- Home

- »

- Advanced Interior Materials

- »

-

Steel Rebar Market Size And Share, Industry Report, 2030GVR Report cover

![Steel Rebar Market Size, Share & Trends Report]()

Steel Rebar Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Construction, Infrastructure, Industrial), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-3-68038-283-9

- Number of Report Pages: 105

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Steel Rebar Market Summary

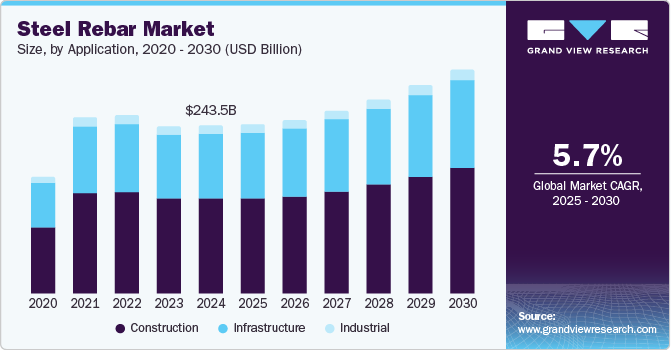

The global steel rebar market size was estimated at USD 243.46 billion in 2024 and is projected to reach USD 325.32 billion by 2030, growing at a CAGR of 5.7% from 2025 to 2030. Government spending to support infrastructure development to stimulate economic growth is expected to impact market growth positively.

Key Market Trends & Insights

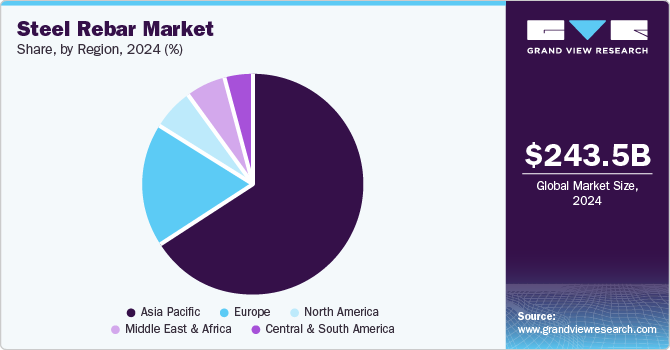

- Asia Pacific dominated the global steel rebar market with the largest revenue share in 2024.

- The steel rebar market in China led the Asia Pacific market and held the largest revenue share in 2024.

- By application, the construction segment led the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 243.46 Billion

- 2030 Projected Market Size: USD 325.32 Billion

- CAGR (2025-2030): 5.7%

- Asia Pacific: Largest market in 2024

For instance, in first quarter of 2023, China accelerated infrastructure investment to boost economic growth and has launched over 10,000 projects in the country. These infrastructure projects include advanced manufacturing, water conservation, transport, modern services and new type of infrastructure.According to U.S. government, major highways and 45,000 bridges are to be repaired in the country. The Act mandates allocation of USD 110.00 billion for rebuilding the infrastructures. Moreover, government has decided to allocate funds for development of ports, water supply, and airports as well. These investments are projected to lift demand for steel rebar in U.S. during the forecast period.

Investments in manufacturing facilities are expected to further augment market growth over coming years. For instance, in December 2023, Waaree Energy announced its plan to setup manufacturing facility in Brookshire, U.S. The facility is expected to have production capacity of 3 gigawatts (GW) of solar modules per year. It is expected to start its operations by the end of 2024. As per company’s website, company plans to increase its solar module capacity to 5 GW by 2027.

Drivers, Opportunities & Restraints

The steel rebar industry is anticipated to grow due to rising infrastructure investments, particularly in emerging economies. Increasing urbanization and government initiatives for smart cities are likely to boost demand. The shift towards earthquake-resistant and high-strength rebars is expected to drive innovation. The expansion of the construction sector, especially in residential and commercial projects, is likely to support market growth. Additionally, advancements in manufacturing technologies are anticipated to enhance production efficiency and cost-effectiveness.

Volatility in raw material prices, particularly iron ore and scrap steel, is expected to challenge market stability. Stringent environmental regulations on steel production are likely to increase compliance costs for manufacturers. The availability of substitute materials such as fiber-reinforced polymers is anticipated to limit demand. Economic slowdowns and fluctuations in construction activity are likely to impact market growth. Additionally, trade restrictions and tariffs on steel imports are expected to create uncertainties in supply chains.

