Standalone 5G Network Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Spectrum (Sub-6 GHz, mmWave), By Network (Public, Private), By Vertical (Manufacturing, Automotive ), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-130-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Standalone 5G Network Market Trends

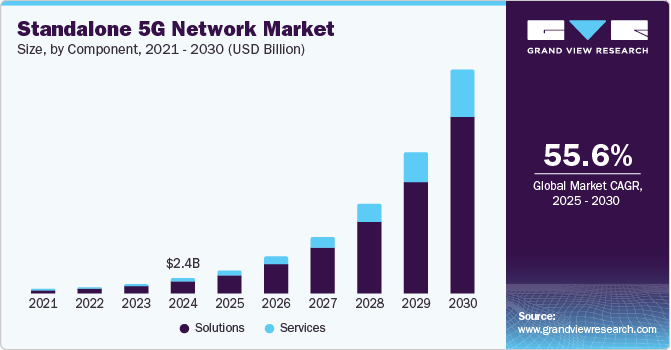

The global standalone 5G network market size was valued at USD 2.41 billion in 2024 and is projected to grow at a CAGR of 55.6% from 2025 to 2030. Standalone (SA) 5G network consists of a 5G core and a 5G radio access network (RAN), which manages the connections between a network and users. The number of 5G connections is increasing at a rapid pace. According to The Groupe Speciale Mobile Association (GSMA), the number of 5G consumer connections surpassed one billion in 2022 and is projected to increase to approximately 1.5 billion in 2023. Thus, the growth of the market is primarily driven by the increasing number of 5G connections across the globe.

Growing investments in 5G SA infrastructure by several network operators across the world are contributing to the growth of the standalone 5G network market. According to the Global Mobile Suppliers Association’s (GSA) 5G-Standalone July 2023 Summary report, 115 operators across 52 countries and territories around the globe have been investing in public 5G SA networks, either through trials, planned deployments, or active rollouts. In addition to the investment in public 5G SA, numerous organizations are piloting, testing, or deploying 5G SA technologies for private networks. Such investments and initiatives by global mobile network operators (MNOs) are expected to boost the market’s growth.

The SA 5G network provides numerous benefits, such as enhanced end-user experience, new business opportunities, network efficiency, ultra-low latency, high reliability, enhanced security, and less complexity, as compared to 5G NSA. The SA 5G technology enables instant user access to 5G, especially for wide 5G frequency bands, resulting in increased data throughput and reduced latency. Additionally, the SA 5G network operates on dedicated 5G spectrum bands, reducing interference and congestion, thereby enhancing reliability and minimizing the possibility of data outages. This increased reliability is important for critical applications, such as industrial automation and emergency services.

Thus, the increasing adoption of the SA 5G network in various applications owing to its benefits is fueling the market’s growth. The growing number of Internet of Things (IoT) devices and demand for high-speed connectivity is further boosting the market’s growth. The SA 5G networks offer significantly increased network capacity. It manages an extensive range of devices simultaneously connected to the network, ensuring effective data transfer and seamless communication, even in crowded venues and dense urban areas. Furthermore, the Massive Machine Type Communication (mMTC) feature of the SA 5G network enables efficient connectivity for various IoT devices, ranging from industrial equipment to small sensors.

Despite the myriad advantages and promising prospects associated with the SA 5G network, it has specific challenges and limitations that could hamper the growth of the market. The deployment of SA 5G infrastructure involves a higher level of investment in infrastructure, including the installation of new antennas and base stations. Building a widespread and robust 5G network includes overcoming logistical challenges, such as local regulations and site acquisition. In addition, implementing SA 5G technology includes high installation costs and a time-consuming process for network operators. However, growing investments in the SA 5G network from global mobile network operators are expected to diminish these growth constraints.

Component Insights

The solutions segment accounted for the largest share of 81.25% in 2024. The segment is further segmented into 5G radio access network (RAN), 5G core network, and others (backhaul and front haul, switches, routers). The robust deployment of a 5G RAN and 5G core with numerous microcell and small cell base stations worldwide is driving the growth of the segment. In addition, 5G core offers benefits, such as ultra-low latency, faster upload speeds, edge functions, and ultra-high reliability, which ultimately drive the demand for SA 5G network among organizations to improve their performance.

The services segment is anticipated to grow at a significant CAGR during the forecast period. The increasing need for SA 5G network-related services, such as consulting, implementation & integration, support & maintenance, and training & education, is propelling the segment’s growth. The increasing demand for expertise and support in deploying and managing SA 5G networks is further boosting the segment’s growth. Thus, increasing demand for dedicated services by customers to ensure seamless operation, high performance, and security is fueling the growth of the segment.

