Specialty Oleochemicals Market Size, Share & Trends Analysis Report By Product (Specialty Esters, Fatty Acid Methyl Ester, Glycerol Ester, Alkoxylates, Fatty Amines), By Application, By Region, And Segment Forecast, 2020 - 2027

- Report ID: GVR-4-68038-436-9

- Number of Report Pages: 76

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Specialty & Chemicals

Report Overview

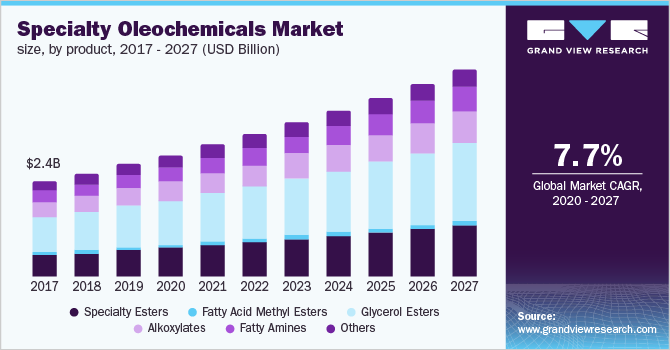

The global specialty oleochemicals market size to be valued at USD 36.2 billion by 2027 and is expected to grow at a compound annual growth rate (CAGR) of 7.7% during the forecast period. Increasing demand for biopolymers is projected to positively influence the market for specialty oleochemicals. Growing concerns regarding plastic/polymers biodegradability have triggered manufacturers in the market to focus on the development of bio-based alternatives.

The market is highly influenced by abundant feedstock supply from the Asia Pacific, which is one of the significant factors behind the inflated prices of specialty oleochemicals in North America and Europe. Therefore, raw material suppliers and integrated plantation-based Asia Pacific manufacturers have substantial growth opportunities in the market for specialty oleochemicals.

To strengthen market position and revenues, the market participants are entering into a significant number of collaborations with the distributors, which helps them achieve greater penetration into the market for specialty oleochemicals. In November 2019, Emery Oleochemicals entered into a collaborative agreement with Omya Inc. in order to expand its distribution network. Participation in R&D, along with new and innovative product launches, is one of the factors driving intense competition among the players.

Furthermore, compliance with the national and international regulatory norms is one of the critical concerns for the manufacturers. Compliance with these norms for sustainable cultivation, manufacturing, and distribution has turned out as a significant winning factor for manufacturers involved in domestic as well as offshore businesses.

Integration along the value chain has helped the players maximize profits and negate the participation of external players. Emery Oleochemicals and Vantage Specialty Chemicals have vertically integrated their business by participating in in-house plantation, raw material procurement, production, and distribution. KLK OLEO and IOI Group have integrated their backward functions with the help of their large palm oil plantations in Malaysia.

Specialty Oleochemicals Market Trends

The consumption of specialty oleochemicals is projected to increase significantly in the coming years as the demand for pharmaceutical, food, and personal care products is growing substantially. The demand for personal care products has grown due to an increase in disposable income, high market penetration, and product innovation.

The growing demand for biodegradable materials combined with the implementation of severe restrictions on the use of petrochemicals is expected to have a positive impact on the market in the forecast period. The volatility of essential oil prices followed by the growing concerns about food security in many developing countries has raised the prospects of using vegetable oil for industrial applications.

Manufacturing costs are high, and there are concerns about food security. The demand for vegetable oils has increased, indicating that global consumption of oils and fats has increased significantly. The rising concerns about food security are because it creates additional outlets when vegetable oil is scarce for another critical purpose. On the other hand, the manufacturing process is expensive and requires advanced technology. Such factors hamper the market growth to some extent.

Environmental standards are becoming increasingly serious, and renewable resources are reducing. Oleochemicals have the opportunity to grow and will eventually replace traditional petroleum-based products. The demand for green chemicals is expanding and consumer demand for such products is increasing.

Product Insights

Specialty esters are an alternative to chemicals and materials that are manufactured using petroleum for various applications. These chemicals help manufacturers and consumers adhere to the Environmental Protection Agency (EPA) and Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) guidelines, which emphasize the use of biobased resources in environmentally sensitive applications to decrease carbon footprint.

Fatty acid methyl ester (FAME) is a derivative of fatty acid ester. It is manufactured by the transesterification of methanol and fats (vegetable oils, waste cooking oils, or animal fats) in the presence of sodium methoxide or sodium hydroxide as a catalyst. FAME is used for the production of biodiesel and detergents and is superior to conventional fossil fuels in terms of its sulfur content, carbon emission, and biodegradability.

