- Home

- »

- Consumer F&B

- »

-

Specialty Cheese Market Size, Share & Trends Report, 2030GVR Report cover

![Specialty Cheese Market Size, Share & Trends Report]()

Specialty Cheese Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Fresh Cheese, Flavored Cheese), By Form (Blocks, Shredded), By Distribution Channel (Supermarkets & Hypermarkets, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-466-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Specialty Cheese Market Summary

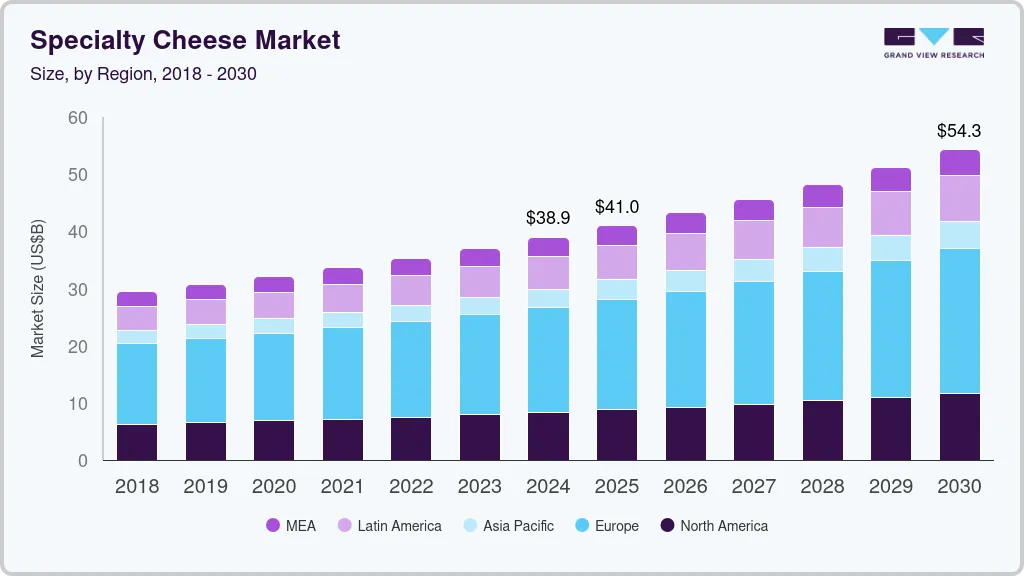

The global specialty cheese market size was estimated at USD 38.93 billion in 2024 and is projected to reach USD 54.27 billion by 2030, growing at a CAGR of 5.8% from 2025 to 2030. One of the most significant drivers of the market is the rising consumer preference for premium and artisanal products.

Key Market Trends & Insights

- Europe dominated the specialty cheese market, accounting for a revenue share of 48.5% in 2023.

- In the U.S., a surge in cheese production, alongside sophisticated distribution networks, has facilitated wider access to specialty cheeses.

- In terms of product, the fresh cheese segment held a revenue share of 35.2% in 2023.

- Based on form, the cheese blocks segment held a revenue share of 40.7% in 2023.

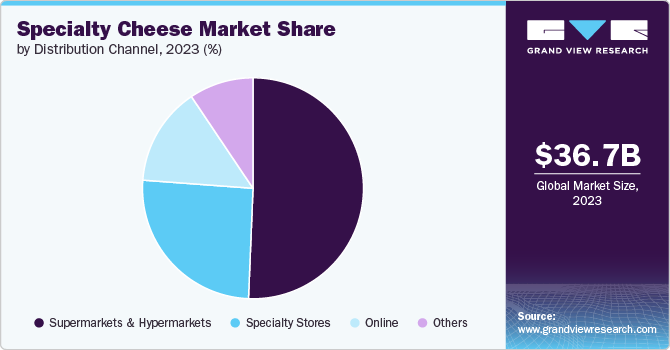

- On the basis of distribution channel, supermarkets & hypermarkets accounted for a revenue share of 50.6% of the market in 2023 due to the broad product selection available at these stores.

Market Size & Forecast

- 2024 Market Size: USD 38.93 billion

- 2030 Projected Market Size: USD 54.27 billion

- CAGR (2025-2030): 5.8%

- Europe: Largest market in 2023

As consumers increasingly seek higher-quality food products, they are drawn to specialty cheeses offering unique flavors and textures not found in mass-produced options. Moreover, specialty cheeses such as Brie, Camembert, Gouda, and artisanal Cheddar are often handcrafted and involve traditional production techniques, distinguishing them from regular, factory-made cheeses.The growing interest in the origin of food products has also contributed to the demand for regional and artisanal cheeses, which are often tied to specific geographic locations and cultures. Consumers, especially in developed markets such as North America and Europe, are willing to pay a premium for these cheeses. Moreover, many specialty cheeses, such as goat and sheep milk varieties, contain higher levels of vitamins, minerals, and proteins compared to traditional cow milk cheeses. For example, goat cheese is easier to digest for lactose-sensitive individuals and contains healthy fats like medium-chain fatty acids (MCTs), which have been linked to energy production and metabolic benefits.

