Sports Nutrition And Dietary Supplements Testing & Certification Market Size, Share & Trends Analysis Report By Type (Stability Testing, Analytical Testing), By Ingredient (Vitamins, Amino Acids), By Service Provider, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-324-7

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

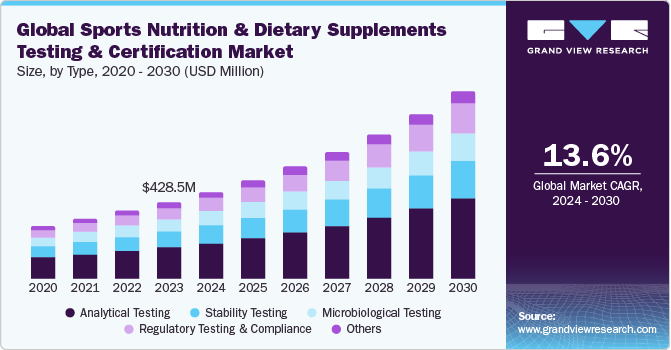

The global sports nutrition and dietary supplements testing & certification market size was estimated at USD 428.5 million in 2023 and is projected to grow at a CAGR of 13.60% from 2024 to 2030. Sale of counterfeit products in the market, increase in health consciousness and rise in awareness about sports nutrition & dietary supplement products, and increasing accessibility and availability of supplements are some of the factors driving market growth.

The spread of the COVID-19 pandemic has raised concern as well as awareness about the importance of a healthy lifestyle. It has led to the adoption of fitness exercises & healthy diet. A large number of people are now focused on self-care and are tracking their nutrition & health. This changing lifestyle trend has increased the adoption of sports nutrition. Many people are focused on self-care & preventive medication.

Ensuring the quality and availability of dietary supplements and sports nutrition has gained great importance. Customers seek assurance that the products they are purchasing are effective and safe as well as free from impurities. One approach to addressing this concern is through the implementation of certification and testing programs. Testing involves the thorough analysis of products to ensure that their contents align with the information provided on the label.

Moreover, providing accurate information about the benefits, proper usage, and potential risks associated with sports nutrition and dietary supplement products can help individuals make informed decisions about incorporating them into their fitness routines. Accessibility to dietary & sports nutrition is increasing due to the emergence of e-commerce and through reaching a wider audience through various channels, such as digital media, television, print, and influencers. Furthermore, companies in this industry are leveraging consumer insights to develop products that align with global health trends and address interconnected aspects of health such as digestive health, immune support, skin health, & mental wellness. Thus, the rapid launch of new products to address the growing consumer demand for effective, multifunctional, and personalized solutions is expected to propel the growth of various certification schemes that substantiate the claims made by these products.

The global COVID-19 pandemic has had a complex impact on the market growth. There has been a notable increase in demand for immune-boosting supplements as consumers seek to enhance their overall health during this challenging time. However, disruptions in supply chains, manufacturing operations, and distribution channels presented significant challenges for companies operating in this sector. In addition, owing to the travel restrictions and social distancing guidelines, testing and certification agencies implemented remote auditing procedures. This allowed them to continue assessing manufacturing facilities and product quality while minimizing physical contact. However, the increasing demand for sports nutrition products & dietary supplements and heightened focus on ensuring the safety and quality of these products post-pandemic are expected to drive the market growth in the near future.

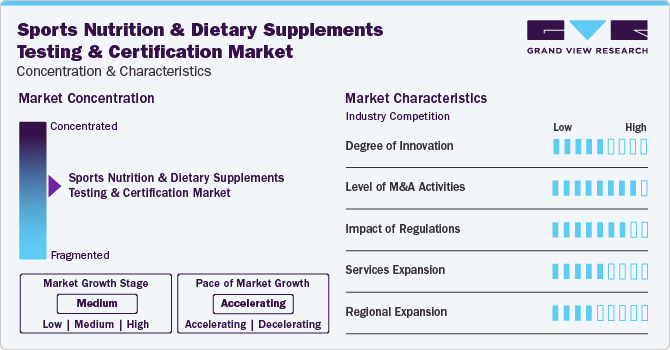

Market Concentration & Characteristics

Key players are involved in launching new products and services. They undertake this strategy to strengthen their product portfolios and offer their customers technologically advanced & innovative products. In February 2020, The National Measurement Laboratory at LGC Limited expanded its portfolio by launching a multiallergen reference material kit to detect allergens in food.