Spectrum Insights

The sub-6 GHz segment dominated the market in 2024. The sub-6 GHz frequency comprises a mid-band and a low band of spectrum ranges, primarily 6 GHz and below. Prominent communication service providers globally are actively investing in acquiring a low-band and a mid-band frequency spectrum to provide high-capacity services to consumers, enterprises, and various industries. This, in turn, is expected to improve the segment’s growth during the forecast period.

The mmWave segment is expected to grow at a significant CAGR over the forecast period. mmWave frequency bands comprise high-frequency spectrums that offer enhanced bandwidth capacity and exceptionally low latency. These bands are particularly beneficial in applications demanding ultra-reliable connectivity, notably in remote patient surgeries and Vehicle-to-Vehicle (V2V) connectivity. Therefore, the strong emphasis on the advancement of SA 5G networks using mmWave frequencies for mission-critical applications is expected to improve the segment’s growth over the forecast period.

Network Insights

The public segment dominated the market in 2024. The segment is expected to grow at the highest CAGR during the forecast period. Increasing investment and deployment of public SA 5G networks by MNOs across the globe is driving the segment’s growth. For instance, according to the Global Mobile Suppliers Association’s (GSA) 5G-Standalone July 2023 Summary report, 36 operators in 25 countries have deployed or launched public 5G SA networks. Such initiatives are expected to bode well for the segment’s growth during the forecast period. The private segment is expected to register a significant CAGR over the forecast period.

Private SA 5G offers benefits, such as enhanced connectivity, security and privacy, and increased reliability, which is contributing to the increasing demand for private SA 5G networks. Thus, the development of private networks is also expected to grow during the forecast period. For instance, in August 2023, Virgin Media O2 Business launched a commercial plug-and-play private 5G SA network, targeting businesses in both rural and urban areas. The network is easily deployable, allowing businesses to access the advantages provided by private networks without complex installation requirements. Such initiatives are expected to improve the segment’s growth.

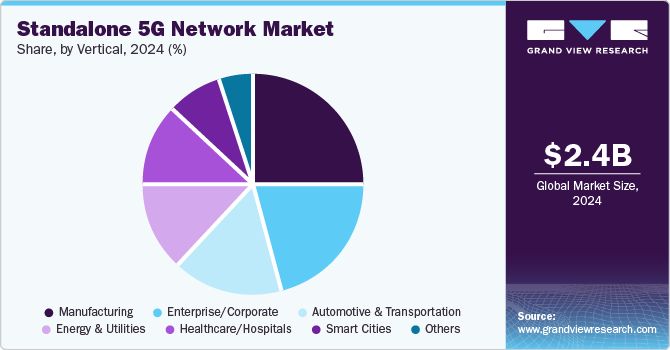

Vertical Insights

The manufacturing segment dominated the market in 2024. In the manufacturing industry, owing to its reduced latency and increased reliability, the SA 5G network enables the deployment of cutting-edge industrial automation systems. It also enables real-time remote monitoring, control, and synchronization of machinery and processes. This enhances efficiency, productivity, and flexibility across manufacturing and various industrial domains. Thus, owing to the abovementioned benefits of the SA 5G network, it is widely being adopted in the manufacturing industry. This, in turn, propels the segment’s growth.

The automotive and transportation segment is expected to grow at a significant CAGR over the forecast period. In the automotive sector, SA 5G networks play a significant role in enabling real-time communication among autonomous vehicles and with advanced infrastructure. Owing to its ultra-low latency, vehicles can make rapid decisions. This enables them to promptly respond to evolving road situations, improving road safety and paving the path for entirely autonomous transportation systems. Thus, the demand for the SA 5G network is growing in the automotive sector.

