- Home

- »

- Petrochemicals

- »

-

Specialty Oilfield Chemicals Market Size, Share Report, 2030GVR Report cover

![Specialty Oilfield Chemicals Market Size, Share & Trends Report]()

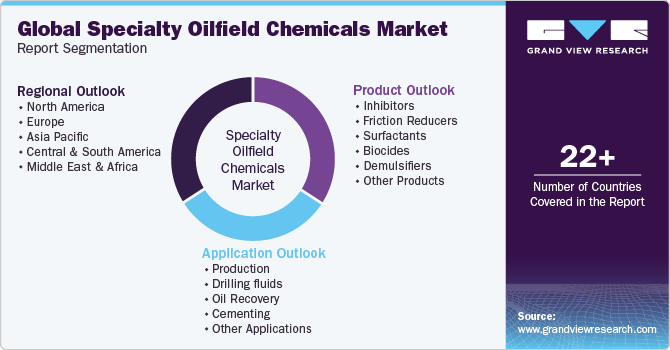

Specialty Oilfield Chemicals Market Size, Share & Trends Analysis Report By Product (Inhibitors, Biocides, Friction Reducers, Surfactants, Demulsifiers), By Application (Production, Drilling Fluids, Oil Recovery, Cementing), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-169-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Specialty Oilfield Chemicals Market Trends

The global specialty oilfield chemicals market size was estimated at USD 10.04 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.4% from 2024 to 2030. The growth is attributed to the increasing crude oil production, coupled with growing demand from the enhanced oil recovery application. In addition, the use of specialty oilfield chemicals helps prolong the lifecycle of industrial equipment by removing unwanted deposited metal scales, eventually minimizing equipment maintenance costs. This advantage in reducing maintenance costs is further expected to have a positive impact on market growth.

Moreover, the advancement and introduction of automation in the oil & gas production techniques further require increased usage of specialty oilfield chemicals. For instance, the implementation of hydraulic fracturing, commonly referred to as fracking, in the oil and gas industry. This technique involves injecting fluids into rock formations at high pressures to induce fractures, thereby enabling the extraction of previously inaccessible oil and gas resources. Specialty oilfield chemicals are employed to mitigate turbulent flow during pumping operations, facilitating the creation of fractures and the efficient placement of sand. The widespread use of fracking has significantly boosted oil and gas production, reshaping the energy landscape and unlocking vast reserves that were previously considered economically unviable to exploit.

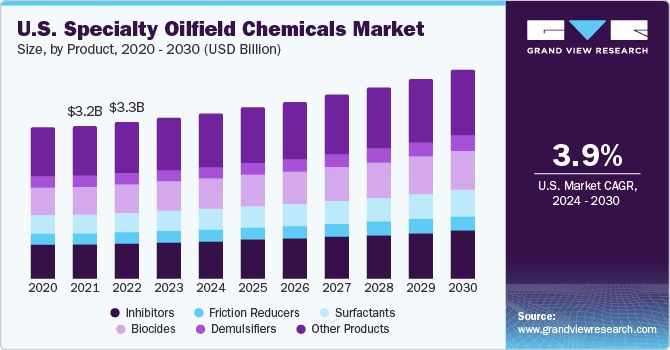

The U.S. is a major consumer of the product in North America with a revenue share of 80.7% in 2023. The growth of the product market during the forecast period can be attributed to the increasing demand from oil & gas industry in the country. According to the Council on Foreign Relations, the U.S. fulfills over 90 percent of its natural gas supply and 75 percent of its crude oil supply domestically, accounting for 11 million barrels of crude oil and 1 million cubic feet of natural gas per day in 2021. Thus, the growing demand for oil in the country is anticipated to drive the demand for specialty oilfield chemicals over the forecast period.

Specialty oilfield chemicals are specifically tailored to address more complex or unique challenges encountered in specific oilfield environments or operations. They are often developed in response to specific well conditions, such as high temperatures, high pressures, or corrosive environments. These chemicals are formulated to meet the demanding requirements of these conditions and provide effective solutions.

