- Home

- »

- IT Services & Applications

- »

-

Staffing Factoring Services Market Size & Share Report 2030GVR Report cover

![Staffing Factoring Services Market Size, Share & Trends Report]()

Staffing Factoring Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Category (Domestic and International), By Type (Recourse and Non-recourse), By Financial Institution, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-275-6

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Staffing Factoring Services Market Trends

The global staffing factoring services market size was estimated at USD 132.6 billion in 2023 and is projected to grow at a CAGR of 6.6% from 2024 to 2030. Economic factors, such as GDP growth, unemployment rates, and changing business sentiments, are playing a significant role in driving the demand for staffing factoring services. Businesses opt for temporary staffing during periods of economic growth to support growth initiatives, leading to higher demand for staffing factoring services.

Conversely, economic downturns may result in higher unemployment rates and reduced business activity, impacting the demand for temporary staffing and staffing factoring services. Advances in technology are enhancing the efficiency, transparency, and scalability of staffing factoring services. Online factoring platforms, digital payment solutions, and automated processes are further streamlining the factoring process, reducing administrative burdens and improving customer experiences.

FinTech companies and banks are aggressively adopting advanced technologies to offer innovative factoring services and remain competitive in the global market. Several emerging companies in the banking industry have also started offering non-recourse factoring services, thus increasing the demand for these services. The market is expected to witness considerable growth over the forecast period owing to the above-mentioned factors.

The preference for temporary staffing is growing among businesses, as they strive for agility and cost-efficiency while adapting quickly to fluctuating market conditions, seasonal demands, and project-based work. While permanent hires are typically bound by long-term commitments, temporary staffing offers companies the flexibility to scale their workforce up or down in response to their changing needs. Incumbents of niche industries typically rely on temporary workers to fill short-term skill gaps or address specific project requirements that require specialized skills and knowledge. Factoring services provide a solution by allowing staffing agencies to convert their accounts receivable into immediate cash, thereby facilitating the timely payment of temporary workers.

Factoring services provide a reliable mechanism for risk mitigation in the staffing industry. By converting accounts receivable into immediate cash, staffing agencies can reduce their exposure to credit risk and insulate themselves from the financial impact stemming from client payment delays or defaults. This risk mitigation aspect is particularly crucial in industries characterized by high client turnover rates or unpredictable payment cycles, enhancing the attractiveness of factoring services.

Market Concentration & Characteristics

The increasing adoption of blockchain technology among banks and Non-Banking Financial Companies (NBFCs) is opening new opportunities for the market growth. Advances in Distributed Ledger Technology (DLT) are allowing market players to utilize the technology, improve their services, and gain a competitive edge. DLT provides several benefits, such as sending and receiving product information transparently and storing customers’ information securely.

Key players in the market are aggressively obtaining new contracts to retain and increase their market share. For instance, in March 2024, REV Capital’s New York office secured a factoring contract worth USD 3 million for a new staffing client. The staffing client faced significant challenges in terms of last-minute bank deal breaks and upcoming payroll cycles. Thus, by accessing the exact requirements of the staffing firm, REV Capital’s team of experts offered fast and hassle-free factoring services within three full days prior to the requested deadline by the client.

In April 2022, FCI launched Edifactoring 2.0 platform, an online platform to support the two-factor business model for members of FCI through a set of Electronic Document Interchange (EDI) messages. The platform runs on FCI’s legal structure and helps to overcome the challenges in cross-bordering factoring. It will help local factors to communicate with each other in a safe and transparent place.

While there are alternative financing options available to staffing agencies, such as bank loans or lines of credit, factoring services offer unique benefits, including immediate cash flow, risk mitigation, and flexibility. However, the availability of alternative financing options does pose a moderate threat, especially as technology advances and new financial products emerge.

Buyers are increasingly focused on risk mitigation and credit protection when selecting factoring partners. They seek factoring companies that conduct thorough credit checks on their clients and debtors, assess credit risk profiles, and implement robust risk management practices.