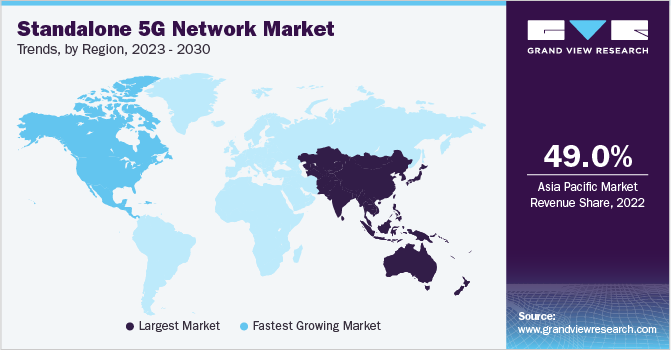

Regional Insights

North America standalone 5G network market is expected to grow at a significant CAGR during the forecast period. The strong presence of market players, such as T‑Mobile USA, Inc., Verizon Communications Inc., and AT&T, Inc., is attributed to the regional market growth. The rapid development of smart cities in the U.S. has led to a significant increase in the deployment of IoT devices across various applications, such as transportation, public safety, security, and energy management. Thus, there is an anticipated rise in demand for SA 5G networks in the U.S., driven by businesses extensively utilizing the IoT ecosystem.

U.S. Standalone 5G Network Market Trends

The standalone 5G network market in the U.S. held a dominant position in 2024. The U.S. standalone 5G network market is rapidly advancing, driven by the need for enhanced connectivity to support emerging technologies such as autonomous systems, industrial IoT, and smart cities. The growing investments made in 5G infrastructure/equipment manufacturing in the U.S. are expected to drive the market’s growth from 2024 to 2030.

Asia Pacific Standalone 5G Network Market Trends

The standalone 5G network market in Asia Pacific dominated the global market and accounted for the largest share of 51.0% in 2024. Increasing deployment and adoption of the SA 5G network in countries such as China, Japan, India, South Korea, Singapore, and Australia, is the major driving factor behind the market growth in the region. Governments across the Asia Pacific are promoting 5G SA expansion with spectrum allocation policies, infrastructure investments, and subsidies, especially in China, Japan, and South Korea. Emerging markets such as India, Indonesia, and Vietnam are also rolling out 5G plans to bridge connectivity gaps and accelerate economic growth through digital transformation.

Japan standalone 5G network market is expected to grow rapidly in the coming years. Leading Japanese telecom operators, including NTT Docomo are actively investing in the rollout of standalone 5G networks. In July 2024, NTT DOCOMO, INC. announced the upcoming commercial deployment of New Radio-Dual Connectivity (NR-DC) across three frequency bands: 3.7 GHz, 4.5 GHz, and 28 GHz. Starting August 1, 2024, this technology will enable Japan's fastest download speeds, reaching up to 6.6 Gbps, utilizing 5G Standalone architecture.

The standalone 5G network market in China is experiencing rapid growth, driven by the country's ambitious technological advancements and significant investments in telecommunications infrastructure. As one of the leading countries in 5G development, China is focusing on building a robust standalone network that operates independently of previous generations.

Europe Standalone 5G Network Market Trends

The standalone 5G network market in Europe was identified as a lucrative region in 2024. The Europe standalone 5G network market is witnessing steady growth as telecom operators across the region transition from non-standalone 5G to standalone (SA) 5G networks, which use a dedicated 5G core to unlock the full potential of the technology. Governments across Europe are investing in improving their networking infrastructure. Prominent telecom operators, including Deutsche Telekom AG, Vodafone Limited, Orange, and Telefónica, are leading the deployment of standalone 5G infrastructure across major European markets. These companies are investing heavily to expand their standalone 5G footprint, focusing on key industries that benefit from real-time, high-speed connectivity.

The U.K. standalone 5G network market is gaining momentum as the country prioritizes advanced digital infrastructure to enhance connectivity, drive innovation, and support the evolving needs of industries and consumers. Standalone 5G in the U.K. allows for a fully independent network architecture, delivering high-speed, low-latency connections essential for applications in smart manufacturing, healthcare, and autonomous vehicles.

The standalone 5G network market in Germany held a substantial market share in 2024 as the country pushes to lead in next-generation connectivity. Major telecom operators, including Deutsche Telekom AG, Vodafone Germany, and Telefónica, S.A., are making substantial investments in 5G SA infrastructure.

Key Standalone 5G Network Company Insights

Some of the key companies in the standalone 5G network market include Telefonaktiebolaget LM Ericsson, T‑Mobile USA, Inc., Nokia Corporation, and others. Telefonaktiebolaget LM Ericsson and Nokia, two European telecom giants, are prominent in regions such as Europe, North America, and parts of Asia, where they provide advanced standalone 5G solutions and benefit from government-backed support in 5G infrastructure development.

-

Telefonaktiebolaget LM Ericsson specializes in providing telecommunications equipment, software, and services to network operators and service providers worldwide. Ericsson’s standalone 5G solutions are designed to maximize the potential of 5G by enabling enhanced capabilities such as ultra-reliable low-latency communication, massive IoT support, and improved network efficiency.

