Sports Protective Equipment Market Size, Share & Trends Analysis Report By Product, By Distribution Channel (Online, Offline), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-097-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Sports Protective Equipments Market Trends

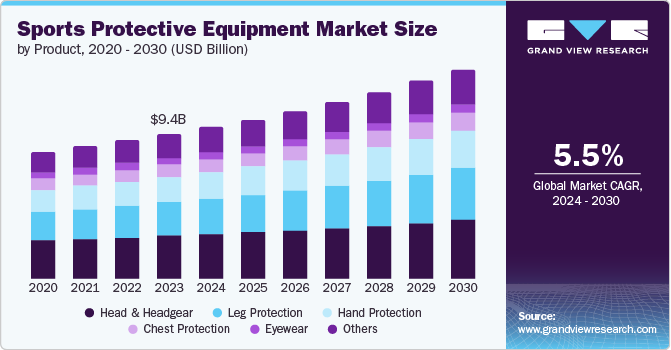

The global sports protective equipment market size was valued at USD 9.40 billion in 2023 and is projected to grow at a CAGR of 5.5% from 2024 to 2030. The increasing awareness about sports-related injuries and the importance of safety during physical activities have increased the demand for protective gear. Athletes, coaches, and parents are becoming more conscious of the risks associated with sports participation, driving the adoption of protective equipment across various sports disciplines

The increasing awareness about sports-related injuries and the importance of safety during physical activities have increased the demand for protective gear. Athletes, coaches, and parents are becoming more conscious of the risks associated with sports participation, driving the adoption of protective equipment across various sports disciplines. Many sports organizations and governing bodies mandate the use of specific protective gear to ensure the safety of participants. Athletes who comply with these regulations protect themselves and adhere to the standards set by their respective sports associations, promoting fair play and safety across the board.

Protective gear can contribute to the overall health and longevity of athletes' careers by minimizing the impact of repetitive stress on joints, muscles, and bones. For instance, knee pads in basketball or volleyball can help prevent chronic knee injuries that may develop over time due to constant jumping and landing.

Product Insights

Head & headgear dominated the market and accounted for a market revenue share of 29.9% in 2023. The increasing popularity of professional sports leagues such as the Indian Premier League (IPL), American Football League, and World Cycling League and the growing interest in sports in countries worldwide drive the demand for head protection products. Helmets and headgear protect athletes from head injuries, particularly in high-impact sports such as American football, ice hockey, and cycling. The rising awareness of the dangers linked to head injuries and concussions has fueled the need for advanced helmets that are of superior quality and technology.

Leg protection equipment is expected to register the fastest CAGR of 6.6% during the forecast period. Contact sports such as soccer, hockey, and American football inherently involve a higher risk of leg injuries due to physical impacts and collisions. As their popularity grows, so does the need for effective leg protection solutions. Sports leagues, schools, and recreational clubs are investing in leg protection equipment to safeguard players and adhere to safety regulations.

Distribution Channel Insights

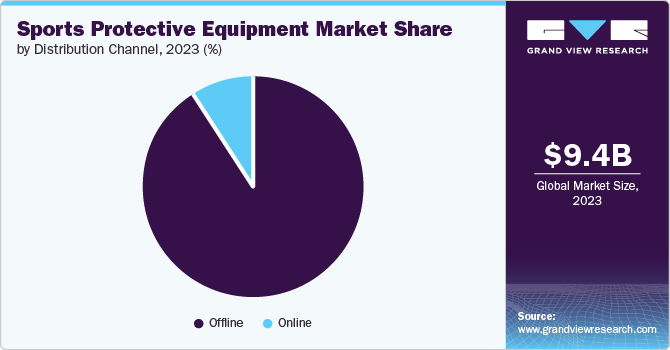

The offline distribution channel accounted for the largest market revenue share in 2023. The tactile nature of sports protective gear necessitates physical interaction before purchase. Consumers often prefer wearing helmets, pads, or guards to ensure proper fit and comfort. This hands-on experience provided by brick-and-mortar stores enhances customer satisfaction and reduces the likelihood of returns, driving sales through offline channels.

The online distribution channel is expected to register the fastest CAGR during the forecast period. The increasing penetration of the internet and smartphones has made online shopping more accessible and convenient for consumers. This shift towards digital platforms has led to a rise in online purchases of sports protective gear, as customers can easily browse a wide range of products and purchase from the comfort of their homes.

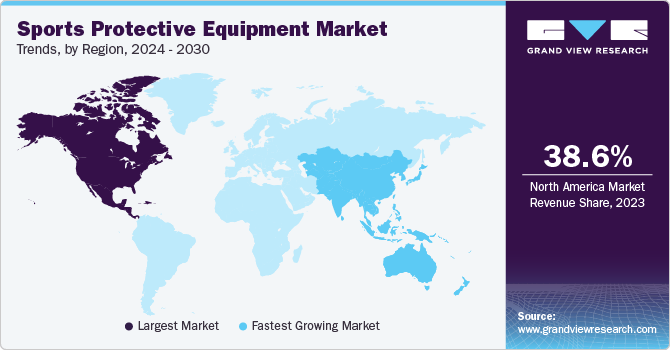

Regional Insights

North America sports protective equipment market accounted for the largest market revenue share of 38.6% in 2023. The Super Bowl, being one of the most-watched sporting events in North America, catalyzes the growth of the sport’s protective equipment market. As millions of viewers tune in to watch the game, there is heightened awareness about player safety and the importance of using proper protective gear. This increased visibility often leads to a surge in sales of sports protective equipment before and after the Super Bowl, as both professional and amateur athletes seek to enhance their safety measures.

