Spreads Market Size, Share & Trends Analysis Report By Product (Butter/Cheese, Fruit Spreads, Chocolates And Nuts), By Distribution Channel (Supermarkets And Hypermarkets, Convenience Store, Online), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-522-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2020 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Spreads Market Size & Trends

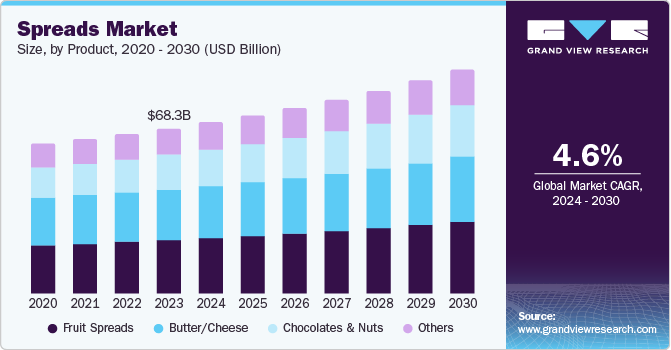

The global spreads market size was valued at USD 68.3 billion in 2023 and is expected to expand at a CAGR of 4.6% from 2024 to 2030. The spreads form an essential breakfast ingredient in the western countries, which has been driving the market. Increasing demand for natural and healthy spreads and consumer preferences for artisan bakery products are accelerating the growth of the food spread market across the globe. Also, the growing demand of healthy and nutritious food items across the world is accelerating the global spreads market.

In western countries such as Germany, UK and the U.S., bread is consumed with various types and flavors of spreads such as chocolate, peanut butter, cheese, jam and honey in breakfast. According to Food Republic, in 2023, each American was expected to consume 17 KG of bread in a year. Spreads are popular in all age groups even with changing tastes as there is a wide variety of flavors available in the market. Also, the preferences are different in different countries. For instance, in India butter is more popular as spread over bread however in Spain, tomato ketchup is preferred.

The market growth is attributed to growing demand for gourmet jams for gifting purposes. These products have gained popularity owing to the consumers’ perception of considering it as a luxury gift product to friends, relatives, hosts, and office colleagues. Moreover, an increase in disposable income has enabled the consumers to purchase gourmet jam for themselves, therefore contributing to the market growth.

Consumers inclination towards a healthy lifestyle is encouraging the consumers to opt for low-calorie and healthy spreads. Sweet spreads have artificial sweeteners and flavors, which lead to long term health issues. To cater to this demand, companies are coming up with clean labels by using natural and healthy ingredients. Companies are continuously introducing products to keep up with the consumers’ changing taste preferences. Based on the preference trends, it has been observed that consumers in Italy prefer Nutella spreads, whereas Indian consumers prefer butter as a spread to their toast, Germany prefers its toast with cheese and jam, and Spain consumes a large amount of tomato spread on their pizza, toast, and in pasta.

Product Insights

Fruit spreads held the largest revenue share of 32.6 % in 2023. Fruit spreads are most popular among all the other segments in market as these are consumed with variety of bakery products across the world. Also, these products are available in many flavors and textures such as jams, jelly, fruit syrups and fruit pastes. For instance, the fruit spread by Crofter’s Organic is used with 30 food items such as toast, muffins, pizza, smoothie and pancakes. It contains low sugar and cater variety of tastes.

The chocolates and nuts segment is expected to grow at the fastest CAGR of 5.9 % from 2024 to 2030. This is attributed to the growing popularity of chocolates and nuts is the common sweet and savory combination they offer. These are considered as healthy as they contain low sugar and essential fatty acids, fats. Ultimately, consumers from all age groups can have these at any time. Moreover, chocolates are eaten for enhancing the mood and enhance blood flow as well.

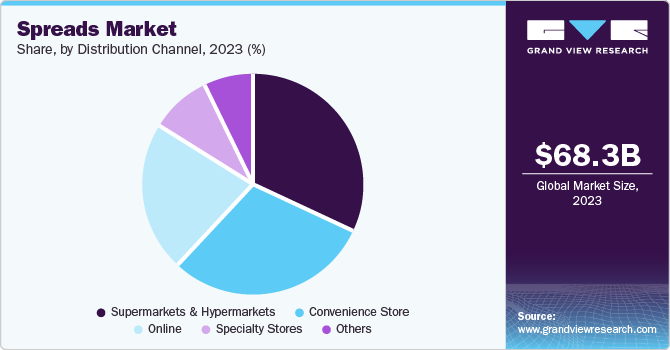

Distribution Channel Insights

The hypermarket and supermarket segment dominated the market with the largest revenue share of 31.6 % in 2023. Consumers prefer purchasing food items from supermarkets as they can check the product in person which play an important role in decision. Also, representatives from companies during product launches communicate the product and its differentiation to customers, encouraging them to try new flavors. Moreover, consumers prefer to purchase when there is more variety, which is available in supermarkets and hypermarkets.