Product innovation and the continuous introduction of new flavors are essential drivers of the market. Manufacturers are focusing on crafting new varieties of cheese to cater to the adventurous palates of modern consumers. For instance, cheeses infused with herbs, spices, fruit, or even alcohol have gained popularity. Consumers are no longer satisfied with traditional cheese flavors; they seek out options such as truffle-infused Brie, whiskey-soaked Cheddar, or cranberry-flavored Stilton. Additionally, manufacturers have been experimenting with different aging processes, producing cheeses with distinctive textures and taste profiles. For example, blue cheeses with varying degrees of intensity, from mild to pungent, appeal to different consumer preferences.

Changing eating habits, particularly the growing trend toward snacking and grazing, have positively impacted the market. Cheese, which is often perceived as a nutritious and filling snack, has become a popular choice among consumers who prefer smaller, more frequent meals throughout the day. Specialty cheese products such as individually wrapped portions of Gouda, Cheddar cubes, or pre-sliced Brie are increasingly marketed as convenient and healthy snack options. The shift toward high-protein snacks has further fueled the demand for specialty cheese. Many consumers are choosing cheese-based snacks over traditional carbohydrate-heavy snacks like chips and crackers. Specialty cheese is often perceived as a wholesome and indulgent snack that delivers both flavor and nutrition, making it a popular choice for health-conscious consumers.

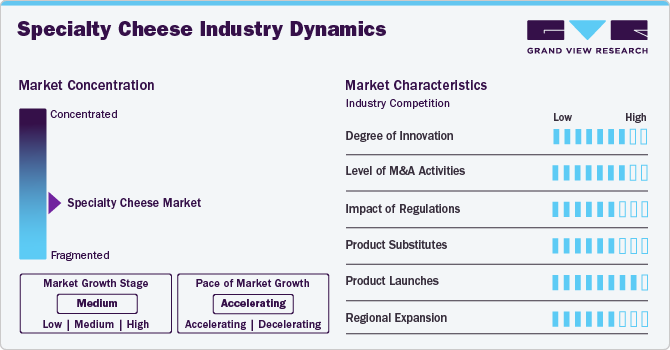

Market Concentration & Characteristics

Innovation in the market is driven by product diversification, flavor infusions, and the development of plant-based and lactose-free cheese alternatives. Manufacturers are experimenting with ingredients like truffles, spices, and herbs to create unique offerings.

Mergers and acquisitions (M&A) in the e market are frequent, as large dairy companies aim to expand their portfolios and regional reach by acquiring niche or artisanal brands. For instance, global players like Lactalis and Saputo have been active in acquiring specialty cheese producers, helping them diversify their product offerings, enter new markets, and strengthen their competitive positioning within the premium cheese segment.

Regulations in the market primarily focus on food safety, labeling, and quality standards, with strict guidelines regarding the use of additives, preservatives, and regional authenticity (such as PDO status). Compliance with these regulations, particularly in regions like the European Union and North America, ensures consumer protection but can also increase production costs and limit market entry for smaller, artisanal producers.

Product substitutes for specialty cheese include plant-based cheese alternatives, vegan spreads, and traditional dairy products like cream cheese and butter. The rise of veganism and lactose intolerance has prompted growth in plant-based cheese, posing a competitive challenge to traditional specialty cheese. However, the unique flavors and textures of specialty cheese still make it difficult for substitutes to completely replace it in culinary applications.

Recent product launches in the market reflect the demand for flavor innovation and dietary inclusivity. Brands are introducing new varieties like truffle-infused cheese, spiced cheddar, and lactose-free options. Additionally, plant-based specialty cheeses, such as almond or cashew-based varieties, are gaining traction. These product launches cater to evolving consumer preferences for gourmet, health-conscious, and sustainable food options.

Region expansion in the market is particularly robust in emerging markets like the Asia-Pacific and the Middle East. Increasing urbanization, rising disposable incomes, and the influence of Western diets have expanded the demand for premium cheese products in these regions. European and North American brands are actively targeting these markets through local partnerships, online platforms, and specialty retailers to grow their global presence.

