Spinal Muscular Atrophy Treatment Market Size, Share & Trends Analysis Report By Type (Type 1, Type 2, Type 3, Type 4), By Treatment (Gene Therapy, Drug), By Route of Administration, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-626-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

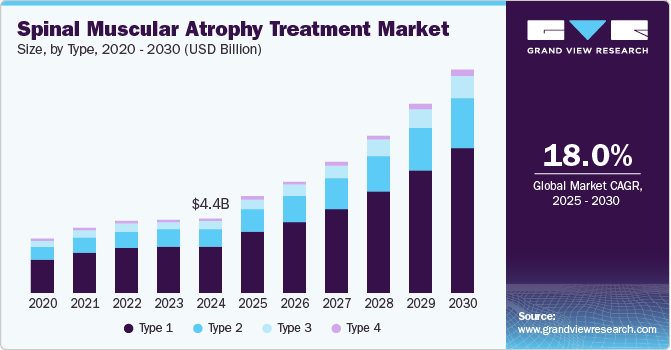

The global spinal muscular atrophy treatment market size was estimated at USD 4.40 billion in 2024 and is anticipated to grow at a CAGR of 18.0% from 2025 to 2030. The increasing advancements in gene therapy have played a pivotal role in revolutionizing the treatment of spinal muscular atrophy. Breakthrough therapies such as Zolgensma (onasemnogene abeparvovec) and Spinraza (nusinersen). have significantly improved patient outcomes, offering new hope for individuals affected by spinal muscular atrophy.

In addition, a deeper understanding of the genetic causes of spinal muscular atrophy has enabled the creation of targeted treatments, providing more personalized options for patients. Identifying specific gene mutations and gene editing techniques further enhances the potential for effective therapies. These innovations are shaping the future of the spinal muscular atrophy treatment industry.

The growing prevalence and diagnosis of spinal muscular atrophy are key factors driving the demand for treatments. Improved screening programs, such as newborn screening for spinal muscular atrophy, have led to higher diagnosis rates, resulting in a larger patient population in need of treatment. As awareness about spinal muscular atrophy, particularly in newborns and infants, increases, earlier diagnosis and better management of the condition have become possible. This growing awareness has also encouraged more healthcare providers to recognize and treat spinal muscular atrophy at earlier stages, improving patient outcomes. Therefore, these factors significantly contribute to the expanding demand for effective therapies in the spinal muscular atrophy treatment industry.

Moreover, technological innovations greatly enhance spinal muscular atrophy treatment. Advances in biotechnology, such as RNA-based therapies and sophisticated drug delivery systems, are improving the effectiveness and accessibility of treatments, allowing for more precise and targeted care. Moreover, the rise of telemedicine and remote monitoring platforms has made spinal muscular atrophy management more convenient by enabling patients to receive consultations and follow-ups from a distance. This is especially beneficial for individuals living in remote or underserved regions where access to specialized care may be limited. These technological innovations are playing a key role in shaping the growth and future of the spinal muscular atrophy treatment industry.

Type Insights

The type 1 segment dominated the market with a revenue share of 63% in 2024, driven by the rising prevalence of spinal muscular atrophy in infants and young children. Increased awareness and improved diagnostic methods have enabled earlier detection and quicker treatment initiation for type 1 spinal muscular atrophy. The availability of effective therapies, including gene therapies and new medications, has significantly improved patient outcomes, encouraging more families to seek treatment. In addition, ongoing research and development in this area have led to the creation of innovative therapies specifically designed for type 1 spinal muscular atrophy patients. Therefore, these factors continue to drive growth in the spinal muscular atrophy treatment industry.

The type 2 segment is predicted to grow at a significant CAGR over the forecast period, fueled by ongoing advancements in treatment methodologies and increased clinical trials aimed at this demographic. As healthcare providers become more adept at managing spinal muscular atrophy, there is a growing recognition of the need for tailored therapies for type 2 patients. Moreover, the rising incidence of spinal muscular atrophy cases is prompting further investment in research initiatives that explore new treatment avenues, thereby expanding the market potential for type 2 therapies.

