- Home

- »

- Plastics, Polymers & Resins

- »

-

Specialty Polyamides Market Size And Share Report, 2030GVR Report cover

![Specialty Polyamides Market Size, Share & Trends Report]()

Specialty Polyamides Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Long Chain, High Temperature), By End-use (Automotive & Transportation, Electrical & Electronics), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-211-2

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Specialty Polyamides Market Summary

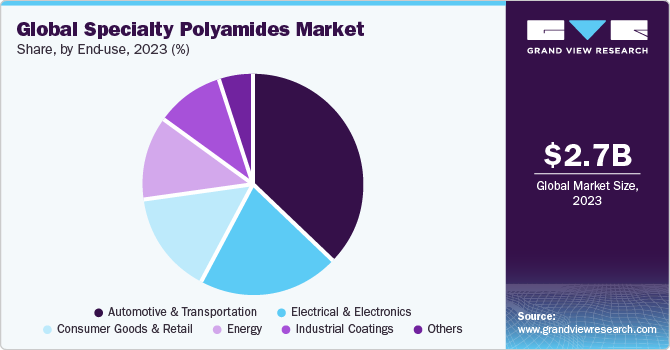

The global specialty polyamides market size was estimated at USD 2.71 billion in 2023 and is projected to reach USD 4.31 billion by 2030, growing at a CAGR of 7.0% from 2024 to 2030. One key trend driving the market's growth is the growing demand for lightweight materials in the automotive and transportation industries.

Key Market Trends & Insights

- The specialty polyamides market in Asia Pacific region accounted for the largest share of 43.27% in 2023.

- Specialty polyamide market in the U.S. is witnessing a massive demand owing to the growing automotive manufacturing sector.

- By product, high temperature specialty polyamide segment held the largest market share of 47.24% in 2023.

- By end use, automotive & transportation segment accounted for the largest share in end-use segment in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.71 Billion

- 2030 Projected Market Size: USD 4.31 Billion

- CAGR (2024-2030): 7.0%

- Asia Pacific: Largest market in 2023

In addition, growing concerns about automotive fuel efficiency and strong demand for cleaner solutions are expected to drive demand for the product over the forecast period. With the increasing focus on green technologies and sustainability, the use of specialty polyamide in the automotive industry is expected to increase over the forecast period. Globalization, coupled with an increase in the disposable income of consumers, is projected to drive the global automotive market, which is further expected to augment the specialty polyamide market. Moreover, the high strength-to-weight ratio of specialty polyamide has made it popular in other transportation industries, such as aerospace and defense. Specialty polyamide has been popularly used in the components of military aircraft and helicopters to reduce their overall weight significantly.

As specialty polyamide is ultra-lightweight and exhibits high tensile strength and other superior properties, sports goods manufacturers have endeavored to make use of the fibers for basic material of their final products. Specialty polyamide is an indispensable basic material used in various sporting goods. Manufacturers are also developing multiple sporting/leisure goods made of specialty nylons. This type of polyamide has been popularly used in the manufacturing of fishing rods, golf club shafts, various rackets, yachts, rowing boats, bicycle frames, baseball bats, hockey sticks, and bows.

Market Concentration & Characteristics

The market is moderately fragmented, with key participants involved in R&D and technological innovations. Notable companies include Evonik Industries AG, Arkema S.A., BASF SE, LG Chem, INVISTA, Solvay SA, and Asahi Kasei Corporation, among others. Several players are engaged in framework development to improve their market share.

The market is characterized by a high degree of innovation. Researchers and manufacturers are continually developing new formulations that offer superior performance characteristics such as increased strength, flexibility, thermal stability, and chemical resistance. For instance, innovations in polyamide 6 and polyamide 66 have led to materials with enhanced mechanical properties suitable for high-stress applications in the automotive and aerospace industries. In addition, the development of high-performance polyamides with improved wear resistance and reduced moisture absorption has expanded their use in demanding environments.

The market is highly impacted by regulations. Regulations affect the supply and demand dynamics within the market. For instance, the European Union’s REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation requires extensive testing and documentation for chemical substances, including polyamides. This can restrict the availability of certain raw materials, leading to a shift towards safer, compliant alternatives. As a result, manufacturers must adapt their product offerings to meet regulatory requirements, potentially reshaping market preferences towards more sustainable and compliant specialty polyamides.

