Speech-to-text API Market Size, Share & Trends Analysis Report By Component (Software, Services), By Development, By Organization Size, By Application, By Verticals, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-963-7

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Speech-to-text API Market Size & Trends

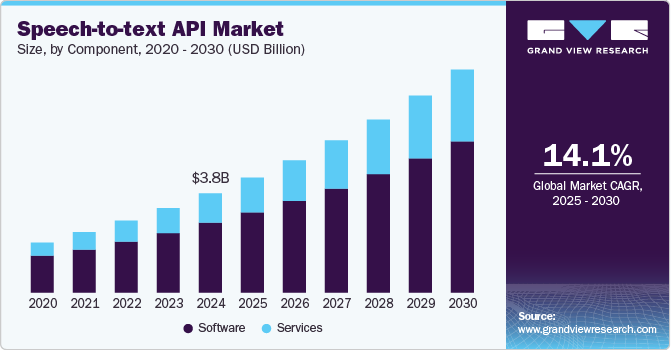

The global speech-to-text API market size was estimated at USD 3,813.5 million in 2024 and is projected to grow at a CAGR exceeding 14.1% from 2025 to 2030. The growth of the speech-to-text industry can be attributed to increasing demand for handheld devices, the growing elderly population's dependence on technology, greater government funding for education for differently abled students, and the growing number of persons with various learning difficulties or learning styles. Moreover, the growth of the market is the rapid adoption of digitization trends in all sectors and the development of new advanced technologies in the field of education.

Speech-to-text technologies work on various devices, including smartphones, tablets, and computers. The government is encouraging speech-to-text technologies in the field of education. For example, the Individuals with Disabilities Education Act (IDEA) provides interactive software in the classroom for students who cannot hear well. Moreover, In May 2022, Northern Illinois University professors developed an interactive software lecture that uses speech-to-text API technology to help students learn the Nemeth code (a Braille code for mathematics).

COVID-19 resulted in the rapid adoption of speech-to-text technologies, with universities and schools working online. In online learning and classes, speech-to-text technology has been gaining attention and is being increasingly adopted by various academic institutes worldwide. Speech-to-text technology helps communicate with the users when the text on the screen is unclear or reading the text is inconvenient. Technological advancements result in the development of enhanced features in speech-to-text technologies. For example, developers of data analytics applications are searching for medical speech recognition abilities that will allow them to accurately and efficiently transcribe audio and video containing the COVID-19 terminology into text for downstream analytics. For instance, in 2021, Amazon Web Services Inc. developed Amazon Transcribe Medical, a centrally managed speech recognition (ASR) server that helps add medical speech-to-text abilities to any application.

Component Insights

Software component led the market with a revenue share of 70.3% in 2024. High penetration of software segment can be attributed to advancements in increased computing power, information storage capacity, and parallel processing capabilities to supply high-end services. For instance, in January 2021, Amazon Web Services Inc. and Talkdesk, a cloud call center software company, collaborated to provide customers with freedom, agility, and insight to manage contact center operations and improve customer experience by combining Talkdesk CX Cloud's unique cloud-native capabilities with AWA's extensive AI and Cloud offerings. Moreover, this speech recognition software is used to make audio information available to users and has automatic subtitles for deaf people.

Leading firms in various industries are implementing speech-to-text technologies to deal with the constantly rising video-based material. This aids firms in developing new ways to tap into the massive volumes of data accessible to create new processes, services, and products, giving them a competitive advantage. For instance, in August 2020, Speechmatics, a provider of Autonomous Speech Recognition technology, collaborated with Prosodica Inc., a software development company, a provider of audio analysis and innovative voice technology, to offer superior call experiences to improve customer care and enhance customer experiences.

Deployment Insights

The on-premises segment dominates the market with a revenue share in 2024. The on-premises deployment model is preferred by sectors related to communication, marketing, HR, legal departments, studios, researchers, and broadcasters, among others, due to security concerns. Furthermore, due to its security and licensing, on-premises deployment is preferred by large corporations and banking institutions. Such security concerns are expected to supplement the growth of the on-premises model segment over the forecasting period.

The cloud segment by development is expected to grow at a significant CAGR from 2025 to 2030. Cloud-based technology provides benefits such as minimum capital requirement and easy deployment, facilitating the adoption of the cloud deployment model. The adoption of a cloud-based model is projected to be encouraged by the COVID-19 pandemic, as social distancing and lockdown practices encourage companies to move to a cloud-based speech-to-text API model that can be operated remotely. Cloud-based speech-to-text software has development potential due to businesses' increasing demand for SaaS services (Software as a Service). Furthermore, the cloud segment of the market is predicted to grow faster as demand for cost-effective, scalable, and easy-to-use speech-to-text API Software grow.

Organization Size Insights

The large enterprise segment dominates the market, with a revenue share in 2024. The major factor propelling the growth of the segment is the high capital stability, which allows large enterprises to afford such APIs integrations. However, over the projection period, the SME segment is expected to grow faster. Large firms are facing extending competition from developing SMEs, which is driving the segment's expansion.

