol Myers Squibb announced a license agreement and research collaboration for the development and commercialization of iPSC-derived allogeneic cell therapies. Hence, with the application of these cells coupled with strategic activities by market players, potential personalized medicines can be developed in the near future.

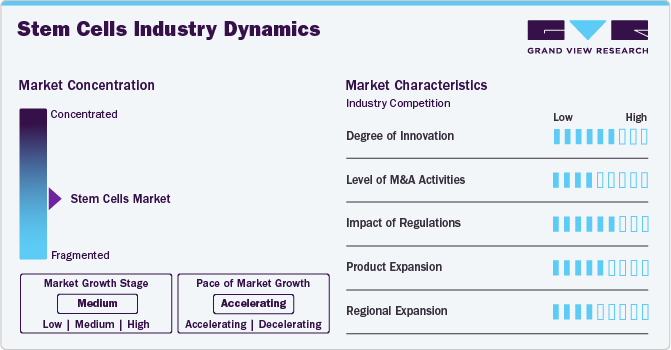

Market Concentration & Characteristics

The market growth stage is moderate, and the pace is accelerating. The market is expected to witness growth due to the increasing availability of a variety of stem cell types such as mesenchymal stem cells, induced pluripotent stem cells, etc. for various research and development applications. Furthermore, intense competition in the market has led to highly competitive prices for high quality stem cell offerings.

Innovations in the market are improving the precision, scalability, and therapeutic potential of stem cells. Key innovative developments such as CRISPR-based gene editing are pushing the boundaries of stem cell-based therapies for various diseases, such as cancer, cardiovascular disease, etc., and represent a promising growth outlook for the market.

Mergers and acquisitions are contributing to the market expansion and can lead to an increase in the adoption of research and development activities. For instance, in July 2022, Vertex Pharmaceuticals Incorporated acquired ViaCyte focusing on stem cell-derived cell replacement therapies.

Stringent guidelines govern research and clinical practices in the market and compliance with regulations may lead to additional procedural costs and increased research and development timelines which may restrict the market growth.

The market has moderate levels of product and regional expansion. The increase in market expansion pace has led to the availability of stem cell technologies to local healthcare providers and researchers which has led to advancements in personalized medicine, tissue engineering, and therapeutic applications of stem cells. This factor is expected to boost the market growth in the near future.

Product Insights

Adult stem cells held the largest revenue share of 70.76% of the market in 2024 as these cells do not involve the destruction of embryos, which is the case in embryonic stem cells. Furthermore, there is no risk of graft rejection in the case of adult stem cells. Development of cell banking services and advancements in bio-preservation and cryopreservation are expected to further boost the demand for adult stem cells. Lesser ethical concerns surrounding adult cells further propel the growth of this segment. The benefits of adult stem cell banking such as the capacity for autologous transformation, low risk of tumor formation, and availability of established treatment options are factors that are expected to boost the segment’s growth during the forecast period.

Mesenchymal Stem Cells (MSCs), hematopoietic stem cells, epithelial/skin stem cells, and neural stem cells, are all subtypes of ASCs. The MSC segment is expected to witness the fastest CAGR during the forecast period due to its use in autologous transplantation, substantial clinical trials that demonstrated its application for treating various diseases, and extensive ongoing research to investigate its therapeutic applications.

The induced pluripotent stem cells segment is expected to grow at the CAGR of 11.08% from 2025 to 2030, owing to increased investment in developing regenerative medicines using induced pluripotent stem cells, ensuring reproducibility and maintenance, ability to differentiate into all cell types, and high proliferative ability. Many leading companies are also expanding services related to iPSCs as their importance in the treatment of various diseases grows. For instance, in January 2021, REPROCELL launched a new personalized induced pluripotent stem cell production service for generating patient-specific iPSC. The service will assist in the preparation and storage of an individual's iPSCs for the development of regenerative medicines to treat future illnesses or injury. They are developed from mature cells using ready-to-use RNA reprogramming technology.

Application Insights

Regenerative medicine and drug discovery and development are two applications within the application segment. Increased approvals for clinical trials on stem cell therapies targeting various diseases have resulted in the regenerative medicine segment capturing the larger market share of 85.62% in 2024. Longeveron LLC, for example, announced in June 2020 that Japan's Pharmaceutical and Medical Devices Agency (PMDA) had approved the start of a Phase 2 clinical trial to evaluate the safety and efficacy of their mesenchymal stem cells that can be used to treat aging frailty.

Furthermore, several governments are heavily investing in the development of regenerative medicines. For instance, the Government of Canada invested around USD 6.9 million in regenerative medicine research in March 2020. This fund will be used to support nine translational projects and four clinical trials aimed at developing new therapies in the field of regenerative medicine. The developed regenerative medicines will aid in the treatment of a variety of blood disorders, heart diseases, diabetes, and vision loss.

The drug discovery and development segment is expected to grow at a faster CAGR from 2025-2030. As it is useful in studying human disease etiology, identifying pathological mechanisms, and developing therapeutic strategies for tackling various diseases, market products are seeing increased penetration across the drug discovery process. Because they can mimic patients' molecular and cellular phenotypes, iPSC-based models are preferred over phenotypic screening. Pharmaceutical companies can use these to test hypothesized drug mechanisms in vitro in a cost-effective manner before conducting clinical trials.

Technology Insights

The cell acquisition segment captured the highest revenue share of 33.43% of the market in 2024. The discovery of embryonic stem cells has paved the way for the development of novel treatments for several diseases. These cells are pluripotent and can be used to differentiate many cell types in the body. However, obtaining embryonic cells directly from the embryo has raised ethical concerns. Hence, researchers discovered an alternative—iPS cells. For instance, in September 2020, a collaborative team of researchers from Singapore and Australia studied the molecular changes, which occur when adult skin cells become induced pluripotent stem cells (iPSCs). This led to the creation of new stem cells that could produce placenta tissue which could possibly lead to the development of new treatments for placenta complications arising during pregnancy.

The cell acquisition segment is further segmented into bone marrow harvest, umbilical blood cord, and apheresis. The bone marrow harvest segment captured the highest revenue share owing to factors such as rising awareness, increasing prevalence of blood cancer, and easy access to bone marrow transplantation therapy.

Therapy Insights

The allogenic therapy segment captured the largest revenue share of 59.33% in 2024 with regard to revenue generation. Factors such as high pricing and growth in stem cell banking have contributed to the segment’s growth. Moreover, many cell therapy companies are shifting their business toward the development of allogeneic cell therapy products. This, in turn, is expected to result in the significant growth of this segment.

In addition, strategic activities by key market players to strengthen their product portfolio will further offer lucrative opportunities in the review period. For instance, In March 2021, Acepodia announced the closing of its USD 47 million Series B financing to advance the pipeline of allogenic cell therapy candidates. In June 2022, Immatics and Bristol Myers Squibb expanded their strategic alliance for the development of gamma delta allogeneic cell therapy programs.

However, autologous therapy is expected to witness a higher CAGR from 2025 to 2030. This is primarily due to the low risk of complications associated with autologous treatment. Other factors anticipated to propel the growth of this segment include affordability, improved survival rate of patients, no need for identifying an HLA-matched donor, and no risk of graft-versus-host diseases. Furthermore, autologous MSCs are investigated for their potential in the treatment of osteoarthritis as they can differentiate into cartilage and bone tissues.

MSCs have the ability to migrate to the site of injury, promote tissue repair by releasing anabolic cytokines, inhibit pro-inflammatory pathways, and differentiate into specialized connective tissues. Thus, the adoption of autologous MSCs in regenerative medicine has increased, which is expected to propel the market growth during the forecast period.

End-use Insights

The pharmaceutical and biotechnology companies segment captured the largest revenue share of 54.19% in 2024. Some of the factors that can be attributed to the segment's share are the rising prevalence of chronic disease, an increase in clinical trials, and an upsurge in strategic activities along with improvements in healthcare services. For instance, in August 2022, StemCyte, Inc. obtained approval from the U.S. FDA for their Phase II clinical trial for post-COVID syndrome using umbilical cord blood stem cell therapy. Moreover, in April 2022, the U.S. FDA granted clearance to BioCardia’s Investigational New Drug (IND) application to initiate a Phase I/II clinical trial of BCDA-04 in adults improving from acute respiratory distress syndrome linked with COVID-19.

Moreover, the increasing number of clinical trials coupled with the approval of stem cell-based therapies from regulatory bodies will further offer lucrative opportunities. For instance, there are around 5,000 listed clinical trials involved in stem cells research on ClinicalTrials.gov, with new clinical trials being offered every day in this field.

Regional Insights

North America stem cell market accounted for the largest revenue share of 43.89% in 2024. The presence of innovators and key market players has resulted in higher penetration of market products in the region. North America leads the market owing to the strong biotechnology industry, the presence of key players, extensive R&D, and the promotion of personalized medicines. The region accounts for the highest revenue share. Moreover, growth in this region can be further attributed to rising government initiatives for promoting stem cell therapies. For instance, in March 2020, the government of Canada invested around USD 7 million in regenerative medicine and stem cell research. It will support 9 transnational projects and 4 clinical trials in the country for the growing regenerative medicine sector.