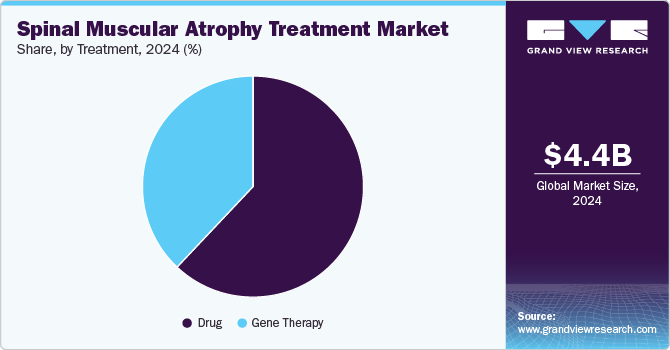

Treatment Insights

The drug segment dominated the spinal muscular atrophy treatment market with the largest revenue share in 2024, which can be attributed to the successful launch and adoption of innovative treatments such as Zolgensma and Evrysdi. These groundbreaking drugs have transformed the management of spinal muscular atrophy by targeting and addressing the genetic causes of the disease. The growing number of drug approvals and clinical successes has raised awareness among both healthcare professionals and patients, fueling the demand for these therapies. In addition, patient assistance programs offered by pharmaceutical companies are improving access to these life-changing treatments. These factors are contributing significantly to the growth of the spinal muscular atrophy treatment industry.

The gene therapy segment is projected to grow at a significant CAGR over the forecast period due to its life-changing impact on spinal muscular atrophy treatment. The advent of gene therapies has opened new frontiers in patient care, offering potential cures rather than just symptomatic relief. As more gene therapy options become available and clinical data supporting their efficacy continues to accumulate, healthcare providers are likely to adopt these innovative treatments more readily. This shift toward genetic interventions is expected to enhance patient outcomes and drive market growth significantly.

Route of Administration Insights

The injection segment dominated the market with the largest revenue share in 2024, driven by its established efficacy and rapid delivery of therapeutic agents directly into the bloodstream. Injectable treatments are often preferred for their ability to provide immediate effects, particularly in critical cases of spinal muscular atrophy where timely intervention is essential. Moreover, advancements in injection technologies have improved patient compliance and comfort, further solidifying injection segment dominance in spinal muscular atrophy treatment.

The oral segment is anticipated to grow at the highest CAGR over the forecast period, which can be attributed to increasing patient preference for non-invasive administration methods. Oral medications offer convenience and ease of use compared to injections, making them particularly appealing for long-term management of chronic conditions. As pharmaceutical companies focus on developing effective oral formulations that maintain therapeutic efficacy, this segment is expected to gain traction among patients and healthcare providers.

Regional Insights

North America spinal muscular atrophy treatment market held the highest revenue share of 68.4% in 2024, driven by a robust healthcare infrastructure and high levels of investment in research and development. The presence of leading pharmaceutical companies in this region encourages innovation and accelerates the availability of new treatments. Furthermore, high awareness levels among healthcare professionals and patients regarding spinal muscular atrophy contribute significantly to early diagnosis and effective management strategies.

U.S. Spinal Muscular Atrophy Treatment Market Trends

The U.S. spinal muscular atrophy treatment market dominated North America with a significant revenue share in 2024 due to its advanced medical facilities and comprehensive insurance coverage for innovative therapies. The U.S. also leads clinical trials for new spinal muscular atrophy treatments, enhancing patients' access to cutting-edge therapies. This combination of factors positions the U.S. as a key player in driving growth within the North American spinal muscular atrophy treatment landscape.

Europe Spinal Muscular Atrophy Treatment Market Trends

Europe spinal muscular atrophy treatment market held a substantial market share in 2024, driven by increasing awareness about spinal muscular atrophy among healthcare providers and patients. The European market benefits from collaborations between pharmaceutical companies, research institutions, and advocacy groups that promote innovation and expand patient treatment options. In addition, favorable regulatory environments facilitate quicker access to new therapies, further driving market growth.

Asia Pacific Spinal Muscular Atrophy Treatment Market Trends

The Asia Pacific spinal muscular atrophy treatment market is expected to register the highest CAGR of 24.6% over the forecast period, which can be attributed to improving healthcare infrastructure and rising awareness about rare diseases such as spinal muscular atrophy. The region's growing population base also contributes to increased demand for effective treatment options as more families seek solutions for affected individuals. Partnerships between global pharmaceutical and local biotech companies enhance access to innovative therapies across the Asia Pacific.

The Japan spinal muscular atrophy treatment market dominated the Asia Pacific with a significant revenue share in 2024, fueled by an advanced healthcare system and high adoption rates of novel therapies. Japan's commitment to addressing rare diseases through research initiatives has increased availability of effective treatments for spinal muscular atrophy patients. This proactive approach ensures that patients receive timely interventions, improving overall health outcomes within this demographic.

