Steel Market Size, Share & Trends Analysis Report By Product (Flat Steel, Long Steel), By Application (Building & Construction, Automotive & Transportation, Heavy Industries), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-863-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Steel Market Size & Trends

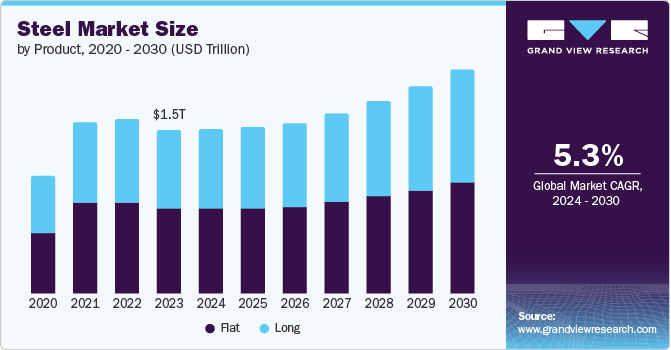

The global steel market size was estimated at USD 1.47 trillion in 2024 and is projected to grow at a CAGR of 4.6% from 2025 to 2030. This growth is attributed to the rising investments in infrastructure and construction as they require substantial amounts of steel for projects. In addition, urbanization and population growth are increasing the demand for housing and commercial buildings, further boosting steel consumption. Furthermore, the automotive and renewable energy sectors are also significant contributors, with a growing need for high-quality steel products.

The global steel market is witnessing transformative trends and drivers that significantly shape its future. A major trend is the focus on sustainability, as steel manufacturers increasingly invest in green technologies to minimize carbon emissions. This includes adopting electric arc furnaces and developing low-carbon steel production methods to align with environmental standards and consumer preferences for eco-friendly products. Digital transformation is also becoming prevalent, with the industry leveraging IoT, AI, and data analytics to enhance operational efficiency and streamline manufacturing processes.

In addition, the shift towards electric vehicles and the need for durable, energy-efficient building materials are driving this demand. The steel industry is experiencing consolidation and strategic partnerships, as companies merge or join forces with tech firms to boost competitiveness and innovate production processes.

Furthermore, infrastructure development is crucial as global investments in infrastructure are projected to grow notably with steel being a key material in these projects. The automobile industry's growth, especially with the rise of electric vehicles, is also a significant factor, as evidenced by the International Energy Agency’s forecast of over 10 million electric car sales in 2022. Moreover, urbanization trends are increasing demand for residential and commercial buildings; the UN estimates that by 2050, 68% of the global population will reside in urban areas, necessitating substantial steel use in construction.

Product Insights

The long steel segment dominated the global steel industry and accounted for the largest revenue share of 54.1% in 2024, primarily driven by increasing construction and infrastructure activities worldwide. As urbanization accelerates and population levels rise, demand for long steel products, such as rebar and structural sections, continues to expand. In addition, major investments in infrastructure projects, including roads, bridges, and utilities, further contribute to this growth. Furthermore, industrialization in emerging economies plays a significant role in boosting the consumption of long steel products across various sectors.

The flat steel is expected to grow at a CAGR of 4.6% over the forecast period, owing to the rising demand from diverse industries, particularly automotive and construction. The shift towards electric vehicles necessitates high-strength flat steel for lightweight and energy-efficient designs. In addition, the construction sector's focus on sustainable building materials drives the need for flat steel products. Furthermore, technological advancements in manufacturing processes also enhance product quality and efficiency, making flat steel more appealing. Moreover, strategic partnerships among steel manufacturers and technology firms are fostering innovation and expanding market reach within this segment.

Application Insights

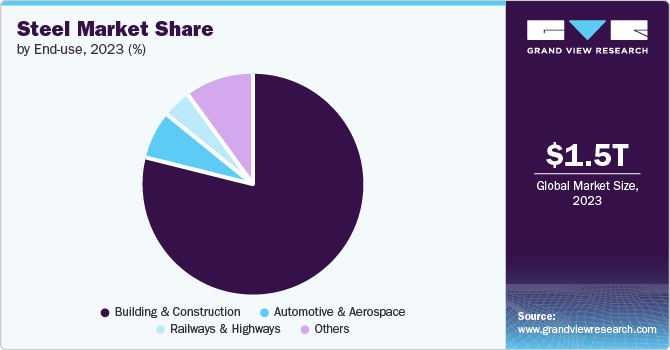

The building & construction applications led the market and held the largest revenue share of 45.5% in 2024. This growth is attributed to increasing urbanization and infrastructure development. In addition, as populations rise, the demand for residential and commercial buildings intensifies, necessitating substantial steel use for structural integrity. Furthermore, the emphasis on sustainable construction practices encourages the use of steel due to its durability and recyclability, enhancing its market appeal.

The consumer goods segment is expected to grow at a CAGR of 5.7% from 2025 to 2030, driven by the rising demand for durable and high-quality products. Steel's strength and versatility make it a preferred material for various consumer goods, including appliances and electronics. Furthermore, the shift towards energy-efficient and eco-friendly products also propels steel consumption, as manufacturers seek sustainable materials that can be recycled. Moreover, increasing disposable incomes and changing consumer preferences drive demand for innovative steel-based products, further supporting the expansion of this segment in the global steel market.

Regional Insights

The Asia Pacific steel market dominated the global market and accounted for the largest revenue share of 54.8% in 2024. This growth is attributed to the extensive infrastructure development and urbanization. Countries such as China and India are investing heavily in construction projects, including highways, bridges, and commercial buildings, which significantly increases steel demand. In addition, the booming automotive industry requires substantial steel for vehicle production. Moreover, the region's diverse manufacturing sector, coupled with a growing emphasis on renewable energy projects, further propels the demand for steel, solidifying Asia Pacific's position as a global leader in steel consumption.