Asia Pacific Stem Cells Market Trends

The stem cells market in Asia Pacific is expected to grow at a rapid rate of 16.08% CAGR during 2025-2030 owing to strong product pipelines of therapies based on stem cells and a huge patient population base. The market is expected to grow at a rapid rate due to the increasing incidence rate of diseases such as cancer, neurological disorders, and diabetes. Moreover, government funding to accelerate research on stem cells further strengthens the growth of this region. For instance, In February 2022, the government of India set up state-of-the-art stem cell research facilities in 40 leading health research and educational institutions. The government has also spent USD 80 million through the Indian Council of Medical Research (ICMR) in the last three years on certain research projects.

Key Stem Cells Company Insights

Key players in this market are developing new products and undertaking collaborative initiatives to increase their product portfolio, customer reach, and geographic presence. These strategies are expected to favor market growth in the coming years as more players enter the market and try to secure their market position.

Key Stem Cells Companies:

The following are the leading companies in the stem cells market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc

- STEMCELL Technologies, Inc.

- Merck KGaA

- Sartorius AG (CellGenix GmbH)

- PromoCell GmbH

- Takara Holdings, Inc.

- Lonza

- ATCC

- AcceGen

- Cell Applications, Inc.

- Bio-Techne

- Cellular Engineering Technologies

Recent Developments

-

In April 2024, PromoCell GmbH launched the Cryo-SFM Plus cryopreservation medium to preserve primary cells, stem cells, or established cell lines.

-

In January 2024, STEMCELL Technologies, Inc. acquired Propagenix Inc., enabling STEMCELL to develop products based on Propagenix’s EpiX technology in regenerative medicine.

-

In December 2023, the University of Texas at San Antonio (UTSA) and GenCure, a subsidiary of BioBridge Global, formalized their collaboration through the signing of a master services agreement. This agreement outlines their joint efforts in advancing the development of cellular therapy products, services, and testing.

-

In October 2023, bit.bio, a company dedicated to programming human cells for innovative treatments, unveiled its latest product, ioCRISPR-Ready Cells. These cells are tailored for scientists aiming to create gene knockouts in human cells with physiological relevance.

-

In September 2023, SKAN Research Trust (SKAN) collaborated with the Wellcome-MRC Cambridge Stem Cell Institute (CSCI) based in the UK. The partnership includes a joint research initiative focused on investigating the genomic patterns associated with age-related neurodegenerative diseases within an Indian cohort.

Stem Cells Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 16.84 billion |

|

Revenue forecast in 2030 |

USD 28.89 billion |

|

Growth rate |

CAGR of 11.41% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, technology, therapy, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Thermo Fisher Scientific Inc; STEMCELL Technologies, Inc.; Merck KGaA; Sartorius AG (CellGenix GmbH); PromoCell GmbH; Takara Holdings, Inc.; Lonza; ATCC; AcceGen; Cell Applications, Inc.; Bio-Techne; Cellular Engineering Technologies |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional and segment scope. |

Global Stem Cells Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global stem cells based on the product, application, technology, therapy, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Adult Stem Cells (ASCs)

-

Hematopoietic

-

Mesenchymal

-

Neural

-

Epithelial/Skin

-

Others

-

-

Human Embryonic Stem Cells (HESCs)

-

Induced Pluripotent Stem Cells (iPSCs)

-

Very Small Embryonic Like Stem Cells

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Regenerative Medicine

-

Neurology

-

Orthopedics

-

Oncology

-

Hematology

-

Cardiovascular and Myocardial Infraction

-

Injuries

-

Diabetes

-

Liver Disorder

-

Incontinence

-

Others

-

-

Drug Discovery and Development

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell Acquisition

-

Bone Marrow Harvest

-

Umbilical Blood Cord

-

Apheresis

-

-

Cell Production

-

Therapeutic Cloning

-

In-vitro Fertilization

-

Cell Culture

-

Isolation

-

-

Cryopreservation

-

Expansion and Sub-Culture

-

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Autologous

-

Allogeneic

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and Biotechnology Companies

-

Hospitals & Cell Banks

-

Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global stem cells market size was estimated at USD 15.10 billion in 2024 and is expected to reach USD 16.84 billion in 2025.

b. The global stem cells market is expected to grow at a compound annual growth rate of 11.41% from 2025 to 2030 to reach USD 28.89 billion by 2030.

b. Adult stem cells dominated the stem cells market with a share of 70.76% in 2024 owing to their high penetration over other stem cell types and the presence of a substantial number of approved adult stem cell therapies for clinical use.

b. Some key players operating in the stem cells market include Advanced Cell Technology Inc., STEMCELL Technologies Inc., PromoCell GmbH, Cellular Engineering Technologies Inc., and others.

b. Key factors that are driving the stem cells market growth include the rising number of stem cell banks, the growing focus on increasing the therapeutic potential of these products, and extensive research for the development of regenerative medicines.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.1.1. Product Segment

1.1.2. Application Segment

1.1.3. Technology Segment

1.1.4. Therapy Segment

1.1.5. End-use Segment

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources

1.3.4. Primary Research

1.4. Information or Data Analysis

1.4.1. Data analysis models

1.5. Market Formulation & Validation

1.6. Model Details

1.7. List Of Secondary Sources

1.8. List Of Primary Sources

1.9. Objectives

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related/Ancillary Market Outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Ongoing Developments In Regenerative Medicine