The market is marked by a high level of merger and acquisition activities carried out by various industry players. This is driven by several factors, including the desire to gain a competitive advantage in the industry and the need to consolidate in a rapidly growing market. For instance, in May 2023, SGS Société Générale de Surveillance SA acquired Nutrasource Pharmaceutical. This acquisition enabled SGS to expand its capabilities in health & nutrition in North America, complementing its global portfolio of solutions in the converging health, nutrition, and wellness industries.

Impact of regulations is high as testing and certification ensure that sports nutrition and dietary supplements meet regulatory standards and are safe for consumption. These services help manufacturers demonstrate compliance with regulations, assure consumers of product quality, and differentiate their products in a competitive market.

Numerous industry players are focusing on expanding their product and services portfolio. They are enhancing their product and service lines and provide their customers with integrated solutions. For instance, in January 2020, Eurofins Scientific launched the Food Assurance Business Line, which integrated the then-existing Food Assurance businesses in North America, Europe, and Asia. This new business line offers assurance services, such as auditing, certification, training, and consultation, including labeling services for international market access.

The industry is experiencing moderate regional expansion, driven by an increasing customer base for testing and certification services. Companies are strategically entering new markets to strengthen their presence. For example, in May 2024, NSF established a new headquarters in Brussels to enhance its presence in the European market.

Type Insights

Based on type, the analytical testing segment led the market with the largest revenue share of 41.02% in 2023. Increasing regulatory scrutiny from bodies like the FDA and EFSA requires comprehensive analytical testing to verify product purity, potency, and absence of contaminants. Rising consumer demand for transparency and high-quality products compels manufacturers to invest in thorough testing to ensure label accuracy & build consumer trust. The growing popularity of sports nutrition and dietary supplements, driven by heightened health consciousness and fitness trends, further boosts the need for reliable analytical testing. Moreover, technological advancements in analytical methods, such as High-Performance Liquid Chromatography (HPLC) and mass spectrometry, enhance the precision and efficiency of these tests, making them essential for product development and quality assurance.

The regulatory testing & compliance segment is expected to witness at the fastest CAGR of 15.31% over the forecast period. With the increasing focus on health, wellness, and performance, the sports and dietary nutrition industries have witnessed a surge in consumer demand for safe & effective products. This has led to a heightened emphasis on regulatory testing and compliance, as both consumers and regulatory bodies seek to ensure the quality, purity, & safety of these products. Furthermore, the rapid expansion of the market, fueled by rising health consciousness and fitness trends, requires manufacturers to adhere to stringent regulatory requirements to avoid costly recalls and legal penalties.

Ingredient Insights

Based on ingredient, the amino acid segment led the market with the largest revenue share of 25.46% in 2023. Consumers are increasingly seeking products that are safe, effective, and free from contaminants. The rising demand for high-quality amino acid supplements, which are essential for muscle growth, is a significant factor driving the segment. Core users or heavy users are focused on sports supplements required for muscle building, strength performance, endurance, and recovery. They are focused on supplements required for optimal athletic performance. According to the Journal of International Society of Sports Nutrition, in a survey conducted in 2018, 82.2% of athletes were using sports supplements, of which 60.6% were male athletes. Similarly, as per 2020 bodybuilding supplement statistics, 80.1% of gym-goers preferred protein supplements, while 36.8% consumed Branched Chain Amino Acids (BCAAs). This increasing demand for protein-based supplement options has led to a rise in the number of protein supplement products entering the market, which, in turn, is expected to result in a higher demand for protein testing and verification services in the near future.

