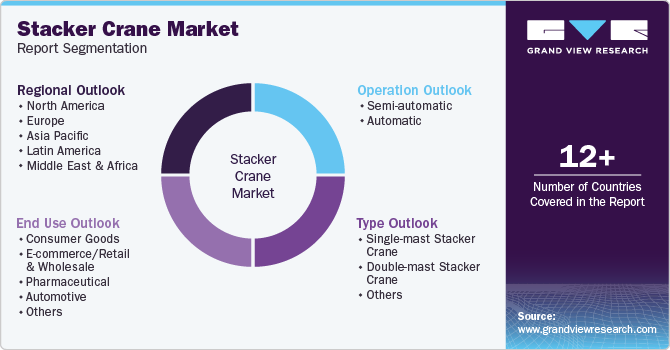

Stacker Crane Market Size, Share & Trends Analysis Report By Type, By Operation (Semi-automatic, Automatic), By End Use (Consumer Goods, Pharmaceutical, Automotive), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-469-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Stacker Crane Market Size & Trends

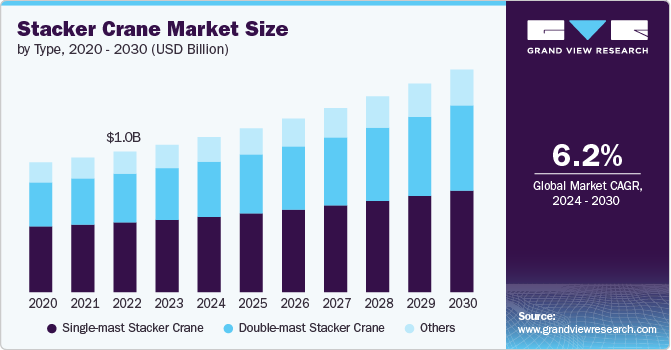

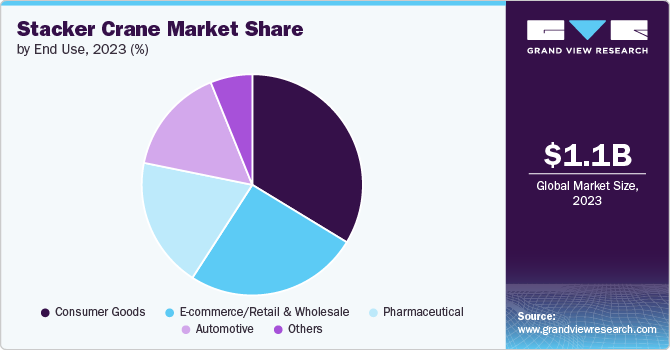

The global stacker crane market size was estimated at USD 1.09 billion in 2023 and is expected to grow at a CAGR of 6.2% from 2024 to 2030. The growing need for efficient storage and retrieval systems in warehouses and logistics operations is a major driving factor behind the growth of the market. Various industries are increasingly adopting automated solutions such as stacker cranes to optimize their supply chain, enhance productivity, and reduce labor costs. In addition, rapidly growing e-commerce and manufacturing industry across the globe and rising technological advancements in stacker cranes are further expected to boost the growth of the stacker crane market.

As industries across the globe are increasingly adopting smart manufacturing practices, stacker cranes equipped with advanced sensors, Artificial Intelligence (AI), and Internet of Things (IoT) connectivity are becoming essential. These innovations enable real-time data collection and analysis, enhancing operational efficiency, reducing labor costs, and minimizing errors. Several companies are streamlining their supply chains and improving inventory management, making stacker cranes a critical investment for businesses looking to remain competitive in a rapidly evolving landscape. Thus, the rise of Industry 4.0 and automation is significantly contributing to the growth of the market.

The rapid growth of the e-commerce sector is increasing the demand for efficient warehousing solutions, such as stacker cranes. Owing to the increasing consumer demand for faster delivery and enhanced service, warehouses are focusing on adopting stacker cranes to optimize their operations. Stacker cranes enable high-density storage and quick retrieval of products, making them vital in e-commerce fulfillment centers. As online shopping continues to expand, businesses are increasingly investing in automated storage solutions to meet the demands of their customers, thereby driving the growth of the stacker crane market.

Furthermore, innovations such as improved control systems, enhanced safety features, and integration with warehouse management systems are driving the adoption of stacker cranes. Advanced robotics and AI-driven algorithms optimize the performance and functionality of stacker cranes, allowing for more precise handling of goods. As technology evolves, stacker cranes are becoming more versatile and capable of adapting to the specific needs of various industries, driving widespread adoption across sectors. Thus, rising technological advancements in stacker cranes are expected to contribute to the growth of the market.

