- Home

- »

- Organic Chemicals

- »

-

Spray Foam Market Size, Share And Growth Report, 2030GVR Report cover

![Spray Foam Market Size, Share & Trends Report]()

Spray Foam Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Open Cell, Closed Cell), By Density (High, Low, Medium), By Application (Construction, Packaging), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-302-1

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Spray Foam Market Summary

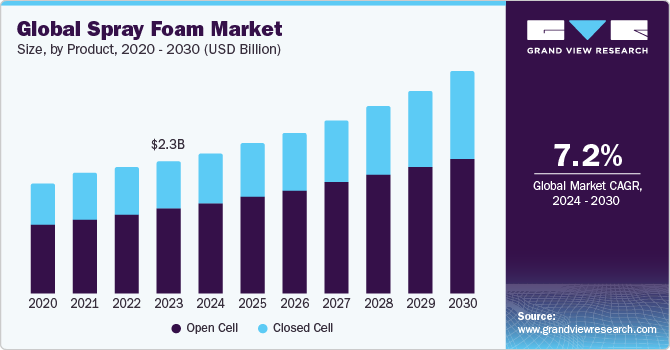

The global spray foam market size was estimated at USD 2.34 billion in 2023 and is projected to reach USD 3.63 billion by 2030, growing at a CAGR of 6.5% from 2024 to 2030. The market is expected to witness growth over the forecast period, owing to the rising awareness regarding energy savings of buildings.

Key Market Trends & Insights

- The North America region dominated the market with a revenue share of 42.5% in 2023.

- By product, the open-cell foam segment held the largest revenue share in 2023 at 67.2%.

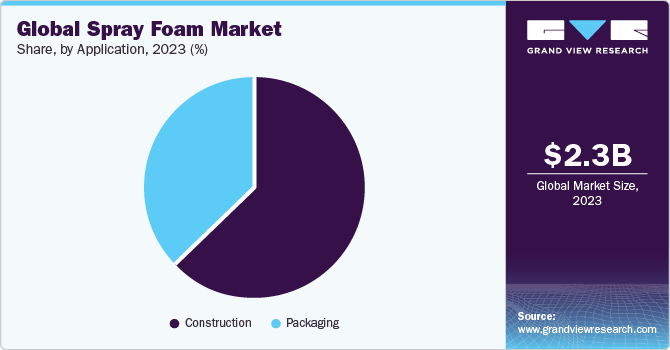

- By application, the construction segment dominated the market with the highest revenue share of 63.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.34 Billion

- 2030 Projected Market Size: USD 3.63 Billion

- CAGR (2024-2030): 6.5%

- North America: Largest Market in 2023

Growth in building and construction activities, including the construction of new structures and the remodeling of old building structures, are also expected to drive the market growth. Spray foam is an important building insulation material globally, as it minimizes the environmental impact of buildings by saving energy.

Spray foam prices are dependent on raw material prices and the density of spray foam. As the density increases, the amount of spray applied per square meter increases, thereby increasing the cost. Furthermore, the thermal insulation of spray foam is two times better than rockwool. The insulation layer applied is thin, thus, the consumption of the material is less and its labor cost also decreases, due to the rapid application.

Market Concentration & Characteristics

The global spray foam market is moderately fragmented, with the presence of many small and large players. This further makes the market more competitive, with players focusing more on different strategies, including product differentiation, mergers, acquisitions, and research & development. Many small and regional players are present in the market; however, global companies try to increase their market footprint, due to their ability to invest in research & development, scale production, and meet stringent quality & performance requirements.

Companies are developing environmentally friendly products, which not only reduce their carbon footprint but also reduce CO2 emissions by thousands of tons every year. One such example is the Huntsman International product, Icynene, which is environmentally friendly, contains no toxic chemicals, and is composed of completely recycled natural materials.

Product Insights

Based on product, the market for spray foam is segmented into open cell and closed cell foam. The open cell segment dominated the market with the highest revenue share of 67.2% in 2023. The properties of open cell foam, such as flexibility and softness make it suitable for residential roofs & walls. This type of spray foam also improves soundproofing and requires minimal labor costs for installation. These factors are anticipated to bode well for the market share of this segment over the forecast period.

