- Home

- »

- Healthcare IT

- »

-

Spiritual Wellness Apps Market Size, Industry Report, 2033GVR Report cover

![Spiritual Wellness Apps Market Size, Share & Trends Report]()

Spiritual Wellness Apps Market (2025 - 2033) Size, Share & Trends Analysis Report By Platform (Android, iOS), By Device (Smartphones, Tablets), By Subscription (Paid, Free), By Type (Meditation & Mindfulness Apps, Yoga & Movement-Based Spirituality Apps), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-444-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Spiritual Wellness Apps Market Summary

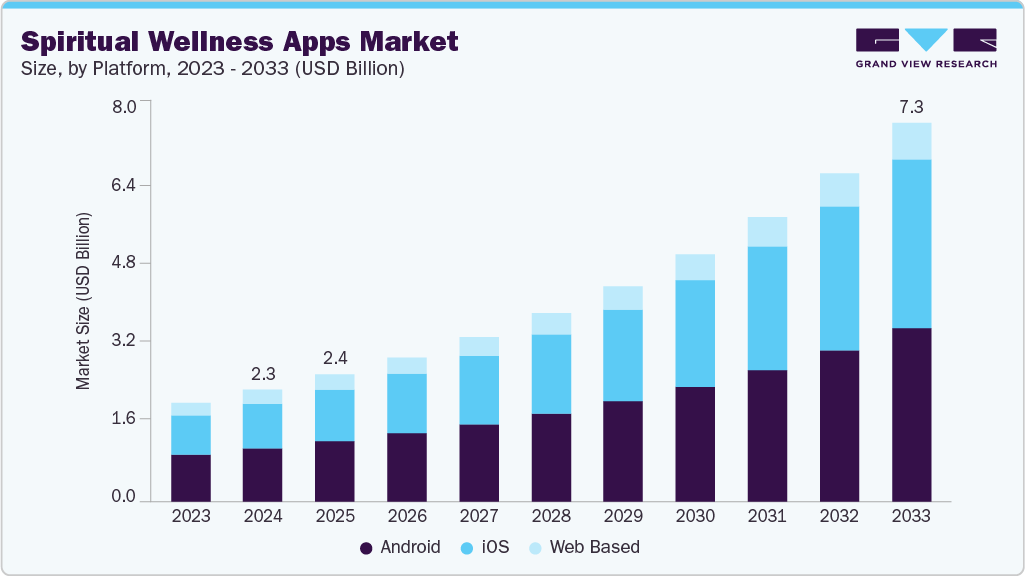

The global spiritual wellness apps market size was estimated at USD 2.16 billion in 2024 and is projected to reach USD 7.31 billion by 2033, growing at a CAGR of 14.63% from 2025 to 2033. Factors such as the rising number of people suffering from depression, anxiety, and stress, rising awareness regarding mental health, increasing use of tablets and smartphones, and favorable government initiatives that promote meditation and yoga drive market growth.

