- Home

- »

- Specialty Polymers

- »

-

Specialty & High Performance Films Market Size Report 2030GVR Report cover

![Specialty & High Performance Films Market Size, Share & Trends Report]()

Specialty & High Performance Films Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Barrier, Safety And Security, Decorative, Microporous, Others), By Product, By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-277-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

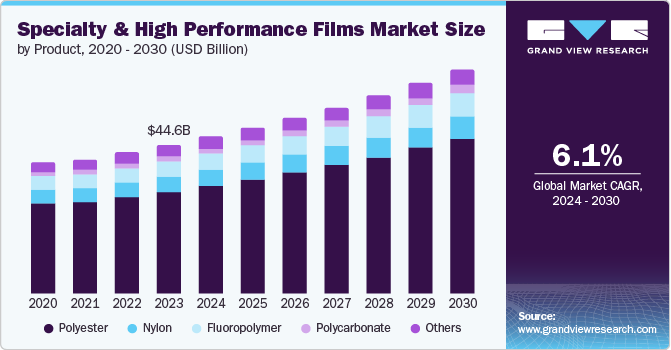

The global specialty & high performance films market size was valued at USD 44.60 billion in 2023 and is projected to grow at a CAGR of 6.1% from 2024 to 2030. Innovations in materials science and film manufacturing techniques have led to the development of films with superior properties such as enhanced durability, improved optical clarity, and excellent resistance to environmental factors. These advancements enable the creation of films that meet the evolving needs of various industries, including automotive, aerospace, and electronics, thus fueling demand for high-performance films.

With the proliferation of electronic devices and gadgets, there is a growing demand for films that offer electrical insulation, thermal management, and protection against electromagnetic interference. Specialty films are used in applications such as flexible displays, touchscreens, and protective covers, whose unique properties enhance electronic products' performance and longevity. As consumer electronics continue advancing, the need for high-performance films will likely increase correspondingly.

Additionally, the rise in environmental consciousness and regulatory pressures is driving the adoption of specialty films with eco-friendly characteristics. Many industries are seeking recyclable, biodegradable, or sustainable films to meet stringent environmental regulations and cater to eco-conscious consumers. This shift towards greener alternatives is spurring innovation in developing specialty films that offer high performance and reduced environmental impact. As sustainability becomes a more prominent concern, the market for eco-friendly specialty films is expected to expand.

Product Type Insights

Polyester dominated the market and accounted for a market revenue share of 68.6% in 2023. Polyester films are widely utilized as substrates for flexible circuits, displays, and touchscreens due to their superior electrical insulation and thermal stability. The electronics industry's rapid evolution, characterized by the development of more advanced and compact devices, fuels the need for high-performance polyester films. As consumer electronics and wearable technology become more prevalent, the demand for polyester films as crucial components in these devices is expected to grow.

Polycarbonate is expected to register the fastest CAGR of 7.4% during the forecast period. Polycarbonate films are employed in architectural applications such as skylights, facades, and roofing due to their high impact resistance, UV stability, and thermal insulation properties. The demand for innovative building materials that offer energy efficiency and durability is rising, and polycarbonate films fit these criteria well. As the construction industry embraces modern, sustainable building practices, the use of polycarbonate films in architectural applications is expected to grow.

Application Insights

Barrier accounted for the largest market revenue share in 2023. Barrier films, known for their ability to protect products from external elements such as moisture, oxygen, and UV light, are crucial in maintaining freshness and extending the shelf life of packaged goods. This is particularly significant in the food and beverage industry, where the packaging directly influences the quality and longevity of products. As consumer preferences for convenience and longer-lasting products continue to rise, the demand for high-performance barrier films is expected to grow correspondingly.

The decorative segment is expected to register significant growth during the forecast period. Decorative films are widely employed in architectural applications, including window films, wall coverings, and surface finishes, due to their ability to provide stylish and functional enhancements. In commercial and residential interiors, decorative films offer an economical and versatile alternative to traditional materials, enabling designers to create unique and visually appealing environments. The growing trend towards modern and customizable interiors, coupled with the need for cost-effective design solutions, fuels the adoption of decorative films in architecture and interior design.