Category Insights

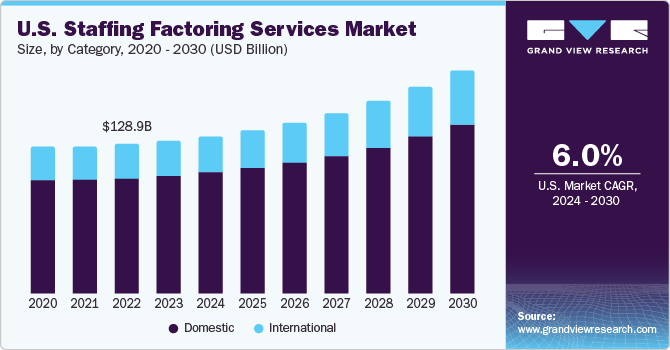

Based on category, the domestic segment led the market with the revenue market share of 73.8% in 2023. The growth of the segment can be attributed to the effective, rapid adoption of the factoring receivable methods across major industries. Furthermore, the increasing significance of electronic invoices has contributed to the consolidation of the domestic factoring market. Domestic factoring provides weekly or monthly analysis of sales and payable invoices for staffing agencies. Moreover, the high staffing demand in countries such as the U.S. and Canada is a key driving factor for the market growth.

The international segment is expected to register at the fastest CAGR of around 7.2% from 2024 to 2030. The prevalence of remote work and the availability of global talent pools have revolutionized the way companies scout talent, allowing them to hire workers from various countries for temporary assignments or project-based work. However, managing the payment and financing aspects of cross-border workforce placements can be challenging for international staffing agencies. International staffing factoring services play a crucial role in facilitating the efficient management of cross-border workforce placements.

Type Insights

Based on type, the recourse segment led the market with the largest revenue share of over 54% in 2023. Recourse factoring comes with common offerings except for debt protection. It is the most customary factoring service, where a company buys back invoices that a factoring company failed to collect. Several organizations widely use this factoring to sell invoices at the lowest discounts. Furthermore, it offers several benefits, such as lower fees, flexibility on advanced rates, and flexibility in credit requirements. Recourse factoring providers offer customized financing solutions tailored to the specific needs of staffing agencies.

The non-recourse segment is expected to register at the fastest CAGR of around 7.0% from 2024 to 2030. In non-recourse factoring services, the financing company is responsible for the risks of unpaid invoices, which offers protection against debts. The growth of the segment can be attributed to the widespread adoption of non-recourse factoring in both developed and developing countries. Non-recourse factoring is an ideal option for businesses with a large customer base, as they may want to clean up their balance sheet by offloading their accounts receivable. Non-recourse factoring provides staffing agencies with immediate access to working capital by advancing funds against their accounts receivable.

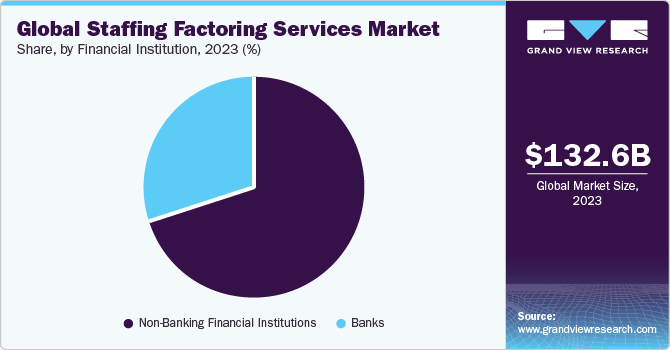

Financial Institution Insights

Based on financial institution, the non-banking financial institution segment led the market with the largest revenue share of 70% in 2023. The non-banking financial institution segment held the largest market share in 2023. Non-Banking Financial Institutions are entities that provide financial services but do not hold a full banking license. Non-Banking Financial Institutions offer flexibility and customization in factoring arrangements; unlike traditional banking systems, NBFIs can tailor factoring solutions to meet the unique preferences and circumstances of staffing agencies. This flexibility extends to factors such as terms, pricing structures, advance rates, and service levels, allowing staffing agencies to choose arrangements that best suit their business requirements.

