- Home

- »

- Medical Devices

- »

-

Spinal Cord Stimulation Devices Market Size Report, 2030GVR Report cover

![Spinal Cord Stimulation Devices Market Size, Share & Trends Report]()

Spinal Cord Stimulation Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Rechargeable, Non-rechargeable), By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-143-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Spinal Cord Stimulation Devices Market Summary

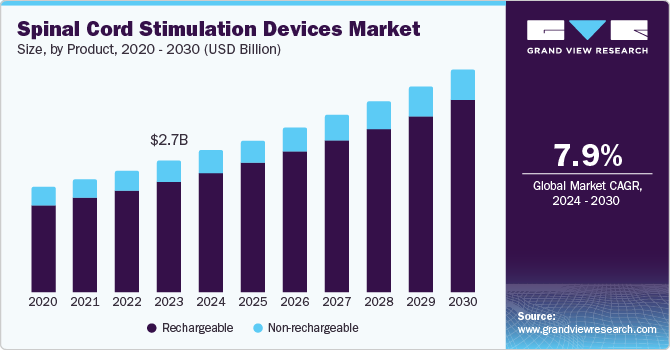

The global spinal cord stimulation devices market size was valued at USD 2.74 billion in 2023 and is projected to reach USD 4.66 billion by 2030, growing at a CAGR of 7.9% from 2024 to 2030. The spinal cord stimulator, known as the dorsal column stimulator, is an implanted device for managing chronic pain through a neuromodulator. The device prevents the brain from feeling pain by sending electric signals that interfere with pain signals. The rise in chronic pain cases, the aging population, technological improvements, and increased awareness are the main drivers of growth in the spinal cord stimulation devices market. Chronic pain is a prevalent affliction that impacts millions of individuals globally. p>

Key Market Trends & Insights

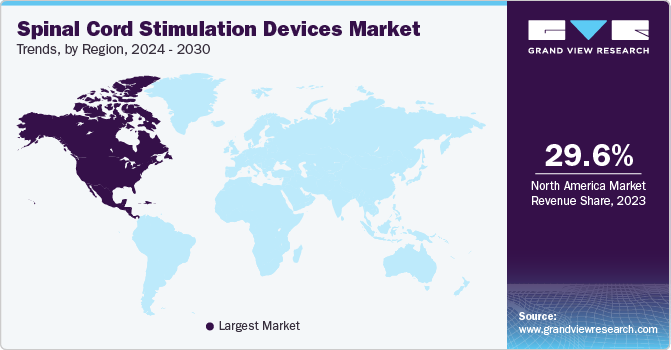

- North America spinal cord simulation devices market held the largest market revenue share of 29.6% in 2023.

- The U.S. held the largest market revenue share regionally in 2023.

- The rechargeable segment held the largest market revenue share of 84.1% in 2023.

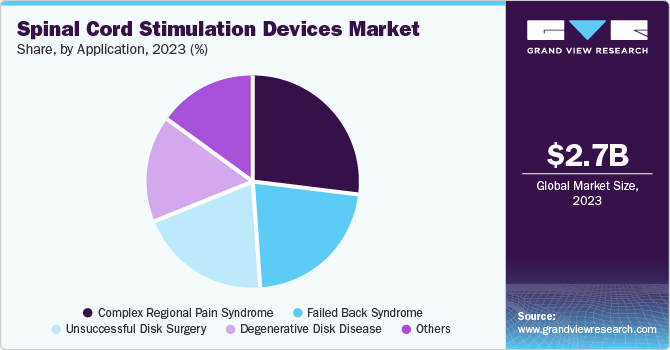

- The complex regional pain syndrome segment held the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.74 Billion

- 2030 Projected Market Size: USD 4.66 Billion

- CAGR (2024-2030): 7.9%%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The increasing occurrence of chronic pain conditions, including failed back surgery syndrome, complex regional pain syndrome, and neuropathic pain, significantly increases the need for spinal cord stimulation devices. With the growing aging population in the world, there is also a rise in age-related health problems such as degenerative disc disease and other spinal issues that frequently necessitate the use of spinal cord stimulation devices. Elderly individuals have a higher likelihood of developing chronic pain conditions, which has increased the need for efficient methods of pain management.

Technological advancements in spinal cord stimulation devices also contribute to the surge in demand. Innovations such as improved battery life, wireless technology, and more precise stimulation settings have enhanced the efficacy and convenience of these devices. Moreover, newer devices allow for greater customization and adjustments based on individual patient needs, which can lead to better pain management outcomes. The increasing availability of minimally invasive implantation procedures has made these devices more accessible, reducing recovery time and associated risks and further driving their adoption.