High capital investment and maintenance complexity could hamper the growth of the market.The significant initial investment needed for stacker crane installation remains a barrier to their adoption, especially for smaller businesses with budget limitations. In addition, the complexity of stacker cranes requires careful maintenance; even occasional breakdowns or malfunctions can disrupt operations, resulting in delays and higher operational costs. Furthermore, stacker cranes are vulnerable to single points of failure. When one crane breaks down, it can make the entire aisle's inventory inaccessible, disrupting order fulfillment and halting warehouse operations, thereby hindering the market’s growth.

Type Insights

The single-mast stacker crane segment dominated the market in 2023 and accounted for 49.12% share of global revenue. Single mast stacker cranes are gaining traction due to their cost-effectiveness and versatility in various applications. These cranes are typically lighter and less expensive than their double mast counterparts, making them an attractive option for small to medium-sized businesses with limited budgets. Their compact design allows for easy maneuverability in narrower aisles, optimizing space utilization in warehouses. In addition, their ability to handle a range of goods, from pallets to smaller items, makes them suitable for diverse industries, driving their growth in the market.

The double-mast stacker crane segment is projected to witness significant growth from 2024 to 2030. The growth of the double-mast stacker crane segment can be attributed to their enhanced lifting capacity and stability. These cranes can handle heavier loads and reach greater heights compared to single mast models, which is particularly beneficial for warehouses with tall racking systems. In addition, double-mast stacker cranes can seamlessly integrate with warehouse management systems, allowing for real-time inventory tracking and improved data management. This integration enhances operational visibility and supports better decision-making regarding inventory control, thereby driving the segment’s growth.

Operation Insights

The semi-automatic segment dominated the market in 2023. Semi-automatic stacker cranes are increasingly gaining traction as they effectively balance the benefits of manual operation with the efficiencies of full automation. These cranes offer operators greater control while helping with lifting and moving tasks, making them suitable for warehouses that require a mix of human oversight and machine efficiency. This hybrid approach allows businesses to optimize labor resources without significant upfront investment in fully automated systems. Thus, the increasing adoption of semi-automatic stacker cranes by industries that handle varied inventory types and volumes to enhance productivity and reduce operational costs is boosting the segment’s growth.

The automatic segment is projected to witness significant growth from 2024 to 2030. Automatic stacker cranes are experiencing significant growth due to their ability to streamline operations and reduce labor costs. Fully automated systems integrate advanced technologies such as AI, sensors, and real-time data analytics, allowing for efficient, error-free handling of goods. These cranes can operate continuously without human intervention, making them ideal for high-throughput environments, such as e-commerce fulfillment centers and large-scale warehouses. In addition, their capability to minimize operational downtime and enhance safety through reduced human involvement makes them a key investment for companies looking to stay competitive in a rapidly evolving market, thereby driving segment growth.

End Use Insights

The consumer goods segment dominated the market in 2023. The increasing demand for efficient warehousing and distribution systems in the consumer goods sector is the major driving factor behind the segment’s growth. Several consumer goods companies are investing in automated storage solutions to handle the high volume of goods and meet consumer expectations for rapid delivery. Stacker cranes facilitate high-density storage, allowing businesses to maximize their warehouse space and streamline order fulfillment processes. Furthermore, the versatility of stacker cranes makes them suitable for a wide range of products, from packaged goods to bulk items, further enhancing their appeal in this dynamic industry, thereby boosting the segment’s growth.

The automotive vehicles segment is projected to witness significant growth from 2024 to 2030. The need for efficient material handling in automotive manufacturing and assembly processes can be attributed to the segment’s growth. Automotive manufacturers are increasingly adopting automated solutions to optimize their supply chains and improve production efficiency. Stacker cranes play a crucial role in managing heavy components and parts, ensuring that they are stored and retrieved with precision. The automotive sector is shifting towards more complex production methods, such as just-in-time manufacturing and greater customization. This drives the demand for advanced stacker crane systems that can manage diverse load types and sizes.

Regional Insights

The Asia Pacific stacker crane market dominated in 2023 and accounted for a 44.54% share of the global revenue. The growth of the market is driven by the region's expanding manufacturing and logistics sectors. As countries such as China and India continue to industrialize, the demand for efficient material handling solutions is increasing. In addition, the rise of e-commerce in the region is also encouraging companies to invest in automated storage systems to enhance order fulfillment capabilities. Furthermore, government initiatives aimed at modernizing infrastructure and promoting automation are contributing to the growth of stacker cranes.