3.2.1.2. Rising Funds For Accelerating Stem Cell Research

3.2.1.3. Growing Demand For Stem Cell Banking

3.2.1.4. Increasing Prevalence Of Genetic Disorders and Cancer

3.2.2. Market Restraint And Challenges Analysis

3.2.2.1. Ethical Concern Related To Stem Cell Research

3.2.2.2. Lack Of A Well-Defined Regulatory Framework In Certain Applications Of Stem Cell

3.3. Industry Analysis Tools

3.3.1. Porter’s Five Forces Analysis

3.3.2. PESTEL Analysis

3.3.3. COVID-19 Impact Analysis

Chapter 4. Product Business Analysis

4.1. Stem Cells Market: Product Movement Analysis

4.2. Adult Stem Cells (ASCs)

4.2.1. Adult Stem Cells (ASCs) Market, 2018 - 2030 (USD Billion)

4.2.2. Hematopoietic

4.2.2.1. Hematopoietic Market, 2018 - 2030 (USD Billion)

4.2.3. Mesenchymal

4.2.3.1. Mesenchymal Market, 2018 - 2030 (USD Billion)

4.2.4. Neural

4.2.4.1. Neural Market, 2018 - 2030 (USD Billion)

4.2.5. Epithelial/Skin

4.2.5.1. Epithelial/Skin Market, 2018 - 2030 (USD Billion)

4.2.6. Others

4.2.6.1. Others Market, 2018 - 2030 (USD Billion)

4.3. Human Embryonic Stem Cells (HESCs)

4.3.1. Human Embryonic Stem Cells (HESCs) Market, 2018 - 2030 (USD Billion)

4.4. Induced Pluripotent Stem Cells (iPSCs)

4.4.1. Induced Pluripotent Stem Cells (iPSCs) Market, 2018 - 2030 (USD Billion)

4.5. Very Small Embryonic Like Stem Cells

4.5.1. Very Small Embryonic Like Stem Cells Market, 2018 - 2030 (USD Billion)

Chapter 5. Application Business Analysis

5.1. Stem Cells Market: Application Movement Analysis

5.2. Regenerative Medicine

5.2.1. Regenerative Medicine Market, 2018 - 2030 (USD Billion)

5.2.2. Neurology

5.2.2.1. Neurology Market, 2018 - 2030 (USD Billion)

5.2.3. Orthopedics

5.2.3.1. Orthopedics Market, 2018 - 2030 (USD Billion)

5.2.4. Oncology

5.2.4.1. Oncology Market, 2018 - 2030 (USD Billion)

5.2.5. Hematology

5.2.5.1. Hematology Market, 2018 - 2030 (USD Billion)

5.2.6. Cardiovascular and Myocardial Infraction

5.2.6.1. Cardiovascular and Myocardial Infraction Market, 2018 - 2030 (USD Billion)

5.2.7. Injuries

5.2.7.1. Injuries Market, 2018 - 2030 (USD Billion)

5.2.8. Diabetes

5.2.8.1. Diabetes Market, 2018 - 2030 (USD Billion)

5.2.9. Liver Disorder

5.2.9.1. Liver Disorder Market, 2018 - 2030 (USD Billion)

5.2.10. Incontinence

5.2.10.1. Incontinence Market, 2018 - 2030 (USD Billion)

5.2.11. Others

5.2.11.1. Others Market, 2018 - 2030 (USD Billion)

5.3. Drug Discovery and Development

5.3.1. Drug Discovery and Development Market, 2018 - 2030 (USD Billion)

Chapter 6. Technology Business Analysis

6.1. Stem Cells Market: Technology Movement Analysis

6.2. Cell Acquisition

6.2.1. Cell Acquisition Market, 2018 - 2030 (USD Billion)

6.2.2. Bone Marrow Harvest

6.2.2.1. Bone Marrow Harvest Market, 2018 - 2030 (USD Billion)

6.2.3. Umbilical Blood Cord

6.2.3.1. Umbilical Blood Cord Market, 2018 - 2030 (USD Billion)

6.2.4. Apheresis

6.2.4.1. Apheresis Market, 2018 - 2030 (USD Billion)

6.3. Cell Production

6.3.1. Cell Production Market, 2018 - 2030 (USD Billion)

6.3.2. Therapeutic Cloning

6.3.2.1. Therapeutic Cloning Market, 2018 - 2030 (USD Billion)

6.3.3. In-vitro Fertilization

6.3.3.1. In-vitro Fertilization Market, 2018 - 2030 (USD Billion)

6.3.4. Cell Culture

6.3.4.1. Cell Culture Market, 2018 - 2030 (USD Billion)

6.3.5. Isolation

6.3.5.1. Isolation Market, 2018 - 2030 (USD Billion)

6.4. Cryopreservation

6.4.1. Cryopreservation Market, 2018 - 2030 (USD Billion)

6.5. Expansion and Sub-Culture

6.5.1. Expansion and Sub-Culture Market, 2018 - 2030 (USD Billion)

Chapter 7. Therapy Business Analysis

7.1. Stem Cells Market: Therapy Movement Analysis

7.2. Autologous

7.2.1. Autologous Market, 2018 - 2030 (USD Billion)

7.3. Allogeneic

7.3.1. Allogeneic Market, 2018 - 2030 (USD Billion)

Chapter 8. Application Business Analysis

8.1. Stem Cells Market: Application Movement Analysis

8.2. Infectious Diseases

8.2.1. Infectious Diseases Market, 2018 - 2030 (USD Billion)

8.3. Immunology

8.3.1. Immunology Market, 2018 - 2030 (USD Billion)

8.4. Oncology

8.4.1. Oncology Market, 2018 - 2030 (USD Billion)

8.5. Stem Cells

8.5.1. Stem Cells Market, 2018 - 2030 (USD Billion)

8.6. Neurobiology

8.6.1. Neurobiology Market, 2018 - 2030 (USD Billion)

8.7. Others

8.7.1. Other Applications Market, 2018 - 2030 (USD Billion)

Chapter 9. End Use Business Analysis

9.1. Stem Cells Market: End-use Movement Analysis

9.2. Pharmaceutical and Biotechnology Companies

9.2.1. Pharmaceutical and Biotechnology Companies Market, 2018 - 2030 (USD Billion)

9.3. Hospitals & Cell Banks

9.3.1. Hospitals & Cell Banks Market, 2018 - 2030 (USD Billion)

9.4. Academic & Research Institutes

9.4.1. Academic & Research Institutes Market, 2018 - 2030 (USD Billion)

Chapter 10. Regional Business Analysis

10.1. Stem Cells Market Share By Region, 2025 & 2030

10.2. North America

10.2.1. North America Stem Cells Market, 2018 - 2030 (USD Billion)

10.2.2. U.S.

10.2.2.1. Key Country Dynamics

10.2.2.2. Target Disease Prevalence

10.2.2.3. Competitive Scenario

10.2.2.4. Regulatory Framework

10.2.2.5. U.S. Stem Cells Market, 2018 - 2030 (USD Billion)

10.2.3. Canada

10.2.3.1. Key Country Dynamics

10.2.3.2. Target Disease Prevalence

10.2.3.3. Competitive Scenario

10.2.3.4. Regulatory Framework

10.2.3.5. Canada Stem Cells Market, 2018 - 2030 (USD Billion)

10.2.4. Mexico

10.2.4.1. Key Country Dynamics

10.2.4.2. Target Disease Prevalence

10.2.4.3. Competitive Scenario

10.2.4.4. Regulatory Framework

10.2.4.5. Mexico Stem Cells Market, 2018 - 2030 (USD Billion)

10.3. Europe

10.3.1. Europe Stem Cells Market, 2018 - 2030 (USD Billion)

10.3.2. UK

10.3.2.1. Key Country Dynamics

10.3.2.2. Target Disease Prevalence

10.3.2.3. Competitive Scenario

10.3.2.4. Regulatory Framework

10.3.2.5. UK Stem Cells Market, 2018 - 2030 (USD Billion)

10.3.3. Germany

10.3.3.1. Key Country Dynamics

10.3.3.2. Target Disease Prevalence

10.3.3.3. Competitive Scenario

10.3.3.4. Regulatory Framework

10.3.3.5. Germany Stem Cells Market, 2018 - 2030 (USD Billion)

10.3.4. France

10.3.4.1. Key Country Dynamics

10.3.4.2. Target Disease Prevalence

10.3.4.3. Competitive Scenario

10.3.4.4. Regulatory Framework

10.3.4.5. France Stem Cells Market, 2018 - 2030 (USD Billion)

10.3.5. Italy

10.3.5.1. Key Country Dynamics

10.3.5.2. Target Disease Prevalence

10.3.5.3. Competitive Scenario

10.3.5.4. Regulatory Framework

10.3.5.5. Italy Stem Cells Market, 2018 - 2030 (USD Billion)

10.3.6. Spain

10.3.6.1. Key Country Dynamics

10.3.6.2. Target Disease Prevalence

10.3.6.3. Competitive Scenario

10.3.6.4. Regulatory Framework

10.3.6.5. Spain Stem Cells Market, 2018 - 2030 (USD Billion)

10.3.7. Denmark

10.3.7.1. Key Country Dynamics

10.3.7.2. Target Disease Prevalence

10.3.7.3. Competitive Scenario

10.3.7.4. Regulatory Framework

10.3.7.5. Denmark Stem Cells Market, 2018 - 2030 (USD Billion)

10.3.8. Sweden

10.3.8.1. Key Country Dynamics

10.3.8.2. Target Disease Prevalence

10.3.8.3. Competitive Scenario

10.3.8.4. Regulatory Framework

10.3.8.5. Sweden Stem Cells Market, 2018 - 2030 (USD Billion)

10.3.9. Norway

10.3.9.1. Key Country Dynamics

10.3.9.2. Target Disease Prevalence

10.3.9.3. Competitive Scenario

10.3.9.4. Regulatory Framework

10.3.9.5. Norway Stem Cells Market, 2018 - 2030 (USD Billion)

10.4. Asia Pacific

10.4.1. Asia Pacific Stem Cells Market, 2018 - 2030 (USD Billion)

10.4.2. Japan

10.4.2.1. Key Country Dynamics

10.4.2.2. Target Disease Prevalence

10.4.2.3. Competitive Scenario

10.4.2.4. Regulatory Framework

10.4.2.5. Japan Stem Cells Market, 2018 - 2030 (USD Billion)

10.4.3. China

10.4.3.1. Key Country Dynamics

10.4.3.2. Target Disease Prevalence

10.4.3.3. Competitive Scenario

10.4.3.4. Regulatory Framework

10.4.3.5. China Stem Cells Market, 2018 - 2030 (USD Billion)

10.4.4. India

10.4.4.1. Key Country Dynamics

10.4.4.2. Target Disease Prevalence

10.4.4.3. Competitive Scenario

10.4.4.4. Regulatory Framework

10.4.4.5. India Stem Cells Market, 2018 - 2030 (USD Billion)

10.4.5. Australia

10.4.5.1. Key Country Dynamics

10.4.5.2. Target Disease Prevalence

10.4.5.3. Competitive Scenario

10.4.5.4. Regulatory Framework

10.4.5.5. Australia Stem Cells Market, 2018 - 2030 (USD Billion)

10.4.6. Thailand

10.4.6.1. Key Country Dynamics

10.4.6.2. Target Disease Prevalence

10.4.6.3. Competitive Scenario

10.4.6.4. Regulatory Framework

10.4.6.5. Thailand Stem Cells Market, 2018 - 2030 (USD Billion)

