- Home

- »

- Clothing, Footwear & Accessories

- »

-

Spectacles Market Size, Share, Growth, Industry Report 2030GVR Report cover

![Spectacles Market Size, Share & Trends Report]()

Spectacles Market (2025 - 2030) Size, Share & Trends Analysis Report By Parts (Frames, Lens), By Distribution Channel (Offline, Online), By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-3-68038-554-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Spectacles Market Summary

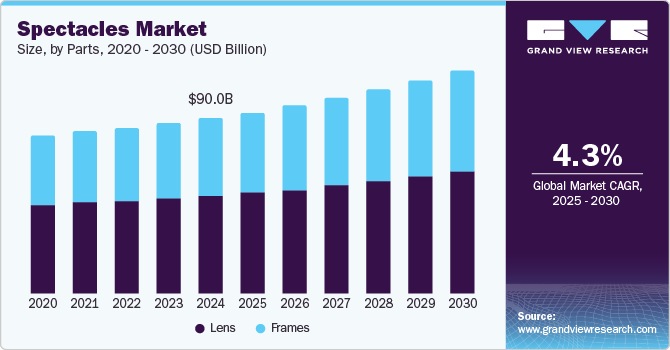

The global spectacles market size was valued at USD 90.07 billion in 2024 and is projected to reach USD 114.63 billion by 2030, growing at a CAGR of 4.3% from 2025 to 2030. The market growth is attributed to the increasing prevalence of vision-related issues such as myopia, hypermetropia, and astigmatism is driving the demand for corrective eyewear.

Key Market Trends & Insights

- North America spectacle industry dominated the global industry with the largest revenue share of 32.1% in 2024.

- The U.S. spectacle industry is expected to grow significantly over the forecast period.

- By parts, the lenses segment dominated the market with the largest revenue share of 55.7% in 2024.

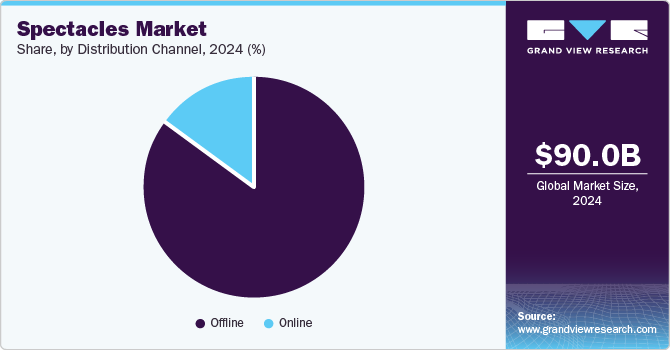

- By distribution channel, the offline channel dominated the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 90.07 Billion

- 2030 Projected Market Size: USD 114.63 Billion

- CAGR (2025-2030): 4.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Additionally, rising awareness about eye health and the importance of regular eye check-ups is encouraging more people to invest in quality spectacles. The trend towards fashion-forward eyewear, where spectacles are seen as a fashion statement, is also contributing to market growth. The advancements in lens technology, including the development of thinner, lighter, and more scratch-resistant lenses, have enhanced the comfort and appeal of spectacles. The growing geriatric population, which often requires vision correction, and the increasing acceptance of eyewear as a lifestyle accessory are further fueling the market expansion. Furthermore, a rise in disposable income and the high spending capacity of the population is anticipated to propel industry expansion.

Rising incidences of refractive errors, especially among the younger population, is anticipated to boost the product demand. Furthermore, the preference for prescription glasses over contact lenses for effective vision correction is expected to positively influence the growth. The high prevalence of vision problems among the younger generation owing to the technological disadvantages of extended usage of computers, smartphones, televisions, and other digital devices is anticipated to drive the demand for spectacles. An increased risk of Computer Vision Syndrome (CVS) is anticipated to drive the demand for anti-glare glasses and, in turn, fuel the growth of the market over the forecast period.