The closed cell spray foam is a significant category of the market, as this type of foam is majorly useful in extreme temperatures, keeping heat outside or inside of a building. They generally have a higher R-value than open-cell foams.

Density Insights

High-density spray foam is the densest of all types of spray foam. High-density spray foam has an extremely high R-value, thus, it is often employed for roofing and exterior applications in industrial and commercial construction. Medium-density spray foam bears great stress without any breakage and is the most commonly used type of spray foam insulation in new construction.

Low-density spray foam insulation is commonly used for interior applications. Common applications of low-density spray foam insulation include unvented attics, wall cavities, ducts, basement walls, roof decks, ceilings, and crawl spaces. Additionally, low-density spray foam insulation is frequently used during construction to fill wall cavities.

Application Insights

The construction segment dominated the market with the highest revenue share of 63.0% in 2023, owing to the product usage in buildings for insulation purposes. Spray foam eliminates unwanted air leakage by sealing holes and cracks in the building and improving durability & energy efficiency. Its advantages include increased building strength, high insulation values, zero air permeability, weather & flood resistance, improved indoor air quality, reduced operating costs, and lower environmental impacts.

The packaging segment is expected to register a significant CAGR during the forecast period. Spray foam provides protective packaging that protects fragile goods against possible transit damage, due to impact vibration & shock. Demand for spray foam packaging is rising, due to its properties, such as light weight and reduced transportation costs.

Regional Insights

The North America spray foam market dominated the global market with a revenue share of 42.5% in 2023, which is attributed to increased product demand from countries, such as the U.S. and Canada. The product is widely utilized in the residential and commercial sectors across North America, due to its properties, such as supportive rules and regulations, environmental advantages, and zero toxic emissions.

U.S. Spray Foam Market Trends

The U.S. market for spray foam is experiencing growth driven by the increasing consumer demand for non-toxic insulations in homes. Spray foams are used across U.S. homes, as they are an ideal kind of insulation that helps maintain the internal temperature of buildings.

Europe Spray Foam Market Trends

The spray foam market in Europe has been experiencing steady growth in terms of demand in recent years. This growth can be attributed to surging construction activities and ongoing advancements in technologies in the region. As Europe witnesses a rise in infrastructure development projects and renovations, the requirement for reliable and energy-saving insulation has become paramount in the region. Renovation of dwellings in Europe is anticipated to create numerous growth opportunities for vendors of spray foams.

The UK spray foam market has a potential product market, owing to the government’s goal to meet carbon emission goals by 2050. Hence, it could become a necessity to use spray foam insulation in construction applications. For instance, Icynene has been approved by regulatory bodies and is, thus, widely used in the country.

Asia Pacific Spray Foam Market Trends

The spray foam market in Asia Pacific is expected to grow at a significant CAGR, due to the rising population and disposable income of the middle-class population in the region. Demand for spray foam is majorly derived from countries, such as China and India. Spray foams are used in construction applications for sealing cracks, as well as for filling concrete gaps. The rise in spending on infrastructure development projects in emerging countries, such as China and India, is one of the major reasons driving the use of spray foams in construction applications. The highest growth in demand for spray foams can be witnessed in countries, such as China and India, owing to the surged government spending on construction industry.

The China spray foam market is prominent in the construction industry. China’s 14th Five-Year Plan emphasizes new infrastructure projects, and investment in new infrastructure is expected to reach roughly USD 4.2 trillion. The new plan emphasized energy efficiency and green building development, with net zero energy buildings.

Central & South America Spray Foam Market Trends

The spray foam market in Central & South America comprises emerging countries, such as Brazil and Argentina. The product market in this region is expected to grow in the coming years, owing to developing charging infrastructure in the region.

The Brazil spray foam market is a key market globally, owing to the need for single-family and multifamily housing in the country. Government initiatives to provide affordable housing to its citizens are expected to boost residential construction growth in the coming years.

Middle East & Africa Spray Foam Market Trends

The spray foam market in the Middle East & Africa is registering increasing demand, driven by factors such as the growth of construction and growing infrastructure in the region.

The South Africa spray foam market is expected to grow over the forecast period due to growth in the construction sector in the region. The country has been undertaking extensive infrastructure development projects, leading to a rise in demand for spray foam.