Key Market Trends & Insights

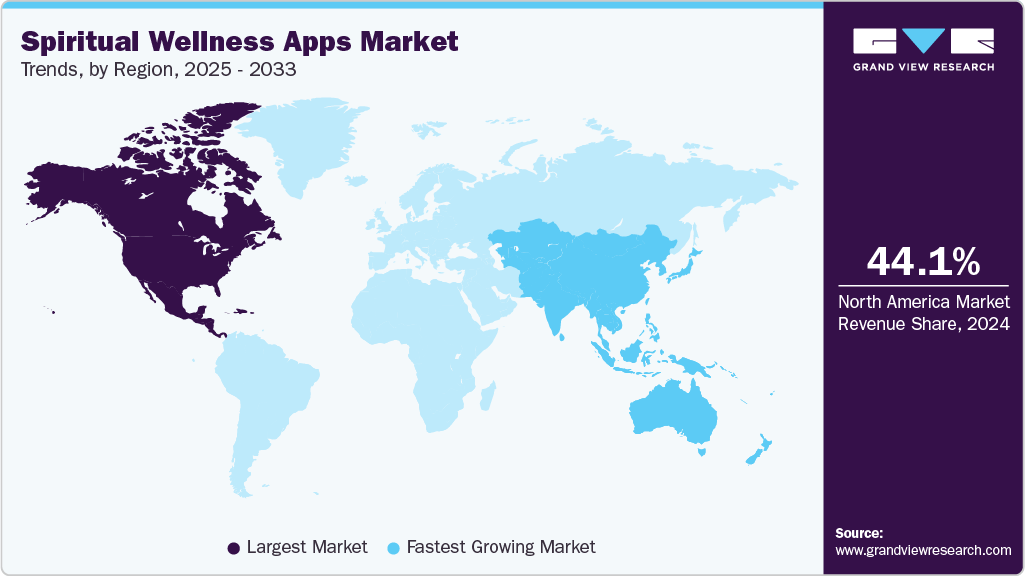

- North America spiritual wellness apps market dominated the global market in 2024 and accounted for the largest revenue share of 44.14%.

- The spiritual wellness apps market in the U.S. held the largest share in 2024.

- By platform, the Android segment dominated the market in 2024 with a revenue share of 47.84%.

- By device, the smartphones segment dominated the market in 2024 and accounted for the largest revenue share of 57.06%.

- By subscription, the the paid (In-App Purchase) segment dominated the market in 2024 with a revenue share of 62.94%.

Market Size & Forecast

- 2024 Market Size: USD 2.16 Billion

- 2033 Projected Market Size: USD 7.31 Billion

- CAGR (2025-2033): 14.63%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

For instance, in June 2024, YogaRenew, an online yoga school, launched its digital app with an extensive library of online yoga workshops, classes, series, and dharma talks. Government initiatives and rapid digitalization promoting meditation and yoga positively impact the market growth. For instance, in May 2024, with a new policy, the UK government anticipates liberating approximately 5,000 court days across England and Wales. This policy mandates that individuals in claims valued at or below USD 13,214.1 engage in a compulsory one-hour mediation session. The Small Claims Mediation Service by the HM Courts & Tribunals Service (HMCTS) offers this session free of cost.

Rising scientific research has supported the health benefits of practicing yoga. This research has led to endorsements from healthcare professionals, which have created potential growth opportunities for the market. In March 2024, Gwyneth Paltrow became co-owner of Moments Of Space. It is an AI-powered meditation app which promotes a non-conventional approach, offering guided practices designed for busy lifestyles; she highlighted how the method has been transformational in her daily life and aims to make meditation more accessible to beginners and skeptics.

The rise in the launches of affirmation and positivity apps and the government's collaboration with market players to enhance individuals' mental well-being fuel the market growth. For instance, in August 2024, Love Expands introduced a Self-Care Super App that features a gratitude journal, positive affirmations, inspirational quotes, and soundscapes. This app aims to enhance sleep, wellness, and motivation for a happier life. It transforms digital mental health care by offering all the necessary features to enhance positivity and mental well-being.

Virtual app vendors focus on launching innovative solutions and extending their geographical reach through different strategies such as partnerships, product launches, collaborations, and approvals. They offer free premium access to users and support in maintaining their mental health at home. In March 2024, Digital mental health company Headspace launched Headspace XR. A new VR app on Meta Quest is designed to strengthen the mind-body connection through movement, breathwork, mood-boosting games, and guided meditations, aiming to engage younger audiences, especially Gen Z.

Healthcare Mobile App Trends

Analyst Perspective: Mindfulness Apps have gained traction owing to the COVID-19 pandemic. The dynamics for digital health have changed, and hence, developments in mobile health would be one of the pioneering parameters to demonstrate the growth of healthcare IT in the coming years.