The herbal segment is projected to witness at the fastest CAGR of 15.47% from 2024 to 2030. Increasing consumer demand for natural and herbal products, perceived as safer and healthier alternatives to synthetic supplements, plays a significant role. This trend is coupled with growing consumer awareness of potential contaminants, such as heavy metals, pesticides, and microbial impurities, which necessitates rigorous testing to ensure product safety & efficacy. Furthermore, technological advancements in testing methods, including sophisticated chromatography and mass spectrometry techniques, enhance the accuracy & reliability of detecting contaminants in herbal supplements. In addition, the increasing incidence of adulteration and mislabeling in the herbal supplement market highlights the need for comprehensive testing and certification to maintain consumer trust & brand integrity.

Service Provider Insights

Based on service provider, the testing laboratories & companies segment led the market with the largest revenue share of 70.22% in 2023. Testing laboratories play a vital role in the dietary supplements industry by ensuring products are safe, effective, and compliant with regulatory standards. It provides essential services to verify the quality of supplements. This includes testing for purity, potency, and composition to ensure products meet the highest standards. The demand for their services is driven by increasing consumer awareness, regulatory requirements, and the need for transparency & quality assurance. Advancements in testing technologies and the growth of the supplement market further propel the need for comprehensive testing and certification services.

The regulatory consulting companies segment is projected to witness at the fastest CAGR of 15.19% from 2024 to 2030. One significant trend in the market for supplements certification in regulatory consulting companies is the increasing complexity of regulatory requirements. As regulatory bodies worldwide tighten their regulations for the supplement industry, companies are facing a growing array of standards and guidelines that they must navigate to ensure compliance. Another trend is the rising demand for strategic regulatory guidance and support. Supplement companies are seeking more than just assistance with compliance; they are looking for partners who can help them develop long-term regulatory strategies that align with their business goals. Moreover, regulatory consulting firms are evolving to provide holistic regulatory solutions that encompass not only compliance but also strategic planning, risk management, and market access strategies.

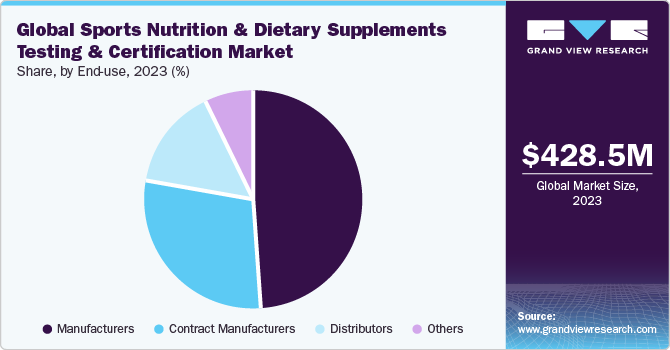

End-use Insights

Based on end-use, the manufacturers segment led the market with the largest revenue share of 48.92% in 2023, as manufacturers are increasingly prioritizing certifications that demonstrate the quality and safety of their products. Certifications such as Good Manufacturing Practices (GMPs), ISO 9001, and Hazard Analysis and Critical Control Points (HACCP) are becoming standard requirements to ensure compliance with industry standards and regulations. Moreover, manufacturers are collaborating with certification bodies, industry associations, and regulatory agencies to develop & promote standardized certification programs. Collaborative efforts enhance industry-wide alignment, credibility, and acceptance of certification standards, thereby boosting market growth.

The contract manufacturers segment is projected to witness at the fastest CAGR of 14.26% over the forecast period. Increasing regulatory scrutiny and stringent standards imposed by agencies such as the FDA, EFSA, and other international regulatory bodies drive contract manufacturers to obtain certifications. Compliance with regulations ensures that products meet the safety and quality standards required for market approval.

