- Home

- »

- Biotechnology

- »

-

Spine Biologics Market Size, Share & Growth Report, 2030GVR Report cover

![Spine Biologics Market Size, Share & Trends Report]()

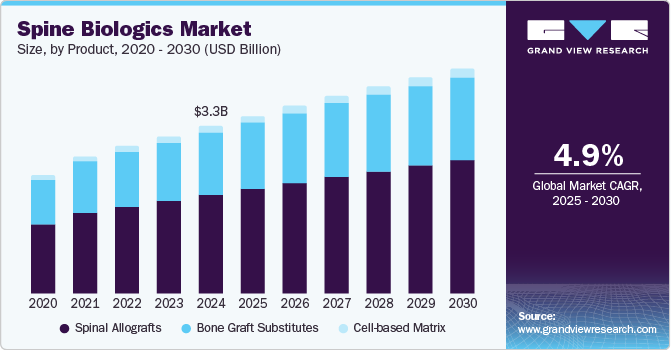

Spine Biologics Market Size, Share & Trends Analysis Report By Product (Spinal Allografts, Bone Graft Substitutes, Cell-Based Matrix), By Surgery, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-588-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Spine Biologics Market Size & Trends

The global spine biologics market size was estimated at USD 3.25 billion in 2024 and is projected to grow at a CAGR of 4.9% from 2025 to 2030. Spine biologics is a specialized field in orthopedic and neurosurgical medicine emphasizing spine health's biological and regenerative aspects. It utilizes biologics, including stem cells and growth factors, to enhance healing and improve results in spinal treatments. An increase in the prevalence of conditions such as degenerative disc disease and spinal injuries drives demand for innovative treatment options that promote healing and recovery.

The rising elderly demographic is particularly susceptible to spinal issues, driving the need for effective biological solutions. Moreover, healthcare providers are prominently shifting towards less invasive surgical options that utilize biologics, promoting faster recovery and reducing complications, which enhances their adoption in clinical practice.

According to the National Library of Medicine, recent research has focused on biological treatment approaches to prevent or reverse degenerative disc disease. These methods include cell injections, growth factors, nucleus pulposus replacement, annulus fibrosus (AF) repair, and tissue-engineered discs. Both animal and clinical studies have shown promising results for cell-based therapies, highlighting their regenerative potential. Furthermore, clinical data indicate that stem cell injections are safe when performed appropriately. These are significant factors contributing to the growth of the spine biologics market.

Product Insights

The spinal allografts segment dominated the market, with a revenue share of 58.7% in 2024. This growth is driven by the increasing demand for superior biocompatibility, significantly reducing rejection risk, as evidenced by successful lumbar spine surgeries. Their use in anterior cervical discectomy and fusion (ACDF) procedures shows their ability to facilitate natural tissue regeneration. Moreover, they eliminate donor site morbidity, making them preferable in complex surgeries. Furthermore, advancements in preservation methods, such as terminal sterilization, enhance their safety and reliability, further driving their market dominance.

The cell-based matrix is projected to witness the fastest CAGR of 7.0% over the forecast period, attributed to the increasing number of clinical trials demonstrating the safety and efficiency of cell-based therapies are enhancing their credibility and promoting wider adoption among surgeons and patients. Furthermore, advancements in cell therapies allow for treatments to be tailored to individual patient needs, increasing their appeal and effectiveness compared to standardized allografts and bone graft substitutes. Therefore, these developments improve the functionality and application of cell-based matrices, enabling more complex and effective solutions in spinal surgeries.

