Stainless Steel Forgings Market Size, Share & Trends Analysis Report By Application (Automotive, Aerospace & Defense, Industrial), By Process (Open Die, Close Die, Ring Rolled), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-197-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Stainless Steel Forgings Market Trends

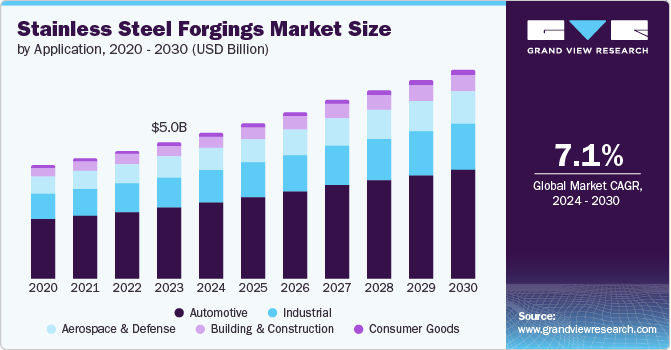

The global stainless steel forgings market size was valued at USD 5.01 billion in 2023 and is projected to grow at a CAGR of 7.1% from 2024 to 2030. Industries such as automotive, aerospace, construction, and energy heavily rely on stainless steel forgings due to their outstanding durability and ability to withstand harsh conditions. Increasing automobile production and building and construction sectors drive the market growth. The demand for lightweight forged products is rising, leading to an expansion in manufacturing activities worldwide. Factors such as higher flexibility, cryogenic toughness, lower maintenance, and heat resistance contribute to the increased demand for stainless steel.

There is an upswing in the construction industry from emerging economies owing to increased government expenditure on infrastructure, which is expected to increase the demand for these products. For instance, the Federal Ministry of Digital and Transport in the Germany has planned to spend around USD 293.8 billion by 2030 on its Federal Transport Infrastructure Plan (FTIP) 2030 plan. Such investments are likely to help in driving market growth over the forecast period.

The automotive industry is currently experiencing a significant increase in the need for lightweight components that offer improved wear and tear resistance. As a result, the utilization of stainless steel forgings has been on the rise to improve the quality of vehicles. For instance, in February 2024, Ramkrishna Forgings LTD. received an order worth USD 220 million in North America, which is expected to help in the supply of light vehicle segments across the North America region. Such development activities are expected to foster growth in the market.

As industrialization and infrastructure development projects advance globally, the demand for robust and dependable components in construction, energy, and machinery continues to grow. Innovations in forging technology have increased production efficiency and the ability to manufacture complex shapes precisely, further driving the adoption of stainless steel forgings in industrial settings. For instance, the ministry of Road Transport and highways, India (MoRTH) has targeted to construct of roads of 13814km in the year 2024.

Application Insights

The automotive segment dominated the market and accounted for a share of 52.9% in 2023. The significant growth of the market can be attributed to the widespread use of forged parts in automobiles, ranging from engine components and chassis structures to transmission parts. According to the information published by the ACEA in May 2023, about 85.4 million motor vehicles were produced in 2022 globally, which shows a rise of about 5.7% compared to the previous year. This development of the automotive sector worldwide is a major driver for segmental growth.

The aerospace & defense segment is expected to grow at the fastest CAGR over the forecast period due to the utilization of steel forging to fabricate essential, high-strength components necessary for aircraft and spacecraft. In addition, the market's investment and development activities are expected to foster segmental growth. For instance, in August 2023, Friza, a company operating in the forging and steel industry, announced an investment of USD 200 million to expand their plants. The investment is expected to help in increasing the capacity of the forging and aerospace plants.

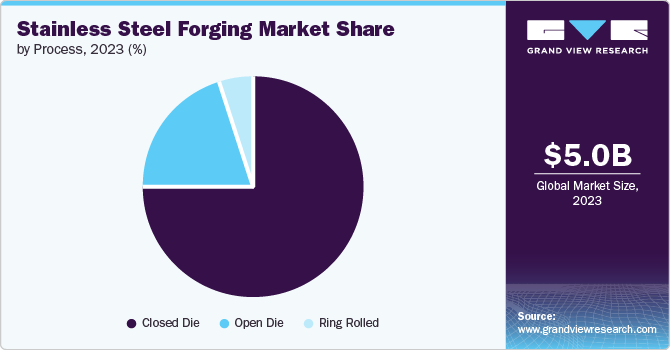

Process Insights

Closed die dominated the market and accounted for a revenue share of 74.9% in 2023. The process of closed die forging offers remarkable precision and dimensional accuracy, enabling manufacturers to craft difficult shapes with tight tolerances, making it an ideal choice for producing critical components. The development of industries such as automotive and aerospace are expected to drive demand for this segment.

The open die segment is expected to grow at the fastest CAGR over the forecast period due to its applications in construction, automotive, aerospace, and machinery manufacturing. The expansion activities in this sector are likely to foster segmental growth. For instance, in October 2023, Goodluck India Limited announced its expansion plans, which include carrying out the business of forging, treatment, machining, and coating of stainless steel and special steel using open forging and other methods.