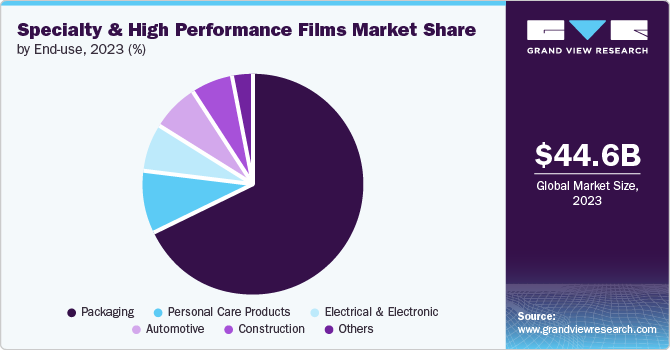

End Use Insights

The packaging segment accounted for the largest market revenue share in 2023. Specialty films provide excellent barrier properties that protect products from moisture, oxygen, and light, helping to preserve the freshness and quality of food and beverages. Packaging solutions that ensure product longevity and safety become increasingly important as consumer preferences shift towards convenient and long-lasting products. This trend is particularly evident in the food industry, where high-performance films are used to enhance packaging functionality and maintain product integrity.

The construction segment is anticipated to grow at the fastest CAGR over the forecast period. Films are used in decorative window films, architectural facades, and surface coverings to create unique and modern designs. As architects and designers seek innovative ways to achieve aesthetically pleasing and functional spaces, specialty films' versatility and customization options drive their adoption in construction projects.

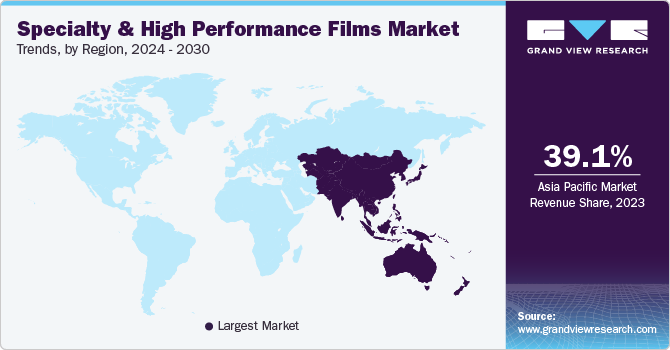

Regional Insights

North America specialty & high performance films market held a substantial share in 2023. With its robust manufacturing and technological sectors, North America has a high demand for specialty films that offer enhanced performance characteristics such as durability, flexibility, and resistance to environmental factors. Industries such as automotive, aerospace, and electronics continually seek innovative films to improve product performance and meet regulatory standards. This demand for advanced materials fuels the growth of the region's specialty and high-performance films market.

U.S. Specialty & High Performance Films Market Trends

The U.S. specialty & high performance films anticipated to grow significantly over the forecast period. With the growing demand for advanced medical devices and packaging solutions in the country, there is an increasing need for films that offer biocompatibility, barrier protection, and sterilization capabilities. Specialty films used in medical packaging and as protective coatings for medical devices play a critical role in maintaining product integrity and ensuring patient safety. The rise in healthcare expenditures and technological advancements in medical devices contribute to the market's positive trajectory.

Europe Specialty & High Performance Films Market Trends

Europe specialty & high performance films market was identified as a lucrative region in 2023. With online shopping gaining popularity among consumers in the region, there is an increased need for effective packaging solutions that ensure product safety during transit while providing aesthetic appeal. High-performance films are utilized for protective packaging applications due to their lightweight nature and ability to provide excellent barrier properties against moisture, oxygen, and other external factors that could compromise product integrity.

The UK specialty & high performance films market is expected to grow rapidly in the coming years. The rapid expansion of the electronics industry proliferates the country's market. With increasing demand for electronic devices such as smartphones, tablets, and wearables, there is a corresponding need for high-performance films used in displays, insulation layers, and protective coatings. Due to their lightweight nature and excellent electrical insulating properties, specialty films are essential components in flexible printed circuits (FPCs) and other electronic applications..

Asia Pacific Specialty & High Performance Films Market Trends

Asia Pacific specialty & high performance films market accounted for the largest market revenue share of 39.1% in 2023. As cities expand and modernize, there is an increasing need for advanced building materials, including energy-efficient glazing and protective films for construction applications. Specialty films offering benefits such as enhanced thermal insulation, UV protection, and durability are becoming essential in residential and commercial projects. The region's large-scale infrastructure projects and urban development initiatives drive significant demand for these films, contributing to market growth.