Product Insights

The fresh cheese segment held a revenue share of 35.2% in 2023. One of the primary reasons for fresh cheese’s dominance is its versatility and widespread culinary applications. Fresh cheese varieties such as mozzarella, ricotta, and feta are integral to numerous dishes across global cuisines. For example, mozzarella is a staple ingredient in pizzas, pasta, and salads, while feta is widely used in Mediterranean dishes. Moreover, fresh cheese is often perceived as healthier and more natural due to its minimal processing and shorter aging period. It contains fewer preservatives and additives compared to aged and blue cheeses, which enhances its appeal among health-conscious consumers. Fresh cheeses typically have lower fat content than aged cheeses, further boosting their popularity among individuals seeking lighter, healthier alternatives. This trend is particularly strong in regions like North America and Europe, where consumers are increasingly opting for fresh, organic, and minimally processed foods.

Flavored cheese is expected to grow at a CAGR of 6.7% from 2024 to 2030. Consumer interest in experimentation and adventurous flavors has increased significantly in recent years. Modern consumers, particularly younger generations such as millennials and Gen Z, are increasingly drawn to foods that offer new and exciting flavor profiles. Flavored cheeses, which may be infused with herbs, spices, fruits, or even alcohol, cater to this demand for novel and diverse taste experiences. Popular varieties include cheeses infused with jalapenos, truffles, or cranberries, which provide unique sensory experiences for consumers.

Form Insights

The cheese blocks segment held a revenue share of 40.7% in 2023. Cheese blocks provide consumers with greater flexibility in terms of usage. Buyers can slice, shred, or cube cheese blocks according to their preferences, making them suitable for various culinary applications. This versatility makes cheese blocks highly desirable among home cooks and foodservice establishments alike, contributing to their dominant market share. Moreover, cheese blocks have longer shelf life compared to pre-sliced or shredded varieties. They can be stored for longer periods without losing quality, which appeals to consumers who prefer to buy cheese in bulk. This makes them a cost-effective option, especially for families or individuals who consume cheese regularly.

Shredded cheese is expected to grow at a CAGR of 6.2% from 2024 to 2030This segment is growing rapidly due to the increasing demand for convenience and time-saving solutions in the kitchen. Shredded cheese is pre-prepared, which eliminates the need for consumers to shred cheese themselves, making it ideal for busy households and commercial kitchens. As convenience becomes a major purchasing driver, shredded cheese’s appeal continues to rise. The growth of the ready-to-eat and prepared meals sector has also fueled the demand for shredded cheese. Moreover, shredded cheese is commonly used in prepared meals such as casseroles, pizzas, and salads, all of which are growing in popularity as consumers look for quick and easy meal options. This trend is particularly evident in urban areas where time-strapped consumers are seeking ways to streamline meal preparation.

Distribution Channel Insights

Sales through supermarkets & hypermarkets accounted for a revenue share of 50.6% of the market in 2023 due to the broad product selection available at these stores. Hypermarkets and supermarkets typically carry a wide range of specialty cheese varieties, from fresh and aged cheese to flavored and regional specialties. This extensive selection appeals to consumers who want the convenience of purchasing all their grocery items, including cheese, in one location. Moreover, supermarkets and hypermarkets offer affordable pricing and promotions, which attract budget-conscious consumers. Bulk purchasing options, special offers, and loyalty programs make these stores a cost-effective choice for purchasing specialty cheese, contributing to their dominant market share.

Sales through online channels are expected to grow at a CAGR of 7.1% from 2024 to 2030. Online shopping offers convenience and accessibility. Consumers can browse a wide range of specialty cheese products from the comfort of their homes and have them delivered directly to their doors. This convenience is particularly appealing to consumers who may not have access to specialty cheese retailers or gourmet shops in their local area. The growth of direct-to-consumer (DTC) models has also boosted online sales. Specialty cheese brands can now sell their products directly to consumers through online platforms, bypassing traditional retail channels. This allows consumers to access unique or limited-edition cheeses that may not be available in supermarkets.

Regional Insights

The specialty cheese market in North America has been witnessing robust growth, driven by shifting consumer preferences towards gourmet and artisanal products. In the U.S., a surge in cheese production, alongside sophisticated distribution networks, has facilitated wider access to specialty cheeses. According to industry reports, notable states like Wisconsin and California are leading producers, offering a variety of artisanal cheeses that cater to evolving consumer tastes. Moreover, Canada is experiencing an uptick in specialty cheese consumption, driven by an increasing interest in gourmet products and a burgeoning craft cheese movement. The Canadian market is characterized by a strong emphasis on organic and premium products, as consumers seek out cheeses that reflect their values of sustainability and ethical sourcing.