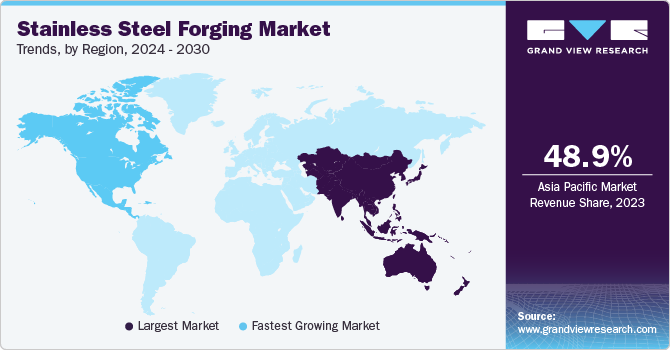

Regional Insights

North America stainless steel forgings market is expected to grow at the fastest CAGR over the forecast period. Investments in aerospace and defense, as well as the upgrading of infrastructure, are contributing to the growing demand for high-quality forged components. The automotive industry in North America is being propelled towards lightweight and high-strength materials due to their environmental implications. According to the information published by the Government of Canada, the five major players in the Canadian automotive market assemble over 1.4 million vehicles in the country annually, and the sector contributed approximately USD 12.5 billion to the country’s GDP in 2020.

U.S. Stainless Steel Forgings Market Trends

The stainless steel forgings market in the U.S. is expected to grow during the forecast period due to the presence of local and global players in the market and development initiatives. According to the Aerospace Industries Association, the industry sales revenue increased by 6.7%, reaching USD 952 billion in 2022. The growth of different industries in the country is expected to drive further market growth over the forecast period.

Europe Stainless Steel Forgings Market Trends

The stainless steel forgings market in Europe is expected to grow during the forecast period due to its strong automotive, industrial machinery, and aerospace sectors. The presence of key players in the market and development projects carried out in the various countries in sectors such as automotive, infrastructure development, and aerospace are expected to drive market growth in the region.

Germany stainless steel forgings market is expected to grow owing to the increasing investment in the infrastructural projects and industrial development. For instance, the country invested approximately USD 62 billion in the green infrastructure aiming to achieve greenhouse gas neutrality by 2045. This is expected to drive demand for sustainable products and foster innovation and further competition in the market.

Asia Pacific Stainless Steel Forgings Market Trends

Asia Pacific stainless steel forgings market dominated in 2023 with a revenue share of 48.9%. Asia Pacific demand is anticipated to be driven by the growth of manufacturing operations in emerging economies such as Japan, China, and India. The increasing foreign investments and the supportive government policies in these nations are driving the demand for these products.

The stainless steel forgings market in China is expected to grow significantly owing to the continuous expansion in its industrial and manufacturing sectors. For instance, in March 2023, Shandong Iraeta Heavy Industry Co. Ltd., based in east China, introduced the world's largest seamless ring forging piece. Such developments in the country are expected to boost market growth in the region.

India stainless steel forgings market is expected to grow rapidly in the coming years due to the presence of key players in the market and the development of various industries with applications in stainless steel forgings. For instance, according to the India Brief Equity Foundation, automobile production in the country in 2023 accounted for 25.9 million vehicles, which is expected to boost demand in the market.

Key Stainless Steel Forgings Company Insights

Some of the companies in the stainless steel forging market include American Axle & Manufacturing, Inc.; ATI; Bharat Forge; Bruck GmbH; Cornell Forge Co. Companies in the market are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Bharat Forge is an Indian forging company that produces power from renewable sources. The company manufactures products in sectors such as aerospace, automotive, railways, oil and gas, and defense. Its facilities have fully automated forging press lines that range from 1600T to 16000T.

-

American Axle & Manufacturing specializes in the design, engineering, and manufacturing of driveline and metal forming technologies. These solutions are specifically developed to cater to the needs of electric, hybrid, and internal combustion vehicles.

Key Stainless Steel Forgings Companies:

The following are the leading companies in the stainless steel forgings market. These companies collectively hold the largest market share and dictate industry trends.

- American Axle & Manufacturing, Inc.

- ATI

- Bharat Forge

- Bruck GmbH

- Cornell Forge Co.

- ELLWOOD Group Inc.

- LARSEN & TOUBRO LIMITED.

- Precision Castparts Corp.

- Scot Forge

- Trenton Forging

Recent Developments

-

In April 2024, Maiden Forgings, a company engaged in producing lines of stainless steel, carbon steels, and alloy steel, bought 4 acres of land for its consolidation and expansion plan, which is expected to help it in purchasing new machinery and enhancing capacity.

-

In June 2021, Bharat Forge acquired Sanghvi Forging and Engineering, which produces open and closed die forging products for various industries. The acquisition is likely to strengthen the company's market position.

Stainless Steel Forgings Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 5.37 billion |

|

Revenue forecast in 2030 |

USD 8.10 billion |

|

Growth Rate |

CAGR of 7.1% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, process, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; South Korea; Brazil; GCC; South Africa |

|

Key companies profiled |

American Axle & Manufacturing, Inc., ATI., Bharat Forge, Bruck GmbH, Cornell Forge Co., ELLWOOD Group Inc., LARSEN & TOUBRO LIMITED., Precision Castparts Corp., Scot Forge, Trenton Forging. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Stainless Steel Forgings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global stainless steel forgings market report based on application, process, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace & Defense

-

Building & Construction

-

Consumer Goods

-

Industrial

-

-

Process Outlook (Revenue, USD Million, 2018 - 2030)

-

Open Die

-

Closed Die

-

Ring Rolled

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

GCC

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."