Product Insights

The specialty polyamides is segmented as long chain specialty polyamides, high temperature specialty polyamides, and MSD6/PARA. High temperature specialty polyamide held the largest market share of 47.24% in 2023. High temperature polyamides are highly crystalline polyamides that differ from other specialty polyamides, such as PA 6/10, PA 11, PA 6/12, and PA 12, due to their thermal and mechanical properties. High temperature polyamides include PA6T/6I/66, PA6T/66/DT, PA6T/66, PA46, PA9T, PA4T, PA6T/6, PA6T/6I, PA6T/DT, and PA10T. High temperature polyamides are high-performance materials that are cost-effective and offer ease of processing, strength, and durability. Manufacturers of end products from a variety of applications prefer high-performance polyamides when the goal is increased strength, enhanced thermal performance, reduced weight, durability, and simplified processing.

The long chain specialty polyamides segment is expected to grow at the fastest CAGR over the forecast period.Long chain specialty polyamides include PA12, PA11, PA610, PA612, PA410, PA1010, and PA1012. These specialty polyamides are traditionally used to produce monofilaments, which are further used in a broad range of high chemical resistance and good dimensional stability applications.The rising focus on sustainability in business activities is driving investments to promote innovations in the segment. For instance, In October 2023, Arkema S.A., a specialty chemicals company, announced the reduction of the carbon footprint of Rilsan polyamide 11 by 46%, now achieving less than 2 kg of CO2 emissions per kilogram. This is about a 70% improvement compared to traditional polyamide resins made from fossil fuels.

End-use Insights

Automotive & transportation accounted for the largest share in end-use segment in 2023. Specialty polyamides are commonly used in the automotive industry as they meet the needs of automotive thermal management components. It maintains excellent toughness and strength when exposed to hot automotive fluids. It finds important application in the above fields due to its excellent balance of oil resistance, toughness, mechanical strength, design flexibility, and thermal stability. In automotive & transportation applications, the demand for products is expected to be driven by its PA 12, PA 11, PA 4/6, and PA 6/12 grades. These grades are typically used in automotive cooling systems, engine covers, air intake manifolds, tire cords, headlamp bezels, airbag containers, hoses & tubing, exterior automobile parts, including door & tailgate handles, fuel caps & lids, wheel covers, and front-end grilles among others.

The electrical & electronics segment is expected to grow at a rapid CAGR through the forecast period. With the advent of technologies like artificial intelligence (AI), machine learning (ML), and cloud computing, the need for semiconductors is rising, propelling the segment. Specialty polyamide filled with electrically conductive materials provides resistance to electrostatic discharge (ESD), electromagnetic interference (EMI), and radio-frequency interference (RFI) shielding in electronic equipment as well as for conveyor systems and trays used to manufacture semiconductor chips.

Region Insights

The increase in demand for specialty polyamides in North America has made it one of the major regional consumers. The spur in demand for the product from the automotive and electronics industries has propelled the growth of the market in the region. Auto manufacturers are attempting to cut down vehicular emissions by implementing lightweight materials to reduce the curb weight of the vehicle. Additionally, electric vehicles are increasingly being adopted to control emissions.

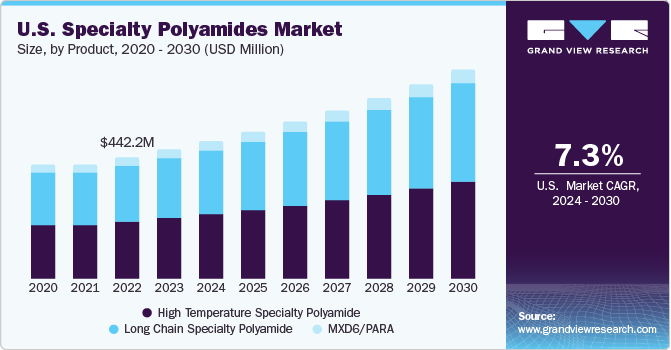

U.S. Specialty Polyamides Market Trends

Specialty polyamide market in the U.S. is witnessing a massive demand owing to the growing automotive manufacturing sector. According to the International Organization of Motor Vehicle Manufacturers, the total vehicle production in the U.S. grew by 6% to 10.6 million units in 2023 from 10.1 million units in 2022. The U.S. is one of the most lucrative markets for automotive manufacturing owing to its well-developed economy coupled with the presence of supportive government policies.

