- Home

- »

- Advanced Interior Materials

- »

-

Steel Wire Market Size, Share, Trends, Industry Report 2033GVR Report cover

![Steel Wire Market Size, Share & Trends Report]()

Steel Wire Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Carbon Steel, Stainless Steel, Alloy Steel), By Application (Construction, Automotive, Energy), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-970-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Steel Wire Market Summary

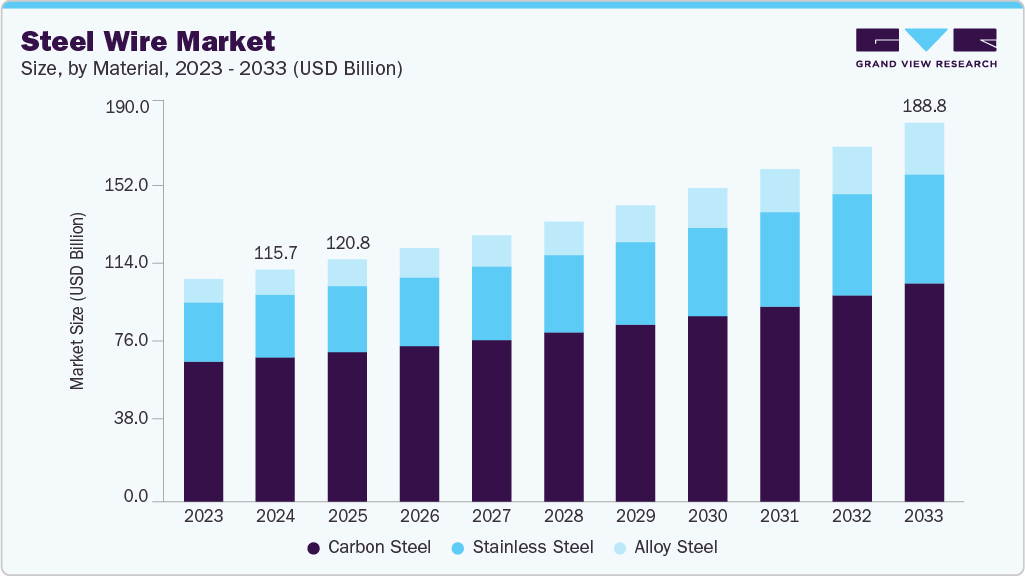

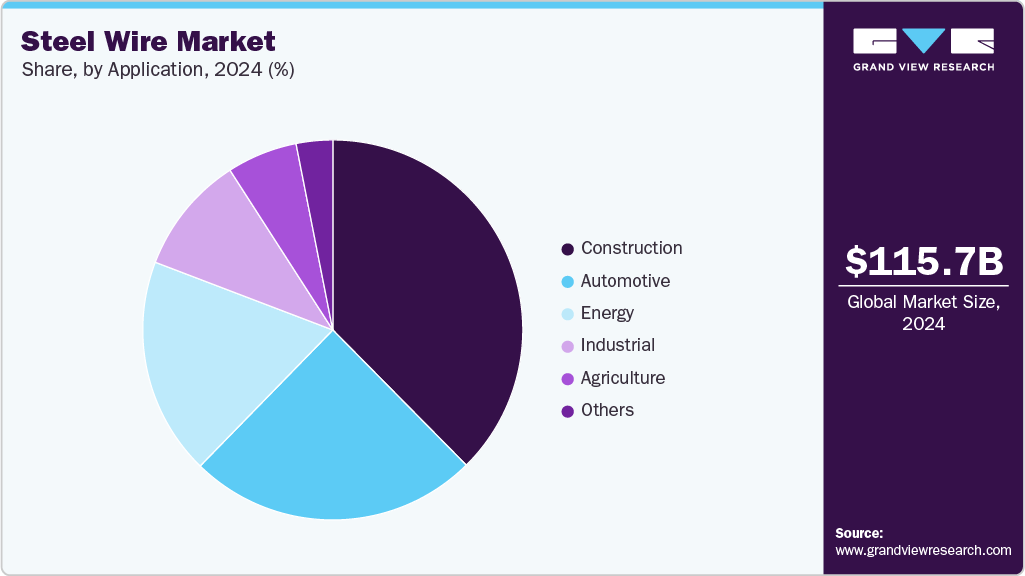

The global steel wire market size was estimated at USD 115.68 billion in 2024 and is projected to reach USD 188.76 billion by 2033, growing at a CAGR of 5.7% from 2025 to 2033. The market is growing mainly because of the number of construction and infrastructure projects worldwide.

