Sports Supplement Market Size, Share & Trends Analysis Report By Product (Capsules/Tablets, Powder, Liquid, Bars), By Source (Animal-based, Plant-based), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-869-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Sports Supplement Market Size & Trends

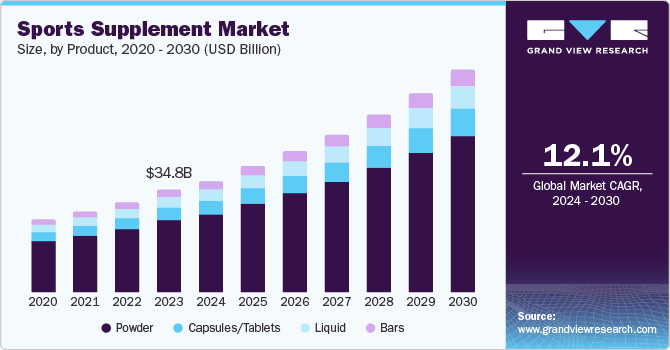

The global sports supplement market size was valued at USD 34.79 billion in 2023 and is projected to grow at a CAGR of 12.1% from 2024 to 2030. This growth is attributable to increasing awareness about health benefits associated with active lifestyles, adopting sports & exercises in routine, the rising prevalence of chronic diseases due to sedentary lifestyles, growing acceptance of sports supplements, impactful social media promotion strategies by businesses, continuous innovation in product formulations, and consumer preference for convenient consumption options.

A rising preference for a healthy and active lifestyle is a significant factor propelling the market. Younger consumers are increasingly inclined towards fitness and sports as a central aspect of their lives. Growing awareness of the benefits of healthy lifestyles and nutritious dietary choices leads to higher demand for sports supplements.

The adoption of sedentary lifestyles and unhealthy diets has increased the risk of various diseases, including diabetes, cardiovascular diseases, obesity, and cancer. According to the World Health Federation, approximately 2.7 billion people could face obesity or overweight conditions by 2025. Consumers are increasingly adopting new practices such as sports, yoga, gym, and healthy food, propelling the demand for sports supplements. Sports supplements are growing in demand due to their help in boosting performance and increasing recovery speed during and after sports activities.

The continuous innovation in product formulations is driving market expansion. Ongoing research and development activities result in new and enhanced sports supplement offerings. Moreover, manufacturers' increasing use of social media platforms like YouTube and Instagram to promote their products is expected to boost the demand for sports supplement products.

Product Insights

The powder segment dominated the market and accounted for a revenue share of 67.9% in 2023. The powder segment’s dominance in the sports supplement market can be attributed to its versatility, higher nutrient concentration, cost-effectiveness, longer shelf life, ease of storage, variety of options available, and effective marketing strategies that have increased consumer awareness. Powders can be easily mixed with various liquids such as water, milk, or juice, allowing users to customize their intake according to personal preferences and dietary needs. This flexibility makes it easier for consumers to incorporate these supplements into their daily routines.

The liquid segment is expected to grow rapidly during the forecast period 2024 to 2030. This growth can be attributed to its convenience & ease of consumption, and rapid absorption characteristic. Liquid supplements offer a high level of convenience, making them an attractive option for busy consumers. It is easy to consume on the go, which aligns well with the increasing demand for “grab-n-go” products. This convenience factor particularly appeals to sports & fitness enthusiasts and wellness consumers who do not have the time or interest to prepare traditional meals or snacks.

Source Insights

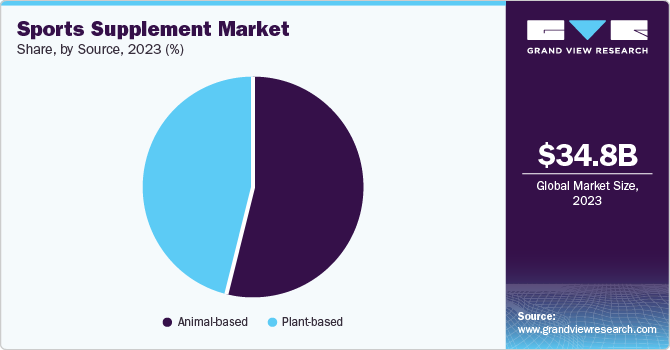

Theanimal-baseddominated the market and accounted for the largest revenue share in 2023. This dominance can be attributed to superior its nutritional profile, higher bioavailability, and consumer preferences. Animal-based supplements, such as whey protein, casein, and collagen, offer a comprehensive amino acid profile, this complete amino acid profile of an animal-based supplement makes it highly effective for muscle recovery and performance enhancement. National Library of Medicines have validated the efficacy of animal-based supplements in enhancing athletic performance increasing the credibility of animal-based sports supplements.

The plant-based segment is expected to grow at the fastest CAGR during the forecast period. This growth is attributable to increasing awareness of environmental sustainability and ethical considerations. Consumers are becoming more conscious of the environmental impact of animal agriculture, which includes high greenhouse gas emissions, deforestation, and water usage. Additionally, ethical concerns regarding animal welfare and cruelty-free practices motivate consumers to seek plant-based alternatives. Plant-based sports supplements are good for fiber, vitamins, amino acids, and mineral sources.

Distribution Channel Insights

Hypermarkets & supermarkets dominated the market and accounted for the largest revenue share in 2023. Hypermarkets and supermarkets offer consumers accessibility and convenience. They also provide an extensive range of products under one roof. This includes a variety of sports supplements, such as supplement powders, energy bars, RTD (Ready-To-Drink) protein drinks, and more. This wide selection allows consumers to easily compare different brands and types of supplements, facilitating informed purchasing decisions.

