- Home

- »

- Food Additives & Nutricosmetics

- »

-

Specialty Food Ingredients Market Size, Share Report 2030GVR Report cover

![Specialty Food Ingredients Market Size, Share & Trends Report]()

Specialty Food Ingredients Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Food & Beverage, Pharmaceutical, Personal Care), By Product (Sensory, Functional), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-591-5

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

fort based on product, application, and region:

Specialty Food Ingredients Market Trends

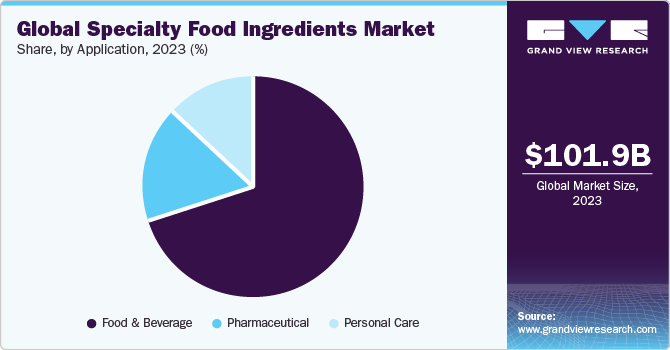

The global specialty food ingredients market size was estimated at USD 101.9 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2030. Rapid expansion of key application industries including food and beverages, pharmaceuticals, and personal care, and growing penetration of organized as well as e-retail across the world are primarily fueling growth in the industry. Specialty food ingredients typically preserve, texture, emulsify, color, and help to process and add an extra health dimension to produced food. They are all key to guaranteeing a wide range of processed foods offered today to consumers. They range from micro-ingredients such as vitamins, minerals, and enzymes to macro-ingredients such as specific proteins, fats, carbohydrates, fibers, and other substances. Moreover, the market is driven by the demand for products that are free from artificial ingredients and additives. This has led to the development of clean-label ingredients that use natural and simple ingredients.

With their technological, nutritional, and health-related functions, they make the food tasty, pleasant to eat, safe, sustainable, healthy, and affordable. Specialty foods are outpacing their non-specialty counterparts in almost all categories due to a rise in awareness regarding the overall food quality. Specific categories aligned with better-for-you options, health and wellness, and freshness are growing at the fastest rate.

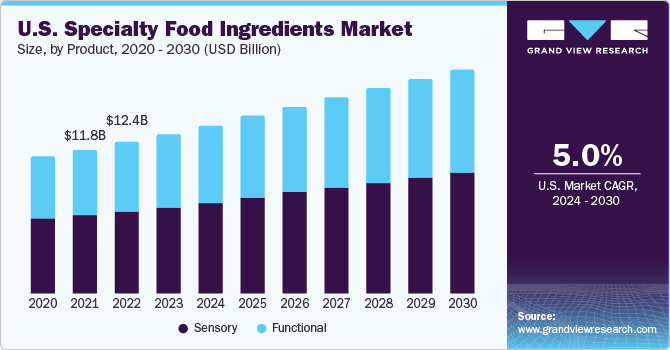

In the U.S. market, functional specialty food ingredients under the product segment are expected to witness robust growth from 2024 to 2030. The high penetration of organized retail across the country has also significantly contributed to a large share of specialty food ingredients in the country. The changing lifestyles, growing urban population, rising economic activities in emerging countries, and increasing penetration of e-retail worldwide are a few macro factors driving the global market.

The demand for food is poised to grow as the world population is expected to increase from 7.3 billion in 2015 to 9.7 billion in 2050, which, in turn, is anticipated to fuel demand for specialty food ingredients. Furthermore, as consumer shopping habits have drastically changed due to the COVID-19 outbreak, specialty ingredients companies that service center-of-the-store retail categories have observed an increase in sales over the past few weeks as consumers have drastically increased their purchases of center-of-store products.

Market Dynamics

Several awareness campaigns run by government agencies, non-governmental organizations, and companies have boosted consumer understanding regarding the nutritional benefits of food ingredients, which, in turn, is projected to fuel the market growth.

The product line of some companies engaged in manufacturing protein supplements also includes organic and natural products, which is further triggering market growth. Attractive packaging techniques have led to increased consumer awareness, which has triggered spending on protein supplements.