North America Stacker Crane Market Trends

The North America stacker crane market is expected to witness notable growth from 2024 to 2030. The strong presence of advanced logistics and warehousing infrastructure across the region can be attributed to the growth of the market. In addition, the presence of major e-commerce and retail companies and the rapid growth of the automotive industry further fuel the adoption of stacker cranes in the region.

U.S. Stacker Crane Market Trends

The U.S. stacker crane market is expected to grow at a significant CAGR from 2024 to 2030. There is a growing trend towards automation in warehouses, with stacker cranes playing a crucial role in enhancing operational efficiency. These systems enable faster storage and retrieval processes, reduce labor costs, and improve inventory management accuracy. In addition, technological advancements in stacker cranes, such as integration with warehouse management systems and improved navigational capabilities are further propelling the market's growth in the country.

Europe Stacker Crane Market Trends

The Europe stacker crane market is expected to grow at the highest CAGR from 2024 to 2030. Increasing investments in smart manufacturing and automation technologies are driving demand for stacker cranes across the region. Furthermore, the growing trend of e-commerce and increased focus on logistics optimization are further supporting the adoption of stacker cranes across various sectors.

Key Stacker Crane Company Insights

The market players are focusing on numerous strategic initiatives, such as new product development, agreements, and partnerships & collaborations to acquire a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In December 2022, PSA Antwerp (PSAA), a Belgian terminal operator entered into an agreement with Austrian crane manufacturer Kuenz and global technology leader ABB Ltd., specializing in electrification and automation, to acquire 14 automated stacking cranes for its Europa Terminal. These advanced cranes would enable PSAA to increase the terminal's capacity by 40% while significantly advancing its sustainability goals by cutting total carbon emissions per handled container by over 50%.

-

In October 2020, Stoecklin Logistics, a provider of innovative supply chain solutions, launched a line of dynamic MASTer Stacker Cranes. These cranes are designed with moving speeds and high acceleration, enhanced energy efficiency, and modular construction that significantly boosts performance and availability. The models feature greater standardization across various cranes and load capacities, simpler and quicker wheels and hoists, shorter assembly and manufacturing times, lighter construction, and improved access to components for easier maintenance.

Key Stacker Crane Companies:

The following are the leading companies in the stacker crane market. These companies collectively hold the largest market share and dictate industry trends.

- Mecalu, S.A.

- American Crane & Equipment Corporation

- ME-JAN d.o.o.

- Daifuku Co. Ltd.

- Jungheinrich AG

- Mitsubishi Logisnext Americas Inc.

- Demag Cranes & Components GmbH

- Kardex

- Alstef Group

- ATS Group

Stacker Crane Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.15 billion |

|

Revenue forecast in 2030 |

USD 1.65 billion |

|

Growth rate |

CAGR of 6.2% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, operation, end use, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

Mecalux, S.A.; American Crane & Equipment Corporation; ME-JAN d.o.o.; Daifuku Co., Ltd.; Jungheinrich AG; Mitsubishi Logisnext Americas Inc.; Demag Cranes & Components GmbH; Kardex; Alstef Group; ATS Group |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Stacker Crane Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global stacker crane market based on type, operation, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-mast Stacker Crane

-

Double-mast Stacker Crane

-

Others

-

-

Operation Outlook (Revenue, USD Million, 2018 - 2030)

-

Semi-automatic

-

Automatic

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer Goods

-

E-commerce/Retail and Wholesale

-

Pharmaceutical

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global stacker crane market size was estimated at USD 1.09 billion in 2023 and is expected to reach USD 1.15 billion in 2024.

b. The global stacker crane market is expected to grow at a compound annual growth rate of 6.2% from 2024 to 2030 to reach USD 1.65 billion by 2030.

b. Asia Pacific dominated the stacker crane market with a share of 44.54% in 2023. The growth of the market is driven by the region's expanding manufacturing and logistics sectors.

b. Some key players operating in the stacker crane market include Mecalux, S.A., American Crane & Equipment Corporation, ME-JAN d.o.o., Daifuku Co., Ltd., Jungheinrich AG, Mitsubishi Logisnext Americas Inc., Demag Cranes & Components GmbH, Kardex, Alstef Group, and ATS Group.

b. Key factors that are driving the market growth include the growing need for efficient storage and retrieval systems in warehouses and logistics operations and the rapidly growing e-commerce and manufacturing industry across the globe.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."