The online segment is expected to grow at a significant CAGR during the forecast period due to the increasing awareness of consumers regarding health and fitness along with the customers preferring the ease of buying products sitting at home. The rise in e-commerce platforms and digital marketing strategies, such as social media promotions by manufacturers on social media platforms, has further propelled this growth. In addition, product availability, competitive prices, and access to customers’ reviews are contributing to the market growth.

Regional Insights

North America sports supplement market held the largest revenue share of 33.8% in 2023 due to the increasing adoption of a healthy lifestyle, demand for health & wellness products, developed retail infrastructure, innovation & product development, and high disposable income. A well-established retail network, including supermarkets, specialty stores, convenience stores, and online platforms, ensures the widespread availability of sports supplements. A higher disposable income in the region allows consumers to spend more on premium and health-oriented products, propelling the market growth.

U.S. Sports Supplement Market Trends

The U.S. sports supplement market held a significant market share in North America in 2023 owing to developed retail infrastructure, a strong consumer base for healthy products, and strong marketing and branding. In addition, targeted marketing through e-commerce and online shopping platforms increases the sale of sports supplements. The U.S. population has a large consumer base that is increasingly showing an interest in sports supplements.

Europe Sports Supplement Market Trends

Europe sports supplement market held a significant market share in 2023 due to growing awareness among consumers about health & nutrition, and a well-developed regional distribution network including supermarkets, convenience stores & online platforms. Consumers are increasingly interested in transparency regarding food ingredients. Increasing awareness about the environment is increasing the demand for plant-based sports supplements.

UK sports supplement market held a substantial market share in 2023 owing to increasing health concerns due to modern lifestyle contributing to opting for healthy practices such as gym and sports. The availability of sports supplements in mainstream supermarkets and convenience stores has increased their accessibility and popularity among health-conscious consumers. In addition, Celebrities and influencers promoting supplements on social media platforms have contributed to the increased awareness and demand for sports supplements.

Asia Pacific Sports Supplement Market Trends

Asia Pacific sports supplement market is expected to grow at the fastest CAGR during the forecast period. This growth is attributed to Increasing awareness of health and wellness, the growing middle class in the region, and Western influence on choices. Consumers are becoming more conscious of their health and thus are looking for healthier lifestyle practices such as gym, yoga, and sports. Moreover, the growing middle class in countries like China, India, and Australia is fueling demand for premium and imported products, including sports supplements. The increasing influence of Western dietary habits and lifestyles is driving the adoption of supplements in diet.

India sports supplement market is expected to grow significantly due to rapid urbanization and changing lifestyles, the influence of Western culture, and the growing middle class and young population. Rapid urbanization and changing lifestyles have led to the adoption of improved lifestyles and increased consumption of sports supplements. Moreover, the growing middle class with disposable income is driving demand for premium and imported food products, including sports supplements.

Key Sports Supplement Company Insights

Some of the key companies in the sports supplement market include Creative Edge Nutrition Inc., GlaxoSmithKline PLC, Universal Nutrition., Nature's Bounty, GNC Holdings, LLC

and others. Organizations are focusing on innovative offerings with different flavors to increase the consumer base. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Universal Nutrition provides high-quality nutritional products for bodybuilders and hard-training athletes worldwide. It offers a range of sports nutrition products, including the iconic Animal Pak, designed to inspire, educate, and empower individuals to live strong and healthy lives. Its offerings cater to those engaged in classic weight training and sports, with a special Naturals line for those seeking more balanced wellness solutions.

-

GNC Holdings, LLC is a global retailer of health and wellness products, specializing in sports supplements. It offers a wide range of products including pre-workouts, protein powders, energy drinks, and vitamins. These products are designed for athletes, fitness enthusiasts, and individuals seeking to enhance their physical performance and overall health. GNC’s offerings cater to various fitness goals, from muscle building to endurance and recovery, ensuring everyone finds the right supplement for their needs.

Key Sports Supplement Companies:

The following are the leading companies in the sports supplement market. These companies collectively hold the largest market share and dictate industry trends.

- Creative Edge Nutrition Inc.

- GlaxoSmithKline PLC

- Universal Nutrition.

- Nature's Bounty

- GNC Holdings, LLC

- Glanbia PLC

- Herbalife International of America, Inc.

- SciTec, Inc.

- Atlantic Grupa d.d.

- Enervit

Recent Developments

-

In October 2023, Glanbia’s Optimum Nutrition, a sports nutrition brand, launched Clear Protein, a new product featuring 100% plant protein isolate. This innovative clear protein shake offers 20g of high-quality protein per serving, supporting training and daily nutrition goals. Each serving also includes 3.6g of BCAAs (branched-chain amino acids), zero sugar, & is vegan society-approved.

Sports Supplement Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 38.80 billion |

|

Revenue forecast in 2030 |

USD 76.94 billion |

|

Growth Rate |

CAGR of 12.1% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, source, distribution channel, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Australia & New Zealand, Brazil, and South Africa |

|

Key companies profiled |

Creative Edge Nutrition Inc., GlaxoSmithKline PLC, Universal Nutrition, Nature's Bounty, GNC Holdings, LLC, Glanbia PLC, Herbalife International of America, Inc., SciTec, Inc., Atlantic Grupa d.d., Enervit |

|

Customization scope |

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Sports Supplement Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sports supplement market report based on product, source, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Capsules/Tablets

-

Powder

-

Liquid

-

Bar

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Animal-based

-

Plant-based

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."