The online segment is anticipated to expand at the fastest CAGR of 5.9 % over the forecast period. Availability of different platforms, attractive discounts, cash backs, and easy return and exchange options are some of the factors that influence the consumers to purchase the products from e-commerce websites. Moreover, the establishment of e-commerce companies dedicated towards food delivery and companies offering products through their own websites are fueling the segment growth. As per the article published on GIE Media, Inc, globally, more than 2.85 billion people were expected to use online food delivery services in 2023.

Regional Insights

North America spreads market held the largest revenue share of 35.1% in 2023. The popularity of fast-food items such as sandwiches and burgers in the region is driving the market. Customers prefer spreads such as mayonnaise, garlic butter, avocado spread, and cheese in the region. Also, as there are many companies offering spreads with low fats and sugar, consumers are preferring these products, propelling the growth of the market.

Asia Pacific Spreads Market Trends

Asia Pacific is projected to expand at the fastest CAGR of 6.0 % over the forecast period. The increase in preference for chocolate based spread due to its taste is a prime factor magnifying the growth of the market in the region. In developing and populated countries such as China, India and Japan, there is a popular trend to adopt western food culture, further shaping the regional growth of this market. Food chains such as McDonalds are popular in these countries contributing to the market expansion. Large brands in the market are aggressively focusing to increase the number of outlets in such countries.

Additionally, the online food delivery apps in this region have significantly contributed to the market growth. Due to prompt delivery service and advancements in the websites, consumers prefer ordering food online. According to an article published on GIE Media Inc., two-third of app users worldwide are in the APAC region.

Europe Spreads Market Trends

Consumption of spreads in Germany, UK and France is high in comparison to other countries. Various applications in dessert & bakery are one of the key contributors to the food spread market growth in the region. Additionally, with the growing tourism industry, the number of hotels, food joints and restaurants are continuously increasing, raising the demand of these products in the region.

Key Spreads Company Insights

Some of the key companies in the spreads market include Hormel Foods Corporation, The J.M. Smucker Company, B&G Foods, Inc. and Ventura Foods. Organizations are aiming to expand customer base by taking several strategic initiatives such as product innovation, product range expansion, mergers and acquisitions.

-

Hormel Foods Corporation is a food manufacturing and processing company which operates globally with more than 40 brands. Its product range includes canned meats, butter, jams, sauces and nutritional supplements.

Key Spreads Companies:

The following are the leading companies in the spreads market. These companies collectively hold the largest market share and dictate industry trends.

- Hormel Foods Corporation

- The J.M. Smucker Company

- B&G Foods, Inc.

- Ventura Foods

- Capilano Honey Ltd.

- The HERSHEY Company

- Ferrero

- Hero

- Andros Group

- The Kraft Heinz Company.

Recent Developments

-

In May 2024, Jif launched Jif Peanut Butter & Chocolate Flavored Spread. It is lower in sugar and has thick smooth texture which makes it easy to spread and a topping for meals, snacks and desserts.

-

In May 2024, St Dalfour announced the launch of St Dalfour SuperFruits, a newest product line. The SuperFruits line incorporates exotic fruits flavors from around the globe.

-

In January 2024, St Dalfour, announced its partnership with chef, Pierre Gagnaire. This collaboration is expected to offer food enthusiasts a new dimension to gourmet experiences.

Spreads Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 70.87 billion |

|

Revenue forecast in 2030 |

USD 92.68 billion |

|

Growth Rate |

CAGR of 4.6% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea Brazil; South Africa |

|

Key companies profiled |

Hormel Foods Corporation.; The J.M. Smucker Company; B&G Foods, Inc.; Ventura Foods; Capilano Honey Ltd.; The HERSHEY Company; Ferrero Hero; Andros Group; The Kraft Heinz Company. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Spreads Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2030. For this study, Grand View Research has segmented the global spreads market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2020 - 2030)

-

Butter/Cheese

-

Fruit Spreads

-

Chocolates & Nuts

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2020 - 2030)

-

Supermarkets And Hypermarkets

-

Convenience Store

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2020 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."