Glycerol esters, also known as acylglycerols or glycerides, are formed by the reaction between glycerol and fatty acids. Food-grade glycerol is significantly used in the production of ice creams, chewing gums, flavored beverages, and cosmetics. Glycerol has three hydroxyl groups, which can be esterified to form triglycerides, diglycerides, and monoglycerides. These are further used for the production of glycerol monostearate (GMS), medium-chain triglycerides (MCT), oleates, glycerol di-stearate, and other glycerides.

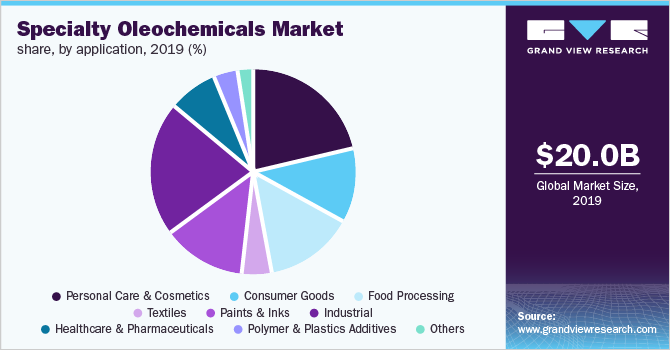

Application Insights

In personal care and cosmetics, specialty oleochemical derivatives/formulations find application in creams, skincare, sun care, hair care, and oral care products. The growing demand for organic and anti-aging products to maintain a youthful appearance is driving the need for personal care products. This, in turn, is expected to trigger the demand for specialty oleochemical derivatives in the personal care and cosmetics application segment. Over the past decade, this industry has shown continuous growth coupled with increasing shelf space in supermarkets, hypermarkets, retail stores, and boutique stores across the world.

The consumer goods segment comprises of products such as perfumes, soaps, shampoos, cleaners, and detergents, where specialty oleochemicals are directly consumed by consumers in accordance with their needs. The shifting consumer preference toward use of less toxic and natural ingredients in household cleaners, detergents, and plastics products is expected to drive the specialty oleochemicals market over the forecast period.

In the food processing segment, specialty oleochemical derivatives are used in frozen foods, confectionery, and beverage processing. Alcohol ethoxylates sulfates, sucrose esters, and glycerol esters are some of the specialty oleochemical derivatives that are majorly used in the food processing industry. Shifting consumer preference for healthier diet intake and consumer inclination toward weight loss programs is expected to steer product demand in food additives and processing applications over the long term.

The textiles segment comprises chemical agents that are used in fiber finishing, textile printing, fabric softener, and coning fall applications. Specialty oleochemical derivatives are used as microbial agents, antistatic agents, wetting agents, emulsifiers, dyeing agents, and lubricants. The ongoing technological innovation in textile processing and spinning is anticipated to urge fabric processors to incorporate multifunctional products to enhance their textile operations over the long term.

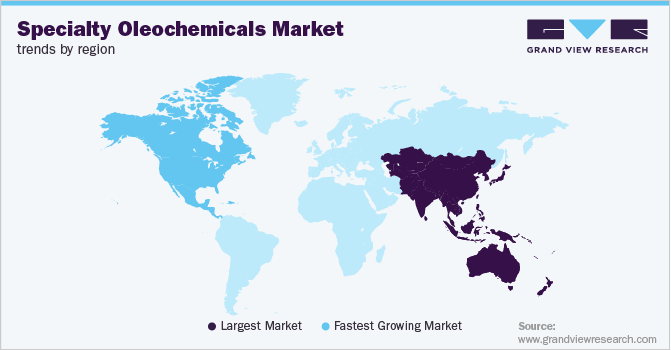

Regional Insights

In 2019, Asia Pacific dominated the market for specialty oleochemicals and is likely to witness the fastest growth over the forecast period. This can be attributed to the presence of a large number of manufacturers in Malaysia and Indonesia. The abundance of raw materials such as palm oil and palm kernel oil coupled with huge captive consumption in the region has been motivating manufacturers to increase their capacities in the region. The trend is expected to drive the market for specialty oleochemicals in the region over the forecast.