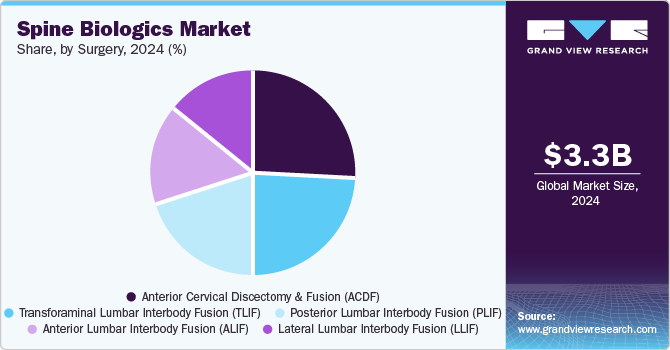

Surgery Insights

The anterior cervical discectomy and fusion (ACDF) segment dominated the market with the largest revenue share of 25.9% in 2024. According to the National Library of Medicine, anterior cervical discectomy and fusion (ACDF), introduced by Cloward in 1958, has gained widespread acceptance for managing medically refractory cervical myelopathy and radiculopathy. Patients undergoing one- or two-level ACDF report high satisfaction rates and low complication incidences. Moreover, the popularity of multi-level ACDF has increased in recent decades, driven by advancements in biologics and instrumentation. Therefore, ACDF has become one of the most frequently performed surgeries in neurosurgical practice, often yielding excellent clinical outcomes.

The transforaminal lumbar interbody fusion (TLIF) segment is projected to grow at a CAGR of 6.2% over the forecast period. This growth is attributed to each successive repetition of the TLIF procedure, which has progressively enhanced patient safety, reduced recovery times, and improved clinical results. In addition, the integration of 3D neuro segmentation technology and advanced imaging has allowed surgeons to customize their techniques to the unique anatomical features of each patient, marking a shift from a traditional “one-size-fits-all” approach to customized techniques, therefore driving the transforaminal lumbar interbody fusion (TLIF) surgeries.

Regional Insights

North America spine biologics market dominated the global market with a revenue share of 48.2% in 2024, fuels by its large patient base and the high prevalence of spinal conditions such as spinal stenosis, degenerative disc disease, and spinal deformities. A well-established healthcare system and many key manufacturers and innovators in North America drive continuous advancements in the spine biologics market.

U.S. Spine Biologics Market Trends

The U.S. spine biologics market dominated North America, with a significant revenue share in 2024. The increasing incidence of spine disorders such as degenerative disc disease, herniated discs, and spinal injuries is rising, driving demand for effective treatment solutions. According to the National Institutes of Health, approximately 80% of Americans will experience back pain at some point, leading to a higher need for surgical interventions. In addition, the U.S. Food and Drug Administration (FDA) has streamlined the approval process for biologics, facilitating faster market entry for new products. Therefore, the driving demand for the spine biologics market in the U.S.

Europe Spine Biologics Market Trends

Europe spine biologics market held a substantial market share in 2024. According to the European Spine Society, approximately 75% of Europeans will experience back pain at some point, increasing demand for surgical and biological medications. Moreover, there is a notable trend toward minimally invasive surgical techniques across Europe. A study published in Spine Journal indicates that these techniques can reduce recovery times by up to 30% compared to traditional methods, further aiding the adoption of biological treatments in Europe.

The spine biologics market in Germany is expected to grow in the forecast period, attributable to the increasing aging demographic associated with a higher incidence of spinal issues. The elderly are more susceptible to degenerative spine conditions, leading to increased demand for spinal surgeries and biologics. Furthermore, Germany is at the forefront of technological innovation in healthcare, with advancements in biological materials, such as stem cell therapies and tissue-engineered grafts, driving the growth in Germany.

Asia Pacific Spine Biologics Market Trends

Asia Pacific spine biologics market is expected to register the fastest CAGR of 5.8% over the forecast period, attributed to a significant demographic shift due to a rapidly aging population, especially in Japan, China, and South Korea. This increase in elderly individuals is contributing to a higher rate of spinal degenerative disorders. Consequently, there is a growing demand for spine biologics, essential in spinal fusion and bone grafting treatments. Therefore, this trend drives the urgent need for effective therapeutic solutions for evolving healthcare challenges.

