- Home

- »

- Food Additives & Nutricosmetics

- »

-

Specialty Ingredients Market Size, Industry Report, 2030GVR Report cover

![Specialty Ingredients Market Size, Share & Trends Report]()

Specialty Ingredients Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Food & Beverage, Pharmaceutical, Personal Care, Animal Feed, Others), By Region, And Segment Forecasts

- Report ID: 978-1-68038-772-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Specialty Ingredients Market Summary

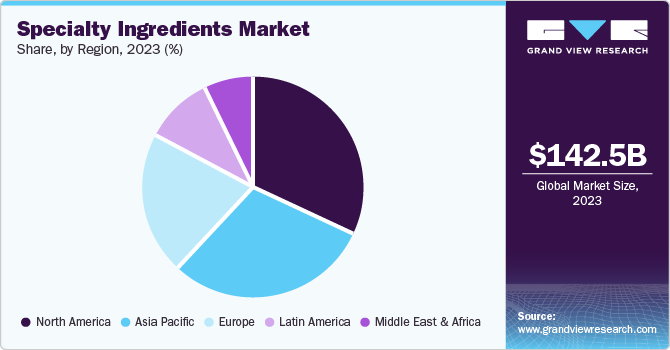

The global specialty ingredients market size was valued at USD 142.5 billion in 2023 and is projected to reach USD 215.8 billion by 2030, growing at a CAGR of 6.1% from 2024 to 2030. The market growth is attributed to the changing consumer preferences towards organic, natural, and health-conscious food products, fueling demand for specialty ingredients. The increasing popularity of clean-label products and growing awareness of the health risks associated with synthetic additives have further boosted the market.

Key Market Trends & Insights

- The North America dominated the global market and accounted for the largest revenue share of 32.1% in 2023.

- The U.S. dominated the North American market with a significant share in 2023.

- By application, Food & beverage dominated the market and accounted for the largest revenue share of 72.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 142.5 Billion

- 2030 Projected Market Size: USD 215.8 Billion

- CAGR (2024-2030): 6.1%

- North America: Largest market in 2023

In addition, the rising demand for convenience foods due to busy lifestyles and high disposable incomes, particularly in emerging economies, is contributing to market expansion. Furthermore, collaborations among industry players, technological advancements in ingredient production, and the growing vegan population seeking plant-based protein sources drive the specialty food ingredients market globally.

The specialty ingredient industry deals with providing high-quality, unique ingredients. The market has huge prospects across the world. Specialty ingredients are utilized to enhance the quality and benefits of the core product, either in industrial processing or the end consumer. It is rising continuously as balanced nutrition is a necessity for the health of humans and animals. The shift in consumers aligned with the rising demand for packaged and processed food items and the requirement of feeding an ever-growing population in a sustainable way to tackle health concerns of the population while meeting individual nutritional needs are factors fueling the market growth for specialty ingredients in the forecast period.

However, with the growing interest in residue-free, organic, and natural food and beverage products, specialty ingredients, such as natural flavors, colors, and preservatives, play a vital role in fulfilling such market demands. In addition, the cosmetics and personal care segment has witnessed growth, with consumers seeking products with natural and broad varieties with enhanced performance. Specialty ingredients are also implemented in the pharmaceutical industry. These are active pharmaceutical ingredients, essential in formulating pharmaceutical drugs or medicines, with a broad range of medicine production properties to enhance pharmaceutical preparations.

Furthermore, specialty ingredients are adopted to formulate an innovative and wide range of beauty products. With the increasing demand from large and medium-scale industries, particularly for specialty ingredients with suitable characteristics to prevent deficiencies and to provide the integration of all the essential nutrients, specialty ingredients are significantly needed. Moreover, specialty ingredients play a vital role in producing feed additives and mixtures in animal feed industries, as these ingredients are important in ensuring appropriate animal nutrition. The ingredients provide several benefits. However, specialty ingredient producers need to certify the safety standards of the product for the animal, the consumers, and the environment.

Application Insights

Food & beverage dominated the market and accounted for the largest revenue share of 72.0% in 2023 driven by increasing consumer demand for healthier, natural, and clean-label products. It has fueled the use of specialty ingredients such as natural colors, flavors, and preservatives in a wide range of food and beverage categories. Another key factor is the popularity of functional foods fortified with vitamins, minerals, and probiotics. Furthermore, the expansion of convenience foods, plant-based alternatives, and the globalization of food trends contribute to the growing demand for specialty ingredients in the food and beverage industry.

Furthermore, the food & beverage applications are categorized into sensory and functional products. The sensory product accounted for the largest revenue share in 2023, owing to increasing consumer demand for enhanced taste, aroma, and texture in food and beverages. Consumers prioritize quality and experience, so manufacturers focus on sensory ingredients to improve product appeal. In addition, the rise of convenience foods and packaged products further fuels this trend as companies seek to differentiate their offerings through innovative sensory enhancements, making them more attractive to health-conscious and discerning consumers.

The pharmaceutical application is expected to grow at a CAGR of 8.3% over the forecast period. The market is driven by the rising prevalence of chronic diseases, such as diabetes, cancer, cardiovascular disorders, and skin-related problems, the growing demand for biosimilar, oncology medications, and generic drugs, and extensive adoption of active pharmaceutical ingredient (APIs) by generic drug companies to produce inexpensive alternatives to branded medications is also fueling the pharmaceutical specialty ingredient market growth. Moreover, the commercialization of biopharmaceuticals and biologics, recombinant proteins, and vaccines also boosts the market growth.