Key Market Trends & Insights

- Asia Pacific dominated the steel wire market with the largest revenue share of 54.4% in 2024.

- The steel wire industry in the U.S. is expected to grow at a substantial CAGR of 4.6% from 2025 to 2033.

- By material, the carbon steel segment accounted for the largest revenue share of over 62.5% in 2024.

- By application, the agriculture segment is anticipated to register the fastest CAGR of 8.7% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 115.68 Billion

- 2033 Projected Market Size: USD 188.76 Billion

- CAGR (2025-2033): 5.7%

- Asia Pacific: Largest market in 2024

- Latin America: Fastest growing market

Steel wires are widely used in bridges, roads, buildings, and other large structures. They help strengthen concrete and are also used for fencing and safety barriers. Many countries, especially developing ones like India, China, and Southeast Asian countries, are investing heavily in improving their infrastructure. Governments are spending more on smart cities, highways, metros, and power lines, which increases the demand for steel wires. As construction activities continue to grow, the need for steel wire will also keep rising.Governments across Asia, Africa, and Latin America are heavily investing in transportation networks, bridges, railways, and urban infrastructure. For instance, India’s “PM Gati Shakti” master plan involves a multi-billion-dollar logistics and infrastructure investment requiring massive structural steel. Similarly, China’s Belt and Road Initiative (BRI), which spans over 60 countries, continues to catalyze steel demand through large-scale construction and transportation projects.

The automotive industry remains a robust consumer of steel, particularly in producing car bodies, engines, chassis, and safety components. With the global shift toward electric vehicles (EVs), manufacturers increasingly use high-strength, lightweight steel to reduce vehicle weight while maintaining crash safety and structural integrity. For instance, General Motors and Toyota have adopted advanced high-strength steel (AHSS) in their EV platforms to balance durability and fuel economy. According to the International Energy Agency (IEA), global electric car sales reached approximately 17 million units in 2024, up from 14 million in 2023, accounting for nearly one in every five cars sold. This rapid EV adoption has significantly bolstered demand for specialized automotive steel grades, particularly cold-rolled and galvanized steel used in battery enclosures, motor housings, and lightweight body structures. Key manufacturing hubs like China, Germany, and the U.S. are leading this trend, supporting steady steel consumption from the transportation sector.

The shift toward renewable energy has created a surge in demand for specialized steel for producing wind turbines, solar mounting systems, and hydroelectric infrastructure. For instance, offshore and onshore wind farms require large quantities of steel for towers, foundations, and nacelle components. An example is the Hornsea Project in the UK, the world’s largest offshore wind farm, which uses over 200,000 tons of steel. Additionally, transmission towers and electric grids, necessary to support renewable integration, continue to be built using galvanized and structural steel.

Urbanization and population growth drive a strong demand for residential and commercial real estate, fueling the need for structural steel products such as rebar, beams, columns, and sheets. The U.S. residential housing market has seen consistent growth post-pandemic, and countries like Saudi Arabia are developing futuristic smart cities like NEOM, which are projected to use over 1.5 million tons of steel in their initial construction phases alone. Real estate expansion in Southeast Asia, particularly Vietnam and Indonesia, also accelerates steel consumption for high-rise and mid-level developments.

Drivers, Opportunities & Restraints

Strong demand from key industries such as construction, automotive, and manufacturing drives the growth of the steel wire industry. As infrastructure projects expand globally, especially in developing regions like Asia-Pacific and the Middle East, the use of steel wire in bridges, buildings, and roads is growing rapidly. In the automotive industry, steel wire is essential for springs, tire reinforcements, and control cables. Additionally, industrial sectors such as mining, oil & gas, and marine operations rely on high-strength steel wire ropes for lifting and hauling, further supporting market growth. Technological advancements in wire drawing and coating have also made steel wire more durable and corrosion-resistant, boosting its appeal across end-use industries.

Several promising opportunities exist in the steel wire market. With the global shift toward EVs and renewable energy, there is a rising demand for specialty wires that are lightweight, strong, and heat-resistant. Furthermore, the growth of smart cities and 5G infrastructure offers new avenues for using fine steel wires in telecommunication cables and energy grids. Emerging markets in Africa and Southeast Asia present untapped potential due to rapid urbanization and government investment in infrastructure. Developing eco-friendly and recyclable steel wire products is another opportunity, as sustainability becomes a priority for many industries and governments.