10.4.7. South Korea

10.4.7.1. Key Country Dynamics

10.4.7.2. Target Disease Prevalence

10.4.7.3. Competitive Scenario

10.4.7.4. Regulatory Framework

10.4.7.5. South Korea Stem Cells Market, 2018 - 2030 (USD Billion)

10.5. Latin America

10.5.1. Latin America Stem Cells Market, 2018 - 2030 (USD Billion)

10.5.2. Brazil

10.5.2.1. Key Country Dynamics

10.5.2.2. Target Disease Prevalence

10.5.2.3. Competitive Scenario

10.5.2.4. Regulatory Framework

10.5.2.5. Brazil Stem Cells Market, 2018 - 2030 (USD Billion)

10.5.3. Argentina

10.5.3.1. Key Country Dynamics

10.5.3.2. Target Disease Prevalence

10.5.3.3. Competitive Scenario

10.5.3.4. Regulatory Framework

10.5.3.5. Argentina Stem Cells Market, 2018 - 2030 (USD Billion)

10.6. MEA

10.6.1. MEA Stem Cells Market, 2018 - 2030 (USD Billion)

10.6.2. South Africa

10.6.2.1. Key Country Dynamics

10.6.2.2. Target Disease Prevalence

10.6.2.3. Competitive Scenario

10.6.2.4. Regulatory Framework

10.6.2.5. South Africa Stem Cells Market, 2018 - 2030 (USD Billion)

10.6.3. Saudi Arabia

10.6.3.1. Key Country Dynamics

10.6.3.2. Target Disease Prevalence

10.6.3.3. Competitive Scenario

10.6.3.4. Regulatory Framework

10.6.3.5. Saudi Arabia Stem Cells Market, 2018 - 2030 (USD Billion)

10.6.4. UAE

10.6.4.1. Key Country Dynamics

10.6.4.2. Target Disease Prevalence

10.6.4.3. Competitive Scenario

10.6.4.4. Regulatory Framework

10.6.4.5. UAE Stem Cells Market, 2018 - 2030 (USD Billion)

10.6.5. Kuwait

10.6.5.1. Key Country Dynamics

10.6.5.2. Target Disease Prevalence

10.6.5.3. Competitive Scenario

10.6.5.4. Regulatory Framework

10.6.5.5. Kuwait Stem Cells Market, 2018 - 2030 (USD Billion)

Chapter 11. Competitive Landscape

11.1. Company Categorization

11.2. Strategy Mapping

11.3. Company Market Position Analysis, 2024

11.4. Company Profiles/Listing

11.4.1. Thermo Fisher Scientific, Inc.

11.4.1.1. Overview

11.4.1.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

11.4.1.3. Product Benchmarking

11.4.1.4. Strategic Initiatives

11.4.2. STEMCELL Technologies Inc.

11.4.2.1. Overview

11.4.2.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

11.4.2.3. Product Benchmarking

11.4.2.4. Strategic Initiatives

11.4.3. Merck KGaA

11.4.3.1. Overview

11.4.3.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

11.4.3.3. Product Benchmarking

11.4.3.4. Strategic Initiatives

11.4.4. CellGenix GmbH

11.4.4.1. Overview

11.4.4.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

11.4.4.3. Product Benchmarking

11.4.4.4. Strategic Initiatives

11.4.5. PromoCell GmbH

11.4.5.1. Overview

11.4.5.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

11.4.5.3. Product Benchmarking

11.4.5.4. Strategic Initiatives

11.4.6. Takara Holdings, Inc.

11.4.6.1. Overview

11.4.6.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

11.4.6.3. Product Benchmarking

11.4.6.4. Strategic Initiatives

11.4.7. Lonza

11.4.7.1. Overview

11.4.7.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

11.4.7.3. Product Benchmarking

11.4.7.4. Strategic Initiatives

11.4.8. Cellular Engineering Technologies

11.4.8.1. Overview

11.4.8.2. Product Benchmarking

11.4.8.3. Strategic Initiatives

11.4.9. ATCC

11.4.9.1. Overview

11.4.9.2. Product Benchmarking

11.4.9.3. Strategic Initiatives

11.4.10. AcceGen

11.4.10.1. Overview

11.4.10.2. Product Benchmarking

11.4.10.3. Strategic Initiatives

11.4.11. Cell Applications, Inc.

11.4.11.1. Overview

11.4.11.2. Product Benchmarking

11.4.11.3. Strategic Initiatives

11.4.12. Bio-Techne

11.4.12.1. Overview

11.4.12.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

11.4.12.3. Product Benchmarking

11.4.12.4. Strategic Initiatives

List of Tables

TABLE 1 List of Secondary Sources

TABLE 2 List of Abbreviations

TABLE 3 Global Stem Cells Market, by Product 2018 - 2030 (USD Million)

TABLE 4 Global Stem Cells Market, by Application 2018 - 2030 (USD Million)

TABLE 5 Global Stem Cells Market, by Technology 2018 - 2030 (USD Million)

TABLE 6 Global Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

TABLE 7 Global Stem Cells Market, by End-use, 2018 - 2030 (USD Million)

TABLE 8 Global Stem Cells Market, by Region, 2018 - 2030 (USD Million)

TABLE 9 North America Stem Cells Market, by Country, 2018 - 2030 (USD Million)

TABLE 10 North America Stem Cells Market, by Product 2018 - 2030 (USD Million)

TABLE 11 North America Stem Cells Market, by Application 2018 - 2030 (USD Million)

TABLE 12 North America Stem Cells Market, by Technology 2018 - 2030 (USD Million)

TABLE 13 North America Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

TABLE 14 North America Stem Cells Market, by End use, 2018 - 2030 (USD Million)

TABLE 15 U.S. Stem Cells Market, by Product 2018 - 2030 (USD Million)

TABLE 16 U.S. Stem Cells Market, by Application 2018 - 2030 (USD Million)

TABLE 17 U.S. Stem Cells Market, by Technology 2018 - 2030 (USD Million)

TABLE 18 U.S. Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

TABLE 19 U.S. Stem Cells Market, by End use, 2018 - 2030 (USD Million)

TABLE 20 Mexico Stem Cells Market, by Product 2018 - 2030 (USD Million)

TABLE 21 Mexico Stem Cells Market, by Application 2018 - 2030 (USD Million)

TABLE 22 Mexico Stem Cells Market, by Technology 2018 - 2030 (USD Million)

TABLE 23 Mexico Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

TABLE 24 Mexico Stem Cells Market, by End use, 2018 - 2030 (USD Million)

TABLE 25 Canada Stem Cells Market, by Product 2018 - 2030 (USD Million)

TABLE 26 Canada Stem Cells Market, by Application 2018 - 2030 (USD Million)

TABLE 27 Canada Stem Cells Market, by Technology 2018 - 2030 (USD Million)

TABLE 28 Canada Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

TABLE 29 Canada Stem Cells Market, by End use, 2018 - 2030 (USD Million)

TABLE 30 Europe Stem Cells Market, by Country, 2018 - 2030 (USD Million)

TABLE 31 Europe Stem Cells Market, by Product 2018 - 2030 (USD Million)

TABLE 32 Europe Stem Cells Market, by Application 2018 - 2030 (USD Million)

TABLE 33 Europe Stem Cells Market, by Technology 2018 - 2030 (USD Million)

TABLE 34 Europe Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

TABLE 35 Europe Stem Cells Market, by End use, 2018 - 2030 (USD Million)

TABLE 36 Germany Stem Cells Market, by Product 2018 - 2030 (USD Million)

TABLE 37 Germany Stem Cells Market, by Application 2018 - 2030 (USD Million)

TABLE 38 Germany Stem Cells Market, by Technology 2018 - 2030 (USD Million)

TABLE 39 Germany Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

TABLE 40 Germany Stem Cells Market, by End use, 2018 - 2030 (USD Million)

TABLE 41 UK Stem Cells Market, by Product 2018 - 2030 (USD Million)

TABLE 42 UK Stem Cells Market, by Application 2018 - 2030 (USD Million)

TABLE 43 UK Stem Cells Market, by Technology 2018 - 2030 (USD Million)

TABLE 44 UK Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

TABLE 45 UK Stem Cells Market, by End-use, 2018 - 2030 (USD Million)

TABLE 46 France Stem Cells Market, by Product 2018 - 2030 (USD Million)

TABLE 47 France Stem Cells Market, by Application 2018 - 2030 (USD Million)

TABLE 48 France Stem Cells Market, by Technology 2018 - 2030 (USD Million)

TABLE 49 France Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

TABLE 50 France Stem Cells Market, by End use, 2018 - 2030 (USD Million)

TABLE 51 Italy Stem Cells Market, by Product 2018 - 2030 (USD Million)

TABLE 52 Italy Stem Cells Market, by Application 2018 - 2030 (USD Million)

TABLE 53 Italy Stem Cells Market, by Technology 2018 - 2030 (USD Million)

TABLE 54 Italy Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

TABLE 55 Italy Stem Cells Market, by End use, 2018 - 2030 (USD Million)

TABLE 56 Spain Stem Cells Market, by Product 2018 - 2030 (USD Million)

TABLE 57 Spain Stem Cells Market, by Application 2018 - 2030 (USD Million)

TABLE 58 Spain Stem Cells Market, by Technology 2018 - 2030 (USD Million)

TABLE 59 Spain Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

TABLE 60 Spain Stem Cells Market, by End use, 2018 - 2030 (USD Million)

TABLE 61 Denmark Stem Cells Market, by Product 2018 - 2030 (USD Million)

TABLE 62 Denmark Stem Cells Market, by Application 2018 - 2030 (USD Million)

TABLE 63 Denmark Stem Cells Market, by Technology 2018 - 2030 (USD Million)

TABLE 64 Denmark Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

TABLE 65 Denmark Stem Cells Market, by End use, 2018 - 2030 (USD Million)