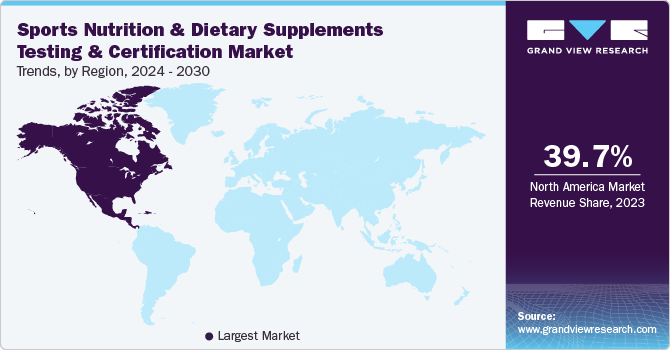

Regional Insights

North America dominated the sports nutrition and dietary supplements testing & certification market with the largest revenue share of 39.69% in 2023. The region experiences market growth. The growing athletic population and high demand for sports nutrition & dietary supplements among working individuals are anticipated to drive the demand for testing and certification of such products & ingredients in the region. In addition, stringent government regulations for the testing and certification of sports nutrition and dietary supplements further propel market growth.

U.S. Sports Nutrition And Dietary Supplements Testing & Certification Market Trends

The sports nutrition & dietary supplements testing & certification market in the U.S. is anticipated to experience at the fastest CAGR over the forecast period, due to the increasing demand for dietary supplements. The usage of supplements among Americans has steadily increased over the past 20 years, and as of 2021, 80% of Americans were consuming dietary supplements. Moreover, 55% of people in the U.S. were looking for supplements to have more energy, 53% to support immune health, 40% to support joint health, 37% to lose weight, 28% to build muscle, and 19% for after-exercise recovery. This growing demand highlights the need for thorough testing and certification to guarantee product safety and effectiveness.

Europe Sports Nutrition And Dietary Supplements Testing & Certification Market Trends

The sports nutrition & dietary supplements testing & certification market in Europe is anticipated to grow at the fastest CAGR over the forecast period, due to the increasing consumer awareness about the importance of health and fitness, the rise in disposable income, and the growing trend of adopting a healthy lifestyle.

The UK sports nutrition & dietary supplements testing & certification market is expected to grow at a significant CAGR over the forecast period. The increasing demand for sports supplements due to their various benefits, such as enhanced immunity and health is anticipated to support the UK market.

The sports nutrition & dietary supplements testing & certification market in France is expected to grow at a substantial CAGR over the forecast period. France has seen a growing demand for vegan-friendly nutritional supplements, with an increasing trend in supplement consumption over the past few years. In addition, several organic and inorganic initiatives undertaken by market participants is likely to boost market growth. For instance, in September 2022, Ozers raised USD 316.25 to introduce a unique microalgae sports supplement. Such innovative products require a specific emphasis on quality testing and certification.

The Germany sports nutrition & dietary supplements testing & certification market is expected to grow at the fastest CAGR over the forecast period, due to the increasing R&D expenditure on food technology projects and acquisitions & expansions by manufacturers of sports nutritional & dietary supplements. Moreover, the demand for sports nutrition supplements is booming due to increased health consciousness and desire for self-improvement. As per the German Federal Institute of Risk Assessment, around one-third of Germans consume dietary pills, capsules, or powder, and around 93% consider supplements essential for human life.

Asia Pacific Sports Nutrition And Dietary Supplements Testing & Certification Market Trends

The sports nutrition & dietary supplements testing & certification market in Asia Pacific is anticipated to witness at the fastest CAGR of 14.90% from 2024 to 2030. Rising awareness regarding healthy lifestyles coupled with growing consumption of dietary supplements are some of the factors bolstering market growth. Moreover, the increasing penetration of e-commerce platforms has elevated the accessibility and availability of sports nutrition and dietary supplement products, which is further expected to anticipate market growth.