The adoption of green steel and sustainable rebar manufacturing practices is anticipated to create new growth avenues. Increasing demand for high-performance rebars in seismic-prone regions is likely to drive specialized product development. Advancements in automation and digitalization in steel production are expected to improve efficiency and reduce costs. The rise of prefabricated construction methods is likely to enhance demand for standardized rebars. Additionally, infrastructure modernization projects in developed economies are expected to open new revenue streams for market players.

Application Insights

Various investments in the construction industry are projected to augment segment growth. For instance, real estate sector of India attracted equity investments of USD 11.4 billion in 2024, an increase of 54% compared to 2023. In addition, the rising need for steel rebars in the construction of production facilities is another growth driver for market. For instance, in February 2025, Uniphar announced expansion of three new facilities in Ireland, Netherlands, and the U.S. The company’s investment are expected to support its product portfolio across pharmaceutical and biotech industry.

The infrastructure application segment is expected to register the fastest CAGR during the forecast period. Rising government expenditure on infrastructure for revamping economic growth from crisis, followed by pandemic, is expected to boost the segment growth over coming years. For instance, as reported by Ministry of Finance, Indonesia invested USD 29.40 billion in infrastructure in 2023 compared to USD 24.04 billion in 2022, an increase of nearly 22%.

Regional Insights

Asia Pacific Steel Rebar Market is projected to witness significant growth during the forecast period, driven by increasing investments in various construction activities, particularly in China and India. For instance, Indian government in its Union Budget of 2025 announced measures for affordable housing. Under this, around 40,000 housing units to be completed in 2025-26 to help the families which have taken loans to buy houses.

China steel rebar market is expected to grow during the forecast period. Rising development of innovative infrastructure is boosting the growth of the construction industry in the country. As per China’s 14th Five-Year Action Plan, total investment in infrastructure from 2021 to 2025 is expected to reach USD 4.2 trillion. According to IMF, China has the potential to become the world’s largest economy by 2030, even with the current gradual slowdown in economic growth. This is expected to positively impact the demand for steel rebar in the country.

Steel rebar market in India is expected to witness growth. Rising construction of new buildings in India is likely to be a prominent driver for increased demand for steel rebar over the forecast period. The government of India changed its policies to allow 100% FDI for the development of infrastructure. It included urban infrastructure and development projects, such as residential or commercial premises, hotels, roads, resorts, educational institutions, hospitals, bridges, and recreational facilities.

North America Steel Rebar Market Trends

North America steel rebar market is anticipated to witness significant growth in steel rebar industry. The growth rate is expected to get influenced by increasing flow of funds toward various infrastructure projects from government of U.S., Mexico, and Canada. For instance, in March 2024 Mexican government announced USD 1.6 billion investment to modernize six major ports: Ensenada, Manzanillo, Lázaro Cárdenas, Acapulco, Veracruz, and Progreso. This initiative aims to enhance trade efficiency and support economic growth by upgrading critical maritime infrastructure.

The U.S. is one of major consumers of steel rebar and this trend is anticipated to prolong considering the rising spending on infrastructure rebuilding projects. Recently U.S. government passed Infrastructure Investment Jobs Act (IIJA) that focuses on boosting the economy and rebuilding public infrastructure by investing in various projects such as bridges, rails, roads, communication, and ports. Infrastructure revamping programs in U.S. are expected to drive steel rebar demand during the forecast period.

Europe Steel Rebar Market Trends

The Europe steel rebar industry has experienced steady growth, driven by ongoing infrastructure projects and a resilient construction sector. However, the industry faces challenges such as rising energy costs and the need for decarbonization. In March 2025, European Commission President Ursula von der Leyen convened a meeting with steel industry leaders to address these issues, particularly in light of impending U.S. tariffs on steel and aluminum imports. The EU is considering extending or tightening existing safeguard measures to protect its steel industry from potential market disruptions.

Germany steel rebar market is expected to grow steadily during the forecast period. Germany is the financial hub and a key growth engine of Europe. As per European Construction Industry Federation, construction investment observed decline of 3.0% in 2023 However, development in infrastructure projects on account of the government’s focus on the country’s economic recovery is expected to benefit rebar demand. Investments in civil and building engineering works in the private and public sectors are projected to remain another key contributor to the growth of the market.