Mobile health apps are designed to support health & wellness. The popularity of these apps is expected to grow due to the rising adoption of meditation and mindfulness apps that help individuals in meditation. This trend is driven by the increasing consciousness about maintaining a healthy lifestyle and easy accessibility to the internet & smartphones. In addition, growing awareness of the benefits of meditation and yoga on mental health is expected to contribute to the increasing adoption of these apps, thus supporting market growth. In September 2024, Mindvalley collaborated with Apple to emphasize personal development. Their app comes pre-installed on display devices in Apple Stores around the globe and is integrated with Apple Vision Pro. It provides AI-driven personalized learning, immersive meditation experiences, and transformative programs designed to enhance accessibility and engagement in self-improvement.

Hallow: Startup Case Study

Overview

Hallow is a Chicago-based startup that offers guided prayer, meditation, and Bible-based content specifically for Catholics. The platform focuses on spiritual well-being by providing available audio resources and instruments that help users maintain consistent prayer practices. The app uses mobile technology to deliver personalized experiences, track progress, and foster community engagement.

Founded: 2018

Headquarters: Chicago, Illinois, USA

Industry: Spiritual wellness / faith-based digital content

Status: Active

Business Model

-

Free trial of mobile app with paid subscription tiers.

-

Target Users: Catholics seeking digital tools for meditation, prayer, and spiritual growth.

-

Subscription Pricing: Monthly ~USD 9.99, Annual ~USD 69.99, Family Plan ~USD 119.99.

- Revenue Source: Primarily from subscription fees, with bulk subscriptions offered to institutions such as schools and parishes.

Key Problems Addressed

-

Limited availability of sound, Catholic-specific spiritual content.

-

Difficulty sustaining regular prayer or meditation routines in modern, distracted lifestyles.

-

Lack of digital community features to support collective spiritual engagement.

Features & Solutions

-

Guided Spiritual Content: Audio prayers, meditations, Bible stories, and reflections aligned with Catholic teachings.

-

Habit-Building Tools: Enabling daily and weekly goals, progress tracking, and push notifications encourages consistent practice.

-

Community Engagement: Prayer families allow users to connect, share intentions, and participate in communal challenges.

- Accessibility: Mobile-friendly design ensures content is available anywhere, anytime.

Growth & Metrics

-

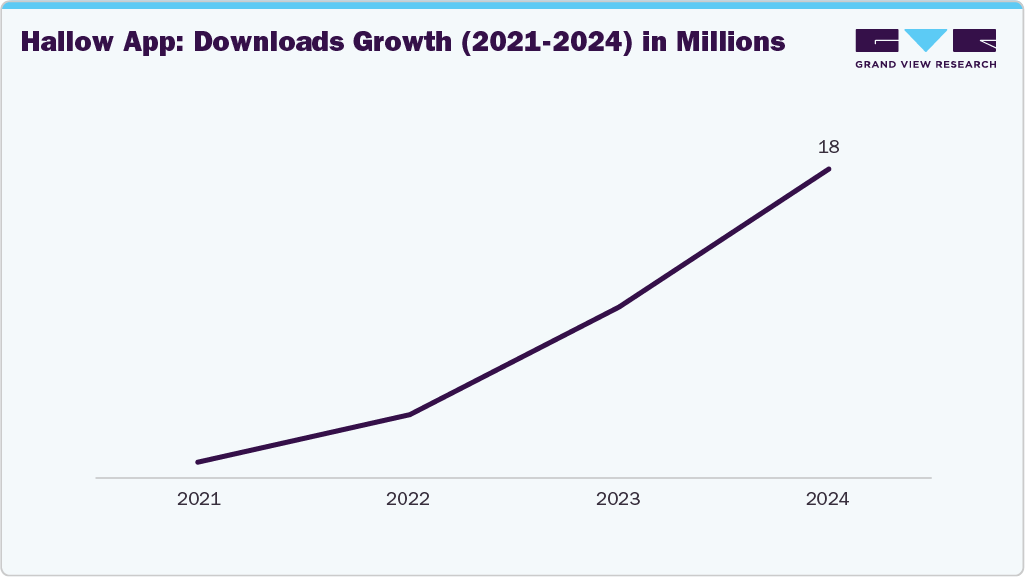

Downloads: Over 18 million as of November 2024.

-

Funding: Total USD 105 Million; latest Series C USD 50 Million (May 2023).

