- Home

- »

- Advanced Interior Materials

- »

-

Steel Pipes & Tubes Market Size And Share Report, 2030GVR Report cover

![Steel Pipes & Tubes Market Size, Share & Trends Report]()

Steel Pipes & Tubes Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Seamless, ERW, SAW), By Application (Oil & Gas, Power Plant), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-640-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Steel Pipes & Tubes Market Summary

The global steel pipes & tubes market size was estimated at USD 133.20 billion in 2023 and is projected to reach USD 71.47 billion by 2030, growing at a CAGR of 6.1% from 2024 to 2030. The rising construction of new petrochemical plants worldwide is expected to boost consumption of steel pipes & tubes across the forecast period.

Key Market Trends & Insights

- Asia-Pacific dominated the global steel pipes & tubes market with the largest revenue share of 60% in 2023.

- By technology, the seamless segment led the market, holding the largest revenue share in 2023.

- By application, the oil & gas segment led the market, holding the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 36.30 Billion

- 2030 Projected Market Size: USD 71.47 Billion

- CAGR (2024-2030): 10.22%

- Asia-Pacific: Largest market in 2023

Product is consumed in piping systems, pressure tubes, and heat exchangers in the chemicals & petrochemicals industry. Thus, increasing investment in the construction of petrochemical plants is expected to benefit market growth. For instance, in December 2022, Essar Group announced its plan to invest ~USD 4,905.4 million for a petrochemical complex in Odisha, India. This oil-to-petrochemical complex is anticipated to have an annual production capacity of 7.5 million tons.

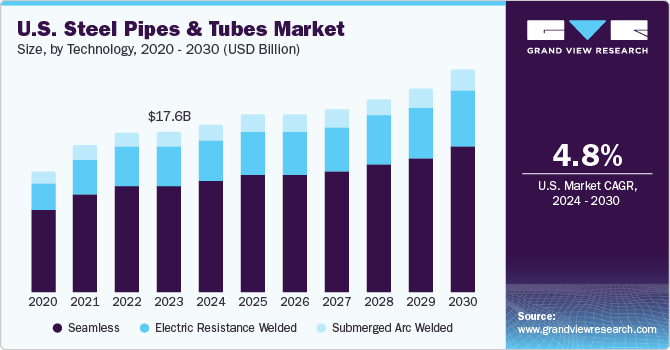

The U.S. oil & gas industry is among the primary end-users of steel pipes & tubes that are used in upstream, midstream, as well as downstream processing of crude oil. The market is anticipated to grow at a steady rate over the forecast period owing to developments in the U.S. oil & gas industry. In December 2023, crude oil production in the U.S. reached a record of 13.21 million barrels per day.

As of June 2023, when Russia and OPEC+ countries have announced production cuts, the U.S. crude oil production is anticipated to rise to 12.61 million barrels per day in 2023. One of the major oil producers in U.S., Exxon Mobil, announced its aim to double its production from U.S. shale holdings over five years with the help of advanced technologies.

Similarly, in June 2022, Chevron Corporation announced to ramp up its production in onshore Permian basin from 700k to 1 million barrels per day by 2025. As of March 2023, despite labor shortages, the company is on track for this expansion. Also, global crude oil proved reserves increased by 1.3% on a y-o-y basis (as of December 2022), reaching 1,757 billion barrels. Thus, increasing investment in oil production is likely to augment need for pipes & tubes for transportation and other operational purposes over the coming years.

Market Concentration & Characteristics

The global market is fragmented in nature, with presence of various key players such as ArcelorMittal, Nippon Steel Corporation, and ThyssenKrupp AG, as well as a few medium and small regional players operating in different parts of the world. Companies are also focused on collaborations, mergers & acquisitions, and joint ventures to broaden their product portfolio and regional presence.

The ongoing crisis in Red Sea shipping routes is expected to harm developing nations. This crisis is expected to lead to longer cargo travel distances and higher freight rates, potentially leading to higher costs. For instance, attacks on cargo ships bound for Suez Canal by the Houthi rebels have reduced the impact of fresh Asian steel import proposals due to changes in shipping routes that have led to increased expenses and longer delivery timelines.

Several Asian producers, such as Jindal Stainless Ltd, have reduced their exports to European market due to a USD 75 per ton increase in shipping expenses and a three-week shipping route around South Africa's Cape of Good Hope. Prominent shipping firms, such as Denmark's Maersk, rerouted their vessels away from Suez Canal, where, under normal circumstances, 15% of the world's shipping traffic flows.

Technology Insights

Seamless held a revenue share of over 67.0% in 2023 of the global market. Billets are heated after being perforated to form the tubular section, which is used to produce seamless. Seamless is used in a variety of sectors, including power generation, oil & gas, and chemicals & petrochemicals.