U.S. Sports Protective Equipment Market Trends

The U.S. sports protective equipments market is anticipated to grow significantly over the forecast period. Due to high-profile injury cases and a deeper understanding of sports-related health risks, there has been a growing recognition of the importance of safety in sports. For instance, the National Football League (NFL) has introduced comprehensive concussion protocols and invested in research for better helmet technologies. The NFL’s Play Smart. Play Safe initiative focuses on improving helmet safety and reducing concussions through rigorous testing and innovation.

Europe Sports Protective Equipment Market Trends

The sports protective equipments market in Europe was identified as a lucrative region in 2023. The Union of European Football Associations (UEFA), the governing body for European football, has introduced regulations mandating the use of high-quality protective gear for players, including advanced shin guards and mouthguards. These efforts by European institutions have heightened the focus on sports safety, driving demand for state-of-the-art protective equipment.

The UK sports protective equipments market is expected to grow rapidly in the coming years. The increasing popularity of sports and fitness activities among the UK population is crucial in driving the demand for sports protective equipment. There has been a significant rise in participation in both organized sports and recreational fitness activities.

Asia Pacific Sports Protective Equipment Market Trends

The Asia Pacific sports protective equipments market is anticipated to register the fastest CAGR over the forecast period. The rise of fitness trends such as CrossFit and yoga has encouraged individuals to invest in high-quality protective gear. Additionally, events such as the Asian Games and the rise of professional sports leagues have fueled interest in sports. The increasing number of sports enthusiasts seeking to enhance their performance while minimizing injury risks directly drives demand for protective equipment such as helmets, knee pads, and mouthguards.

India sports protective equipments market is anticipated to grow significantly over the forecast period. Government initiatives promoting sports at the grassroots level proliferate India's sports protective equipment market. Programs such as the "Khelo India" scheme are designed to identify and nurture young talent in various sports disciplines by providing access to facilities, training, and equipment.

Key Sports Protective Equipment Company Insights

Some of the key companies in the sports protective equipments market include Amer Sports, Nike Inc., Adidas AG, Puma SE, Harrow Sports Inc., Under Armour, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Amer Sports provides a diverse array of products designed to enhance safety and performance across various sports disciplines. These offerings encompass protective gear for skiing, snowboarding, cycling, running, hiking, climbing, watersports, and team sports.

-

Nike Inc.'ssports protective equipment includes helmets, pads, guards, braces, and compression garments for different sports and levels of competition. These products are engineered using advanced technologies and materials to provide athletes with the necessary protection without compromising comfort or performance.

Key Sports Protective Equipment Companies:

The following are the leading companies in the sports protective equipments market. These companies collectively hold the largest market share and dictate industry trends.

- Amer Sports

- Nike Inc.

- Adidas AG

- Puma SE

- Harrow Sports Inc.

- Franklin Sports Inc.

- Bauer Hockey Inc.

- MIZUNO Corporation

- Schutt Sports Inc.

- Under Armour, Inc.

Recent Developments

-

In June 2024, Under Armour, Inc. partnered with the USA Football Team to serve as the official and exclusive outfitter for USA Football’s national teams, providing them with high-quality performance gear and protective equipment. This partnership aims to enhance player safety and performance by ensuring athletes are equipped with top-of-the-line protective gear during training and competitions.

Sports Protective Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 9.85 billion |

|

Revenue forecast in 2030 |

USD 13.58 billion |

|

Growth rate |

CAGR of 5.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, region |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, South Korea Brazil, Argentina, South Arabia, South Africa |

|

Key companies profiled |

Amer Sports, Nike Inc., Adidas AG, Puma SE, Harrow Sports Inc., Franklin Sports Inc., Bauer Hockey Inc., MIZUNO Corporation, Schutt Sports Inc., Under Armour, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

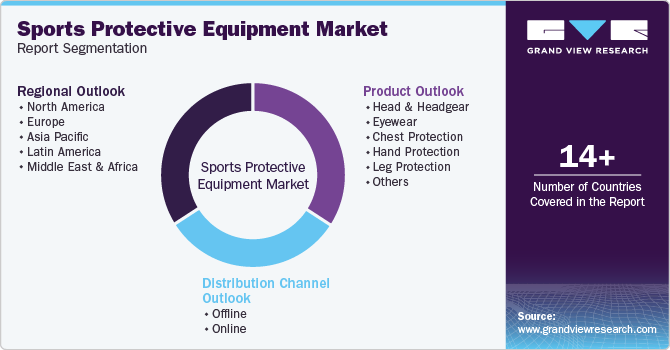

Global Sports Protective Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sports protective equipment market report based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Head & Headgear

-

Eyewear

-

Chest Protection

-

Hand Protection

-

Leg Protection

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

South Arabia

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."