Additionally, the growing body of clinical evidence supporting the effectiveness of spinal cord stimulation in managing chronic pain has led to broader acceptance within the medical community. As a result, insurance companies are more likely to cover the costs of these devices, making them a viable option for a broader range of patients. This combination of clinical validation, improved technology, and expanding insurance coverage fuels the global demand for spinal cord stimulation devices.

Finally, the rising awareness of non-opioid pain management solutions amid the opioid crisis has pushed both patients and healthcare providers to seek alternative treatments. Spinal cord stimulation offers a promising solution for managing pain without the risks associated with long-term opioid use, which is increasingly important in the current healthcare landscape. This shift towards safer, more sustainable pain management options is expected to continue driving the demand for spinal cord stimulation devices globally.

Product Insights

The rechargeable segment held the largest market revenue share of 84.1% in 2023. Rechargeable devices provide a longer battery life and more options to adjust the stimulation settings based on the patient's requirements. This minimizes healthcare costs over time and enhances patient comfort and compliance. Furthermore, rechargeable devices feature smaller and more streamlined battery constructions, resulting in a slimmer and more user-friendly design for patients. Adjusting stimulation levels and maintaining consistent therapy through recharging benefit patients and healthcare providers.

The non-rechargeable segment is projected to grow significantly over the forecast period. Advances in technology have resulted in the creation of smaller and more effective non-rechargeable spinal cord stimulators. These gadgets come with better battery longevity and enhanced stimulation functions, increasing their usage by both patients and healthcare providers. Advancements such as making components smaller and improving signal-processing algorithms have also enhanced their efficiency. Additionally, these devices typically have a longer battery life, lasting several years before replacement is necessary, reducing t e need for surgical interventions compared to rechargeable devices.

Application Insight

The complex regional pain syndrome segment held the largest market revenue share in 2023. The increasing occurrence of complex regional pain syndrome, especially after trauma or surgery, is a significant factor in driving the spinal cord stimulation device market. CRPS is frequently identified as long-lasting pain that can affect the quality of life. With the growing recognition of CRPS by both healthcare providers and patients, more people are receiving diagnoses and treatments, resulting in a greater need for efficient management options such as spinal cord stimulators.

The degenerative disk disease (DDD)segment is expected to grow at the fastest CAGR over the forecast period. Degenerative disk disease is on the rise, particularly among older populations. As individuals age, the intervertebral disks dehydrate and lose their flexibility, resulting in degeneration. This situation frequently leads to long-term pain and impairment, increasing the need for successful interventions, including spinal cord stimulators. The increase in obesity and sedentary habits also adds to the prevalence of DDD, resulting in the increased demand for these devices.

Regional Insights

North America spinal cord simulation devices market held the largest market revenue share of 29.6% in 2023. The rising incidence of chronic pain disorders in the region, including failed back surgery syndrome, complex regional pain syndrome, and neuropathic pain, is a primary factor driving the demand for spinal cord stimulators. Additionally, there is a growing preference for minimally invasive treatments over traditional surgeries, which has made SCS devices a more preferred option for pain management. Technological advancements in SCS, such as improved device efficacy and patient-tailored therapies, have also contributed to the surge in demand.

U.S. Spinal Cord Stimulation Devices Market Insights

The U.S. held the largest market revenue share regionally in 2023. The opioid crisis has significantly influenced the shift toward non-opioid pain management options, and SCS devices offer a viable alternative for chronic pain sufferers. Additionally, the U.S. has seen a rise in conditions such as degenerative disc disease and failed back surgery syndrome, mainly as the population ages.

Europe Spinal Cord Stimulation Devices Market Insights

Europe spinal cord simulation devices market is projected to witness lucrative market growth in upcoming years. The rising incidence of conditions such as diabetic neuropathy and spinal cord injuries, driven by lifestyle factors and increased life expectancy, is fueling demand for more effective and long-term pain relief solutions. Furthermore, European regulatory bodies, particularly the European Medicines Agency (EMA), have streamlined the approval process for medical devices, making it easier for innovative SCS technologies to enter the market. The strong collaboration between European research institutions and medical device manufacturers has led to developing next-generation SCS devices with improved efficacy and patient outcomes.

The UK spinal cord simulation devices market is projected to grow significantly over the forecast period. The UK's aging population is a significant factor, as older adults are more prone to chronic pain that can be managed with SCS devices. Additionally, there is growing awareness among both healthcare providers and patients regarding the benefits of SCS as a non-opioid treatment option, particularly amid concerns over opioid misuse.