Electric resistance welded (ERW) section is gaining prominence in the market due to its modest performance and low price. This segment is anticipated to be driven by plans for fertilizer, oil & gas, and power companies to construct transportation pipelines. For instance, in December 2023, Energean partnered with Chariot to develop a large natural gas project offshore Morocco. The project includes the Anchois natural gas development, which has a capacity of 18 billion cubic meters (gross), and also has significant exploration potential.

Submerged arc welded (SAW) is another crucial segment of the market. SAW primarily competes with ERW and seamless, mainly in the product range of 16 inches to 24 inches. However, SAW is the best pick for pipelines that are above 24 inches. Different types of SAW include longitudinal type (LSAW) and spiral type (SSAW).

Application Insights

Oil & gas segment held the largest market share in 2023 and accounted for over 55.0% of global revenue in 2023. The product is largely consumed in oil country tubular goods (OCTG),distribution, process piping, and other applications in the oil & gas sector. Increasing investment in the cross-country oil and gas transportation pipeline network is expected to propel the demand for products across the forecast period.

For instance, in December 2023, an agreement worth USD 3.5 billion was signed between the U.S. company Apache and the Egyptian government. The agreement allows Apache to explore, develop, and produce crude oil and natural gas in concession areas located in Egypt's Western Desert. The main objective of this agreement is to expand the production rates of crude oil and natural gas beyond the current level of 575,000 barrels per day while overcoming the natural depletion of wells.

In terms of revenue, chemicals & petrochemicals segment is anticipated to grow at a CAGR of 6.1% from 2024 to 2030.Pipes & tubes are increasingly being used in petrochemical plants for process refining on account of their characteristics, such as strong corrosion and oxidation resistance.

The construction industry is another vital end-use for the market where pipes & tubes are used for building structures, foundations, balconies, railings, and many more. Rapid urbanization and industrialization, especially in developing economies, are anticipated to augment segment growth over the forecast period.

Regional Insights

Asia-Pacific dominated the market and accounted for over 60.0% share of global revenue in 2023. The large share is attributed to countries like China, South Korea, India, and Japan, which are the major consumers of products due to the presence of huge manufacturing and petrochemical sectors.

China Steel Pipes & Tubes Market

China is the fastest-growing market in the Asia Pacific. The increasing investment in oil & gas, petrochemicals, and water treatment industry is propelling the market growth. For instance, in January 2024, SABIC announced its final investment decision on a joint venture of USD 6.40 billion manufacturing complex in Fujian, southern China. The construction of the refinery is expected to be completed by 2026.

The complex will comprise a mixed-feed steam cracker that can produce up to 1.8 million tons of ethylene per year and a range of downstream units that will manufacture various products such as ethylene glycols (EG), polyethylene (PE), polypropylene (PP), polycarbonate (PC), and more. Construction is set to commence during the first half of 2024 and is anticipated to be constructed by the second half of 2026.

India Steel Pipes & Tubes Market

The country aims to boost domestic oil and gas production while reducing exports, which is expected to drive up demand in the forecast period.For instance, in December 2023, Oil India and ONGC started negotiations with Bahrain Petroleum Company (Bapco), Japan Petroleum Exploration (Japex), and Mitsui to collaborate on improving domestic exploration and production (E&P) activities. This collaboration aims to double the geographical area under exploration and actively participate in multiple production-sharing contracts.

Suadi Arabia Steel Pipes & Tubes Market

Rising investment in the oil & gas and water treatment industry is propelling demand for the product in Saudi Arabia. For instance, in January 2024, Saudi Aramco awarded contracts worth over USD 3.3 billion to two companies, China's Sinopec and Spain's Tecnicas Reunidas, to construct a gas facility in Saudi Arabia. This new facility will fractionate 510,000 barrels per day (MBD) of natural gas. The project is expected to take about 46 months for Package 1 and about 41 months for Package 2.

Brazil Steel Pipes & Tubes Market

Brazil is the largest consumer of pipes & tubes in Central & South America. Rising investment in petrochemical, oil and gas, and construction industry is propelling demand for product in the country. For instance, Brazil achieved record oil and gas production in September 2023, reaching a daily extraction of 4.666 million barrels of oil equivalent. In the same period, natural gas production reached 157.99 million cubic meters per day, reflecting a 6.9 percent month-on-month increase and a substantial 10.4 percent rise compared to September 2022, according to EBC in November 2023.

Turkey Steel Pipes & Tubes Market

Increasing utilization of diverse pipes & tubes in offshore wind farm projects in Turkey is a key driver behind the market’s growth. These components play a crucial role in the construction and infrastructure of offshore wind turbines, ensuring structural integrity and reliability in challenging marine environments.

Key Steel Pipes & Tubes Company Insights

Some of the key players operating in the market include ArcelorMittal, and Nippon Steel Corporation.