Product Insights

Based on product, the sensory segment dominated the market with a revenue share of 58.8% in 2023. It is attributed that sensory ingredients are vital for enhancing the taste, smell, flavor, and texture of food products. Increasing demand for these ingredients in packaged and convenience foodstuffs and confectioneries is expected to be a major factor driving product demand.

The flavor product market is driven by organic and natural ingredients. The ever-changing consumer preferences lead to demand for different types of flavors. The flavor industry has chiefly been influenced by the consumption of various foods and beverages. Due to fast-changing customer preferences, demand for ready-to-eat food products has been increasing. Thus, this aids in the growth of the food flavor market. The increasing demand for natural ingredients is a primary factor driving the global food flavor market.

Flavors, enzymes, colorants, and emulsifiers are key sensory elements. Enzymes are used owing to their highly active nature of enhanced reactions and function uniquely to control flavor, texture, process time, extended shelf life, and less use of chemical additives. Flavors are among the most significant constituents as they give taste to finished cuisine or product. This segment is characterized as innovative, technical, and specialized in nature and its growth parameters include changing lifestyle of consumers and increased demand for convenience food.

Vitamins have widespread uses in meals, fortification in oils and fats, supplements, and infant formula. The type of vitamins to be used depends upon formulation requirements. Minerals are among the significant components of a balanced diet consumed by humans. One another application of minerals is aiding the function of certain vitamins such as calcium, which helps in the absorbance of vitamin D by cells from diet.

Antioxidant as a key ingredient has a function of protecting finished products against fouling such as fat rancidity and color changes due to oxidation caused by bacteria, fungi, molds, and yeasts. Types of antioxidants are dependent upon formulation requirements of the type of diet. Preservatives are used to preserve quality for a longer period without any harm. Changing consumer preference for safe and hygienic packed sustenance items, especially in the developed regions, is expected to be the major driver for the market. These explicit product qualities have helped manufacturers cater to specific requirements of processors, which is anticipated to boost the market growth in the next eight years.

Application Insights

Based on application, the food and beverage segment dominated the market with a revenue share of 70% in 2023. This is attributable to changing consumer lifestyles and food preferences that have led to the growth of the processed food manufacturing sector, which, in turn, is likely to propel the demand for specialty food ingredients. Also, increasing consumption of alcoholic and non-alcoholic beverages, especially among the young population, is expected to support industry growth.

With a rise in health problems among consumers, they are now more cautious about their consumption habits. This has resulted in demand for functional food items and has become more prominent in the consumer market. This is due to people’s interest in protecting and preserving their health, and in return, has increased the demand for healthier ingredients in packaged products, food service industry, and food and beverage industry.

The personal care industry has witnessed significant growth owing to increasing consumer awareness regarding ingredients used for making such products. Consumers are opting for more natural and healthy products that do not involve harmful chemicals. Thus, manufacturers are widely using such special ingredients in their product offerings.

The pharmaceutical industry is increasingly recognizing the value of specialty food ingredients in developing new products that can help improve patient health outcomes. Specialty food ingredients are used in a variety of pharmaceutical applications, including drug delivery systems, nutraceuticals, and functional foods.

Regional Insights

Asia Pacific region dominated the market with a revenue share of 33.9% in 2023. The popularity of convenience food has boosted demand for emulsifiers in the food industry, making China the largest market for emulsifiers in the Asia Pacific. Moreover, the high population in the country supports expansion of the food and beverage, pharmaceutical, and personal care industries, which are anticipated to act as key drivers for the industry in the country.

In 2023, Europe emerged as the second-largest regional market for specialty food ingredients; however, it is anticipated to witness sluggish growth over the forecast period. Europe has always been known for its world-famous cuisines and with a shift in consumer demand, various innovations of new recipes happen from time to time. Countries in the region such as France, Italy, and Belgium are some of the largest importers of specialty ingredients. Presence of a reasonable number of processing and confectionery companies in Germany and UK adds to production and demand for specialty food ingredients.

North America emerged as the third-largest revenue share in 2023 and is projected to expand at a considerable CAGR from 2024 to 2030. In North America, the U.S. dominated the market in 2021 owing to a growing demand for safe and plant-based products. Young generation in the country is focusing on transparency in food ingredients and demanding healthier and natural food products.