TABLE 66 Sweden Stem Cells Market, by Product 2018 - 2030 (USD Million)

TABLE 67 Sweden Stem Cells Market, by Application 2018 - 2030 (USD Million)

TABLE 68 Sweden Stem Cells Market, by Technology 2018 - 2030 (USD Million)

TABLE 69 Sweden Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

TABLE 70 Sweden Stem Cells Market, by End use, 2018 - 2030 (USD Million)

TABLE 71 Norway Stem Cells Market, by Product 2018 - 2030 (USD Million)

TABLE 72 Norway Stem Cells Market, by Application 2018 - 2030 (USD Million)

TABLE 73 Norway Stem Cells Market, by Technology 2018 - 2030 (USD Million)

TABLE 74 Norway Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

TABLE 75 Norway Stem Cells Market, by End-use, 2018 - 2030 (USD Million)

TABLE 76 Asia Pacific Stem Cells Market, by Country, 2018 - 2030 (USD Million)

TABLE 77 Asia Pacific Stem Cells Market, by Product 2018 - 2030 (USD Million)

TABLE 78 Asia Pacific Stem Cells Market, by Application 2018 - 2030 (USD Million)

TABLE 79 Asia Pacific Stem Cells Market, by Technology 2018 - 2030 (USD Million)

TABLE 80 Asia Pacific Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

TABLE 81 Asia Pacific Stem Cells Market, by End use, 2018 - 2030 (USD Million)

TABLE 82 China Stem Cells Market, by Product 2018 - 2030 (USD Million)

TABLE 83 China Stem Cells Market, by Application 2018 - 2030 (USD Million)

TABLE 84 China Stem Cells Market, by Technology 2018 - 2030 (USD Million)

TABLE 85 China Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

TABLE 86 China Stem Cells Market, by End use, 2018 - 2030 (USD Million)

TABLE 87 Japan Stem Cells Market, by Product 2018 - 2030 (USD Million)

TABLE 88 Japan Stem Cells Market, by Application 2018 - 2030 (USD Million)

TABLE 89 Japan Stem Cells Market, by Technology 2018 - 2030 (USD Million)

TABLE 90 Japan Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

TABLE 91 Japan Stem Cells Market, by End use, 2018 - 2030 (USD Million)

TABLE 92 India Stem Cells Market, by Product 2018 - 2030 (USD Million)

TABLE 93 India Stem Cells Market, by Application 2018 - 2030 (USD Million)

TABLE 94 India Stem Cells Market, by Technology 2018 - 2030 (USD Million)

TABLE 95 India Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

TABLE 96 India Stem Cells Market, by End use, 2018 - 2030 (USD Million)

TABLE 97 South Korea Stem Cells Market, by Product 2018 - 2030 (USD Million)

TABLE 98 South Korea Stem Cells Market, by Application 2018 - 2030 (USD Million)

TABLE 99 South Korea Stem Cells Market, by Technology 2018 - 2030 (USD Million)

TABLE 100 South Korea Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

TABLE 101 South Korea Stem Cells Market, by End use, 2018 - 2030 (USD Million)

TABLE 102 Australia Stem Cells Market, by Product 2018 - 2030 (USD Million)

TABLE 103 Australia Stem Cells Market, by Application 2018 - 2030 (USD Million)

TABLE 104 Australia Stem Cells Market, by Technology 2018 - 2030 (USD Million)

TABLE 105 Australia Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

TABLE 106 Australia Stem Cells Market, by End use, 2018 - 2030 (USD Million)

TABLE 107 Thailand Stem Cells Market, by Product 2018 - 2030 (USD Million)

TABLE 108 Thailand Stem Cells Market, by Application 2018 - 2030 (USD Million)

TABLE 109 Thailand Stem Cells Market, by Technology 2018 - 2030 (USD Million)

TABLE 110 Thailand Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

TABLE 111 Thailand Stem Cells Market, by End use, 2018 - 2030 (USD Million)

TABLE 112 Latin America Stem Cells Market, by Country, 2018 - 2030 (USD Million)

TABLE 113 Latin America Stem Cells Market, by Product 2018 - 2030 (USD Million)

TABLE 114 Latin America Stem Cells Market, by Application 2018 - 2030 (USD Million)

TABLE 115 Latin America Stem Cells Market, by Technology 2018 - 2030 (USD Million)

TABLE 116 Latin America Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

TABLE 117 Latin America Stem Cells Market, by End use, 2018 - 2030 (USD Million)

TABLE 118 Brazil Stem Cells Market, by Product 2018 - 2030 (USD Million)

TABLE 119 Brazil Stem Cells Market, by Application 2018 - 2030 (USD Million)

TABLE 120 Brazil Stem Cells Market, by Technology 2018 - 2030 (USD Million)

TABLE 121 Brazil Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

TABLE 122 Brazil Stem Cells Market, by End use, 2018 - 2030 (USD Million)

TABLE 123 Argentina Stem Cells Market, by Product 2018 - 2030 (USD Million)

TABLE 124 Argentina Stem Cells Market, by Application 2018 - 2030 (USD Million)

TABLE 125 Argentina Stem Cells Market, by Technology 2018 - 2030 (USD Million)

TABLE 126 Argentina Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

TABLE 127 Argentina Stem Cells Market, by End use, 2018 - 2030 (USD Million)

TABLE 128 Middle East & Africa Stem Cells Market, by Country, 2018 - 2030 (USD Million)

TABLE 129 Middle East & Africa Stem Cells Market, by Product 2018 - 2030 (USD Million)

TABLE 130 Middle East & Africa Stem Cells Market, by Application 2018 - 2030 (USD Million)

TABLE 131 Middle East & Africa Stem Cells Market, by Technology 2018 - 2030 (USD Million)

TABLE 132 Middle East & Africa Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

TABLE 133 Middle East & Africa Stem Cells Market, by End use, 2018 - 2030 (USD Million)

TABLE 134 South Africa Stem Cells Market, by Product 2018 - 2030 (USD Million)

TABLE 135 South Africa Stem Cells Market, by Application 2018 - 2030 (USD Million)

TABLE 136 South Africa Stem Cells Market, by Technology 2018 - 2030 (USD Million)

TABLE 137 South Africa Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

TABLE 138 South Africa Stem Cells Market, by End-use, 2018 - 2030 (USD Million)

TABLE 139 Saudi Arabia Stem Cells Market, by Product 2018 - 2030 (USD Million)

TABLE 140 Saudi Arabia Stem Cells Market, by Application 2018 - 2030 (USD Million)

TABLE 141 Saudi Arabia Stem Cells Market, by Technology 2018 - 2030 (USD Million)

TABLE 142 Saudi Arabia Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

TABLE 143 Saudi Arabia Stem Cells Market, by End use, 2018 - 2030 (USD Million)

TABLE 144 UAE Stem Cells Market, by Product 2018 - 2030 (USD Million)

TABLE 145 UAE Stem Cells Market, by Application 2018 - 2030 (USD Million)

TABLE 146 UAE Stem Cells Market, by Technology 2018 - 2030 (USD Million)

TABLE 147 UAE Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

TABLE 148 UAE Stem Cells Market, by End use, 2018 - 2030 (USD Million)

TABLE 149 Kuwait Stem Cells Market, by Product 2018 - 2030 (USD Million)

TABLE 150 Kuwait Stem Cells Market, by Application 2018 - 2030 (USD Million)

TABLE 151 Kuwait Stem Cells Market, by Technology 2018 - 2030 (USD Million)

TABLE 152 Kuwait Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

TABLE 153 Kuwait Stem Cells Market, by End use, 2018 - 2030 (USD Million)

List of Figures

FIG. 1 Market research process

FIG. 2 Information Procurement

FIG. 3 Primary Research Pattern

FIG. 4 Market Research Approaches

FIG. 5 Value Chain-Based Sizing & Forecasting

FIG. 6 Market Formulation & Validation

FIG. 7 Stem Cells Market Segmentation

FIG. 8 Market Snapshot, 2024

FIG. 9 Market Trends & Outlook

FIG. 10 Market Driver Relevance Analysis (Current & Future Impact)

FIG. 11 Market Restraint Relevance Analysis (Current & Future Impact)

FIG. 12 PESTEL Analysis

FIG. 13 Porter’s Five Forces Analysis

FIG. 14 Global Stem Cells Market: Product Movement Analysis

FIG. 15 Global Stem Cells Market, for Adult Stem Cells, 2018 - 2030 (USD Million)

FIG. 16 Global Stem Cells Market, for Hematopoietic Stem Cells (Blood Stem Cells), 2018 - 2030 (USD Million)

FIG. 17 Global Stem Cells Market, for Mesenchymal Stem Cells, 2018 - 2030 (USD Million)

FIG. 18 Global Stem Cells Market, for Neural Stem Cells, 2018 - 2030 (USD Million)

FIG. 19 Global Stem Cells Market, for Epithelial/Skin Stem Cells, 2018 - 2030 (USD Million)