-

ArcelorMittal is a steel manufacturing and mining company. The company's portfolio includes flat steel, long steel, mining products, and pipes and tubes for various applications. ArcelorMittal operates in various regions, including the Americas, Europe, Asia, and Africa. It markets its products locally and through a centralized marketing organization to appliance, engineering, construction, and machinery sectors.

-

Nippon Steel Corporation is a Japanese steel producer with manufacturing bases in Japan and over 15 countries. The company operates in four business segments: steelmaking and fabrication, engineering, chemicals and materials, and system solutions. The company delivers high-quality steel products to various industries, including automotive, construction, and industrial machinery.

Suraj Limited., and Nova Steel Corporation are some of the emerging market participants.

-

Nova Steel Corporation specializes in manufacturing various types of pipes & tubes. The product of the company caters to the demands of various industries such as chemical, oil & gas, petrochemical, paper & pulp, power plant, environmental & water projects, and engineering projects.

-

Qingdao Wuxiao Group Co., Ltd. was founded in 1993 and has since then expanded to cover an area of over 600,000 square meters. The company owns total assets of CNY 1.38 billion (USD 0.19 million) and employs more than 2,000 staff with an annual production capacity of 300,000 tons. The company offers a wide range of products, including steel structures, pipes & tubes, flanges, wind turbine towers, towers, and high-quality transmission towers.

Key Steel Pipes & Tubes Companies:

The following are the leading companies in the steel pipes & tubes market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these steel pipes & tubes companies are analyzed to map the supply network.

- ArcelorMittal

- Hyundai Steel

- Jindal Steel & Power Ltd.

- Nippon Steel Corporation

- Rama Steel Tubes Limited

- Steel Authority of India Limited

- Tata Steel

- ThyssenKrupp AG

- United Steel Corporation

Recent Developments

-

In December 2023, Jindal Stainless Limited acquired Rabirun Vinimay Private Limited (RVPL), which manufactures stainless steel cold sheets with rolled coils and profiles. The company is expected to spend USD 11.50 million to acquire RVPL. RVPL has a cold rolling manufacturing unit in West Bengal, India, which produces steel pipes & tubes with a capacity of 50,000 mt per year

-

In August 2023, NST Mechanical Tubular Products Sales Co., Ltd., a subsidiary of Nippon Steel Trading Corporation, acquired the business and a part of its assets from SAKAISHIN, Ltd. The company markets semi-furnished metal products such as pipes and tubes. The acquisition aims to improve the efficiency of distribution processing centers and sales bases, thus strengthening its sales platform to enhance customer satisfaction.

-

In July 2023, Rama Steel Tubes Limited, signed a MOU with JSW Steel Group to procure hot-rolled coils and manufacture pipes & tubes. The partnership aims to procure 100,000 tons of Hot Rolled Coils (HRC) from JSW Steel to support the manufacturing of various pipes & tubes.

Steel Pipes & Tubes Report Scope

Report Attribute

Details

Market size value in 2024

USD 134.96 billion

Revenue forecast in 2030

USD 192.60 billion

Growth rate

CAGR of 6.1% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Russia; France; Italy; China; India; Japan; Indonesia; Philippines; Brazil; Saudi Arabia

Key companies profiled

ArcelorMittal; United States Steel; Nippon Steel Corporation; Tata Steel; Jindal Steel & Power Ltd.; Rama Steel Tubes Limited; Steel Authority of India Limited (SAIL); Hyundai Steel; AM/NS INDIA; ThyssenKrupp AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Steel Pipes & Tubes Market Report Segmentation

This report forecasts revenue and volume growth at country & regional levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global steel pipes & tubes market report based on technology, application, and region:

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Seamless

-

Electric Resistance Welded

-

Submerged Arc Welded

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Chemicals & Petrochemicals

-

Automotive & Transportation

-

Mechanical Engineering

-

Power Plant

-

Construction

-

Others

-

-

Regional Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Philippines

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global steel pipes & tubes market size was estimated at USD 133.20 billion in 2023 and is expected to drop down to USD 134.96 billion in 2024.

b. The global steel pipes & tubes market is expected to grow at a compound annual growth rate of 6.1% from 2024 to 2030 to reach USD 192.60 billion by 2030.

b. Oil & gas dominated the steel pipes & tubes market with a revenue share of over 57.0% in 2023, owing to incessant oil & gas production and rising drilling activities in various countries.

b. Some of the key players operating in the steel pipes & tubes market include ArcelorMittal, United States Steel, Nippon Steel Corporation, Tata Steel, JSW, and Steel Authority of India Limited (SAIL).

b. The key factors that are driving the steel pipes & tubes market include an increase in petroleum E&P activities in the U.S., Indonesia, Venezuela, China, Nigeria, and Canada and rising installation capacities of powerplants in various countries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.