Asia Pacific Spinal Cord Stimulation Devices Market Insights

Asia Pacific is projected to grow with the fastest CAGR over the forecast period. The rapidly aging population is leading to a higher incidence of chronic pain conditions such as degenerative disc disease and neuropathic pain, driving the need for advanced pain management solutions. In China, the growing healthcare sector, coupled with increasing investments in medical technology and infrastructure, is making SCS devices more accessible to a larger portion of the population. Moreover, the rise in medical tourism in countries such as India and Thailand, where patients seek affordable yet advanced treatment options, also contributes to the demand.

India spinal cord simulation devices market is projected to grow significantly over the forecast period. The rising number of patients with conditions such as failed back surgery syndrome, complex regional pain syndrome, and other chronic pain issues has driven the need for more effective pain management solutions. The expansion of India's private healthcare sector and investment in advanced medical technologies, including SCS devices, make these treatments more accessible.

Key Spinal Cord Stimulation Devices Company Insights

Some of the key companies in the spinal cord stimulation devices market include Boston Scientific Corporation; Medtronic; NeuroSigma, Inc.; Nevro Corp.; Synapse Biomedical Inc.; and others.

-

Synapse Biomedical Inc. offers the NeuRx Diaphragm Pacing System (DPS), a cutting-edge spinal cord stimulator designed to aid patients with spinal cord injuries and amyotrophic lateral sclerosis (ALS). The system includes PermaLoc electrodes implanted in the diaphragm, which are connected to an external pulse generator (EPG) that sends electrical signals to stimulate natural breathing.

-

Boston Scientific Corporation provides a variety of spinal cord stimulation (SCS) devices aimed at managing chronic pain. Their key products include the Precision Montage MRI, which allows for full-body MRI scans and delivers multiple waveforms for pain relief, and the Spectra WaveWriter, which personalizes pain relief through combination therapy and waveform automation.

Key Spinal Cord Stimulation Devices Companies:

The following are the leading companies in the spinal cord stimulation devices market. These companies collectively hold the largest market share and dictate industry trends.

- Boston Scientific Corporation

- Medtronic

- NeuroSigma, Inc.

- Nevro Corp.

- Synapse Biomedical Inc

- Abbott

- GIMER MEDICAL

- PatSnap

- Cirtec

- Bluewind Medical

Recent Developments

-

In December 2022, Abbott announced the launch of the Eterna, the world's smallest implantable, rechargeable spinal cord stimulation (SCS) system for chronic pain management. This device features Abbott's BurstDR stimulation technology, which has been clinically proven to provide superior pain relief. The Eterna system minimizes the need for frequent recharging, requiring only about five charges per year, making it the most convenient option for patients. It also includes MRI compatibility and future upgrade capabilities, ensuring long-term usability and comfort for chronic pain sufferers.

-

In January 2021, Boston Scientific announced the launch of its WaveWriter Alpha spinal cord stimulator systems in the U.S. These systems are designed to provide personalized pain relief by delivering multiple therapies simultaneously, allowing patients to target specific types of pain. With advanced technology and improved battery life, the WaveWriter Alpha systems aim to improve patient outcomes by offering more precise and tailored treatment options for chronic pain patients.

Spinal Cord Stimulation Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.96 billion

Revenue forecast in 2030

USD 4.66 billion

Growth Rate

CAGR of 7.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, Mexico, UK, Germany, Italy, Spain, Denmark, Sweden, Norway, France, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Boston Scientific Corporation; Medtronic; NeuroSigma, Inc.; Nevro Corp.; Synapse Biomedical Inc; Abbott; GIMER MEDICAL; PatSnap.; Cirtec; Bluewind Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

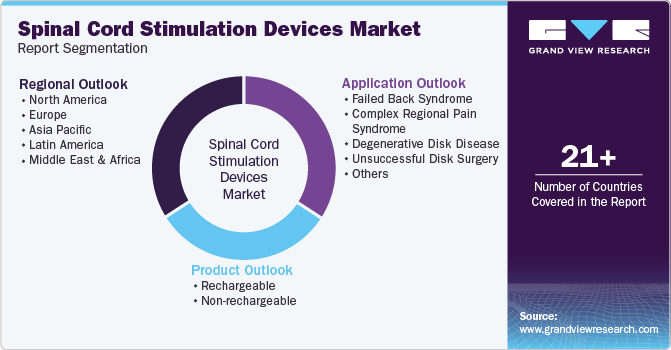

Global Spinal Cord Stimulation Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the spinal cord stimulation devices market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Rechargeable

-

Non-rechargeable

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Failed Back Syndrome

-

Complex Regional Pain Syndrome

-

Degenerative Disk Disease

-

Unsuccessful Disk Surgery

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.