Despite its growth, the steel wire industry faces several challenges. One major constraint is the volatility in raw material prices, especially steel and related alloys. Fluctuating input costs can directly impact production and profitability for manufacturers. Additionally, the market is highly energy-intensive and subject to strict environmental regulations in several countries, which may increase compliance costs and slow expansion.

Material Insights

The carbon steel segment held the largest revenue share of 62.5% in 2024. Carbon steel wire is known for its high tensile strength, cost-effectiveness, and adaptability in mild and high-carbon forms. It is suitable for various applications such as wire ropes, springs, fasteners, and structural reinforcements. Rapid urbanization and infrastructure development, especially in emerging economies, have significantly boosted the demand for carbon steel wires used in the construction sector's concrete reinforcement, fencing, and scaffolding.

The alloy steel segment is anticipated to register the fastest CAGR over the forecast period. Alloy steel wire incorporates chromium, nickel, molybdenum, and vanadium, enhancing its performance under extreme operating conditions. This makes it a preferred choice in demanding applications across aerospace, automotive, energy, and heavy machinery industries. In the automotive sector, alloy steel wire is extensively used in components like suspension springs, engine valve springs, and transmission systems, where durability and resistance to high stress and temperature are critical.

Application Insights

The construction segment held the largest revenue share of 37.6% in 2024. Construction remains a dominant application in the global steel wire industry, driven by rapid urbanization, infrastructure modernization, and growing demand for high-strength, durable materials. As countries across Asia Pacific, the Middle East, and Africa invest heavily in urban infrastructure, including bridges, roads, tunnels, and commercial buildings, there is a heightened need for reinforcement materials that offer structural integrity and flexibility.

The agriculture segment is anticipated to grow significantly over the forecast period. Steel wires are widely used in fencing, trellising, greenhouse structures, and crop support systems due to their high tensile strength, corrosion resistance, and cost-effectiveness. In livestock farming, steel wire fences are essential for creating secure enclosures. In contrast, in horticulture and vineyard cultivation, galvanized wires are extensively used to support plants, improving yield and crop quality.

Regional Insights

The growth of the steel wire market in North America is largely driven by the resurgence of the construction and infrastructure sectors, supported by substantial public and private investments. The U.S. Infrastructure Investment and Jobs Act has allocated significant funding toward roads, bridges, and public transit systems, boosting the demand for steel wire for reinforcement, fencing, suspension cables, and structural supports. Additionally, the push for residential housing development, particularly in suburban and semi-urban areas, is increasing the use of steel wire in concrete reinforcement and structural applications, fueling market expansion.

U.S. Steel Wire Market Trends

The U.S. steel wire industry is witnessing steady growth, mainly due to rising investments in construction and infrastructure projects. The government’s large-scale initiatives, such as the Bipartisan Infrastructure Law, drive demand for steel wire in bridges, highways, railroads, and public buildings. Steel wire is commonly used in reinforcing concrete, fencing, and structural supports, making it essential in residential and commercial construction. As urban development expands and older infrastructure is upgraded, the need for durable and high-strength steel wire continues to rise across the country.

Asia Pacific Steel Wire Market Trends

The Asia Pacific steel wire market led with the largest revenue share of 54.4% in 2024. Asia Pacific is experiencing robust growth, primarily driven by the region’s rapidly expanding construction and infrastructure sectors. Countries such as China, India, and Southeast Asia are witnessing extensive urbanization, leading to increased investments in residential, commercial, and industrial infrastructure. Steel wire is widely used to reinforce concrete structures, fencing, suspension bridges, and elevators, making it a crucial component in infrastructure development. In addition, government-backed initiatives such as China’s Belt and Road Initiative and India’s Smart Cities Mission are accelerating the demand for steel wire across various construction and transportation projects.

Europe Steel Wire Market Trends

The steel wire industry in Europe is growing steadily, mainly due to strong demand from the construction and infrastructure sectors. Steel wire is widely used in concrete reinforcement, fencing, and structural supports. Countries like Germany, France, and the UK invest heavily in modernizing infrastructure, including roads, bridges, and railways. These projects require large volumes of steel wire, especially in urban development and renovation of aging structures. The rise in European residential and commercial construction also supports consistent demand.

