Specialty Fats And Oils Market Size, Share & Trends Analysis Report By Product Type (Specialty Fats, Specialty Oils), By Application (Confectionery, Dairy), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-364-6

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Specialty Fats And Oils Market Trends

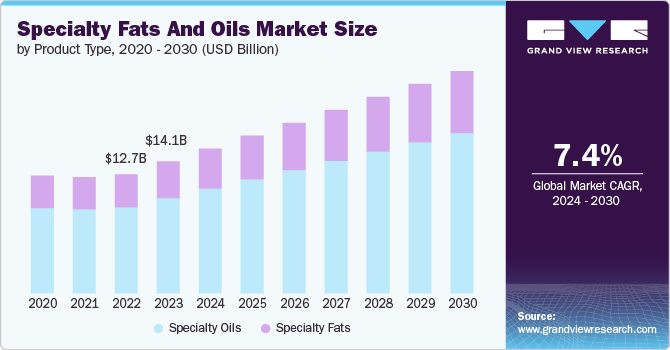

The global specialty fats and oils market size was estimated at USD 14.12 billion in 2023 and is expected to grow at a CAGR of 7.4% from 2024 to 2030. This can be attributed to the increase in demand for nutritional food products, the rise in consumption of bakery and processed food products, technological advancements, and expanding food industry and product innovations.

A significant factor contributing to the growth of the specialty fats and oils market is the rising health consciousness among consumers and the increasing demand for nutritional food products. As consumers prioritize health and wellness in their food choices, manufacturers are responding by developing products that align with these preferences. This trend is expected to continue driving innovation in the industry, leading to a wider range of specialty fats and oils tailored to meet specific dietary needs.

The rising awareness about the importance of early childhood nutrition and development has led to an increased demand for specialized infant nutrition products. Specialty fats and oils are essential ingredients in infant formula, baby food, and other nutritional products designed specifically for infants. The focus on providing high-quality, nutrient-rich products for infants has driven the growth of this segment. In January 2021, Bunge Loders Croklaan (BLC) introduced a new high-quality lipid ingredient for infant formula that enables manufacturers to come closer to replicating the nutritional profile of mother’s milk fat.

Moreover, consumers increasingly seek transparency in food labeling and avoid products with artificial additives or unhealthy fats. Specialty fats and oils derived from natural sources are perceived as cleaner alternatives, driving their popularity among health-conscious consumers. In April 2024, Nourish Ingredients, a prominent player in the emerging ‘animal-free’ specialty fat sector, ventured into non-dairy by introducing Creamilux - a low-inclusion lipid that mimics the creamy texture, flavor, and emulsification properties of dairy fat through precision-fermentation rather than relying on cows.

The increasing consumption of bakery and processed food products globally has emerged as a significant driver for the specialty fats and oils market. As urbanization accelerates and lifestyles become busier, consumers are turning to convenient, ready-to-eat foods, which often rely on specialty fats and oils for texture, flavor, and shelf stability. These ingredients play a crucial role in enhancing the taste, appearance, and overall quality of baked goods, snacks, and other processed foods.

Moreover, the growing middle class in developing countries is fueling demand for a wider variety of processed foods, further boosting the market. This trend is expected to continue driving growth in the specialty fats and oils market as the global appetite for diverse, convenient, and indulgent food products is increasing consistently. In June 2024, Cargill introduced innovative fats for bakers with the launch of the PalmAgility 600 series. This new range of fats is designed to enhance the heat stability and prevent the premature appearance of fat bloom in coatings, significantly extending the shelf life and visual appeal of treats. They are versatile enough for use in a wide array of bakery and snack products

Technological advancements have enabled manufacturers to create specialty fats and oils that offer improved functionalities, such as better stability, texture, and nutritional profiles. These advancements have expanded the applications of these fats and oils in various industries. One significant aspect of technological advancement in this market is the improvement in processing technologies. These advancements have allowed for the production of high-quality specialty fats and oils that can serve as substitutes for common fats like cocoa butter and milk fats. Innovations in extraction and refining processes have not only enhanced product quality but also expanded the application scope of specialty fats and oils, making them more versatile for different industrial uses. In March 2024, India’s first integrated oil palm processing unit commenced operations in Arunachal Pradesh. The oil palm processing facility developed by 3F Oil Palm comprises an advanced oil palm factory, a power plant fueled by palm waste, and an effluent plant that eliminates discharge.