Speech-to-text API Software and services are predicted to increase at a rapid rate among SMEs throughout the projection period due to the availability of cost-effective cloud Software. Due to the covid-19 pandemic situation, both small enterprises and large enterprises are expected to restrict their research and development investments for speech-to-text software, which may hamper the advancement of speech-to-text technology.

Application Insights

The fraud detection & prevention segment dominates the market with a revenue share in 2024. This is due to the growing need for speech-to-text APIs in the entertainment and media industry, which convert video and audio content into shareable and searchable text. The market has been divided intocontact center and customer management, content transcription, fraud detection and prevention, risk and compliance management, subtitle generation, other applications. Additionally, the content translation that uses technology to improve speech to text, such as Cloud and artificial intelligence, is anticipated to accelerate market expansion.

The contact center and customer management segment is expected to witness significant growth over the forecasted period. This growth can be attributed to the increasing use of contact center technologies to help companies create phone menus through APIs such as community forums, omni-channel self-service capabilities, and interactive speech recognition (IVR). Furthermore, content transcription using developing technologies like artificial intelligence and cloud improves speech-to-text conversion, which is projected to drive market expansion.

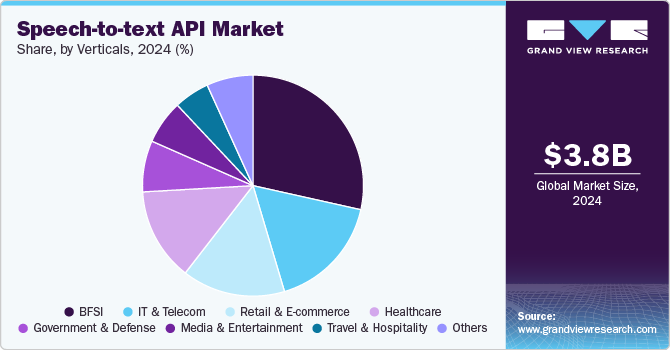

Verticals Insights

The BFSI segment dominates the market, with a revenue share in 2024. The major factor propelling segment growth is using speech-to-text converters to analyze the customer’s feedback. Banks and financial institutions file complaints, address inquiries, and collect feedback from clients daily. Most consumers prefer speaking with an operator rather than typing their questions or browsing through several menus and screens. The speech-to-text converters technology plays an essential role in addressing the customer’s feedback and makes the working of BFSI smooth.

Speech-to-text technologies are used in e-learning applications, online documents, converting website content, and for individuals with vision and learning disabilities. These Software are also helpful for elderly who have a problem with poor eyesight and reading. One of the factors driving the growth of the market is the adoption of speech-to-text technologies by companies to increase their sales and to provide better customer services. For instance, in September 2021, IBM launched IBM Watson Assistant with new automation and artificial intelligence (AI) capabilities, designed to make it easier for businesses to provide better customer service across any channel, including web, phone, SMS, and any messaging platform.

Regional Insights

The North America speech-to-text API market dominated the market with a revenue share of 33.1% in 2024. This is due to the significant technology spending and the widespread accessibility of Software with a strong supplier presence in the region. Moreover, the North America market would expand further as the need to obtain relevant insights from voice data grew. In the region, developed nations like the U.S. and Canada have led the way in adopting advanced technologies. Like intelligent virtual assistants, which can rapidly turn the existing conversation data into automated self-service experiences and enhance customer services.

For instance, in April 2021, Verint System, a software analytics company based in New York, U.S, launched Verint IVA (intelligent Virtual Assistant). This Speech-to-text API offering can quickly transform existing conversation information into automated self-service experiences. It enables business experts to promptly implement a production-ready chatbot to handle calls and provide customer support. With limitless intelligence for both voice and digital, Verint IVA empowers businesses to increase capabilities across the enterprise.

U.S. Speech-to-text API Market Trends

The U.S. Speech-to-text API market held a dominant position in 2024, speech-to-text APIs in the U.S. are experiencing significant advancements and widespread adoption, driven by several key trends. Improved accuracy through deep learning and On-Premises has enhanced transcription reliability, especially for diverse accents and dialects. The demand for real-time processing is on the rise, particularly in industries like healthcare and customer service, leading to APIs that offer instant feedback. Additionally, integration with other AI technologies, such as chatbots and virtual assistants, enhances functionality and user experience.

Europe Speech-to-text API Market Trends

Europe’s AI in the retail market is also growing as in Europe, European countries have diverse languages and dialects, leading to a strong emphasis on multilingual support in speech-to-text APIs. Providers are focusing on improving accuracy across different languages to cater to a varied user base. Moreover, Data privacy regulations like GDPR are shaping the development of speech-to-text technologies. Companies are prioritizing compliance and transparency in data handling, which is becoming a critical factor in user adoption.