FIG. 20 Global Stem Cells Market, for Other Adult Stem Cells, 2018 - 2030 (USD Million)

FIG. 21 Global Stem Cells Market, for Human Embryonic Stem Cells, 2018 - 2030 (USD Million)

FIG. 22 Global Stem Cells Market, for Induced Pluripotent Stem Cells, 2018 - 2030 (USD Million)

FIG. 23 Global Stem Cells Market, for Very Small Embryonic Like Stem Cells, 2018 - 2030 (USD Million)

FIG. 24 Global Stem Cells Market: Application Movement Analysis

FIG. 25 Global Stem Cells Market, for Regenerative Medicine, 2018 - 2030 (USD Million)

FIG. 26 Global Stem Cells Market, for Neurology, 2018 - 2030 (USD Million)

FIG. 27 Global Stem Cells Market, for Orthopedics, 2018 - 2030 (USD Million)

FIG. 28 Global Stem Cells Market, for Oncology, 2018 - 2030 (USD Million)

FIG. 29 Global Stem Cells Market, for Hematology, 2018 - 2030 (USD Million)

FIG. 30 Global Stem Cells Market, for Cardiovascular and Myocardial Infraction, 2018 - 2030 (USD Million)

FIG. 31 Global Stem Cells Market, for Injuries, 2018 - 2030 (USD Million)

FIG. 32 Global Stem Cells Market, for Diabetes, 2018 - 2030 (USD Million)

FIG. 33 Global Stem Cells Market, for Liver Disorder, 2018 - 2030 (USD Million)

FIG. 34 Global Stem Cells Market, for Incontinence, 2018 - 2030 (USD Million)

FIG. 35 Global Stem Cells Market, for Others, 2018 - 2030 (USD Million)

FIG. 36 Global Stem Cells Market, for Drug Discovery and Development, 2018 - 2030 (USD Million)

FIG. 37 Global Stem Cells Market: Technology Movement Analysis

FIG. 38 Global Stem Cells Market, for Cell Acquisition, 2018 - 2030 (USD Million)

FIG. 39 Global Stem Cells Market, for Bone Marrow Harvest, 2018 - 2030 (USD Million)

FIG. 40 Global Stem Cells Market, for Umbilical Blood Cord, 2018 - 2030 (USD Million)

FIG. 41 Global Stem Cells Market, for Apheresis, 2018 - 2030 (USD Million)

FIG. 42 Global Stem Cells Market, for Cell Production, 2018 - 2030 (USD Million)

FIG. 43 Global Stem Cells Market, for Therapeutic Cloning, 2018 - 2030 (USD Million)

FIG. 44 Global Stem Cells Market, for In Vitro Fertilization, 2018 - 2030 (USD Million)

FIG. 45 Global Stem Cells Market, for Cell Culture, 2018 - 2030 (USD Million)

FIG. 46 Global Stem Cells Market, for Isolation, 2018 - 2030 (USD Million)

FIG. 47 Global Stem Cells Market, for Cryopreservation, 2018 - 2030 (USD Million)

FIG. 48 Global Stem Cells Market, for Expansion and Sub-Culture, 2018 - 2030 (USD Million)

FIG. 49 Global Stem Cells Market: Therapy Movement Analysis

FIG. 50 Global Stem Cells Market, for Autologous, 2018 - 2030 (USD Million)

FIG. 51 Global Stem Cells Market, for Allogeneic, 2018 - 2030 (USD Million)

FIG. 52 Global Stem Cells Market, End-User Movement Analysis

FIG. 53 Global Stem Cells Market, for Pharmaceutical and Biotechnology Companies, 2018 - 2030 (USD Million)

FIG. 54 Global Stem Cells Market, for Hospitals & Cell Banks, 2018 - 2030 (USD Million)

FIG. 55 Global Stem Cells Market, for Academic & Research Institutes, 2018 - 2030 (USD Million)

FIG. 56 Regional Outlook, 2024 & 2030

FIG. 57 Global Stem Cells Market: Region Movement Analysis

FIG. 58 North America Stem Cells Market, 2018 - 2030 (USD Million)

FIG. 59 U.S. Stem Cells Market, 2018 - 2030 (USD Million)

FIG. 60 Canada Stem Cells Market, 2018 - 2030 (USD Million)

FIG. 61 Europe Stem Cells Market, 2018 - 2030 (USD Million)

FIG. 62 Germany Stem Cells Market, 2018 - 2030 (USD Million)

FIG. 63 UK Stem Cells Market, 2018 - 2030 (USD Million)

FIG. 64 France Stem Cells Market, 2018 - 2030 (USD Million)

FIG. 65 Italy Stem Cells Market, 2018 - 2030 (USD Million)

FIG. 66 Spain Stem Cells Market, 2018 - 2030 (USD Million)

FIG. 67 Denmark Stem Cells Market, 2018 - 2030 (USD Million)

FIG. 68 Norway Stem Cells Market, 2018 - 2030 (USD Million)

FIG. 69 Sweden Stem Cells Market, 2018 - 2030 (USD Million)

FIG. 70 Asia Pacific Stem Cells Market, 2018 - 2030 (USD Million)

FIG. 71 Japan Stem Cells Market, 2018 - 2030 (USD Million)

FIG. 72 China Stem Cells Market, 2018 - 2030 (USD Million)

FIG. 73 India Stem Cells Market, 2018 - 2030 (USD Million)

FIG. 74 Australia Stem Cells Market, 2018 - 2030 (USD Million)

FIG. 75 South Korea Stem Cells Market, 2018 - 2030 (USD Million)

FIG. 76 Thailand Stem Cells Market, 2018 - 2030 (USD Million)

FIG. 77 Latin America Stem Cells Market, 2018 - 2030 (USD Million)

FIG. 78 Brazil Stem Cells Market, 2018 - 2030 (USD Million)

FIG. 79 Mexico Stem Cells Market, 2018 - 2030 (USD Million)

FIG. 80 Argentina Stem Cells Market, 2018 - 2030 (USD Million)

FIG. 81 Middle East and Africa Stem Cells Market, 2018 - 2030 (USD Million)

FIG. 82 South Africa Stem Cells Market, 2018 - 2030 (USD Million)

FIG. 83 Saudi Arabia Stem Cells Market, 2018 - 2030 (USD Million)

FIG. 84 UAE Stem Cells Market, 2018 - 2030 (USD Million)

FIG. 85 Kuwait Stem Cells Market, 2018 - 2030 (USD Million)

Market Segmentation

- Stem Cells Product Outlook (Revenue, USD Million, 2018 - 2030)

- Adult Stem Cells (ASCs)

- Hematopoietic

- Mesenchymal

- Neural

- Epithelial/Skin

- Others

- Human Embryonic Stem Cells (HESCs)

- Induced Pluripotent Stem Cells (iPSCs)

- Very Small Embryonic Like Stem Cells

- Adult Stem Cells (ASCs)

- Stem Cells Application Outlook (Revenue, USD Million, 2018 - 2030)

- Regenerative Medicine

- Neurology

- Orthopedics

- Oncology

- Hematology

- Cardiovascular and Myocardial Infraction

- Injuries

- Diabetes

- Liver Disorder

- Incontinence

- Others

- Drug Discovery and Development

- Regenerative Medicine

- Stem Cells Technology Outlook (Revenue, USD Million, 2018 - 2030)

- Cell Acquisition

- Bone Marrow Harvest

- Umbilical Blood Cord

- Apheresis

- Cell Production

- Therapeutic Cloning

- In-vitro Fertilization

- Cell Culture

- Isolation

- Cryopreservation

- Expansion and Sub-Culture

- Cell Acquisition

- Stem Cells Therapy Outlook (Revenue, USD Million, 2018 - 2030)

- Autologous

- Allogeneic

- Stem Cells End Use Outlook (Revenue, USD Million, 2018 - 2030)

- Pharmaceutical and Biotechnology Companies

- Hospitals & Cell Banks

- Academic & Research Institutes

- Stem Cells Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Stem Cells Market, by Product 2018 - 2030 (USD Million)

- Adult Stem Cells (ASCs)

- Hematopoietic

- Mesenchymal

- Neural

- Epithelial/Skin

- Others

- Human Embryonic Stem Cells (HESCs)

- Induced Pluripotent Stem Cells (iPSCs)

- Very Small Embryonic Like Stem Cells

- Adult Stem Cells (ASCs)

- North America Stem Cells Market, by Application 2018 - 2030 (USD Million)

- Regenerative Medicine

- Neurology

- Orthopedics

- Oncology

- Hematology

- Cardiovascular and Myocardial Infraction

- Injuries

- Diabetes

- Liver Disorder

- Incontinence

- Others

- Drug Discovery and Development

- Regenerative Medicine

- North America Stem Cells Market, by Technology 2018 - 2030 (USD Million)

- Cell Acquisition

- Bone Marrow Harvest

- Umbilical Blood CordApheresis

- Cell Production

- Therapeutic Cloning

- In-vitro Fertilization

- Cell Culture

- Isolation

- Cryopreservation

- Expansion and Sub-Culture

- Cell Acquisition

- North America Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

- Autologous

- Allogeneic

- North America Stem Cells Market, by End-use 2018 - 2030 (USD Million)

- Pharmaceutical and Biotechnology Companies

- Hospitals & Cell Banks

- Academic & Research Institutes

- U.S.