Key Companies & Market Share Insights

Market is highly fragmented with the presence of large-sized international companies as well as small- and medium-sized domestic players. Large companies are adopting emerging technologies to innovate and craft better products. For instance, Kraft Heinz opened a new digital hub to create digitally powered strategies and help launch new food ideas that can successfully capture a huge segment of the market. Moreover, technologies like blockchain will continue to gain popularity as more food companies become a part of this trend.

Key companies operating in the market are majorly adopting key expansion strategies to expand their geographical presence, production capabilities, and research and development. For instance, in March 2023, Archer Daniels Midland Company unveiled the brand Knwble Grwn, which aims to offer consumers sustainably sourced, wholesome plant-based food ingredients. These products are cultivated by small or underrepresented farmers who employ regenerative agricultural practices, contributing to the environmental preservation of food ingredients.

Key Specialty Food Ingredients Companies:

- Naturex

- Givaudan

- Eli Fried Inc.

- KF Specialty Ingredients

- Ingredion

- Associated British Foods Plc

- Kerry Group

- Agropur Cooperative

- Ashland Inc

- Archer Daniels Midland Company

- Cargill Inc.

- Wild Flavors GmbH

- DSM

- Diana Group SA

- Tate & Lyle

- CHR. Hansen

Global Specialty Food Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 101.9 billion

Revenue forecast in 2030

USD 144.9 billion

Growth rate

CAGR of 5.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; Brazil; Saudi Arabia

Key companies Listed

Naturex; Givaudan; Eli Fried Inc.; KF Specialty Ingredients; Ingredion; Associated British Foods Plc; Kerry Group; Agropur Cooperative; Ashland Inc; Archer Daniels Midland Company; Cargill Inc.; Wild Flavors GmbH; DSM; Diana Group SA; Tate & Lyle; CHR. Hansen

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Specialty Food Ingredients Market Report Segmentation

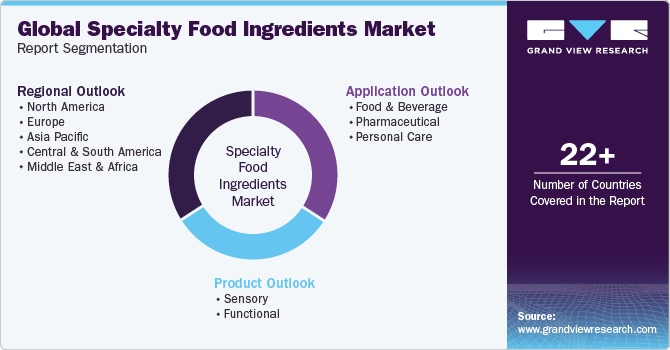

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global specialty food ingredients market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sensory

-

Enzymes

-

Emulsifiers

-

Flavors

-

Colorants

-

Others

-

-

Functional

-

Vitamins

-

Minerals

-

Antioxidants

-

Preservatives

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Snacks

-

Bakery

-

Confectionery

-

Dairy Products

-

Breakfast Cereals

-

Frozen Foods

-

Meat, Poultry & Seafood

-

Baby Food

-

Sauces, Dressings & Condiments

-

Alcoholic

-

Non-alcoholic

-

Others

-

-

Pharmaceutical

-

Personal Care

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global specialty food ingredients market size was estimated at USD 101.9 billion in 2023 and is expected to reach USD 114.9 billion in 2024.

b. The global specialty food ingredients market is expected to grow at a compound annual growth rate of 5.2% from 2023 to 2030 to reach USD 144.98 billion by 2030.

b. Asia Pacific dominated the specialty food ingredients market with a share of 33.9% in 2023. This is attributable to popularity of convenience food and expansion of end-use industries in the economies of China.

b. Some key players operating in the specialty food ingredients market include Naturex, Givaudan, Eli Fried Inc., KF Specialty Ingredients, Ingredion, Associated British Foods Plc, Kerry Group, Agropur Cooperative, Ashland Inc, Archer Daniels Midland Company, Cargill Inc., Wild Flavors GmbH, and DSM, to name a few.

b. Key factors that are driving the specialty food ingredients market growth include shift in consumer focus towards organic products coupled with growing demand for anti-ageing and environmental defense skin care products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.