-

Ratings: 4.7 stars on Google Play Store (1k+ reviews).

Market & Competition

-

Primary Market: Catholic population (1.3 billion), seeking digital spiritual wellness solutions worldwide.

-

Competitors: Glorify, Amen, PrayerMate, Pray.com, Soultime Christian, First15.

- Differentiation: Catholic-focused content, integrated habit-forming tools, and digital community support distinguish Hallow from broader mindfulness and meditation apps.

Conclusion

Hallow illustrates the opportunities in the faith-based digital wellness sector. It provides tailored content, habit formation, and community features that have driven rapid adoption, strong user engagement, and significant funding. Hallow's success underscores the potential of targeted, niche applications to deliver both user value and sustainable business growth.

Key Takeaways

-

Focus on Niche Markets: Targeting a specific audience allows for tailored features and deeper engagement.

-

Combine Content with Habit Formation: Meaningful content coupled with tools for routine-building enhances long-term user retention.

-

Community Engagement Matters: Providing a platform for group interaction improves user loyalty and satisfaction.

-

Scalable Revenue Model: Free trial plans added to subscriptions provide wide accessibility while supporting monetization.

- Strategic Differentiation: Specialized content and user-centric design are critical in competitive wellness and meditation markets.

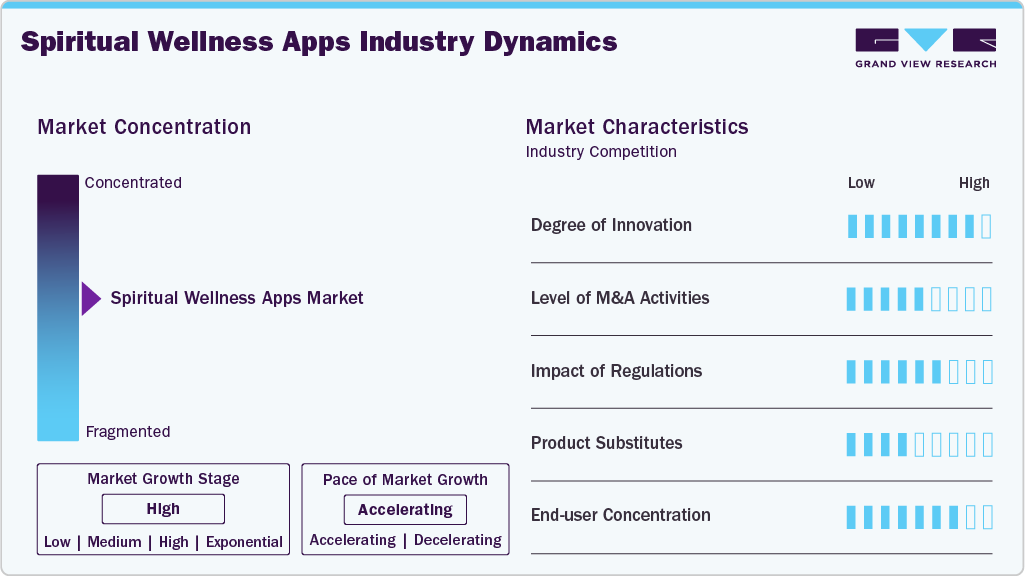

Market Concentration & Characteristics

The industry has been characterized by a high degree of innovation due to integrating artificial intelligence (AI) in spiritual solutions and the rise in app launches. For instance, in December 2023, Maureen J. St Germain, author and spiritual teacher at St. Germain Mystery School, introduced Illuminate. This meditation app marks a significant leap in spiritual apps, providing an immersive and unique experience for users seeking spiritual exploration and growth.

The industry is characterized by a medium level of merger and acquisition (M&A) activity. The market players undertake mergers & acquisitions to expand their product portfolio, further contributing to industry growth. For instance, in March 2023, Labayh, a Saudi Arabia-based health tech startup, acquired Nafas, a UAE-based meditation app to enhance psychological well-being in Arab countries.