- U.S. Stem Cells Market, by Product 2018 - 2030 (USD Million)

- Adult Stem Cells (ASCs)

- Hematopoietic

- Mesenchymal

- Neural

- Epithelial/Skin

- Others

- Human Embryonic Stem Cells (HESCs)

- Induced Pluripotent Stem Cells (iPSCs)

- Very Small Embryonic Like Stem Cells

- Adult Stem Cells (ASCs)

- U.S. Stem Cells Market, by Application 2018 - 2030 (USD Million)

- Regenerative Medicine

- Neurology

- Orthopedics

- Oncology

- Hematology

- Cardiovascular and Myocardial Infraction

- Injuries

- Diabetes

- Liver Disorder

- Incontinence

- Others

- Drug Discovery and Development

- Regenerative Medicine

- U.S. Stem Cells Market, by Technology 2018 - 2030 (USD Million)

- Cell Acquisition

- Bone Marrow Harvest

- Umbilical Blood CordApheresis

- Cell Production

- Therapeutic Cloning

- In-vitro Fertilization

- Cell Culture

- Isolation

- Cryopreservation

- Expansion and Sub-Culture

- Cell Acquisition

- U.S. Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

- Autologous

- Allogeneic

- U.S. Stem Cells Market, by End-use 2018 - 2030 (USD Million)

- Pharmaceutical and Biotechnology Companies

- Hospitals & Cell Banks

- Academic & Research Institutes

- U.S. Stem Cells Market, by Product 2018 - 2030 (USD Million)

- Canada

- Canada Stem Cells Market, by Product 2018 - 2030 (USD Million)

- Adult Stem Cells (ASCs)

- Hematopoietic

- Mesenchymal

- Neural

- Epithelial/Skin

- Others

- Human Embryonic Stem Cells (HESCs)

- Induced Pluripotent Stem Cells (iPSCs)

- Very Small Embryonic Like Stem Cells

- Adult Stem Cells (ASCs)

- Canada Stem Cells Market, by Application 2018 - 2030 (USD Million)

- Regenerative Medicine

- Neurology

- Orthopedics

- Oncology

- Hematology

- Cardiovascular and Myocardial Infraction

- Injuries

- Diabetes

- Liver Disorder

- Incontinence

- Others

- Drug Discovery and Development

- Regenerative Medicine

- Canada Stem Cells Market, by Technology 2018 - 2030 (USD Million)

- Cell Acquisition

- Bone Marrow Harvest

- Umbilical Blood CordApheresis

- Cell Production

- Therapeutic Cloning

- In-vitro Fertilization

- Cell Culture

- Isolation

- Cryopreservation

- Expansion and Sub-Culture

- Cell Acquisition

- Canada Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

- Autologous

- Allogeneic

- Canada Stem Cells Market, by End-use 2018 - 2030 (USD Million)

- Pharmaceutical and Biotechnology Companies

- Hospitals & Cell Banks

- Academic & Research Institutes

- Canada Stem Cells Market, by Product 2018 - 2030 (USD Million)

- Mexico

- Mexico Stem Cells Market, by Product 2018 - 2030 (USD Million)

- Adult Stem Cells (ASCs)

- Hematopoietic

- Mesenchymal

- Neural

- Epithelial/Skin

- Others

- Human Embryonic Stem Cells (HESCs)

- Induced Pluripotent Stem Cells (iPSCs)

- Very Small Embryonic Like Stem Cells

- Adult Stem Cells (ASCs)

- Mexico Stem Cells Market, by Application 2018 - 2030 (USD Million)

- Regenerative Medicine

- Neurology

- Orthopedics

- Oncology

- Hematology

- Cardiovascular and Myocardial Infraction

- Injuries

- Diabetes

- Liver Disorder

- Incontinence

- Others

- Drug Discovery and Development

- Regenerative Medicine

- Mexico Stem Cells Market, by Technology 2018 - 2030 (USD Million)

- Cell Acquisition

- Bone Marrow Harvest

- Umbilical Blood CordApheresis

- Cell Production

- Therapeutic Cloning

- In-vitro Fertilization

- Cell Culture

- Isolation

- Cryopreservation

- Expansion and Sub-Culture

- Cell Acquisition

- Mexico Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

- Autologous

- Allogeneic

- Mexico Stem Cells Market, by End-use 2018 - 2030 (USD Million)

- Pharmaceutical and Biotechnology Companies

- Hospitals & Cell Banks

- Academic & Research Institutes

- Mexico Stem Cells Market, by Product 2018 - 2030 (USD Million)

- North America Stem Cells Market, by Product 2018 - 2030 (USD Million)

- Europe

- Europe Stem Cells Market, by Product 2018 - 2030 (USD Million)

- Adult Stem Cells (ASCs)

- Hematopoietic

- Mesenchymal

- Neural

- Epithelial/Skin

- Others

- Human Embryonic Stem Cells (HESCs)

- Induced Pluripotent Stem Cells (iPSCs)

- Very Small Embryonic Like Stem Cells

- Adult Stem Cells (ASCs)

- Europe Stem Cells Market, by Application 2018 - 2030 (USD Million)

- Regenerative Medicine

- Neurology

- Orthopedics

- Oncology

- Hematology

- Cardiovascular and Myocardial Infraction

- Injuries

- Diabetes

- Liver Disorder

- Incontinence

- Others

- Drug Discovery and Development

- Regenerative Medicine

- Europe Stem Cells Market, by Technology 2018 - 2030 (USD Million)

- Cell Acquisition

- Bone Marrow Harvest

- Umbilical Blood CordApheresis

- Cell Production

- Therapeutic Cloning

- In-vitro Fertilization

- Cell Culture

- Isolation

- Cryopreservation

- Expansion and Sub-Culture

- Cell Acquisition

- Europe Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

- Autologous

- Allogeneic

- Europe Stem Cells Market, by End-use 2018 - 2030 (USD Million)

- Pharmaceutical and Biotechnology Companies

- Hospitals & Cell Banks

- Academic & Research Institutes

- UK

- UK Stem Cells Market, by Product 2018 - 2030 (USD Million)

- Adult Stem Cells (ASCs)

- Hematopoietic

- Mesenchymal

- Neural

- Epithelial/Skin

- Others

- Human Embryonic Stem Cells (HESCs)

- Induced Pluripotent Stem Cells (iPSCs)

- Very Small Embryonic Like Stem Cells

- Adult Stem Cells (ASCs)

- UK Stem Cells Market, by Application 2018 - 2030 (USD Million)

- Regenerative Medicine

- Neurology

- Orthopedics

- Oncology

- Hematology

- Cardiovascular and Myocardial Infraction

- Injuries

- Diabetes

- Liver Disorder

- Incontinence

- Others

- Drug Discovery and Development

- Regenerative Medicine

- UK Stem Cells Market, by Technology 2018 - 2030 (USD Million)

- Cell Acquisition

- Bone Marrow Harvest

- Umbilical Blood CordApheresis

- Cell Production

- Therapeutic Cloning

- In-vitro Fertilization

- Cell Culture

- Isolation

- Cryopreservation

- Expansion and Sub-Culture

- Cell Acquisition

- UK Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

- Autologous

- Allogeneic

- UK Stem Cells Market, by End-use 2018 - 2030 (USD Million)

- Pharmaceutical and Biotechnology Companies

- Hospitals & Cell Banks

- Academic & Research Institutes

- UK Stem Cells Market, by Product 2018 - 2030 (USD Million)

- Germany

- Germany Stem Cells Market, by Product 2018 - 2030 (USD Million)

- Adult Stem Cells (ASCs)

- Hematopoietic

- Mesenchymal

- Neural

- Epithelial/Skin

- Others

- Human Embryonic Stem Cells (HESCs)

- Induced Pluripotent Stem Cells (iPSCs)

- Very Small Embryonic Like Stem Cells

- Adult Stem Cells (ASCs)

- Germany Stem Cells Market, by Application 2018 - 2030 (USD Million)

- Regenerative Medicine

- Neurology

- Orthopedics

- Oncology

- Hematology

- Cardiovascular and Myocardial Infraction

- Injuries

- Diabetes

- Liver Disorder

- Incontinence

- Others

- Drug Discovery and Development

- Regenerative Medicine

- Germany Stem Cells Market, by Technology 2018 - 2030 (USD Million)

- Cell Acquisition

- Bone Marrow Harvest

- Umbilical Blood CordApheresis

- Cell Production

- Therapeutic Cloning

- In-vitro Fertilization

- Cell Culture

- Isolation

- Cryopreservation

- Expansion and Sub-Culture

- Cell Acquisition

- Germany Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

- Autologous

- Allogeneic

- Germany Stem Cells Market, by End-use 2018 - 2030 (USD Million)