Manufacturers focus on catering to the rising demand for spectacles made using different materials. The rising popularity of trendy designs such as cat-eye frames and oversized square glasses in trendy colors, materials, and sizes is expected to bode well for growth. High demand for clear and transparent framed glasses is also expected to positively influence the growth of the spectacle market in the near future.

By 2030, 33% of the global population will be aged 45 and above. The rising aging population coupled with the prevalence of presbyopia is anticipated to create growth opportunities for new entrants. Manufacturers focus on producing different types of spectacles for different tasks and activities such as computer use, driving, and gaming among others.

Parts Insights

Lenses dominated the market with the largest revenue share of 55.7% in 2024. Increasing demand for different types of lenses, such as single vision, bifocal, trifocal, and progressive lenses, is anticipated to drive the segment growth. Due to the rise in the aging population, high demand for the bifocal lens is anticipated to further fuel the growth. Manufacturers heavily invest in research and development to introduce new products catering to the specific requirements of consumers.

Frames are expected to grow at the fastest CAGR of 4.6% over the forecast period. The increasing emphasis on eyewear as a fashion accessory is leading consumers to invest in multiple pairs of frames to suit different styles and occasions. The trend towards personalized and customized eyewear is also gaining traction, with consumers seeking frames that reflect their unique personalities and preferences. Additionally, advancements in frame materials and designs, such as lightweight and durable materials, have enhanced the comfort and appeal of spectacles. The growing awareness of eye health and the importance of regular eye check-ups are also contributing to the demand for new and stylish frames. Furthermore, the rising disposable incomes in emerging economies are enabling more consumers to purchase premium and designer frames.

Distribution Channel Insights

The offline channel dominated the market with the largest revenue share in 2024. Offline retail stores, such as optical shops and retail chains, offer a personalized shopping experience that includes professional eye examinations, customized fittings, and immediate product availability. The ability to try on frames and receive expert advice enhances consumer confidence and satisfaction, leading to higher sales. Additionally, the presence of a wide variety of frames and lenses in physical stores allows consumers to make informed choices based on their preferences and needs. The trust and reliability associated with brick-and-mortar stores also contribute to their popularity. Moreover, offline channels often engage in local marketing and promotions, attracting a steady stream of customers.

The online channel is expected to grow at the fastest CAGR over the forecast period. The convenience of online shopping enables consumers to browse and purchase spectacles from the comfort of their homes at any time. E-commerce platforms offer detailed product descriptions, virtual try-on features, customer reviews, and a wider selection of frames and lenses, including specialty and designer brands not always available in local stores. Additionally, online retailers often provide competitive pricing, discounts, and subscription services, making it more affordable for consumers to purchase their preferred eyewear. The increasing use of smartphones and the internet has facilitated the growth of online sales, as consumers can easily shop on the go. Furthermore, the rise of social media and digital marketing has enhanced product visibility and consumer engagement, attracting a larger audience to online channels.

Regional Insights

North America spectacle industry dominated the global industry with the largest revenue share of 32.1% in 2024. The high prevalence of vision problems and the increasing awareness about eye health have driven demand for spectacles in the region. Moreover, North America has a strong presence of major eyewear brands and retailers, which ensures the availability of a wide variety of high-quality and fashionable eyewear products. The region's advanced healthcare infrastructure and high disposable incomes also contribute to the higher spending on eye care products, including premium and designer frames and lenses. Additionally, the growing trend of eyewear as a fashion accessory has further fueled market growth, as consumers often purchase multiple pairs to match different outfits and occasions.

U.S. Spectacle Market Trends

The U.S. spectacle industry is expected to grow significantly over the forecast period owing to the increasing prevalence of vision problems and the rising awareness about eye health. As more people seek vision correction solutions, the demand for spectacles is expected to rise. Additionally, the trend of eyewear as a fashion accessory is gaining momentum, with consumers purchasing multiple pairs to match different outfits and occasions. The growing middle-class population and rising disposable incomes are also contributing to the market expansion. Furthermore, the increasing adoption of online shopping and the proliferation of e-commerce platforms are making it easier for consumers to access various eyewear products.