-

Nokia offers a comprehensive portfolio that includes advanced radio access networks (RAN), core network solutions, and advanced software to facilitate seamless connectivity. The company’s SA 5G architecture is designed to maximize network efficiency, reduce latency, and enhance capacity, enabling operators to deliver a wide range of services, from enhanced mobile broadband to critical IoT applications.

Key Standalone 5G Network Companies:

The following are the leading companies in the standalone 5G network market. These companies collectively hold the largest market share and dictate industry trends.

- Telefonaktiebolaget LM Ericsson

- T‑Mobile USA, Inc.

- Nokia

- Vodafone Group Plc

- Huawei Technologies Co., Ltd.

- Verizon

- SAMSUNG

- AT&T

- Singtel

- Rogers Communications

Recent Developments

-

In August 2023, Telefonaktiebolaget LM Ericsson and TDC NET launched Denmark's first 5G Standalone (SA) network, marking a significant advancement in the country's telecommunications capabilities. This new network operates independently of previous generations, utilizing a dedicated 5G core that enhances performance through lower latency, better spectrum utilization, and increased reliability.

-

In June 2023, Vodafone launched 5G Ultra, the UK's first 5G Standalone (SA) mobile network designed for consumers, offering enhanced connectivity and performance. This new service represents a significant advancement from existing 5G networks, as it upgrades the radio access technology and the core network infrastructure for improved speed, coverage, and battery life for users.

-

In February 2023, Orange launched Spain's first commercial 5G Standalone (SA) network powered by Ericsson's cloud-native dual-mode 5G Core to deliver enhanced user experiences characterized by improved indoor coverage, low latency, and advanced security features. The deployment leverages Ericsson's technologies, enabling Orange to efficiently manage network resources through capabilities like network slicing, which allows for customized connectivity solutions tailored to various business needs.

Standalone 5G Network Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 3.67 billion |

|

Revenue forecast in 2030 |

USD 33.43 billion |

|

Growth Rate |

CAGR of 55.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, spectrum, network, vertical, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Germany, U.K., France, China, Japan, India, South Korea, Australia, Singapore, Brazil, KSA, UAE, and South Africa |

|

Key companies profiled |

Telefonaktiebolaget LM Ericsson; T‑Mobile USA, Inc.; Nokia; Vodafone Group Plc; Huawei Technologies Co., Ltd.; Verizon; SAMSUNG; AT&T; Singtel; Rogers Communications. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Standalone 5G Network Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2030. For this study, Grand View Research has segmented the global standalone 5G network market report based on component, spectrum, network, vertical, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2030)

-

Solutions

-

5G Radio Access Network (RAN)

-

5G Core Network

-

Others (Backhaul and Fronthaul, Switches, Routers)

-

-

Services

-

-

Spectrum Outlook (Revenue, USD Million, 2021 - 2030)

-

Sub-6 GHz

-

mmWave

-

-

Network Outlook (Revenue, USD Million, 2021 - 2030)

-

Public

-

Private

-

-

Vertical Outlook (Revenue, USD Million, 2021 - 2030)

-

Manufacturing

-

Automotive and Transportation

-

Enterprise/Corporate

-

Energy & Utilities

-

Healthcare/Hospitals

-

Smart Cities

-

Others (Agriculture, Smart Home, Public Safety & Defense)

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Singapore

-

-

Latin America

-

Brazil

-

-

MEA

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global standalone 5G network market size was estimated at USD 2.41 billion in 2024 and is expected to reach USD 3.67 billion in 2025.

b. The standalone 5G network market is expected to grow at a compound annual growth rate of 55.6% from 2025 to 2030 to reach USD 33.43 billion by 2030.

b. The Asia Pacific segment dominated the market in 2024. Increasing deployment and adoption of the SA 5G network in countries such as China, Japan, India, South Korea, Singapore, and Australia is the major driving factor behind the market growth in the region.

b. Some key players operating in the standalone 5G network market include Telefonaktiebolaget LM Ericsson; T‑Mobile USA, Inc.; Nokia; Vodafone Group Plc; Huawei Technologies Co., Ltd.; Verizon; SAMSUNG; AT&T; Singtel; Rogers Communications.

b. Increasing deployment of 5G network infrastructure for smart city applications, increasing 5G adoption across several end-use industries, and growing number of 5G adoption across the globe are driving the growth of the standalone 5G network market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."