Key Spray Foam Company Insights

Some of the key players operating in the market include BASF SE, Huntsman International LLC, Johns Manville, Dow, and CertainTeed, LLC.

-

Huntsman Building Solutions is the leading spray polyurethane foam business. It has an icynene polyurethane insulation brand, which is available in open cell and closed cell, and used for interior and exterior construction applications.

-

BASF SE is one of the prominent chemical producers in the world, located in Ludwigshafen, Germany.BASF manufactures both open-cell spray and closed-cell polyurethane foam products for residential and commercial construction.

Key Spray Foam Companies:

The following are the leading companies in the spray foam market. These companies collectively hold the largest market share and dictate industry trends.

- CertainTeed, LLC (Saint-Gobain)

- Covestro AG

- Honeywell International Inc.

- NCFI Polyurethanes

- Henry Company

- RHH Foam Systems

- Rhino Linings Corporation

- BASF SE

- Huntsman International LLC

- Johns Manville

- Dow

Recent Developments:

-

On November 14, 2023, DAP, a leader in the home improvement and construction products industry, transformed spray foam application with the introduction of the first of its kind 1-component broadcast spray foam: Wall & Cavity Foam with Wide Spray Applicator.

-

On April 17, 2023, Huntsman’s high-performance spray foam insulation from Huntsman Building Solutions formed an integral part of Manchester’s OGS container scheme.

-

On May 27, 2022, BASF’s water-blown polyurethane insulation spray foam was used in the latest bus model by Kinglong United Automotive (Suzhou) Co., Ltd. (Suzhou Kinglong). BASF collaborated to develop the 100% water-blown spray open-cell foam system, which meets stringent VOC standards and provides better interior air quality in public transportation.

Spray Foam Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.49 billion

Revenue forecast in 2030

USD 3.63 billion

Growth rate

CAGR of 6.5% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, density, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; India; Japan, South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

BASF SE; Huntsman International LLC; Johns Manville; Dow; CertainTeed, LLC (Saint-Gobain); Covestro AG; Honeywell International Inc; NCFI Polyurethanes; Henry Company; RHH Foam Systems; Rhino Linings Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

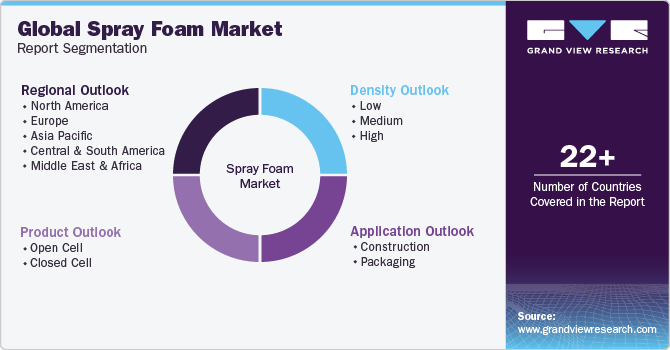

Global Spray Foam Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global spray foam market report based on product, density, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Open Cell

-

Closed Cell

-

-

Density Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Low

-

Medium

-

High

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Construction

-

Packaging

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global spray foam market size was estimated at USD 2.34 billion in 2023 and is expected to reach USD 2.49 billion in 2024.

b. The global spray foam market is expected to grow at a compound annual growth rate of 6.5% from 2024 to 2030 to reach USD 3.63 billion by 2030.

b. North America dominated the spray foam market with a share of 42.5% in 2023. This is attributable to increased product demand from countries like U.S. & Canada. Due to the properties such as rules and regulation friendly, environmental advantages and zero toxic emissions, the product is widely used in the residential and commercial sectors across North America.

b. Some key players operating in the spray foam market include BASF SE, Huntsman International LLC, Johns Manville, Dow, CertainTeed, LLC (Saint-Gobain), Covestro AG, Honeywell International Inc, NCFI Polyurethanes, Henry Company, RHH Foam Systems, Rhino Linings Corporation

b. Key factors that are driving the market growth include growing awareness regarding the energy savings of the buildings. The growing building and construction activities including the construction of the new structures and the remodeling of the old building structures is driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.