Asia Pacific Specialty Polyamides Market Trends

The specialty polyamides market in Asia Pacific region accounted for the largest share of 43.27% in 2023 and is expected to witness the fastest CAGR over the forecast period. The availability of low-cost raw materials and labor and increased spending power are the major driving factors for the market's growth in this region. In addition, a huge untapped market and supportive government policies are attracting global specialty polyamide manufacturers to set up their manufacturing and distribution facilities in this region.

China specialty polyamides market held the largest share in the region in 2023. China is the largest producer of automobiles and a prominent player in the electrical & electronic components market, owing to the presence of leading manufacturers, such as Dongfeng Motor Company, Great Wall Motors, Xiaomi Corporation, Hisense Co., Ltd., and Sumitomo Electric Industries, Ltd. The wide range of applications of specialty polyamides in the automobile industry is driving the market.

The specialty polyamides market in India is poised to grow significantly over the forecast period. The market is driven by the emerging digital transformation of businesses and the increasing adoption of EVs in the country. Governmental initiatives such as Digital India, and the Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India (FAME India) Scheme are supporting the drivers.

Europe Specialty Polyamides Market Trends

The specialty polyamides market in Europe is one of the leading manufacturers of automobiles and is expected to continue its dominance in the sector over the forecast period. The rising demand for lightweight electric and hybrid vehicles, along with the presence of major automotive manufacturers, including AUDI AG, BMW AG, Mercedes-Benz AG, JAGUAR LAND ROVER LIMITED, ASTON MARTIN, Volkswagen, Volvo Car Corporation, FCA Italy S.p.A., Ferrari S.p.A., Automobili Lamborghini S.p.A., and Porsche Austria GmbH & Co. in the region is projected to result in automotive industry expansion, which, in turn, is expected to drive the demand for specialty polyamide in automotive industry over the forecast period.

Germany specialty polyamides market dominated the region in terms of revenue in 2023. Long chain specialty polyamides are expected to significantly contribute to the market in Germany owing to the high demand for PA 12 in oil & gas, automotive, electrical & electronics, and consumer goods applications.

The specialty polyamides market in France is expected to witness substantial growth over the forecast period. The government’s focus on promoting the use of polymers, owing to their lightweight and energy-efficient properties, has contributed to the development of the plastic industry. Most of the plastics companies in the country are medium- and small-sized companies. France plastic industry is emphasizing on developing new products for electronics, technical fabrics, and 3-D printing applications. Industry 4.0 technologies and products for applications in automotive, consumer & retail, and medical sectors are key areas of opportunity for polyamide manufacturers in the country.

Central & South America Specialty Polyamides Market Trends

The specialty polyamides market in Central & South America (CSA) region is advancing at a promising growth rate owing to the ongoing development in electronics and automotive industries. Positive economic trends in the region have significantly increased the purchasing power of customers, which has favorably impacted the regional market growth. The growing sectors of consumer goods, electrical & electronics, industrial, and automotive in the region are expected to contribute to the regional product demand over the next few years.

Middle East & Africa Specialty Polyamides Market Trends

The specialty polyamides market in the Middle East & Africa (MEA) is projected to witness significant growth on account of the rapid expansion of application industries like energy, consumer goods & retail, electrical & electronics, automotive & transportation, and industrial coatings. Energy is one of the fastest-growing application segments in the MEA market on account of the presence of The Organization of the Petroleum Exporting Countries (OPEC) member countries in the region. Specialty polyamides are widely used in onshore and offshore oil & gas sector and wind energy sector. In offshore applications, specialty polyamides are used for the transportation of oil & gas to protect against chemical attacks, aging, and corrosion.

Key Specialty Polyamides Company Insights

Key companies are adopting several organic and inorganic growth strategies, such as new product development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

Key Specialty Polyamides Companies:

The following are the leading companies in the specialty polyamides market. These companies collectively hold the largest market share and dictate industry trends.

- Evonik Industries AG

- Arkema S.A

- BASF SE

- DuPont de Nemours, Inc.

- Koninklijke DSM N.V.

- Asahi Kasei Corporation

- LG Chem

- INVISTA

- Solvay SA

- Radici Partecipazioni SpA

- Ems-Chemie Holding Ag

- Ube Industries Ltd.

- Kuraray Co., Ltd.

- Mitsubishi Gas Chemical Company, Inc.

- Toyobo Co., Ltd.

- ShanDong DongChen Engineering Plastic Co., Ltd.