Europe Spectacle Market Trends

European spectacle industry held a considerable share in 2024. The increasing prevalence of vision problems such as myopia, hypermetropia, and presbyopia is leading to a higher demand for corrective eyewear. Additionally, there is a growing awareness of the importance of regular eye check-ups and eye health, which is encouraging more people to invest in quality spectacles. The region's aging population, which often requires vision correction, is also contributing to market growth. Furthermore, the trend of eyewear as a fashion accessory is gaining popularity, with consumers purchasing stylish frames to match their outfits. Technological advancements in lens materials and designs are enhancing the comfort and appeal of spectacles, further driving market expansion

Asia Pacific Spectacle Market Trends

Asia Pacific spectacle industry is expected to grow at the fastest CAGR of 4.7% over the forecast period owing to rising disposable incomes and increasing health awareness. The region's large and growing middle-class population is driving demand for quality eyewear. Additionally, the prevalence of vision problems such as myopia and astigmatism is high, leading to a greater need for corrective lenses. The presence of domestic and international eyewear brands in the market also contributes to growth. Moreover, initiatives such as low-cost or free eye examination campaigns in developing countries are helping to diagnose and treat vision problems, further boosting market expansion. The trend of eyewear as a fashion accessory is also gaining traction, with consumers in the region increasingly viewing spectacles as a style statement.

Key Spectacles Company Insights

Some key companies in the spectacle market include Essilor International, Johnson & Johnson Vision, Alcon, ZEISS Group, HOYA Corporation, and others.

-

Essilor International is renowned for its advanced lens technologies, including single vision, bifocal, trifocal, and progressive lenses. The company also offers specialized lenses such as Stellest for myopia management, which are designed to slow down the progression of myopia in children and teenagers. Essilor's lenses come with various coatings, including anti-reflective, scratch-resistant, anti-fog, and UV protection, enhancing both vision quality and durability.

-

Johnson & Johnson Vision provides a comprehensive range of vision care products and services, including contact lenses, intraocular lenses, and laser vision correction solutions. The company's best-selling contact lens brand, ACUVUE, offers a variety of lenses for different vision needs, including daily disposables, toric lenses for astigmatism, and multifocal lenses for presbyopia. Johnson & Johnson Vision also offers innovative treatments for eye conditions such as Meibomian Gland Dysfunction (MGD) with the TearScience LipiFlow treatment and personalized laser vision correction with the iDESIGN System.

Key Spectacles Companies:

The following are the leading companies in the spectacles market. These companies collectively hold the largest market share and dictate industry trends.

- Essilor International

- Johnson & Johnson Vision

- Alcon

- ZEISS Group

- HOYA Corporation

- ZENNI OPTICAL, INC

- Warby Parker

- Lenskart

- Titan Company

- MODO

Recent Developments

-

In August 2024, Titan Eye+ announced that it is poised to transform the eyewear shopping experience with its event, The Great Indian Spectacle. This event aims to showcase the latest eyewear trends at accessible prices, offering discounts of up to 25% on various frames and spectacles

Spectacles Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 92.96 billion

Revenue forecast in 2030

USD 114.63 billion

Growth Rate

CAGR of 4.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Parts, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; Saudi Arabia

Key companies profiled

Essilor International; Johnson & Johnson Vision; Alcon; ZEISS Group; HOYA Corporation; ZENNI OPTICAL, INC; Warby Parker; Lenskart; Titan Company; MODO

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Spectacles Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global spectacles market report based on parts, distribution channel, and region:

-

Parts Outlook (Revenue, USD Billion, 2018 - 2030)

-

Frames

-

Lens

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.