China specialty & high performance films market is anticipated to grow rapidly over the forecast period. China's increasing focus on sustainability and environmental conservation has led to a growing preference for specialty and high-performance films that offer eco-friendly and recyclable attributes. As the government and consumers emphasize sustainable practices, manufacturers are innovating to develop bio-based and compostable films, thus expanding the market.

Key Specialty & High Performance Films Company Insights

Some of the key companies in the specialty & high performance films market include BASF SE, Clariant AG, Albemarle Corporation, Songwon Industrial Co., Ltd., and others.

-

BASF SE offers an extensive range of specialty and high-performance films designed to meet the diverse needs of various sectors, including packaging, automotive, electronics, and construction. These films are engineered to provide exceptional properties such as durability, flexibility, and resistance to environmental factors. The company’s portfolio includes polyamide (PA) films, polyethylene (PE) films, and other advanced polymer-based solutions that cater to specific applications requiring high barrier performance against gases and moisture.

-

Clariant AG offers specialty films that incorporate advanced technologies that enable features such as anti-fogging, UV protection, and anti-static properties. These innovations make them suitable for a wide array of applications, from food packaging that extends shelf life to electronic devices requiring robust protective layers.

Key Specialty & High Performance Films Companies:

The following are the leading companies in the specialty & high performance films market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Clariant AG

- Albemarle Corporation

- Songwon Industrial Co., Ltd.

- Nouryon

- LANXESS AG

- Evonik Industries AG

- Kaneka Corporation

- The Dow Chemical Company

- ExxonMobil Corporation

Recent Developments

-

In May 2024, Clariant AG unveiled a range of innovative solutions at NPE 2024 to significantly reduce the environmental impact of plastics, particularly in specialty and high-performance films. These new offerings are designed to enhance the sustainability profile of plastic products while maintaining their performance characteristics.

-

In January 2024, LANXESS launched a sustainability film highlighting its commitment to sustainable practices within the specialty and high-performance films sector. This film showcases how the company integrates sustainability into its production processes, emphasizing the development of innovative materials that meet high-performance standards and adhere to environmental regulations and sustainability goals.

Specialty & High Performance Films Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 47.14 billion

Revenue forecast in 2030

USD 67.43 billion

Growth Rate

CAGR of 6.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, Volume in Kilotons and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Indonesia, Vietnam, Brazil, Argentina, South Africa, Saudi Arabia, UAE and Kuwait

Key companies profiled

BASF SE, Clariant AG, Albemarle Corporation, Songwon Industrial Co., Ltd., Nouryon, LANXESS AG, Evonik Industries AG, Kaneka Corporation, The Dow Chemical Company, and ExxonMobil Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Specialty & High Performance Films Market Report Segmentation

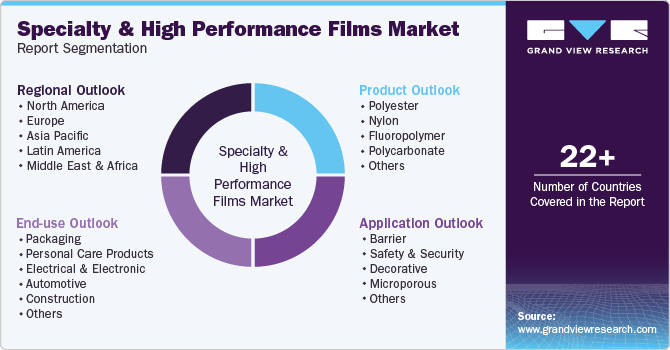

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the specialty & high performance films market report based on product, application, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030) (Volume, Kilotons)

-

Polyester

-

Nylon

-

Fluoropolymer

-

Polycarbonate

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030) (Volume, Kilotons)

-

Barrier

-

Safety and Security

-

Decorative

-

Microporous

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030) (Volume, Kilotons)

-

Packaging

-

Personal Care Products

-

Electrical and electronic

-

Automotive

-

Construction

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030) (Volume, Kilotons)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Indonesia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.