The China sports nutrition & dietary supplements testing & certification market is anticipated to grow at the significant CAGR over the forecast period. With a population of 1.4 billion as of 2023, the demand for healthcare services is growing in China. As a result, there has been an increasing demand for nutritional supplements in recent years. Moreover, the demand for sports nutrition & dietary supplements has been consistently rising in China, driven by the expanding middle class and their increased disposable income. The government also supports the rising demand for nutritional products. For instance, in February 2022, the Chinese government announced plans to invest over USD 331 million in building sports venues for public use. In addition, the burgeoning emphasis on fitness and increasing sports participation contribute to market growth.

The sports nutrition & dietary supplements testing & certification market in Japan is expected to witness at a rapid CAGR over the forecast period. The increasing awareness of health, growing interest in preventive healthcare, rising number of people participating in sports, and changing consumer lifestyle & food preferences have led to a higher demand for sports nutrition & dietary supplements in the country. As a result, there is a growing need for testing and certification services to ensure the safety, quality, & efficacy of these products.

The India sports nutrition & dietary supplements testing & certification market is anticipated to grow at a fastest CAGR over the forecast period, due to a significant increase in the demand for sports nutritional supplements due to its large population and growing emphasis on personal health & wellness. The presence of several gyms and fitness centers in the country is also a significant factor responsible for the sale of sports nutritional products as these centers are involved in the marketing of these products. Thus, the increasing demand for nutritional supplements is driving the growth market. In addition, both government and private food testing laboratories in the country contribute to increased market competition.

Middle East And Africa Sports Nutrition & Dietary Supplements Testing & Certification Market Trends

The sports nutrition & dietary supplements testing & certification market in the Middle East and Africa is projected to grow at the fastest CAGR during the forecast period. The growing preference for a healthy lifestyle and increasing awareness about the benefits of protein-based sports nutrition products have fueled the intake of these products. In addition, the growth of e-commerce platforms has made sports nutrition products more accessible to consumers. Such a rise in consumption anticipates the need to test and certify these products, propelling market growth.

The Saudi Arabia sports nutrition & dietary supplements testing & certification market is expected to grow at a significant CAGR over the forecast period.The country is experiencing a significant rise in the consumption of sports nutrition and dietary supplements due to the increasing awareness about health and fitness among the population. The Saudi Food and Drug Authority (SFDA) is the primary regulatory body responsible for overseeing the import, manufacturing, distribution, and sale of sports nutrition and dietary supplements in Saudi Arabia. The SFDA sets stringent requirements for these products’ quality, safety, and labeling. To ensure compliance with these regulations, manufacturers must obtain SFDA approval before marketing their products in Saudi Arabia.

The sports nutrition & dietary supplements testing & certification market in Kuwait is anticipated to witness at a rapid CAGR over the forecast period, due to the increasing awareness of health and fitness among the population. The demand for high-quality products that are safe and effective has led to a surge in the need for testing and certification services in this industry.

Key Sports Nutrition And Dietary Supplements Testing & Certification Company Insights

Key players operating in the global market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling the market growth.

Key Sports Nutrition And Dietary Supplements Testing & Certification Companies:

The following are the leading companies in the sports nutrition and dietary supplements testing & certification market. These companies collectively hold the largest market share and dictate industry trends.

- NSF International

- Eurofins Scientific

- Intertek Group plc

- BSCG LLC

- UL LLC

- Canadian Analytical Laboratories Inc.

