- Home

- »

- Electronic Devices

- »

-

Specialty Lighting Market Size, Share & Growth Report, 2027GVR Report cover

![Specialty Lighting Market Size, Share & Trends Report]()

Specialty Lighting Market (2020 - 2027) Size, Share & Trends Analysis Report By Light Type (LED), By Application (Entertainment, Purification), By Medical Type (Surgical, Examination), And Segment Forecasts

- Report ID: GVR-4-68038-685-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Specialty Lighting Market Summary

The global specialty lighting market size was valued at USD 5.3 billion in 2019 and is projected to reach USD 8.9 billion by 2027, growing at a CAGR of 7.0% from 2020 to 2027. Increasing adoption of lighting solutions for special purposes and the need for enhanced illumination across medical, entertainment, and other industries are promoting the market growth.

Key Market Trends & Insights

- North America held the largest share of over 35% in 2019 and is expected to lead the market during the forecast period.

- Asia Pacific is projected to register the fastest CAGR over the forecast period .

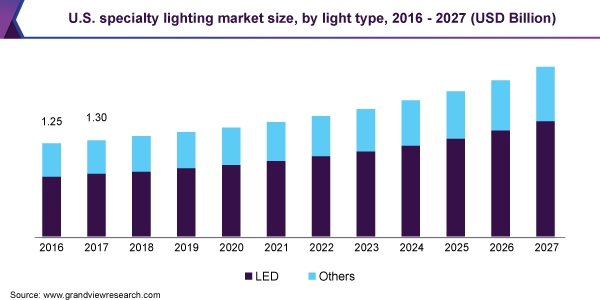

- By light type, the LED lighting segment held the highest market share of over 65% in 2019.

- By application, the entertainment segment held a major market share of over 42% in 2019.

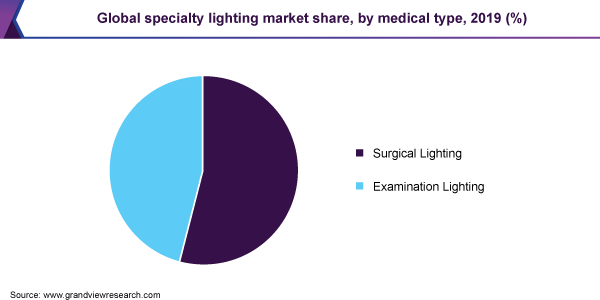

- By medical type, the surgical lighting emerged as the largest segment in 2019 accounting for over 53% of the global share.

Market Size & Forecast

- 2019 Market Size: USD 5.3 Billion

- 2027 Projected Market Size: USD 8.9 Billion

- CAGR (2020-2027): 7.0%

- North America: Largest market in 2019

- Asia Pacific: Fastest growing market

The UV lamps for the disinfection of surface, air, and water are anticipated to be the key growth driver. Moreover, an increasing number of global events, such as music concerts, and the rapidly growing entertainment industry are augmenting the demand for specialty lighting solutions. The increased number of events like concert tours and sports competitions boosts the demand for specialty lighting. The U.S. hosts over 800 music festivals per year, attracting a crowd of nearly 1 million people. Other than the U.S., Japan, India, South Korea, Canada, Germany, France, Italy, and the U.K. are some of the most popular countries for music concerts. Hence, the commencement of these big events helps specialty lighting vendors in generating a significant amount of revenue every year. Also, rising demand from the television series production entities, opera sets, and the film industry is contributing to the market growth.

Technological advancements, such as IoT and smart lighting solutions, are also expected to contribute to market growth. The smart light connected via an app is widely used in clubs and at events. On the other hand, the higher installation cost of these lighting solutions is hindering their adoption. Strict regulations for lighting industries, such as the Energy Star Program, United Nations Environment Programme (UNEP), and the National Electric Code (NEC), pose a challenge to market growth.

The COVID-19 pandemic leading to lockdown and curfew across the world has slowed down the market growth. However, demand for medical lighting is expected to surge owing to the construction of temporary hospitals and demand for surgical and examination facilities. Several countries across the globe are outrunning the number of beds in the hospital, which needs to be curbed with the construction of new isolation and treatment wards and the procurement of more medical equipment and lighting.

Light Type Insights

The LED lighting segment held the highest market share of over 65% in 2019. The introduction of LED over incandescent and halogen bulbs has boosted the market growth owing to longer life, less heating, and cost-saving features of LED lights. LED lights have taken over every section of lighting, including smart, decorative, specialty, and architectural lighting. They are more versatile and convenient for various fixture designs producing color and pattern.

The demand for LED in specialty lighting is increasing due to its advantage in creating lightweight fixtures. The longer shelf life is another major factor driving the adoption of LED specialty lights. The halogen and incandescent lights are prone to breakage and fusing when used for an extended period, while LED lights do not break due to their smaller glass frame fitted inside the fixture. In addition, they consume lesser electricity compared to traditional lights.

Application Insights

The entertainment segment held a major market share of over 42% in 2019. It will maintain its dominance during the forecast years as this industry is completely dependent on various forms of cinematography and photography lighting, such as fill lighting, backlighting, practical light, hard & soft lighting, bounce lighting, and ambient light, to create the desired effects. The film industry, such as Hollywood and Bollywood, is a major contributor to segment growth. Moreover, the film industry hosts many awards shows and events where specialty lighting, which boosts the growth further.