The steel market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, driven by is experiencing significant growth due to the government's focus on infrastructure expansion and modernization. Furthermore, China's commitment to reducing carbon emissions is leading to advancements in low-carbon steel production technologies. Moreover, the automotive sector's rapid development, particularly in electric vehicles, also contributes to improved demand for high-quality steel products, strengthening China's dominance in the global steel market.

Europe Steel Market Trends

Europe steel market is expected to grow at a CAGR of 5.2% over the forecast period, owing to a strong emphasis on innovation and sustainability. European countries are investing in modernizing their steel production processes to enhance energy efficiency and reduce carbon footprints. In addition, the automotive industry remains a significant consumer of steel products, particularly high-strength materials needed for lightweight vehicles. Furthermore, ongoing research and development initiatives within the region foster continuous improvement in production procedures and product quality, ensuring Europe's competitiveness in the global steel market.

North America Steel Market Trends

The steel market in the North America is expected to grow significantly over the forecast period, driven by substantial investments in infrastructure and construction projects. The U.S. government has implemented initiatives aimed at revitalizing aging infrastructure, which significantly boosts steel demand across various sectors. Furthermore, the resurgence of manufacturing activities and reshoring efforts contribute to increased consumption of domestic steel products. Moreover, as industries prioritize sustainability, there is a growing trend towards using recycled steel materials, further enhancing the market's appeal within North America.

U.S. Steel Market Trends

The U.S. steel market led the North American market and accounted for the largest revenue share in 2024, due to robust construction activities and federal investments aimed at infrastructure improvement. In addition, the ongoing expansion of manufacturing sectors such as automotive and aerospace also fuels demand for high-quality steel products. Furthermore, initiatives promoting green building practices are increasing interest in sustainable steel solutions that meet environmental standards while supporting economic growth.

Key Steel Company Insights

Key players in the global steel industry include JFE Steel Corporation, Nippon Steel Corporation, and others. These companies are implementing several strategies to boost their brand presence and gain competitive edge. These include investing in advanced technologies to improve production efficiency and product quality. In addition, companies are also focusing on sustainability initiatives, such as developing low-carbon steel production methods. Furthermore, strategic mergers and acquisitions are being pursued to expand market presence and capacity.

-

Baosteel Group manufactures various types of steel, including carbon steel, stainless steel, and special steel products, catering to sectors such as automotive, construction, and energy. Operating across multiple segments, the company focuses on high-quality steel production and advanced manufacturing techniques, positioning itself as a key supplier in both domestic and international markets while also emphasizing sustainability and innovation in its operations.

-

Emirates Steel produces long products such as rebar and wire rod, as well as flat products including hot-rolled and cold-rolled sheets. The company steel operates primarily in the construction and infrastructure segments, serving various industries that require durable and high-strength materials. By leveraging advanced technologies and sustainable practices, Emirates Steel meets the growing demand for quality steel products within the region and beyond.

Key Steel Companies:

The following are the leading companies in the steel market. These companies collectively hold the largest market share and dictate industry trends.

- ArcelorMittal

- Baosteel Group

- Emirates Steel

- JFE Steel Corporation

- Nippon Steel Corporation

- NUCOR

- Outokumpu

- POSCO

- Tata Steel

- Thyssenkrupp

Recent Developments

-

In January 2025, JFE Steel Corporation announced the sale of its JGreeX green steel to JFE Shoji Pipe & Fitting Corporation (JKK). This marks a significant milestone as it is the first instance of a Japanese steel distributor offering JGreeX in the steel pipe sector. The collaboration with JKK will facilitate a sales system designed for small-lot shipments and rapid deliveries, allowing JFE Steel to effectively market and supply its green steel to a diverse customer base.

-

In October 2024, JSW Group has signed a MoU with POSCO Group of Korea to develop an integrated steel plant in India, aiming an capacity of 5 million tonnes/annum initially. This partnership aims to improve India's steel production capabilities while also exploring opportunities in battery materials and renewable energy sectors, particularly for electric vehicles. The partnership is expected to bolster economic ties and promote sustainable practices in the steel industry, marking a pivotal step in India's industrial growth.

-

In October 2024, JFE Steel Corporation, in collaboration with JSW Steel Limited, announced the acquisition of thyssenkrupp Electrical Steel India Private Limited, a key manufacturer of electrical steel sheets located in Nashik, Maharashtra. This strategic move aims to enhance their production capabilities for grain-oriented electrical steel sheets (GOES) to meet the rising demand in India’s power generation sector.

Steel Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.53 trillion |

|

Revenue forecast in 2030 |

USD 1.92 trillion |

|

Growth Rate |

CAGR of 4.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

January 2025 |

|

Quantitative units |

Volume in Kilotons, Revenue in USD Million, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, and region |

|

Regional scope |

North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Spain, Italy, Russia, Turkey, China, India, Japan, South Korea, Brazil, Argentina, and Iran |

|

Key companies profiled |

ArcelorMittal, Baosteel Group, Emirates Steel, JFE Steel Corporation, Nippon Steel Corporation, NUCOR, Outokumpu, POSCO, Tata Steel, and Thyssenkrupp. |

|

Customization scope |

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Steel Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global steel market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Flat Steel

-

Long Steel

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Automotive & Transportation

-

Heavy Industry

-

Consumer Goods

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Russia

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Iran

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."