The banks segment is expected to register at the fastest CAGR of around 7.4% from 2024 to 2030. Banks typically offer a range of financial services beyond factoring, including lending, treasury management, and investment banking. Staffing agencies can partner with banks to gain access to a broader suite of financial products and expertise, enhancing their overall financial management capabilities. Furthermore, banks are subject to strict regulatory oversight and compliance requirements, ensuring security and reliability for staffing agencies.

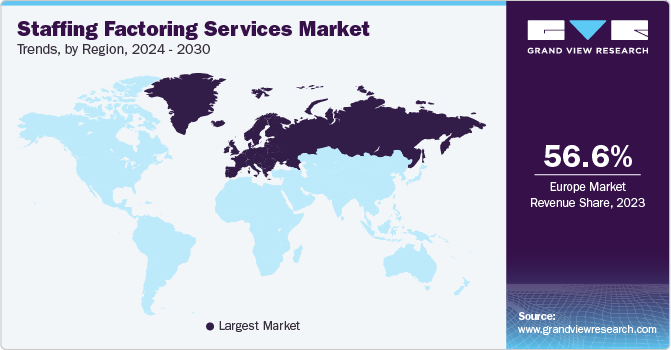

Regional Insights

North America dominated the staffing factoring services market with the revenue share of 5.1% in 2023 and is anticipated to grow at a significant CAGR of 6.4% from 2024 to 2030. Factoring companies in North America such as Porter Capital, REV Capital, and RTS Financial Service, Inc. among others are focusing on providing factoring services catering to niche markets, such as transportation, staffing, advertising, etc. This specialization is allowing factoring companies to understand the unique needs and challenges of their clients better, providing tailored financing solutions and value-added services.

U.S. Staffing Factoring Services Trends

The staffing factoring services market in U.S. is expected to grow at a significant CAGR of 6.0% from 2024 to 2030. The demand for staffing factoring services in the US is experiencing significant growth owing to the rising gig economy, characterized by independent contractors, freelancers, and temporary workers. This trend has led to an increased need for staffing agencies to provide on-demand workforce solutions to businesses.

Asia Pacific Staffing Factoring Services Trends

The staffing factoring services market in Asia Pacific is anticipated to grow at a significant CAGR of 8.8% from 2024 to 2030. Asia Pacific is home to several emerging markets characterized by vibrant business landscapes and flourishing entrepreneurial ecosystems. Nations such as China, India, and various Southeast Asian countries are undergoing rapid industrialization, propelled by advancements in technology and a surge in startup activity. In these dynamic environments, staffing factoring services play a pivotal role in meeting the flexible staffing requirements of emerging businesses.

The China staffing factoring services market is expected to grow at a significant CAGR of 8.3% from 2024 to 2030. The growing demand for flexible and fast financial services in China, coupled with rapid industrialization and vast developments observed in banking systems, is driving the adoption of factoring services in the region. Technological advancements, particularly in online platforms, digital payments, and automation, are transforming the market growth in China.

The staffing factoring services market in India is anticipated to grow at a significant CAGR of 10.2% from 2024 to 2030. Various public and government investments and initiatives such as Make in India, Startup India, and Digital India are fostering entrepreneurship and bolstering the growth of Small and Medium-Sized Enterprises (SMEs) in India. The Make in India initiative encourages domestic manufacturing, Startup India promotes start-up ventures, and Digital India focuses on digital infrastructure development. By supporting SMEs through these initiatives, the government cultivates a conducive ecosystem for business growth, stimulating the demand for factoring services to facilitate the financing needs of emerging enterprises.

The Japan staffing factoring services market is expected to grow at a significant CAGR of 8.6% from 2024 to 2030. The growing adoption of digital platforms, automation, and Artificial Intelligence (AI) in staffing factoring services has enhanced efficiency, transparency, and accessibility. These technological advancements attract businesses looking for modern financing solutions and contribute to market growth. The integration of IoT and AI technologies is playing a vital role in evaluating loan risks and enhancing the load underwriting of financial companies, which is further driving the market growth.