Europe Specialty Cheese Market Trends

Europe specialty cheese market accounted for a revenue share of 48.5% in 2023 due to its rich cheese-making traditions and high per capita consumption of cheese. Countries such as France, Italy, Switzerland, and the Netherlands are renowned for their artisanal cheese production, and European consumers have a long-standing appreciation for high-quality, regionally produced cheeses. Moreover, Europe is home to many protected designation of origin (PDO) cheeses, such as Parmigiano-Reggiano and Roquefort, which are highly sought after globally. The strong cheese culture in Europe drives continuous demand for specialty cheese, both in everyday consumption and gourmet dining. Besides, European consumers have a deep appreciation for the variety and craftsmanship of specialty cheeses, which helps maintain Europe’s dominant position in the global market.

Asia Pacific Specialty Cheese Market Trends

The specialty cheese market in Asia Pacific is expected to grow with a CAGR of 6.7% from 2024 to 2030 due to increasing Western influence, rising disposable incomes, and changing dietary habits. As urbanization continues and consumers become more exposed to global food trends, demand for specialty cheese in countries like China, India, and Japan is rising. The growing middle class in Asia Pacific has led to higher consumption of premium and imported food products, including specialty cheese. Additionally, the expansion of Western-style restaurants and cafes across the region has introduced consumers to a wider variety of cheese-based dishes, further driving demand.

Key Specialty Cheese Company Insights

Key players operating in the market are Lactalis Group, Saputo Inc., Arla Foods, Fonterra Co-operative Group, and Bel Group. The market participants are constantly working towards new product launches, partnerships, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives.

Key Specialty Cheese Companies:

The following are the leading companies in the specialty cheese market. These companies collectively hold the largest market share and dictate industry trends.

- Lactalis Group

- Saputo Inc.

- Arla Foods

- Fonterra Co-operative Group

- Bel Group

- Emmi Group

- Sargento Foods Inc.

- Groupe Savencia Fromage & Dairy

- Murray’s Cheese

- Zanetti S.P.A.

Recent Developments

-

In August 2024, Bergader and Abbey Specialty Foods launched the new edelblu Blue Cheese line, aimed at attracting a younger audience while continuing Bergader's legacy of quality cheeses. The edelblu line features edelblu Cream, a creamy, spreadable Blue cheese, and edelblu Cheese Cubes, convenient for portion control and versatile use in various dishes. Available in Europe and debuting in the U.S. in September, the products are designed for ease of use in quick recipes.

-

In June 2024, Président, a global deli and dairy brand, showcased its latest innovations at the 2024 Summer Fancy Foods Show, held from June 23-25 at the Javits Center in New York. Highlights include the introduction of Leerdammer, a Gouda-style cheese with a mild, nutty flavor, and the eco-friendly packaging redesign of the Président Feta 8 oz. chunk.

Specialty Cheese Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 40.99 billion

Revenue forecast in 2030

USD 54.27 billion

Growth rate

CAGR of 5.8% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan, India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Lactalis Group; Saputo Inc.; Arla Foods; Fonterra Co-operative Group; Bel Group; Emmi Group; Sargento Foods Inc.; Groupe Savencia Fromage & Dairy; Murray’s Cheese; Zanetti S.P.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Specialty Cheese Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global specialty cheese market report based on the product, form, distribution channel, and region.

-

Product Market Outlook (Revenue, USD Million, 2018 - 2030)

-

Fresh Cheese

-

Aged Cheese

-

Soft Cheese

-

Blue Cheese

-

Flavored Cheese

-

-

Form Market Outlook (Revenue, USD Million, 2018 - 2030)

-

Blocks

-

Sliced

-

Shredded

-

Others

-

-

Distribution Channel Market Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Regional Market Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global specialty cheese market size was estimated at USD 36.73 billion in 2023 and is expected to reach USD 38.62 billion in 2024.

b. The global specialty cheese market is expected to grow at a compounded growth rate of 5.7% from 2024 to 2030 to reach USD 53.89 billion by 2030.

b. Fresh cheese dominated the specialty cheese market with a share of 35.2% in 2023. Fresh cheese varieties such as mozzarella, ricotta, and feta are integral to numerous dishes across global cuisines owing to which they are majorlyused and hold a significant market share.

b. Some key players operating in the specialty cheese market include Lactalis Group, Saputo Inc., Arla Foods, Fonterra Co-operative Group, Bel Group, Emmi Group, Sargento Foods Inc., Groupe Savencia Fromage & Dairy , Murray’s Cheese, Zanetti S.P.A.

b. One of the most significant drivers of the specialty cheese market is the rising consumer preference for premium and artisanal products. As consumers increasingly seek higher-quality food products, they are drawn to specialty cheeses that offer unique flavors and textures not found in mass-produced options.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.