Asia Pacific Speech-to-text API Market Trends

The Asia Pacific speech-To-Text API market is anticipated to grow at a significant CAGR from 2025 to 2030. The region's expansion can be attributed to technological advances in countries such as Japan, China, and India. The rapid adoption of smart devices, and the widespread use of voice-controlled connected devices, are the primary factors driving the growth of the Asia Pacific market. Moreover, the region is constructing massive manufacturing industries and infrastructure for the healthcare and education sectors. Voice-based applications are being used in these industries for teaching, trading, and diagnostics that demand speech-to-text converters, promoting the market during the forecast period.

Key Speech-to-text API Company Insights

The market is characterized by intense competition, with a few major global players holding a significant market share. Key players emphasize new product developments to offer avenues for increased profitability through better customer relationships.

Amazon Web Services, Inc. (AWS), a subsidiary of Amazon.com, is a leading cloud computing platform that offers a comprehensive suite of services, including powerful speech-to-text APIs. One of its flagship offerings in this domain is Amazon Transcribe, a fully managed automatic speech recognition (ASR) service that converts speech into text quickly and accurately. Amazon Transcribe supports a variety of languages and is designed for real-time and batch processing, making it versatile for applications across industries like healthcare, media, and customer service. Its features include speaker identification, punctuation, and custom vocabulary support, allowing businesses to tailor the service to their specific needs.

Google Inc., a subsidiary of Alphabet Inc., is a major player in the technology industry, renowned for its advancements in artificial intelligence and cloud computing. In the realm of speech-to-text technology, Google offers the Google Cloud Speech-to-Text API, which leverages state-of-the-art Cloud models to convert audio to text accurately and efficiently.

Key Speech-to-text API Companies:

The following are the leading companies in the speech-to-text API market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Service, Inc.

- Amberscript Global B.V.

- AssemblyAI, Inc.

- Deepgram

- Google Inc.

- IBM Corporation

- Microsoft Corporation

- Nuance Communication, Inc.

- Rev.com, Inc.

- Speechmatics Ltd.

- Verint System, Inc.

- Vocapia Research SAS

- VoiceBase, Inc.

Recent Developments

-

In October 2023, Nuance announced the launch of two new Conversational AI Services, Nuance Recognizer as a Service and Nuance Neural Text-to-Speech as a Service. These API-based offerings will empower customers to create sophisticated AI-driven customer engagement applications while protecting their existing investments as they transition to the cloud. With enhanced accuracy, emotional speech synthesis, and easy integration into various platforms, these services aim to redefine customer experience and drive business efficiency.

-

In October 2023, Amazon Web Services (AWS) is announced a groundbreaking update to Amazon Transcribe, the fully managed automatic speech recognition (ASR) service. Powered by a state-of-the-art speech foundation model, this next-generation system now expands support to over 100 languages, significantly improving accuracy and usability for global applications.

Speech-to-text API Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 4,423.2 million |

|

Revenue forecast in 2030 |

USD 8,569.5 million |

|

Growth rate |

CAGR of 14.1% from 2025 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Market revenue in USD million & CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, development, organization size, application, verticals, region |

|

Regional scope |

North America; Europe; Asia Pacific; South America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Africa; Brazil; KSA; UAE; South Korea |

|

Key companies profiled |

Amazon Web Service, Inc.; Amberscript Global B.V.; AssemblyAI, Inc.; Deepgram; Google Inc.; IBM Corporation; Microsoft Corporation; Nuance Communication, Inc.; Rev.com, Inc.; Speechmatics Ltd.; Verint System, Inc.; Vocapia Research SAS; VoiceBase, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Speech-to-Text API Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global speech-to-text API market report based on components, deployment, organization size, application, verticals, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Service

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Cloud

-

-

Organization size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small & Medium-sized Enterprises (SMEs)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Contact center and customer management

-

Content Transcription

-

Fraud Detection and Prevention

-

Risk and Compliance Management

-

Subtitle Generation

-

Others

-

-

Verticals Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

IT & Telecom

-

Healthcare

-

Retail & eCommerce

-

Government & Defense

-

Media & Entertainment

-

Travel & Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Africa

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Korea

-

-

Frequently Asked Questions About This Report

b. The global speech-to-text API market size was estimated at USD 3,813.5 million in 2024 and is expected to reach USD 4,423.2 million in 2024.

b. The global speech-to-text API market is expected to grow at a compound annual growth rate of 14.1% from 2025 to 2030 to reach USD 8,569.5 million by 2030.

b. North America dominated the speech-to-text API market with a share of around 33.12% in 2024. This is attributable to the significant technology spending and the widespread accessibility of solutions with a strong supplier presence in the region.

b. Some key players operating in the speech-to-text API market include Amazon Web Service, Inc.; Amberscript Global B.V.; AssemblyAI, Inc.; Deepgram; Google Inc.; IBM Corporation; Microsoft Corporation; Nuance Communication, Inc.; Rev.com, Inc.; Speechmatics Ltd.; Verint System, Inc.; Vocapia Research SAS; VoiceBase, Inc.

b. Key factors that are driving the market growth include the rising need for voice-based devices coupled with the development of smartphones and the adoption of speech-to-text solutions for training specially-abled students.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."