The expanding food industry and ongoing product innovations significantly propel the specialty fats and oils market. As food manufacturers strive to meet evolving consumer demands for taste, texture, and nutritional value, they increasingly turn to specialty fats and oils as crucial ingredients. These components allow for the creation of novel food products with improved functionality, stability, and sensory attributes. From enhancing the mouthfeel of low-fat products to extending shelf life and providing specific melting profiles for confectionery, specialty fats and oils enable food companies to differentiate their offerings in a competitive marketplace. This constant push for innovation drives research and development efforts, leading to the introduction of new specialty fat and oil formulations tailored to specific applications, further expanding the market's potential and encouraging growth across various food categories. In August 2023, AAK, a provider of plant-based fats & oil, introduced Cebes choco 15, a patented blend that can enhance the cocoa flavor in baked goods by incorporating up to 15% cocoa ingredients.

Product Type Insights

Specialty oils accounted for a revenue share of 72.3% in 2023. Growing consumer awareness and demand for specialty oils for food products contribute significantly to market expansion. As consumers seek more sustainable, efficient, or advanced solutions, companies respond by innovating and expanding their offerings. In April 2020, The U:ME range of specialty cooking oils was launched by Edible Oils Limited (EOL). The range includes Sun-Olive, Coconut, and Organic Rapeseed variants initially, with plans for additional variants in the future. Moreover, changing consumer preferences towards natural, organic, and sustainably sourced ingredients have propelled the demand for specialty oils derived from premium raw materials. Consumers are increasingly seeking out products that align with their values of health consciousness, environmental sustainability, and ethical sourcing practices. This shift in consumer preferences has created opportunities for manufacturers to innovate and offer a wide range of specialty oils that cater to these evolving demands.

Specialty fats is expected to witness a CAGR of 7.5% during 2024 to 2030. The versatility of specialty fats and oils in various industries such as food and beverages, cosmetics, pharmaceuticals, and industrial sectors has expanded their market scope. This diversification of applications has led to increased demand for specialty fats as they find use in a wide range of products beyond just food items. Furthermore, the rising interest in functional foods fortified with beneficial ingredients such as plant sterols, antioxidants, and fatty acids is driving innovation in the specialty fats market. Manufacturers are developing new formulations of specialty fats to meet the demand for products that not only taste good but also offer specific health benefits. In December 2020, Bunge Loders Croklaan (BLC) introduced Karibon, a cocoa butter equivalent (CBE) made entirely from shea, specifically designed for the chocolate confectionery industry.

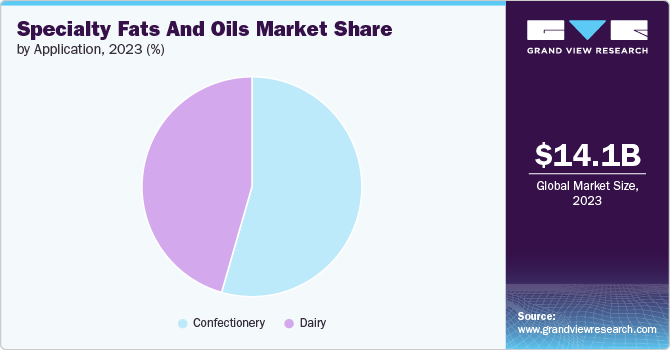

Application Insights

Confectionery accounted for revenue share of 54.5% in 2023. Specialty fats and oils offer functional benefits such as improved mouthfeel, texture enhancement, better aeration, and increased stability in baked goods and confectionery products, leading to increased demand. These properties are essential for achieving the desired sensory experience in products like chocolates, pastries, cakes, cookies, and more.Manufacturers are constantly innovating to develop specialty fats and oils that meet the specific requirements of confectionery and bakery applications. This includes creating trans-fat-free alternatives, customized blends for different applications, and solutions catering to health-conscious consumers without compromising on taste or quality.

Diary segment is expected to grow at a CAGR of 7.9% from 2024 to 2030. Dairy products are a staple in many diets around the world. They provide essential nutrients such as calcium, protein, and vitamins, which are vital for bone health, muscle development, and overall well-being. As health consciousness rises, consumers are increasingly turning to dairy products to fulfill their nutritional needs. Emerging markets such as India, China, and Southeast Asia are experiencing rapid urbanization and growing disposable incomes. This has led to a surge in demand for dairy products, as consumers in these regions seek to adopt Western lifestyles and diets. Dairy companies are actively investing in these markets to meet the increasing demand.