The Federal Trade Commission (FTC) Act enforces consumer protection laws and monitors unfair or deceptive practices. If apps collect personal information, they must provide clear and accurate privacy policies. In the U.S., there is no federal law equivalent to the General Data Protection Regulation (GDPR), but several states have enacted their privacy laws. For example, in 2018, California introduced the California Consumer Privacy Act, giving consumers more control over the personal information businesses collect about them. Other states, such as Virginia, Colorado, and Connecticut, have similar privacy laws based on user location and data collection practices.

Several market players are expanding their business by introducing new spiritual wellness solutions to strengthen their market position and expand their product portfolio. For instance, in June 2024, Churchome, a U.S.-based company, launched the Churchome app to help individuals identify where they are on their spiritual journey and curate content to improve their spiritual growth.

The industry is marked by considerable regional growth, as businesses are focusing on localizing their content and customizing solutions to meet the cultural and language preferences of different areas. The Asia-Pacific and Latin America regions have seen notable growth, fueled by increased smartphone usage and a rising interest in mindfulness practices. Meanwhile, North America and Europe continue to be established markets with consistent levels of adoption.

Platform Insights

By platform, the android segment dominated the market in 2024 with a revenue share of 47.84%. Factors such as the rapidly increasing number of Android users and the growing adoption of smartphones globally are anticipated to fuel segment growth. Furthermore, there are growing downloads of meditation and yoga apps on Android phones to stay active and relieve stress and anxiety. For instance, according to data published by BankMyCell.com in March 2024, approximately 3.9 billion expected active Android smartphone users are spread across 190 countries worldwide.

However, the iOS-segment is expected to grow at the fastest CAGR over the forecast period. The growing adoption of iOS-based Apple devices among customers is attributed to the segment's growth. For instance, according to data published by Backlinko in April 2024, approximately 1.5 billion expected active iPhone users are spread across the globe. iOS is a mobile operating system developed by Apple Inc. for its devices, and its high adoption rate boosts segment growth.

Device Insights

By device, the smartphones segment dominated the market in 2024 and accounted for the largest revenue share of 57.06%. Smartphones have evolved from communication and entertainment devices to devices that can monitor health and fitness. With the widespread use of smartphones and the ready availability of advanced technology, innovators are investing in opportunities to provide various mindfulness and yoga apps. For instance, according to data published by Exploding Topics in June 2024, approximately 276.14 million individuals in the U.S. own a smartphone.

The wearable devices segment in the market is anticipated to witness the fastest CAGR over the forecast period. Technological advancements, growing investments, and the rise in the launch of new products fuel the market growth. For instance, in August 2022, Muse (InteraXon Inc.), a U.S.-based meditation app provider, raised funding of USD 9.5 million in a Series C round led by Sonny Vu’s Alabaster, BDC Capital, and Export Development Canada.

Subscription Insights

By subscription, the paid (In-App Purchase) segment dominated the market in 2024 with a revenue share of 62.94%, owing to the growth in disposable incomes and the rising working population suffering from stress and depression, which increased demand for self-care apps. For example, the Muse (InteraXon Inc.) app offered by Muse (InteraXon Inc.) collects real-time data on brain and body signals through sensors embedded in headbands and converts it into peaceful weather sounds. Thus, such factors fuel market growth.

The free segment in the market is anticipated to register the fastest growth rate over the forecast period. These applications attract a broad audience, particularly in developing regions, as they provide key functionalities without any initial payment. The rising adoption of smartphones and the expansion of internet access enable individuals across various demographics to explore wellness applications for free, contributing to the segment's growth. For example, Neuphony, a brain training app, is available free of cost. It is an app for free meditations and cognitive insights such as calm, focus, and mood, with neurofeedback for brain training. In April 2025, Life Time introduced its first-ever Mindful May program in Chanhassen, Minnesota, offering free guided meditation, breath work, and purpose-driven practices through its app. Centered on spiritual wellness, the initiative encourages users to build daily mindfulness habits that support stress reduction, better sleep, and a stronger sense of balance.