Europe Staffing Factoring Services Trends

The staffing factoring services market in Europe is anticipated to grow at a significant CAGR of 5.2% from 2024 to 2030. European countries have stringent financial regulations and consumer protection laws that govern the operations of financial institutions, including factoring companies. These regulations aim to prevent fraudulent activities, money laundering, and unethical business practices. By complying with these laws, factoring service providers demonstrate their commitment to ethical conduct and adherence to legal requirements, which is essential for maintaining trust and credibility in the market.

The UK staffing factoring services market is anticipated to grow at a significant CAGR of 4.5% from 2024 to 2030. In the UK, certain industries, including hospitality, retail, healthcare, and logistics, are experiencing significant fluctuations in workforce demand due to various factors such as Brexit impact, seasonal variations, peak periods, and skill shortages. These industries require additional staff during busy periods, such as holidays, festivals, or peak shopping seasons, to meet increased customer demand or operational requirements.

The staffing factoring services market in Germany is anticipated to grow at the fastest CAGR of 6.6% from 2024 to 2030. Germany boasts one of the largest and most stable economies in Europe, characterized by robust industrial sectors, technological innovation, and a skilled workforce. The country has a strong economy which helps in fostering business growth and expansion across various end-use industries, driving demand for temporary staffing solutions.

The france staffing factoring services market is expected to grow at a steady CAGR of 5.9% from 2024 to 2030. France has a thriving small and medium-sized enterprise (SME) sector, which forms the backbone of its economy. SMEs often turn to staffing agencies to meet their workforce needs, especially for short-term projects or to cover staff shortages. This reliance on temporary staffing fuels the demand for recourse factoring services, as agencies require financial support to manage their operations and meet the staffing requirements of SME clients.

Middle East & Africa Staffing Factoring Services Trends

The staffing factoring services market in the Middle East & Africa region is anticipated to grow at the fastest CAGR of 7.5% from 2024 to 2030. The MEA market is experiencing significant expansion, driven by increasing government investments aimed at the digitization of financial operations, next-generation digital infrastructure rollout, and the growing availability of smart contract facilities in the region.Further, the evolution of the gig economy and remote work arrangements has transformed the traditional employment landscape, creating new opportunities and challenges for workers and businesses in Saudi Arabia.

Key Staffing Factoring Services Company Insights

Some of the key players operating in the market include Mitsubishi HC Capital UK PLC; altLINE (The Southern Bank Company); and Barclays PLC among others.

-

Mitsubishi HC Capital UK PLC focuses on enhancing its service offerings to meet the evolving needs of the staffing industry. It is helping the company in diversifying its financing solutions to include not only traditional factoring services but also additional value-added services such as payroll processing, risk management, and invoice management

-

altLINE (The Southern Bank Company) in order to improve the company’s brand visibility and reputation within the staffing industry altLINE partners with commercial bankers, accountants, business advisors, and other intermediaries and offers its lending capabilities. By enhancing its presence through targeted marketing efforts, altLINE aims to solidify its market position and become the go-to choice for staffing companies seeking financing solutions

Capstone Corporate Funding, LLC, TCI Business, andPorter Capital are some of the emerging market participants in the global market.

-

Capstone Corporate Funding, LLC offers financial solutions tailored to the staffing industry. With a focus on staffing factoring services, Capstone helps staffing agencies and companies manage their cash flow effectively by providing immediate funds against their accounts receivable. By leveraging their expertise in financial management and understanding of the staffing industry, Capstone offers flexible and innovative financing options to meet the unique needs of its clients

-

Porters Capital is a dynamic financial institution specializing in providing staffing factoring services to businesses across various industries. Founded on the principles of reliability and innovation, Porters Capital has established itself as a trusted partner for companies seeking flexible financing solutions tailored to their unique staffing needs. Further, the company offers a range of factoring services designed to optimize liquidity and support growth initiatives

Key Staffing Factoring Services Companies:

The following are the leading companies in the staffing factoring services market. These companies collectively hold the largest market share and dictate industry trends.

- altLINE (The Southern Bank Company)

- Barclays PLC

- Capstone Corporate Funding, LLC

- Deutsche Factoring Bank

- eCapital Corp

- Factor Funding Co.