Regional Insights

In 2023, the specialty fats and oils market in North America captured a revenue share of 23.9%, owing to the increasing consumer demand for healthier alternatives in food products, such as low-trans-fat and non-GMO options. Additionally, technological advancements in processing methods and growing applications in industries like confectionery and bakery also contribute to market growth.

U.S. Specialty Fats And Oils Market Trends

The specialty fats and oils market in the U.S. accounted for a notable revenue share in 2023. In the U.S., factors driving the market include the rising popularity of plant-based diets and the consequent demand for plant-derived oils like coconut and avocado oil. Moreover, innovations in the cosmetics and personal care industry, where specialty fats and oils are used as key ingredients, contribute significantly to market expansion.

Europe Specialty Fats And Oils Market Trends

In 2023, specialty fats and oils market in Europe is anticipated to grow with a CAGR of 7.5% during 2024 to 2030, owing to increasing consumer awareness and preference for organic and sustainable products, leading to higher demand for specialty oils such as organic sunflower oil and sustainably sourced palm oil alternatives. Additionally, stringent regulatory standards promoting the use of healthier fats and oils in food processing and manufacturing further propel market growth in the region.

Asia Pacific Specialty Fats And Oils Market Trends

Asia Pacific specialty fats and oils market is expected to grow with a CAGR of 8.0% from 2024 to 2030. Asia Pacific is witnessing accelerated growth in the specialty fats and oils market primarily due to the region's robust industrialization in sectors such as cosmetics, pharmaceuticals, and personal care, which utilize specialty oils extensively. Additionally, increasing urbanization and changing dietary habits towards convenience foods are driving demand for specialty fats and oils in the region.

Key Specialty Fats And Oils Company Insights

Key market players such as Cargill, Liberty Oil Mills Ltd., Willmar International Limited, Henry Lamotte Oils GmbH, and the Savola Group, andamong others contribute significantly to the innovation and growth of the market by utilizing tactics such as forging partnerships, making agreements, and expanding production capacity.

Key Specialty Fats And Oils Companies:

The following are the leading companies in the specialty fats and oils market. These companies collectively hold the largest market share and dictate industry trends

- Bunge Limited

- Wilmar International Limited

- Golden Agri-Resources Ltd

- Kuala Lumpur Kepong Berhad

- Sime Darby Plantation Sdn Bhd

- Cargill

- Liberty Oil Mills Ltd.

- Henry Lamotte Oils GmbH

- Savola Group

- IOI Corporation

Recent Developments

-

In June 2024, Blommer Chocolate, a prominant cocoa processor in North America, introduced a new product called Elevate to provide confectioners with a cost-effective alternative to cocoa butter. This move comes as cocoa product prices continue to rise, posing challenges for businesses in the confectionery industry.

-

In February 2024, Chevron Lummus Global initiated operations of the largest special food grade type white oil hydro processing unit at Hongrun Petrochemical (Weifang) Co., Ltd. located in China.

Specialty Fats and Oils Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 15.50 billion |

|

Revenue forecast in 2030 |

USD 23.78 billion |

|

Growth rate |

CAGR of 7.4% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa |

|

Key companies profiled |

Bunge Limited; Wilmar International Limited; Golden Agri-Resources Ltd; Kuala Lumpur Kepong Berhad; Sime Darby Plantation Sdn Bhd; Cargill; Liberty Oil Mills Ltd.; Henry Lamotte Oils GmbH; Savola Group; IOI Corporation |

|

Customization scope |

Free r Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options. |

Global Specialty Fats And Oils Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global specialty fats and oils market report based on type, application and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Specialty Oils

-

Specialty Fats

-

-

Application Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Confectionery

-

Dairy

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global specialty fats and oils market size was estimated at USD 14.12 billion in 2023 and is expected to reach USD 15.50 billion in 2024.

b. The global specialty fats and oils market is expected to grow at a compounded growth rate of 7.4% from 2024 to 2030 to reach USD 23.78 billion by 2030.

b. The specialty oils segment dominated the specialty fats and oils market with a share of 72.28% in 2023. Growing consumer awareness and demand for specialty oils for food products contribute significantly to market expansion. Companies respond by innovating and expanding their offerings as consumers seek more sustainable, efficient, or advanced solutions.

b. Some key players operating in the specialty fats and oils market include Bunge Limited; Wilmar International Limited; Golden Agri-Resources Ltd; Kuala Lumpur Kepong Berhad; Sime Darby Plantation Sdn Bhd

b. Key factors driving the market growth include the increase in demand for nutritional food products, the rise in consumption of bakery and processed food products, technological advancements, and expanding food industry and product innovations.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."