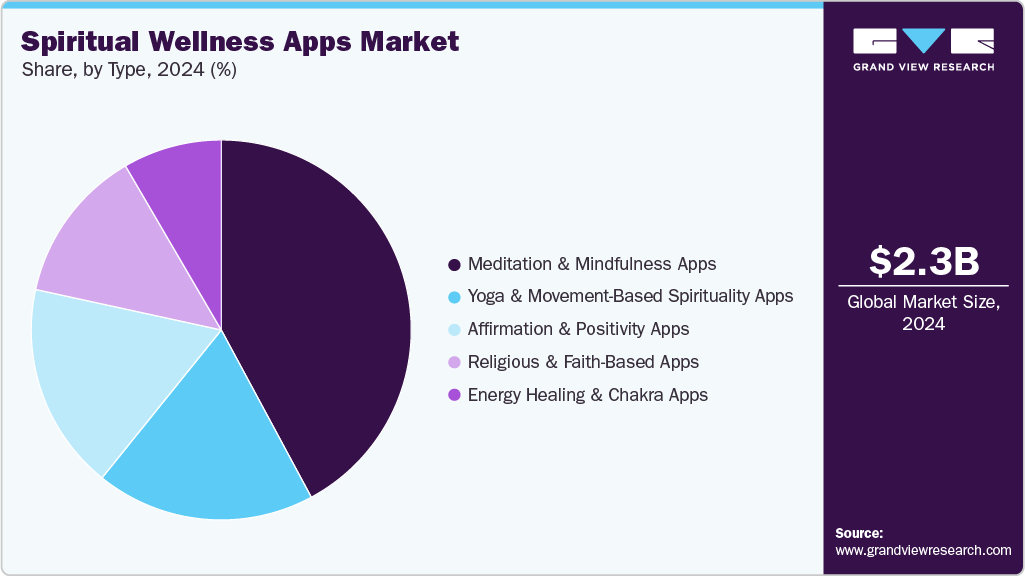

Type Insights

By type, the meditation and mindfulness apps dominated the market with a revenue share of 42.14% in 2024. The rising prevalence of mental health disorders such as depression and anxiety, and growing healthcare expenditures, fuel the demand for meditation and mindfulness apps across the globe. For instance, according to data published by the Kaiser Family Foundation (KFF) in February 2023, over 30% of adults reported symptoms of anxiety and depression in the U.S. Similarly, in March 2023, according to the World Health Organization (WHO), approximately 280 million individuals globally suffered from depression.

The yoga and movement-based spirituality apps segment is anticipated to register the fastest growth rate over the forecast period. Factors such as growing consumer awareness of health and wellness, the popularity of online yoga platforms, and the rise in adoption of various strategies by market players and public organizations fuel the market growth. Yoga offers diverse benefits beyond physical fitness, such as improved flexibility, stress reduction, emotional well-being, and mental clarity. In February 2025, Spirit Daughter launched Moment. A wellness app that provides bite-sized energy-raising sessions which include meditation, mindfulness, and gentle movement. The app includes guided visualizations, affirmations, and movement practices to help users release tension and boost energy.

Regional Insights

North America spiritual wellness apps market dominated in 2024 and accounted for the largest revenue share of 44.14%. This dominance is attributed to rising mobile utilization, growing 5G networks, increasing healthcare expenditures, and growing government initiatives and funding that drive regional market growth. Increasing awareness towards yoga and its benefits boosts market demand in this region.In February 2024, Mindvalley launched its first fully interactive meditation and personal development app on Apple’s Vision Pro. It is developed with Framestore, which offers VR-based guided meditations in natural environments, public speaking simulations, and access to its personal growth library.

U.S. Spiritual Wellness Apps Market Trends

The spiritual wellness apps market in the U.S. held the largest share in 2024. Market growth is fueled by factors such as innovative software development, the presence of multiple market players, and the rise in funding. For instance, in March 2023, Mitgo, a tech company, announced investing in the meditation, mindfulness, and sleep quality mobile app, Practico.