Central & South America Steel Rebar Market Trends

The steel rebar industry in Central and South America is undergoing significant developments, with countries like Bolivia taking strides toward self-sufficiency in steel production. In February 2025, Bolivia inaugurated the Mutun steel plant, a $546-million project funded primarily by the Export-Import Bank of China. Operated initially by Sinosteel Engineering and Technology, the plant is expected to produce 200,000 metric tons of steel annually, covering half of Bolivia's domestic steel demand. This initiative marks a pivotal step in Bolivia's industrialization efforts, reducing reliance on steel imports from neighboring countries.

Brazil steel rebar market is projected to grow over the forecast period. As per the IMF, the real GDP of Brazil is forecast to grow at a rate of 3.6% in 2025. The rising demand for steel rebar in the country can be attributed to the flourishing energy generation industry and the surging investments by automobile manufacturers in Brazil. For instance, in August 2023, the government of Brazil announced its plans to invest USD 200 billion in infrastructure, energy, and transportation projects over the next four years as a part of an initiative to enhance economic growth and employment opportunities in the country.

Key Steel Rebar Company Insights

Some of the key players operating in the market include ArcelorMittal, Nippon Steel Corporation, Baowu Group, and Tata Steel.

-

ArcelorMittal is result of a merger between Mittal Steel Company N.V. and Arcelor in 2007. It is an integrated steel and mining company headquartered in Luxembourg. The company produces a broad range of high-quality finished and semi-finished steel products, including sheet and plate, and long products, including bars, rods, and structural shapes.

-

Nucor is a steel producer and recycling company. The company’s business segments include steel mills, raw materials and steel products. Steel mills segment includes bar mills, sheet mills, structural mills, plate mills, and tubular products. Steel products segment includes reinforcing products, steel mesh, gratings & fasteners, open-web steel joists, joist girders & steel decks, metal buildings & components, and cold finished bar products.

Key Steel Rebar Companies:

The following are the leading companies in the steel rebar market. These companies collectively hold the largest market share and dictate industry trends.

- ArcelorMittal

- NIPPON STEEL CORPORATION

- NLMK

- Nucor

- Tata Steel

- JSW

- POSCO HOLDINGS INC.

- Jiangsu Shagang Group

- SAIL

- Steel Dynamics, Inc.

Recent Developments

-

In November 2023, Nippon Steel announced its plans to acquire stakes in iron ore and coking coal. This is to ensure the uninterrupted supply of raw materials such as iron ore and coking coal and prevent the losses from price fluctuations. Through this move, the company plans to acquire 20% stake in Teck Resources for coal unit.

-

In August 2023, JSW Steel announced that it is likely to increase the capacity of long steel products owing to growing demand for infrastructure. Currently, the company has 28% overall capacity engaged in long steel and it aims to increase this capacity 35% over the next few years.

Steel Rebar Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 246.12 billion

Revenue forecast in 2030

USD 325.32 billion

Growth rate

CAGR of 5.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Mexico; Canada; Germany; France; Italy; Russia; China; Japan; India; Indonesia; Brazil; Saudi Arabia; UAE

Key companies profiled

ArcelorMittal; NIPPON STEEL CORPORATION; NLMK; Nucor; Tata Steel; JSW; POSCO HOLDINGS INC.; Jiangsu Shagang Group; SAIL and Steel Dynamics, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Steel Rebar Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global steel rebar market report based on application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Construction

-

Infrastructure

-

Industrial

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Russia

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global steel rebar market size was estimated at USD 243.46 billion in 2024 and is expected to reach USD 246.12 million in 2025.

b. The global steel rebar market is expected to grow at a compound annual growth rate of 5.7% from 2025 to 2030 to reach USD 325.32 billion by 2030.

b. Based on the application, construction accounted for the largest revenue share of more than 56.0% in 2024 of the overall market. The rising flow of funds towards non-residential & residential construction in various economies worldwide is anticipated to augment the segment growth over the forecast period.

b. Some of the key vendors of the global steel rebar market are ArcelorMittal, Nucor, JSW, NLMK, NIPPON STEEL CORPORATION, Tata Steel, and POSCO, among others.

b. Increasing construction spending in emerging economies and government funding for infrastructure development are the key driving factors of the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.