- TÜV SÜD

- SGS Société Générale de Surveillance SA (Nutrasource)

- LGC Limited

- ConsumerLab.com

- The United States Pharmacopeial Convention (USP)

Recent Developments

- In April 2024, Amazon announced that it requires the sellers to submit test results of dietary supplements to one of the three Testing, Inspection, and Certification (TIC) entities-NSF, UL, and Eurofins. However, companies can continue to test ingredients using ISO 17025-accredited labs, including internal ISO labs; however, sellers will be required to submit testing data to one of the three mentioned TIC organizations

-

In February 2024, The Sports Ministry of Government of India, inaugurated a supplement testing laboratory in Gandhinagar, Gujrat, India. This laboratory, established in collaboration with the National Forensic Science University and the Food Safety Standards Authority of India, tests prohibited substances in dietary supplements used by athletes

-

In January 2023, NSF launched around 229 GMP registrations for nutritional supplements in China. This registration program includes audit requirements on the basis of Chinese manufacturing & product safety standards harmonized with the U.S. GMP and industry best practices

-

In August 2022, Eurofins Scientific announced the acquisition of Japan-based Company QSAI Analysis & Research Center Co., Ltd. This acquisition aided Eurofins to expand its presence in Japan and leverage its food testing services with pesticide testing, veterinary drugs, foreign objects, and sensory testing services

-

In June 2022, Eurofins entered the Saudi Arabia food & pharmaceutical product testing market by acquiring Ajal for Laboratories

-

In May 2021, Intertek announced the expansion of its health, regulatory, and environmental consultancy business line in Russia and Spain. This expansion complements the company’s existing testing services in the food & nutrition sector, assisting clients in regulatory compliance and product approval

-

In January 2021, SGS acquired Analytical & Development Services (ADS), a UK-based company, to strengthen its position in the UK food testing services market

Sports Nutrition And Dietary Supplements Testing & Certification Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 485.1 million |

|

Revenue forecast in 2030 |

USD 1,042.6 million |

|

Growth rate |

CAGR of 13.60% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, ingredient, service provider, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; New Zealand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

NSF International; Eurofins Scientific; Intertek Group plc; BSCG LLC; UL LLC; Canadian Analytical Laboratories Inc.; TÜV SÜD; SGS Société Générale de Surveillance SA (Nutrasource); LGC Limited; ConsumerLab.com; and The United States Pharmacopeial Convention (USP) |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Sports Nutrition And Dietary Supplements Testing & Certification Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sports nutrition and dietary supplements testing & certification market report based on type, ingredient, service provider, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Stability Testing

-

Analytical Testing

-

Microbiological Testing

-

Regulatory Testing & Compliance

-

Others

-

-

Ingredient Outlook (Revenue, USD Million, 2018 - 2030)

-

Herbal

-

Vitamins

-

Minerals

-

Amino Acids

-

Enzymes

-

Probiotics

-

Others

-

-

Service Provider Outlook (Revenue, USD Million, 2018 - 2030)

-

Testing Laboratories & Companies

-

Contract Research Organizations (CROs)

-

Regulatory Consulting Companies

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Manufacturers

-

Contract Manufacturers

-

Distributors

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

New Zealand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global sports nutrition and dietary supplements testing & certification market size was estimated at USD 428.5 million in 2023 and is expected to reach USD 485.1 million in 2024.

b. The global sports nutrition & dietary supplements testing & certification market is expected to grow at a compound annual growth rate of 13.60% from 2024 to 2030 to reach USD 1,042.6 million by 2030.

b. North America dominated the sports nutrition and dietary supplements testing & certification market with a share of 39.69% in 2023. This is attributable to rising awareness about certification and testing programs in the region coupled with growth in demand for sports nutrition products.

b. Some key players operating in the sports nutrition and dietary supplements testing & certification market include NSF International; Eurofins Scientific; Intertek Group plc; BSCG LLC; UL LLC; Canadian Analytical Laboratories Inc.; TÜV SÜD; SGS Société Générale de Surveillance SA (Nutrasource); LGC Limited; ConsumerLab.com; and The United States Pharmacopeial Convention (USP).

b. Key factors that are driving the market growth include the increase in health consciousness and rise in awareness about sports nutrition & dietary supplement products and increasing accessibility and availability of supplements.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."