Favorable regulatory policies by Registration, Evaluation, and Authorization of Chemicals (REACH) with the aim to promote sustainable chemicals and petrochemical alternatives are expected to drive the growth of the market for specialty oleochemicals in Europe. The growing demand for biodiesel on account of rising petroleum prices in the region is expected to drive the demand for glycerin over the forecast period. In addition, increasing demand for biodiesel as an alternative to conventional petroleum diesel is expected to drive the demand for specialty oleochemicals, such as glycerin and methyl ester sulfonate, over the forecast period.

In North America, stringent government regulations regarding the usage of petroleum-based products owing to their harmful environmental effects have fostered the demand for specialty oleochemicals in the region. Rising demand from several end-use industries, including personal care cosmetics, healthcare, and food processing, is expected to augment product consumption.

Key Companies & Market Share Insights

The market for specialty oleochemicals is highly innovation-driven with application development for customized solutions as an absolute necessity. Market players are continually looking to develop new products through R&D activities for emerging applications and end-use markets. This is maintaining high competition among the players.

Established and experienced players are developing high-level technology to improve product standards, thereby ensuring consistency in product quality. Market giants, as well as local players, are focused on developing new products to cater to specific requirements of manufacturers from application industries.

Companies are focusing on acquisitions, joint ventures, mergers, and collaborations with other players to acquire a larger share in the market for specialty oleochemicals. This helps them increase their client base as well as product portfolio. For instance, in September 2017, H.I.G. Capital announced the acquisition of Vantage Specialty Chemicals, Inc. from The Jordan Company for USD 1.0 billion. According to the agreement, Vantage’s six manufacturing facilities located in the U.S. and 14 overseas distribution centers in Europe, Asia, Latin America, and South Africa became part of H.I.G Capital.

Recent Developments

-

In August 2021, - Indorama Corporation, a company based in Singapore publicly stated that they will purchase Oxiteno (Brazil), the chemical corporation of Brazilian petroleum firm Ultrapar Participacoes SA related to adaptation and ending with a delayed amount in 2024

-

In August 2021, Mega First Corporation, a company based in Malaysia acquired Emery Oleochemicals' Asia Pacific unit. Edenor Technology Sdn Bhd a partnership formed by 9M Technologies Sdn Bhd and Mega First Corp Bhd will carry out the acquisition

Specialty Oleochemicals Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2027 |

USD 36.2 billion |

|

Growth rate |

CAGR of 7.7% from 2020 to 2027 |

|

Base year for estimation |

2019 |

|

Historical data |

2016 - 2018 |

|

Forecast period |

2020 - 2027 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2020 to 2027 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Netherlands; Russia; Switzerland; Poland; Sweden; China; India; Japan; South Korea; Malaysia; Singapore; Indonesia; Taiwan; Australia; Brazil; Argentina; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Vantage Specialty Chemicals, Inc.; Emery Oleochemicals; Evonik Industries AG; Wilmar International Ltd.; Kao Chemicals Global; Ecogreen Oleochemicals; Corbion N.V; Cargill, Incorporated; Oleon NV; Godrej Industries; IOI Corporation Berhad; KLK OLEO. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Specialty Oleochemicals Market Segmentation

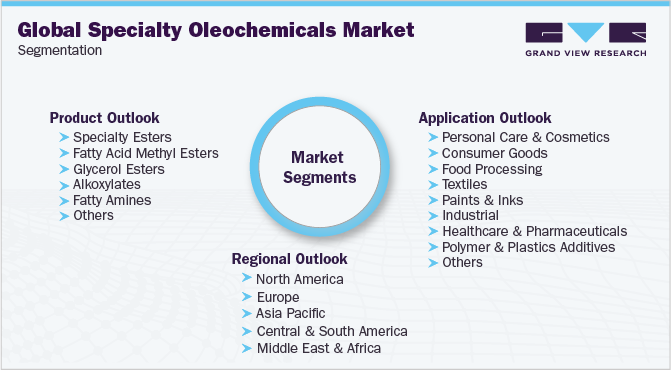

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global specialty oleochemicals market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Specialty Esters

-

Fatty Acid Methyl Esters

-

Glycerol Esters

-

Alkoxylates

-

Fatty Amines

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Personal Care & Cosmetics

-

Consumer Goods

-

Food Processing

-

Textiles

-

Paints & Inks

-

Industrial

-

Healthcare & Pharmaceuticals

-

Polymer & Plastics Additives

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

The U.K.

-

France

-

Italy

-

Spain

-

Netherlands

-

Russia

-

Switzerland

-

Poland

-

Sweden

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Malaysia

-

Singapore

-

Indonesia

-

Taiwan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."