The purification segment is anticipated to exhibit the highest CAGR of 7.9% over the forecast period. The growth is attributed to the usage of specialty UV lights for purifying water, air, and surfaces. The demand for water purification has increased across the globe owing to depleting water sources and recycling of wastewater. Moreover, air purification is vital in pharma and testing labs to avoid foreign particles in medicine or samples. Surface purification is required for disinfecting the place or preventing the formation of bacteria. UV-CLEAN, a no-touch technology with a highly lethal wavelength for killing microorganisms uses an automated disinfection device to inactivate microorganisms at the genetic level using UV-C energy. Hence, the application of UV lighting for purification or disinfection of places is expected to aid in the segment growth.

Medical Type Insights

Surgical lighting emerged as the largest segment in 2019 accounting for over 53% of the global share. Specialty lighting in the medical industry is vital in providing better visibility during medical procedures. The technical and operational guideline for examination and surgical lighting requires 85 CRI to 100 CRI color renditions, and a color temperature ranging between 3,000K to 6,700K. While the 1,000lx illumination suffices for examination lighting requirement. The surgical lighting needs to have illumination in the range of 40,000lx to 160,000lx.

The demand for surgical lighting has been growing with the usage of modern operational equipment to avoid fatality during surgeries. In addition, the advent of LED lights has further improved the reliability of surgical lighting. The examination lighting is estimated to register the fastest CAGR from 2020 to 2027 due to rising product demand. Dedicated examination lighting helps the examiner or doctor to avoid any mishap during the usage of the tool, thereby making it an essential part of the medical checkup procedure, which is anticipated to support the market growth.

Regional Insights

North America held the largest share of over 35% in 2019 and is expected to lead the market during the forecast period. The growth is attributed to the presence of major lighting companies offering services for various areas, such as horticulture, entertainment, water treatment, medical, seaports, and aquarium. Moreover, rapidly expanding end-use industries, such as entertainment, in the region is also driving the product demand. In addition, a robust healthcare system in the U.S. and Canada contributes to the increased demand for surgical and examination lighting.

Asia Pacific is projected to register the fastest CAGR over the forecast period due to rising usage of specialty lighting across several industries. The entertainment industry in India is one of the dominant and highly preferred sectors by market vendors, as there is a constant demand. China and Japan’s healthcare industry is also contributing to regional market growth. Moreover, extensive usage at the harbor to lighten up space and improved safety and productivity while operating during the night supports market growth.

Key Companies & Market Share Insights

Major companies focus on product launches, partnerships, and M&A to expand their portfolio and strengthen their foothold in the global market. For instance, in January 2019, SLD Laser launched its Laser Light products for specialty lighting applications that deliver nearly ten times brighter light than LED, with an extended illumination range of up to 1 km, along with lower power consumption, longer lifetime; and high directional output compared to LED. In March 2020, Signify Holding acquired “Cooper Lighting Solutions” from Eaton, which is aimed at strengthening Signify’s market position in the North American region. Some of the prominent players operating in the specialty lighting market are:

-

Advanced Specialty Lighting

-

Brandon Medical

-

CREE (IDEAL INDUSTRIES, INC.)

-

Getinge AB

-

Herbert Waldmann

-

Integra Lifesciences

-

OSRAM GmbH

-

Signify Holding

-

Steris PLC

-

USHIO

Recent Developments

-

In June 2023, ams OSRAM unveiled the 640 nm Red LED as an extended product of its OSLON® Optimal family of horticultural lighting LEDs. The new LED enables broader spectral coverage for better growth of plants.

-

In June 2023, ams OSRAM introduced a third generation of OSLON® Compact PL LEDs that offer eight percent higher brightness than the second generation.The new LED offers the manufacturer higher value and new design options.

-

In April 2023, Signify introduced Philips Ultra Efficient LED bulbs, which consume 40% less energy as compared to standard Philips LED bulbs. These bulbs offer 3x the lifetime usage as compared to standard Philips LED bulbs and deliver up to 50,000 hours of light.

-

In September 2022, Signify partnered with Upciti to improve public safety, transportation, and sustainability by leveraging their street lighting infrastructure. The companies aim to provide interactive IoT-connected lighting systems to help cities and utilities across the United States and Canada.

Specialty Lighting Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 5.5 billion

Revenue forecast in 2027

USD 8.9 billion

Growth Rate

CAGR of 7.0% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Light type, application, medical type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico

Key companies profiled

Advanced Specialty Lighting; Brandon Medical; CREE (IDEAL INDUSTRIES INC.); Getinge AB; Herbert Waldmann; Integra Lifesciences; OSRAM GmbH; Signify Holding; Steris PLC; USHIO

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global specialty lighting market report on the basis of light type, application, medical type, and region:

-

Light Type Outlook (Revenue, USD Million, 2016 - 2027)

-

LED

-

Others

-

-

Application Outlook (Revenue, USD Million, 2016 - 2027)

-

Entertainment

-

Medical

-

Purification

-

Others

-

-

Medical Type Outlook (Revenue, USD Million, 2016 - 2027)

-

Surgical

-

Examination

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

The U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global specialty lighting market size was estimated at USD 5.31 billion in 2019 and is expected to reach USD 5.57 billion in 2020.

b. The global specialty lighting market is expected to grow at a compound annual growth rate of 7.0% from 2020 to 2027 to reach USD 8.95 billion by 2027.

b. North America dominated the specialty lighting market with a share of 35.5% in 2019. This is attributable to the growing industrial and commercial sector and demand for surgical and examination lighting across the robust healthcare system of the U.S. and Canada.

b. Some key players operating in the specialty lighting market include Advanced Specialty Lighting, Brandon Medical, CREE (IDEAL INDUSTRIES INC.), Getinge AB, Herbert Waldmann, Integra Lifesciences, Steris PLC, and USHIO.

b. Key factors that are driving the market growth include the adoption of lightings for special purposes such as UV lamps for disinfection of surface, air, and water and need for enhanced illumination across aquarium, medical, entertainment, and harbor among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.