The increasing population and aging demographic in China drive the need for enhanced emergency spine biologics, which is anticipated to boost the spine biologics market. The Chinese government is making substantial investments in healthcare infrastructure to address the needs of its aging population. According to WHO, the Healthy China 2030 initiative enhances healthcare access and quality. This initiative emphasizes the integration of advanced medical technologies and surgery, further driving the spine biologics market in China.

Key Spine Biologics Company Insights

Some key companies operating in the market include Stryker, NuVasive, Inc., Orthofix, DePuy Synthes (Johnson & Johnson), and Medtronic. Companies are implementing strategic initiatives, including mergers, acquisitions, and product launches, to expand their market presence and address evolving healthcare demands through spine biologics.

-

Medtronic offers a range of spine biologics products, including the Infuse Bone Graft, which utilizes rhBMP-2 to promote bone growth in spinal fusion surgeries. It also provides Matrifix Injectable Bone Grafts for minimally invasive procedures and various osteoconductive matrix products that support bone regeneration. Additionally, their titanium mesh cages are designed to enhance spinal fusion outcomes. These innovations aim to improve surgical success and accelerate patient recovery.

-

Stryker offers a variety of spine biologics products, including the SPYGLASS Biologics System, which enhances the delivery of biologic materials during minimally invasive procedures. It also provides osteoGen bone Graft, a synthetic bone graft substitute that promotes healing and bone regeneration. The company's Biologics Portfolio also includes advanced scaffolding technologies for optimal integration and support in spinal surgeries. These products aim to improve patient outcomes and surgical effectiveness.

Key Spine Biologics Companies:

The following are the leading companies in the spine biologics market. These companies collectively hold the largest market share and dictate industry trends.

- Stryker

- NuVasive, Inc.

- Orthofix.

- DePuy Synthes (Johnson & Johnson)

- Exactech, Inc.

- Zimmer Biomet

- Arthrex, Inc.

- Medtronic

- Organogenesis Inc.

- Kuros Biosciences.

View a comprehensive list of companies in the Spine Biologics Market

Recent Developments

-

In August 2024, Stryker announced the launch of the Pangea Plating System, which received FDA permission in 2023. This innovative system offers a versatile and comprehensive portfolio featuring variable-angle plating suitable for diverse patient populations. The Pangea Plating System aims to enhance surgical flexibility and improve patient outcomes. This launch emphasizes Stryker's commitment to advancing orthopedic care and providing tailored solutions for surgeons.

-

In September 2024, Medtronic plc announced the launch of several innovations in software, hardware, and imaging to enhance its AiBLE ecosystem, which integrates navigation, robotics, data, AI, imaging, software, and implants for spine and cranial procedures. These advancements are designed to facilitate more predictable outcomes in surgical interventions. Additionally, Medtronic has partnered with Siemens Healthineers to explore opportunities for expanding access to advanced pre-and post-operative imaging technologies in spine care. This collaboration reflects Medtronic's commitment to improving the quality of care for patients with spinal conditions.

Spine Biologics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.45 billion

Revenue forecast in 2030

USD 4.38 billion

Growth rate

CAGR of 4.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, surgery, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Stryker; NuVasive, Inc.; Orthofix; DePuy Synthes (Johnson & Johnson); Exactech, Inc.; Zimmer Biomet; Arthrex, Inc.; Medtronic; Organogenesis Inc.; Kuros Biosciences.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Spine Biologics Market Report Segmentation

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global spine biologics market report based on product, surgery, end use, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Spinal Allografts

-

Machined Bones Allograft

-

Demineralized Bone Matrix

-

-

Bone Graft Substitutes

-

Bone Morphogenetic Proteins

-

Synthetic Bone Grafts

-

-

Cell-based Matrix

-

-

Surgery Outlook (Revenue, USD Billion, 2018 - 2030)

-

Anterior Cervical Discectomy and Fusion (ACDF)

-

Transforaminal Lumbar Interbody Fusion (TLIF)

-

Posterior Lumbar Interbody Fusion (PLIF)

-

Anterior Lumbar Interbody Fusion (ALIF)

-

Lateral Lumbar Interbody Fusion (LLIF)

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."