Key Spinal Muscular Atrophy Treatment Company Insights

Some key companies operating in the market are Biogen; Novartis AG; Pfizer Inc.; Ionis Pharmaceuticals, and Biohaven, Ltd. Companies are undertaking strategic initiatives, such as mergers, acquisitions, and product launches, to expand their market presence and address the evolving healthcare demands in spinal muscular atrophy treatment market.

-

Biogen provides various products for spinal muscular atrophy treatment, with SPINRAZA (nusinersen) being the first approved therapy for this condition. SPINRAZA functions as an antisense oligonucleotide that increases the production of survival motor neuron protein, which is essential for motor neuron health. The company is investigating a higher dose regimen of SPINRAZA, which has shown promising results in clinical trials, potentially improving treatment efficacy.

-

Novartis AG offers innovative treatments for spinal muscular atrophy, primarily through its gene therapy, Zolgensma (onasemnogene abeparvovec). This one-time intravenous infusion targets the genetic cause of spinal muscular atrophy by replacing the defective SMN1 gene, aiming to stop disease progression. The company also investigates therapies such as OAV101 for later-onset spinal muscular atrophy types while providing comprehensive support through the OneGene Program.

Key Spinal Muscular Atrophy Treatment Companies:

The following are the leading companies in the spinal muscular atrophy treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Biogen

- Novartis AG

- Pfizer Inc.

- Ionis Pharmaceuticals

- Biohaven, Ltd.

- F. Hoffmann-La Roche Ltd

- Cytokinetics

- Scholar Rock, Inc.

- PTC Therapeutics

- NMD PHARMA A/S

Recent Developments

-

In November 2024, Biohaven updated its development program for taldefgrobep alfa, a treatment for spinal muscular atrophy. The RESILIENT spinal muscular atrophy study indicated that while taldefgrobep alfa showed clinically meaningful improvements in motor function on the Motor Function Measurement-32 scale (MFM-32), it did not statistically separate from the placebo group at the primary outcome after 48 weeks. Efficacy signals were noted in specific subgroups, particularly among Caucasian participants and those with measurable baseline myostatin levels, and the treatment also demonstrated favorable changes in body composition by significantly reducing fat mass compared to the placebo group.

-

In August 2021, Cytokinetics partnered with Cure SMA to enhance education and awareness regarding spinal muscular atrophy (SMA). This collaboration aimed to address the ongoing needs of the SMA community, particularly in light of the challenges posed by recent global events. The partnership reflects both organizations' dedication to improving the lives of those impacted by SMA through increased understanding and access to information.

Spinal Muscular Atrophy Treatment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 5.72 billion |

|

Revenue forecast in 2030 |

USD 13.09 billion |

|

Growth rate |

CAGR of 18.0% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type,treatment, route of administration, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Norway, Denmark, Sweden,Japan, China, India, South Korea, Australia, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

Biogen; Novartis AG; Pfizer Inc.; Ionis Pharmaceuticals; Biohaven, Ltd.; F. Hoffmann-La Roche Ltd; Cytokinetics; Scholar Rock, Inc.; PTC Therapeutics; NMD PHARMA A/S. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Spinal Muscular Atrophy Treatment Market Report Segmentation

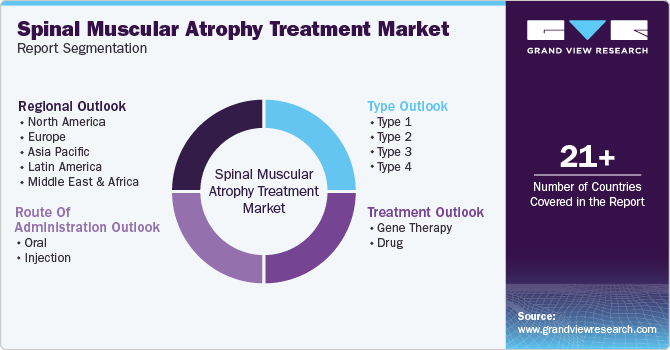

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global spinal muscular atrophy treatment market report based on type, treatment, route of administration, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Type 1

-

Type 2

-

Type 3

-

Type 4

-

-

Treatment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Gene Therapy

-

Drug

-

Spinraza

-

Zolgensma (AVXS-101)

-

Evrysdi

-

Others

-

-

-

Route of Administration Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oral

-

Injection

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."