Europe Spiritual Wellness Apps Market Trends

The spiritual wellness apps market in Europe is anticipated to register a significant growth rate during the forecast period. Factors such as developments in coverage networks, rising smartphone adoption, and increasing internet and social media penetration fuel market growth in this region. In July 2025, See Yoga Retreats in Las Palmas, Gran Canaria, broadened its services to include new meditation retreats and Spanish language classes alongside adaptable yoga programs.

Germany spiritual wellness apps market is anticipated to register a significant growth rate during the forecast period.Technological advancements, such as the widespread adoption of smartphones and the availability of high-speed internet, have made spiritual apps more accessible. They allow users to engage with content anywhere and at any time, which boosts market growth. In January 2025, according to DataReportal, Germany’s population stood at 84.4 million with a median age of 45.5 years. Internet penetration reached 93.5%, translating to nearly 79 million users.

The UK spiritual wellness apps market is anticipated to register a considerable growth rate during the forecast period. Technological advancements, development in the healthcare IT industry, and the rise in the adoption of various strategies by market players fuel the market's growth. For instance, in December 2023, Bear Grylls, a British adventurer and writer, partnered with Neil Smith, a former TV producer and mental health expert, to launch Mettle, a meditation app for men.

Asia Pacific Spiritual Wellness Apps Market Trends

The spiritual wellness apps market in Asia Pacific is anticipated to register the fastest growth over the forecast period. The widespread adoption of smartphones and improved Internet connectivity has made self-care apps more accessible to a broader audience. This trend is expected to empower individuals to prioritize their mental and emotional well-being, leading to increased usage of these applications. For example, in 2023, 5G subscriptions in the Asia Pacific region stood at 61 million, making up more than 20% of all mobile subscriptions in Australia, Singapore, Malaysia, and Thailand.

Australia spiritual wellness apps market is anticipated to register a considerable growth rate during the forecast period.The "Spirituality and Wellness in Australia" project investigates Australians' growing interest in and association with spirituality. Research funded by the Australian Research Council on the "Worldviews of Australia's Generation Z" shows that approximately a quarter of Australian teenagers consider themselves 'spiritual but not religious,' while 8% identify as 'spiritual and religious.' Thus, such factors boost the demand for self-care apps.

Latin America Spiritual Wellness Apps Market Trends

The spiritual wellness apps industry in Latin America is witnessing considerable growth. The rapid increase in smartphone penetration and internet connectivity across Latin America has made digital content more accessible. In October 2024, according to GSMA, mobile data use in Latin America is growing, particularly in video streaming and messaging related to mindfulness and meditation apps. In Bolivia, browsing and streaming make up almost 75% of traffic, while in Chile, streaming is at 35%, showing a rising demand for spiritual wellness content.

Brazil spiritual wellness apps market is anticipated to register a considerable growth rate during the forecast period. The availability of numerous prayer and meditation apps in the country boosts demand. For example, Aquarius is an app that provides series and documentaries about meditation, yoga, sustainability, and spirituality. In August 2024, an article in Frontiers in Psychology reported a pilot study on “Eu + Compassivo,” a self-compassion-based app for Brazilian college students.

Middle East and Africa Spiritual Wellness Apps Market Trends

The Middle East and Africa region is experiencing a lucrative growth rate in the spiritual wellness apps market. With the widespread adoption of mobile technology, there is a rising trend toward applications offering easy access to spiritual guidance. A growing focus on mental health and wellness, propelled by various social and economic pressures in the region, has boosted the demand for apps focusing on mindfulness, meditation, and emotional resilience. In December 2023, according to GSMA, mobile technologies and services generated 5.5% of MENA’s GDP, contributing USD 310 billion in economic value and supporting 1.3 million jobs. By year-end, 427 million people (64% of the population) subscribed to mobile services, while mobile internet penetration reached 49% (327 million users), nearly triple the figure a decade earlier.

UAE spiritual wellness apps market is anticipated to register the fastest growth rate during the forecast period. Industry players are adopting various strategies, such as geographical expansion, partnerships, and collaborations, fueling self-care apps. In June 2025, UAE-based start-up Wishtok launched the country’s first all-in-one wellbeing app, offering therapy, life coaching, and spiritual guidance through over 300 certified professionals.