Regional Insights

The North America specialty ingredients market dominated the global market and accounted for the largest revenue share of 32.1% in 2023. This growth is attributed to rising demand for organic products, mainly in the food and beverage and personal care industries. Investments in R&D for product enhancement and initiatives lead to improved health issues, which boosts specialty ingredients demand in the region.

U.S. Specialty Ingredients Market Trends

The specialty ingredients market in the U.S. dominated the North American market with a significant share in 2023. Customers are shifting from ordinary food items to foods and drinks with specific healthful ingredients. Furthermore, more consumers consume processed foods and beverages with natural and organic ingredients. Therefore, manufacturers are investing in developing fortified meals, fueling the demand for specialty ingredients, including minerals, vitamins, omega-3, protein, etc.

Europe Specialty Ingredients Market Trends

Europe specialty ingredients market is expected to grow significantly over the forecast period. This growth is expected to be driven by increasing consumer demand for healthier, organic, and clean-label products, which is paramount as individuals seek transparency in food ingredients. Furthermore, the rise in health consciousness and the popularity of functional foods are propelling the market forward. Innovations in food technology and a growing interest in diverse culinary experiences further enhance the demand for unique flavors and specialty ingredients.

The specialty ingredients market in the UK is expected to witness substantial growth forward with a consistent demand in terms of specialty ingredients, with a positive outlook associated with product portfolio expansion by several food and beverage companies, practicing innovative solutions, and gaining market positions by providing substitute alternatives to consumers who seek for natural items for a healthy lifestyle. Furthermore, demands from sectors such as pharmaceutical, personal care, and animal feed industries boost the market for specialty ingredients.

Asia Pacific Specialty Ingredients Market Trends

The Asia Pacific specialty ingredients market is expected to grow at a CAGR of 6.6% over the forecast period. The region has grown to be a sizable market for specialty ingredients due to rising demand due to rapid urbanization, changing lifestyles, and growing disposable incomes in countries such as China, India, Japan, and South Korea. In addition, consumers in Asia-Pacific are increasingly interested in healthy and functional foods, fueling the demand for specialty ingredients in various applications such as noodles, snacks, sauces, and beverages. Furthermore, local preferences and traditional cuisines influence the use of specialty ingredients in the region.

The growth of the specialty ingredients market in China is expected to be driven by the vast population, rising demand for food consumption, demand from large and small-scale industries, and the well-established food and beverage industry. The region's strong focus on innovation and consumer demand for natural and organic products further require specialty ingredients to produce final goods. The robust pharmaceutical and personal care industries further require specialty ingredients to produce final goods.

Key Specialty Ingredients Company Insights

Some of the key companies in the specialty ingredients market include ADM, Cargill, Incorporated, Ashland, DuPont, Inolex, Inc., Huntsman International LLC, and DSM. These companies adopt various strategies to maintain competitiveness, including extensive research and development to innovate product offerings. They focus on clean-label and natural ingredients to meet consumer demand for transparency. Furthermore, strategic partnerships and acquisitions enhance market reach and capabilities, while investments in sustainable practices address environmental concerns.

-

Ashland Inc. offers innovative solutions for various industries, including personal care, pharmaceuticals, and food and beverage. The company develops and supplies multiple specialty ingredients that enhance product performance and consumer appeal. With a commitment to sustainability, Ashland leverages advanced polymer science and cutting-edge technologies to create multifunctional ingredients that address complex formulation challenges, ensuring their clients can meet the evolving demands of health-conscious consumers and market trends.

-

Archer-Daniels-Midland Company (ADM) produces natural ingredients for food, beverages, and personal care products. ADM's diverse portfolio includes proteins, flavors, emulsifiers, and other functional ingredients that enhance product taste, texture, and nutritional value. With a strong global presence, ADM continues to drive growth in the specialty ingredients sector through strategic partnerships and research and development initiatives.

Key Specialty Ingredients Companies:

The following are the leading companies in the specialty ingredients market. These companies collectively hold the largest market share and dictate industry trends.

- ADM

- Cargill, Incorporated.

- Ashland.

- DuPont.

- Inolex, Inc.

- Huntsman International LLC

- DSM

- BASF SE

- Kerry Group plc.

- Ingredion.

- Tate & Lyle

Recent Developments

-

In June 2024, Tate & Lyle announced a proposed combination with CP Kelco, aiming to establish a leading global specialty food and beverage solutions business. This strategic move follows Tate & Lyle's six-year transformation into a growth-oriented company focused on healthier, tastier, and more sustainable food products. The merger is expected to enhance its capabilities and market presence, aligning with evolving consumer trends and demands in the food and beverage sector, ultimately benefiting customers and stakeholders.

Specialty Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 151.1 billion

Revenue forecast in 2030

USD 215.8 billion

Growth rate

CAGR of 6.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

ADM; Cargill, Incorporated.; Ashland.; DuPont.; Inolex, Inc.; Huntsman International LLC; DSM; BASF SE; Kerry Group plc.; Ingredion; Tate & Lyle

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Specialty Ingredients Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global specialty ingredients market report based on application, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & beverage

-

Sensory

-

Functional

-

-

Pharmaceutical

-

Active

-

Inactive

-

-

Personal care

-

Active

-

Inactive

-

-

Animal feed

-

Feed Additives

-

Functional Feed Ingredients

-

Premixes

-

Others Mixtures

-

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.