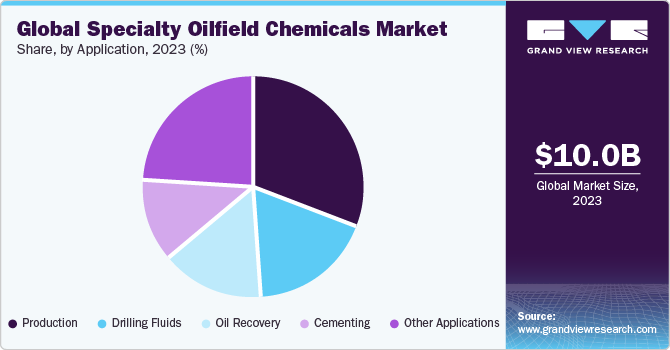

Application Insights

Production application dominated the specialty oilfield chemicals market with a revenue share of 30.5 % in 2023. This is attributed to the fact that these chemicals find application in various stages of production, from drilling to well stimulation and maintenance. Drilling fluid additives are essential to optimize drilling operations, providing stability, preventing formation damage, and reducing friction. Well stimulation chemicals, such as acidizing agents and fracturing fluids, enhance well productivity by dissolving deposits and creating fractures in the reservoir rock. Corrosion and scale inhibitors ensure the longevity of production facilities by protecting against degradation and mineral deposits. Demulsifiers and emulsion breakers separate oil-water emulsions, while enhanced oil recovery chemicals aid in the extraction of additional hydrocarbons.

The application of these specialty oilfield chemicals enables companies to maximize efficiency, reduce downtime, and extend the life of oilfields. As the industry evolves, innovative and eco-friendly chemicals continue to shape the future of oil and gas production. According to the International Energy Agency (IEA), the global consumption of oil is anticipated to reach 104.1 million barrels/day by 2026, with ethane, naphtha, and LPG together accounting for around 70% of the demand. Thus, with the advancing demand for oil & gas production the demand for specialty oilfield chemicals is also anticipated to witness growth over the forecast period.

Oil recovery is another application anticipated to witness growth over the forecast period. Specialty oilfield chemicals play a vital role in enhancing oil recovery processes, maximizing production efficiency, and increasing overall yields in the oil and gas industry. These chemicals are specifically designed to address the unique challenges faced during oil recovery, such as reservoir heterogeneity, fluid displacement, and formation damage.

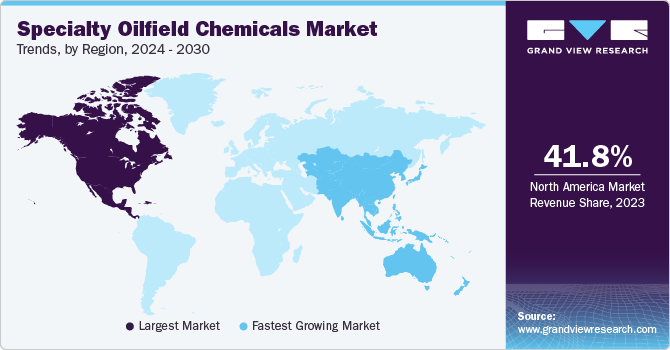

Regional Insights

North America region dominated the market with a revenue share of 41.8% in 2023. This is attributable to the fact that the region has witnessed significant growth in oil and gas production, driven by advancements in drilling technologies, such as hydraulic fracturing (fracking) and horizontal drilling. These technologies have enabled the extraction of oil and gas from unconventional sources, such as shale formations, leading to a surge in production. As a result, the need for specialty oilfield chemicals has increased to support and optimize the extraction, production, and refining processes in the oil and gas industry.

Moreover, according to the U.S. Energy Information Administration, crude oil production in the U.S. is anticipated to account for 12.90 million barrels per day and 13.15 million barrels per day in 2023 and 2024 respectively. Furthermore, according to the International Trade Administration, Mexico is the 12th largest producer of crude oil in the world and 4th largest producer of oil & gas in the Americas, after the U.S., Canada, and Brazil, with earnings from this industry accounting for around 16% of the total Mexico government revenues in 2021. Thus, the advancing oil & gas industry in the U.S., Canada, and Mexico is expected to increase the demand for specialty oilfield chemicals used in the production of oil & gas in the region.

Europe is another region anticipated to witness growth over the forecast period. Europe has been experiencing high oil production activity, particularly in countries like Norway and the North Sea region. Norway, as one of Europe's largest oil producers, has been investing in advanced technologies and techniques to maximize oil recovery from mature fields. This includes the use of specialty chemicals to improve reservoir sweep efficiency, enhance oil recovery rates, and mitigate production challenges like formation damage and scaling. Thus, the demand for these chemicals has consequently increased to support the ongoing oil production activities in the region.