- Pharmaceutical and Biotechnology Companies

- Hospitals & Cell Banks

- Academic & Research Institutes

- Germany Stem Cells Market, by Product 2018 - 2030 (USD Million)

- France

- France Stem Cells Market, by Product 2018 - 2030 (USD Million)

- Adult Stem Cells (ASCs)

- Hematopoietic

- Mesenchymal

- Neural

- Epithelial/Skin

- Others

- Human Embryonic Stem Cells (HESCs)

- Induced Pluripotent Stem Cells (iPSCs)

- Very Small Embryonic Like Stem Cells

- Adult Stem Cells (ASCs)

- France Stem Cells Market, by Application 2018 - 2030 (USD Million)

- Regenerative Medicine

- Neurology

- Orthopedics

- Oncology

- Hematology

- Cardiovascular and Myocardial Infraction

- Injuries

- Diabetes

- Liver Disorder

- Incontinence

- Others

- Drug Discovery and Development

- Regenerative Medicine

- France Stem Cells Market, by Technology 2018 - 2030 (USD Million)

- Cell Acquisition

- Bone Marrow Harvest

- Umbilical Blood CordApheresis

- Cell Production

- Therapeutic Cloning

- In-vitro Fertilization

- Cell Culture

- Isolation

- Cryopreservation

- Expansion and Sub-Culture

- Cell Acquisition

- France Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

- Autologous

- Allogeneic

- France Stem Cells Market, by End-use 2018 - 2030 (USD Million)

- Pharmaceutical and Biotechnology Companies

- Hospitals & Cell Banks

- Academic & Research Institutes

- France Stem Cells Market, by Product 2018 - 2030 (USD Million)

- Italy

- Italy Stem Cells Market, by Product 2018 - 2030 (USD Million)

- Adult Stem Cells (ASCs)

- Hematopoietic

- Mesenchymal

- Neural

- Epithelial/Skin

- Others

- Human Embryonic Stem Cells (HESCs)

- Induced Pluripotent Stem Cells (iPSCs)

- Very Small Embryonic Like Stem Cells

- Adult Stem Cells (ASCs)

- Italy Stem Cells Market, by Application 2018 - 2030 (USD Million)

- Regenerative Medicine

- Neurology

- Orthopedics

- Oncology

- Hematology

- Cardiovascular and Myocardial Infraction

- Injuries

- Diabetes

- Liver Disorder

- Incontinence

- Others

- Drug Discovery and Development

- Regenerative Medicine

- Italy Stem Cells Market, by Technology 2018 - 2030 (USD Million)

- Cell Acquisition

- Bone Marrow Harvest

- Umbilical Blood CordApheresis

- Cell Production

- Therapeutic Cloning

- In-vitro Fertilization

- Cell Culture

- Isolation

- Cryopreservation

- Expansion and Sub-Culture

- Cell Acquisition

- Italy Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

- Autologous

- Allogeneic

- Italy Stem Cells Market, by End-use 2018 - 2030 (USD Million)

- Pharmaceutical and Biotechnology Companies

- Hospitals & Cell Banks

- Academic & Research Institutes

- Italy Stem Cells Market, by Product 2018 - 2030 (USD Million)

- Spain

- Spain Stem Cells Market, by Product 2018 - 2030 (USD Million)

- Adult Stem Cells (ASCs)

- Hematopoietic

- Mesenchymal

- Neural

- Epithelial/Skin

- Others

- Human Embryonic Stem Cells (HESCs)

- Induced Pluripotent Stem Cells (iPSCs)

- Very Small Embryonic Like Stem Cells

- Adult Stem Cells (ASCs)

- Spain Stem Cells Market, by Application 2018 - 2030 (USD Million)

- Regenerative Medicine

- Neurology

- Orthopedics

- Oncology

- Hematology

- Cardiovascular and Myocardial Infraction

- Injuries

- Diabetes

- Liver Disorder

- Incontinence

- Others

- Drug Discovery and Development

- Regenerative Medicine

- Spain Stem Cells Market, by Technology 2018 - 2030 (USD Million)

- Cell Acquisition

- Bone Marrow Harvest

- Umbilical Blood CordApheresis

- Cell Production

- Therapeutic Cloning

- In-vitro Fertilization

- Cell Culture

- Isolation

- Cryopreservation

- Expansion and Sub-Culture

- Cell Acquisition

- Spain Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

- Autologous

- Allogeneic

- Spain Stem Cells Market, by End-use 2018 - 2030 (USD Million)

- Pharmaceutical and Biotechnology Companies

- Hospitals & Cell Banks

- Academic & Research Institutes

- Spain Stem Cells Market, by Product 2018 - 2030 (USD Million)

- Denmark

- Denmark Stem Cells Market, by Product 2018 - 2030 (USD Million)

- Adult Stem Cells (ASCs)

- Hematopoietic

- Mesenchymal

- Neural

- Epithelial/Skin

- Others

- Human Embryonic Stem Cells (HESCs)

- Induced Pluripotent Stem Cells (iPSCs)

- Very Small Embryonic Like Stem Cells

- Adult Stem Cells (ASCs)

- Denmark Stem Cells Market, by Application 2018 - 2030 (USD Million)

- Regenerative Medicine

- Neurology

- Orthopedics

- Oncology

- Hematology

- Cardiovascular and Myocardial Infraction

- Injuries

- Diabetes

- Liver Disorder

- Incontinence

- Others

- Drug Discovery and Development

- Regenerative Medicine

- Denmark Stem Cells Market, by Technology 2018 - 2030 (USD Million)

- Cell Acquisition

- Bone Marrow Harvest

- Umbilical Blood CordApheresis

- Cell Production

- Therapeutic Cloning

- In-vitro Fertilization

- Cell Culture

- Isolation

- Cryopreservation

- Expansion and Sub-Culture

- Cell Acquisition

- Denmark Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

- Autologous

- Allogeneic

- Denmark Stem Cells Market, by End-use 2018 - 2030 (USD Million)

- Pharmaceutical and Biotechnology Companies

- Hospitals & Cell Banks

- Academic & Research Institutes

- Denmark Stem Cells Market, by Product 2018 - 2030 (USD Million)

- Sweden

- Sweden Stem Cells Market, by Product 2018 - 2030 (USD Million)

- Adult Stem Cells (ASCs)

- Hematopoietic

- Mesenchymal

- Neural

- Epithelial/Skin

- Others

- Human Embryonic Stem Cells (HESCs)

- Induced Pluripotent Stem Cells (iPSCs)

- Very Small Embryonic Like Stem Cells

- Adult Stem Cells (ASCs)

- Sweden Stem Cells Market, by Application 2018 - 2030 (USD Million)

- Regenerative Medicine

- Neurology

- Orthopedics

- Oncology

- Hematology

- Cardiovascular and Myocardial Infraction

- Injuries

- Diabetes

- Liver Disorder

- Incontinence

- Others

- Drug Discovery and Development

- Regenerative Medicine

- Sweden Stem Cells Market, by Technology 2018 - 2030 (USD Million)

- Cell Acquisition

- Bone Marrow Harvest

- Umbilical Blood CordApheresis

- Cell Production

- Therapeutic Cloning

- In-vitro Fertilization

- Cell Culture

- Isolation

- Cryopreservation

- Expansion and Sub-Culture

- Cell Acquisition

- Sweden Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

- Autologous

- Allogeneic

- Sweden Stem Cells Market, by End-use 2018 - 2030 (USD Million)

- Pharmaceutical and Biotechnology Companies

- Hospitals & Cell Banks

- Academic & Research Institutes

- Sweden Stem Cells Market, by Product 2018 - 2030 (USD Million)

- Norway

- Norway Stem Cells Market, by Product 2018 - 2030 (USD Million)

- Adult Stem Cells (ASCs)

- Hematopoietic

- Mesenchymal

- Neural

- Epithelial/Skin

- Others

- Human Embryonic Stem Cells (HESCs)

- Induced Pluripotent Stem Cells (iPSCs)

- Very Small Embryonic Like Stem Cells

- Adult Stem Cells (ASCs)

- Norway Stem Cells Market, by Application 2018 - 2030 (USD Million)

- Regenerative Medicine

- Neurology

- Orthopedics

- Oncology

- Hematology

- Cardiovascular and Myocardial Infraction

- Injuries

- Diabetes

- Liver Disorder

- Incontinence

- Others

- Drug Discovery and Development

- Regenerative Medicine

- Norway Stem Cells Market, by Technology 2018 - 2030 (USD Million)

- Cell Acquisition

- Bone Marrow Harvest

- Umbilical Blood CordApheresis

- Cell Production

- Therapeutic Cloning

- In-vitro Fertilization

- Cell Culture

- Isolation

- Cryopreservation

- Expansion and Sub-Culture

- Cell Acquisition

- Norway Stem Cells Market, by Therapy 2018 - 2030 (USD Million)

- Autologous

- Allogeneic