Latin America Steel Wire Market Trends

The Latin America steel wire industry is anticipated to register the fastest CAGR over the forecast period. The market is growing mainly because of rising construction and infrastructure projects in countries like Brazil, Mexico, and Argentina. Steel wire is widely used in buildings, roads, bridges, and fencing, making it essential for development activities. Governments are investing in public infrastructure and housing, which increases the demand for reinforced concrete and mesh applications where steel wire plays a key role. Urban expansion and upgrades to aging infrastructure are also supporting steady market growth in the region.

Middle East & Africa Steel Wire Market Trends

Countries like Saudi Arabia and the UAE are building smart cities, highways, airports, and large commercial projects as part of their national development plans. Steel wire is essential in these projects for reinforcing concrete, fencing, and structural frameworks. As urbanization increases and new housing developments expand across the region, the demand for steel wire products continues to rise.

Key Steel Wire Company Insights

Some of the key players operating in the market include ArcelorMittal and KOBE STEEL.

-

ArcelorMittal is the world's leading integrated steel and mining company, headquartered in Luxembourg. With operations in over 60 countries and industrial footprints in more than 15, it plays a pivotal role in major steel-consuming sectors such as automotive, construction, energy, and appliances. The company focuses on sustainable steel production, innovation, and value-added products, while aligning its operations with decarbonization goals. ArcelorMittal's global presence and vertical integration give it a strategic advantage in raw material sourcing and distribution logistics.

-

Kobe Steel, operating under the KOBELCO brand, is a diversified Japanese conglomerate engaged in steel, aluminum, machinery, and engineering. Founded in 1905 and headquartered in Kobe, Japan, the company is known for its technological excellence and high-performance metal products, particularly for automotive and industrial use. With a strong presence in Asia and North America, Kobe Steel leverages its advanced metallurgy and forging technologies to cater to specialized manufacturing needs across construction, transportation, and energy sectors.

Key Steel Wire Companies

The following are the leading companies in the steel wire market. These companies collectively hold the largest market share and dictate industry trends.

- ArcelorMittal

- Bridon-Bekaert Ropes Group

- Heico Companies’ Metal Processing Group

- Optimus Steel

- HBIS GROUP

- KOBE STEEL

- WireCo WorldGroup

- JFE Steel Corporation

- Nippon Steel Corporation

- Insteel Industries

Recent Development

-

In January 2025, China Steel Corporation (CSC) launched a new initiative to produce low-carbon wire rods aimed at enhancing export competitiveness. The wire rods, made from 1018 and 1022 materials with sizes ranging from 5.5mm to 8mm, are primarily commercial-quality low-carbon steel sourced from CSC's blast furnace. Still, customers can also opt for wire rods from Dragon Steel's electric furnace under the same pricing terms.

Steel Wire Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 120.84 billion

Revenue forecast in 2033

USD 188.76 billion

Growth rate

CAGR of 5.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Poland; Italy; France; Czechia; China; India; Japan; Brazil

Key companies profiled

ArcelorMittal; Bridon-Bekaert Ropes Group; Heico Companies’ Metal Processing Group; Optimus Steel; HBIS GROUP; KOBE STEEL; WireCo WorldGroup; JFE Steel Corporation; Nippon Steel Corporation; Insteel Industries

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Steel Wire Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global steel wire market report based on material, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Carbon Steel

-

Stainless Steel

-

Alloy Steel

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Construction

-

Automotive

-

Energy

-

Industrial

-

Agriculture

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Poland

-

Italy

-

France

-

Czechia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global steel wire market size was estimated at USD 115.68 billion in 2024 and is expected to reach USD 120.84 billion in 2025.

b. The global steel wire market is expected to grow at a compound annual growth rate of 5.7% from 2025 to 2033 to reach USD 188.76 billion by 2033.

b. The carbon steel segment dominated the market with a revenue share of 62.5% in 2024.

b. Some of the key players of the global steel wire market are ArcelorMittal, Bridon-Bekaert Ropes Group, Heico Companies’ Metal Processing Group, Optimus Steel, HBIS GROUP, KOBE STEEL, WireCo WorldGroup, JFE Steel Corporation, Nippon Steel Corporation, Insteel Industries, and others.

b. The key factor driving the growth of the global steel wire market is the increasing demand from construction, automotive, and industrial manufacturing sectors, where steel wire is widely used for reinforcement, suspension, and structural applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.