Key Spiritual Wellness Apps Company Insights

Key players operating in the spiritual wellness apps market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Spiritual Wellness Apps Companies:

The following are the leading companies in the spiritual wellness apps market. These companies collectively hold the largest market share and dictate industry trends.

- Headspace Inc.

- Sattva

- Insight Network Inc.

- Breethe

- Sleep Reset (Ingenio)

- Muse (InteraXon Inc.)

- Mindbliss Inc.

- Enso Meditation (Fascinative Labs).

- Flowtime (Enter Technology Co., Ltd.)

- Calm

Recent Developments

-

In August 2025, Theraexpressions Meditation LLC marked its 10-year anniversary by rolling out an upgraded version of its wellness app, OM Your Mental Health, available on both Apple and Google Play in 176 countries.

-

In February 2025, Spirit Daughter, a wellness and astrology platform, launched a new mindfulness and meditation app designed to elevate users' energy and offer motivational guidance.

-

In May 2025, TikTok introduced an in-app meditation feature aimed at improving sleep and curbing late-night scrolling, with guided exercises triggered during “sleep hours” by default for users under 18, alongside broader safety updates and a USD 2.3M donation to global mental health organizations.

-

In June 2024, Churchome, a U.S.-based company, launched the Churchome app to help individuals identify where they are on their spiritual journey and curate content to improve their spiritual growth.

-

In March 2023, Zoga Wellness, a health and wellness solutions provider, introduced Zoga, a yoga and meditation app. It provides guided meditation and features an Asana library with real-time AI-based posture correction feedback.

-

In March 2023, Mitgo, a tech company, announced investing in the meditation, mindfulness, and sleep quality mobile app, Practico.

Spiritual Wellness Apps Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.45 billion

Revenue forecast in 2033

USD 7.31 billion

Growth rate

CAGR of 14.63% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, device, subscription, type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Headspace Inc.; Sattva; Insight Network Inc.; Breethe; Sleep Reset (Ingenio); Muse (InteraXon Inc.); Mindbliss Inc.; Enso Meditation (Fascinative Labs).; Flowtime (Enter Technology Co., Ltd.), Calm

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Spiritual Wellness Apps Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country level and provides an analysis of industry trends in each of the sub segments from 2021 to 2033. For this study, Grand View Research, Inc. has segmented the global spiritual wellness apps market report on the basis of type, platform, device, subscription, and region:

-

Platform Outlook (Revenue, USD Million, 2021 - 2033)

-

Android

-

iOS

-

Web Based

-

-

Device Outlook (Revenue, USD Million, 2021 - 2033)

-

Smartphones

-

Tablets

-

Wearable Devices

-

-

Subscription Outlook (Revenue, USD Million, 2021 - 2033)

-

Paid (In App Purchase)

-

Free

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Meditation and Mindfulness Apps

-

Yoga and Movement-Based Spirituality Apps

-

Affirmation and Positivity Apps

-

Religious and Faith-Based Apps

-

Energy Healing and Chakra Apps

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. North America dominated the spiritual wellness apps market in 2024 and accounted for the largest revenue share of 44.14%, owing to rising mobile usage, growing 5G networks, increasing healthcare expenditures, and growing government initiatives and funding driving the regional market growth.

b. Some key players operating in the market include Headspace Inc., Sattva, Insight Network Inc., Breethe, Simple Habit, Muse, Mindbliss Inc., Enso Meditation., Flowtime, Calm

b. Factors such as the rising number of people suffering from depression, anxiety, and stress, rising awareness regarding mental health, increasing use of tablets and smartphones, and favorable government initiatives that promote meditation and yoga drive market growth.

b. The global spiritual wellness apps market size was estimated at USD 2.16 billion in 2024 and is expected to reach USD 2.45 billion in 2024.

b. The global spiritual wellness apps market is expected to grow at a compound annual growth rate of 14.6% from 2025 to 2030 to reach USD 4.84 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.