Product Insights

Inhibitors dominated the market with a revenue share of 23.0 % in 2023. This is attributed to the fact that they play a vital role in impeding or slowing down specific chemical reactions.These inhibitors are utilized to address various challenges such as corrosion, scale formation, and fluid stability. Specifically, corrosion inhibitors are formulated to safeguard metal surfaces, such as pipelines and storage tanks, from the damaging effects of corrosive substances commonly found in oilfield fluids. By creating a protective layer on these surfaces, corrosion is effectively mitigated, ensuring the durability and effectiveness of the equipment.

On the other hand, scale inhibitors play a crucial role in preventing or managing the formation of scales that can obstruct or impede the flow of fluids in water systems. These systems encompass valves, pumps, and pipelines employed in production gathering and processing. Scale inhibitors are specialty chemical products that adhere to the internal surfaces of system components, effectively delaying and preventing the deposition of scales.

Surfactant is another type anticipated to witness growth over the forecast period. Surfactants are vital specialty oilfield chemicals that play a critical role in the oil and gas industry. These compounds are specifically formulated to alter the surface properties of fluids, facilitating better interactions with various substances encountered during oilfield operations. Surfactants belong to a significant category of specialty chemical products and are utilized to enhance the recovery of fluids following fracturing processes. They are instrumental in optimizing treatment fluid recovery, preventing down-hole emulsions, and improving initial production (IP) rates as well as long-term production post-fracturing.

Key Companies & Market Share Insights

The market is moderately fragmented with companies competing based on the quality of products offered by them and the technologies used for manufacturing them. An increasing focus of companies on new product launches and partnerships is expected to be a key trend in the specialty oilfield chemicals market. For instance, in October 2023, The Lubrizol Corporation announced a fresh distribution agreement with IMCD Group, a prominent global distribution partner and developer of specialty chemicals and ingredients. This strategic alliance will help Lubrizol meet the growing demands of the specialty and other chemicals market in Bangladesh, thereby strengthening the company's commitment to the region.

Key Specialty Oilfield Chemicals Companies:

- Nouryon

- BASF SE

- SMC Global

- Baker Hughes

- Halliburton

- The Lubrizol Corporation

- Aquapharm Chemical Pvt. Ltd.

- Clariant

- Solvay S.A.

- Thermax Chemical Division

Specialty Oilfield Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.38 billion

Revenue forecast in 2030

USD 13.40 billion

Growth rate

CAGR of 4.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Russia; Norway; China; India; Indonesia; Brazil; Argentina; Venezuela; Saudi Arabia; UAE; Algeria; Nigeria

Key companies profiled

Nouryon; BASF SE; SMC Global; Baker Hughes; Halliburton; The Lubrizol Corporation; Aquapharm Chemical Pvt. Ltd.; Clariant; Solvay S.A.; Thermax Chemical Division

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Specialty Oilfield Chemicals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global specialty oilfield chemicals market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Inhibitors

-

Friction Reducers

-

Surfactants

-

Biocides

-

Demulsifiers

-

Other Products

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Production

-

Drilling fluids

-

Oil Recovery

-

Cementing

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Russia

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Indonesia

-

-

Central & South America

-

Brazil

-

Argentina

-

Venezuela

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Algeria

-

Nigeria

-

-

Frequently Asked Questions About This Report

b. The global specialty oilfield chemicals market size was estimated at USD 10.04 billion in 2023 and is expected to reach USD 10.38 billion in 2024.

b. The global specialty oilfield chemicals market is expected to grow at a compound annual growth rate of 4.4% from 2024 to 2030 to reach USD 13.40 billion by 2030.

b. North America dominated the specialty oilfield chemicals market with a share of 41.8% in 2023. The growth is attributable to the fact that the region has witnessed significant growth in oil and gas production, driven by advancements in drilling technologies, such as hydraulic fracturing (fracking) and horizontal drilling.

b. Some key players operating in the specialty oilfield chemicals market include Nouryon, BASF SE, SMC Global, Baker Hughes, Halliburton, The Lubrizol Corporation, Aquapharm Chemical Pvt. Ltd., Clariant, Solvay S.A., Thermax Chemical Division.

b. Key factors that are driving the market growth include increasing crude oil production, coupled with growing demand from the enhanced oil recovery application. In addition, the use of specialty oilfield chemicals helps prolong the lifecycle of industrial equipment by removing unwanted deposited metal scales, eventually minimizing equipment maintenance costs. This advantage in reducing maintenance costs is further expected to have a positive impact on market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."