- Mitsubishi HC Capital UK PLC

- HSBC Group

- KUKE JSC

- Mizuho Financial Group, Inc.

- Porter Capital

- REV Capital

- RTS Financial Service, Inc.

- Societe Generale

- TCI Business Capital

Recent Developments

-

In March 2024, REV Capital’s New York office secured a factoring contract worth USD 3 million for a new staffing client. The staffing client faced significant challenges in terms of last-minute bank deal breaks and upcoming payroll cycle. Thus, by accessing the exact requirements of the staffing firm, REV Capital’s team of experts offered fast and hassle-free factoring services within three full days prior to the requested deadline by the client

-

In June 2022, eCapital Corp. announced deals worth EUR 3 million (USD 3.15 million) in sterling UK and USD 1.5 million in the U.S., providing a trans-Atlantic working capital line of credit. This financial support was offered to a leading provider of manpower solutions in the renewable energy and sustainable transportation sectors

-

In November 2021, eCapital Commercial Finance, a prominent alternative finance provider in North America catering to small and medium-sized businesses and a division of eCapital Corp., announced the provision of a USD 750,000 factoring facility to an industrial staffing service provider

Staffing Factoring Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 137.77 billion

Market value forecast in 2030

USD 202.55 billion

Growth rate

CAGR of 6.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Category, type, financial institution, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa.

Key companies profiled

altLINE (The Southern Bank Company); Barclays PLC; Capstone Corporate Funding, LLC; Deutsche Factoring Bank; eCapital Corp; Factor Funding Co.; Mitsubishi HC Capital UK PLC; HSBC Group; KUKE JSC; Mizuho Financial Group, Inc.; Porter Capital; REV Capital; RTS Financial Service, Inc.; Societe Generale; TCI Business Capital

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Staffing Factoring Services Market Report Segmentation

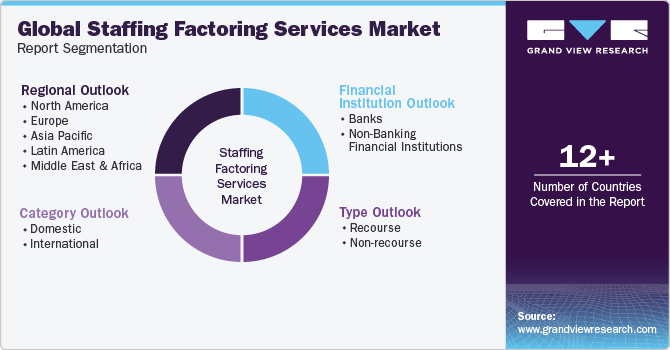

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global staffing factoring services market report based on category, type, financial institution, and region:

-

Category Outlook (Revenue, USD Billion, 2018 - 2030)

-

Domestic

-

International

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Recourse

-

Non-recourse

-

-

Financial Institution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Banks

-

Non-Banking Financial Institutions

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global staffing factoring services market size was estimated at USD 132.60 billion in 2023 and is expected to reach USD 137.77 billion in 2024.

b. The global staffing factoring services market is expected to witness a compound annual growth rate of 6.6% from 2024 to 2030 to reach USD 202.55 billion by 2030.

b. The domestic segment accounted for the largest market share, over 74%, in the staffing factoring services market in 2023. The segment's growth can be attributed to the effective, rapid adoption of factoring receivable methods across major industries.

b. Key industry players operating in the staffing factoring services market include altLINE (The Southern Bank Company); Barclays PLC; Capstone Corporate Funding, LLC; Deutsche Factoring Bank; eCapital Corp; Factor Funding Co.; Mitsubishi HC Capital UK PLC; HSBC Group; KUKE JSC; Mizuho Financial Group, Inc.; Porter Capital; REV Capital; RTS Financial Service, Inc.; Societe Generale; TCI Business Capital.

b. Economic factors, such as GDP growth, unemployment rates, and changing business sentiments, are playing a significant role in driving the demand for staffing factoring services. Businesses opt for temporary staffing during periods of economic growth to support growth initiatives, leading to higher demand for staffing factoring services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.