- Eurostar Engineering Plastics

Recent Developments

-

In April 2024, NYCOA launched NXTamid L, a plasticizer-free long-chain polyamide, as a sustainable alternative to PA11 and PA12. This new material offers performance equivalent to traditional resins while providing customization options, higher service temperature, flexibility, and chemical resistance. The material is designed for various applications and processing technologies, offering benefits such as higher melting temperatures, lower moisture absorption, and improved dimensional stability.

-

In March 2024, Toray Advanced Composites introduced an innovative high-performance thermoplastic material, Toray Cetex TC915 PA+, into its product line. This strengthened polyamide thermoplastic material offers improved strength, advanced stiffness, better temperature stability, and lesser moisture absorption. It is ideal for various applications such as high-performance industrial uses, sporting goods, automotive structures, energy applications, urban air mobility (UAM), and unmanned aerial systems (UAS).

-

In June 2023, Intel, a U.S.-based semiconductor company, invested approximately USD 4.6 billion in a new semiconductor chip assembly and testing facility in Poland. This project, which was expected to create 2,000 jobs, is the largest Greenfield investment in the Polish history. The new facility, to be located near Wrocław, will be part of Intel's EU-wide semiconductor supply chain, which includes an existing wafer fabrication facility in Ireland and a planned one in Germany. The project is expected to strengthen Poland's role in the global semiconductor supply chain and establish the country as an economic trendsetter.

Specialty Polyamides Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.88 billion

Revenue forecast in 2030

USD 4.31 billion

Growth rate

CAGR of 7.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Netherlands; Italy; Poland; Spain; China; India; Japan; Hong Kong; Taiwan; Thailand; South Korea

Key companies profiled

Evonik Industries AG; Arkema S.A.; BASF SE; DuPont de Nemours, Inc.; Koninklijke DSM N.V.; Asahi Kasei Corporation; LG Chem; INVISTA; Solvay America, Inc.; Radici Partecipazioni Spa; Ems-Chemie Holding Ag; Ube Industries Ltd.; Kuraray Co., Ltd.; Mitsubishi Gas Chemical Company, Inc.; Toyobo Co., Ltd.; ShanDong DongChen; Engineering Plastic Co., Ltd.; Eurostar Engineering Plastics

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

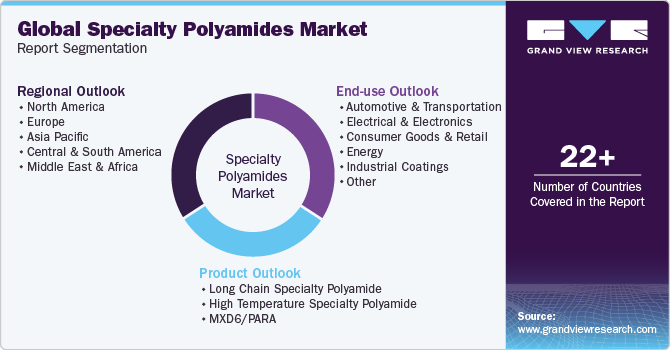

Global Specialty Polyamides Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global specialty polyamides market report based on product, end-use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Long Chain Specialty Polyamide

-

High Temperature Specialty Polyamide

-

MXD6/PARA

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive & Transportation

-

Electrical & Electronics

-

Consumer Goods & Retail

-

Energy

-

Industrial Coatings

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Netherlands

-

Italy

-

Poland

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Hong Kong

-

Taiwan

-

Thailand

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global specialty polyamides market size was estimated at USD 2.71 billion in 2023 and is expected to reach USD 2.88 billion in 2024.

b. The global specialty polyamides market is expected to grow at a compound annual growth rate of 7.0% from 2024 to 2030 to reach USD 4.31 billion by 2030.

b. The high-temperature segment dominated the specialty polyamide market, with a share of 47.2% in 2023. High-temperature polyamides are high-crystalline and differ from other specialty polyamides, such as PA 11, PA 12, PA 6/10, and PA 6/12, on account of their mechanical and thermal properties.

b. Some key players operating in the specialty polyamides market include Evonik Industries AG; Arkema S.A.; BASF SE; DowDuPont, Inc.; Koninklijke DSM N.V.; Asahi Kasei Corporation; LG Chem; INVISTA; Solvay America, Inc.; and Radici Partecipazioni Spa.

b. Key factors that are driving the market growth include Surging demand for lightweight materials in the automotive and transportation industry and growing concerns regarding automobile fuel efficiency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.