- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Specialized Nutrition Market Size, Industry Report, 2030GVR Report cover

![Specialized Nutrition Market Size, Share & Trends Report]()

Specialized Nutrition Market (2025 - 2030) Size, Share & Trends Analysis Report By Ingredient (Protein & Amino Acids, Vitamins, Minerals, Fibers & Specialty Carbohydrates, Omega Fatty Acids), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-487-7

- Number of Report Pages: 119

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Specialized Nutrition Market Summary

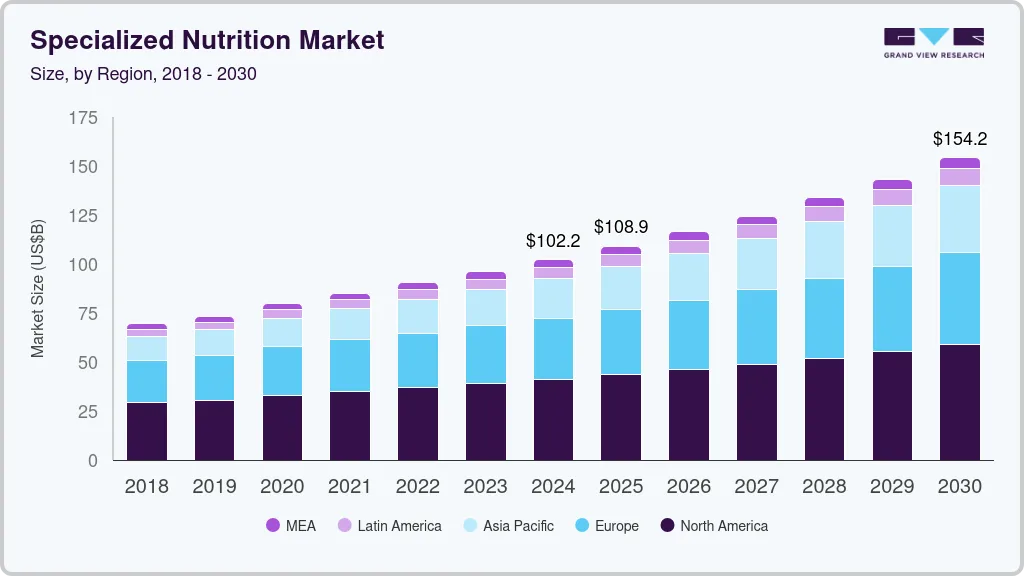

The global specialized nutrition market size was estimated at USD 102.18 billion in 2024 and is projected to reach USD 154.21 billion by 2030, growing at a CAGR of 7.2% from 2025 to 2030. Increasing awareness about health and wellness has driven demand for specialized nutrition products.

Key Market Trends & Insights

- The specialized nutrition market in North America accounted for a share of 40.2% of the global revenue in 2024.

- The specialized nutrition market in the U.S. is projected to grow at a CAGR of 5.7% from 2025 to 2030.

- By ingredients, proteins & amino acids accounted for a revenue share of 44.8% in 2024.

- By application, the elderly nutrition segment accounted for a revenue share of 66.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 102.18 Billion

- 2030 Projected Market Size: USD 154.21 Billion

- CAGR (2025-2030): 7.2%

- North America: Largest market in 2024

Consumers are becoming more informed about the benefits of customized nutrition for enhancing overall performance and managing age-related health issues. Furthermore, a shift towards preventive health measures has led to greater interest in nutrition that supports specific health needs, such as enhanced athletic performance or managing chronic conditions in the elderly. These trends are expected to drive the market growth.

The specialized nutrition market for sports and elderly foods is driven by increasing health consciousness among consumers, a growing elderly population with specific dietary needs, the rise of e-commerce making products more accessible, continuous product innovation featuring enhanced nutritional profiles, and a heightened focus on sustainability and ethical consumption.

The market, encompassing sports and elderly foods, has emerged as a significant segment of the food industry. Sports nutrition, targeted towards athletes and fitness enthusiasts, provides tailored dietary solutions to enhance performance, recovery, and overall well-being. This market segment includes products such as protein powders, sports drinks, energy bars, and supplements that meet the specific nutritional demands of individuals engaged in strenuous physical activity. The increasing popularity of fitness and sports participation drives the growth of the sports nutrition market, as consumers seek specialized products to support their active lifestyles.

On the other hand, elderly foods cater to the unique nutritional requirements of older adults. As individuals age, their dietary needs change, often requiring specialized products that address age-related physiological and metabolic shifts. Elderly foods typically focus on providing essential nutrients, enhancing cognitive function, and supporting bone health. They include products such as fortified foods, nutrient-dense beverages, and supplements designed to address the specific nutritional concerns of seniors. The aging population and growing life expectancies contribute to the increasing demand for elderly foods, making this segment an important area of focus for food manufacturers.

Ingredients Insights

Proteins & amino acids accounted for a revenue share of 44.8% in 2024. Protein & amino acids are the essential ingredients in specialized nutrition, particularly for sports and elderly population. Proteins support muscle repair, strength, and overall health, making them vital for athletes, while easily digestible protein sources like whey and casein are important for the elderly to prevent muscle loss. Meanwhile, amino acids, such as BCAAs (leucine, isoleucine, and valine), are crucial for muscle growth and recovery. In clinical nutrition, hydrolyzed proteins and peptides enhance absorption and support digestive health. These ingredients cater to growing demands for targeted nutrition, offering both performance benefits and age-related support, driving the adoption of protein & amino acids specialized nutrition during the forecast period.

The prebiotics & probiotics ingredient segment is expected to grow at a CAGR of 9.0% from 2025 to 2030. Scientific studies have highlighted the benefits of prebiotics and probiotics in managing digestive disorders, improving gut health, overall immune function, and supporting mental health. For instance, probiotics are known to aid in managing irritable bowel syndrome (IBS) and inflammatory bowel diseases (IBD), which has led to their higher adoption, and expected to drive its market during the forecast period.

Application Insights

Application in elderly nutrition accounted for a revenue share of 66.9% in 2024. The global aging population is an important driver of demand for elderly nutrition products. As the number of elderly individuals increases across the world, the need for specialized nutrition that addresses their specific health requirements. Elderly individuals are at higher risk of nutritional deficiencies due to changes in metabolism, appetite, and absorption efficiency. Specialized nutrition products are designed to address these deficiencies and support overall health. Furthermore, there is a strong focus on preventive health measures to improve the quality of life and reduce the risk of age-related diseases, thus driving the demand for specialized nutrition for elderly during the forecast period.

The application of specialized nutrition in sports is expected to grow at a CAGR of 8.4% from 2025 to 2030. The growing trend towards fitness and active lifestyles has driven increased demand for sports nutrition products. As more people engage in regular physical activity, there is a heightened need for nutrition that supports performance and recovery. Furthermore, the rise of sports media, fitness influencers, and online platforms has increased awareness about the benefits of sports nutrition, augmenting their growth during the forecast period.

Regional Insights

The specialized nutrition market in North America accounted for a share of 40.2% of the global revenue in 2024. The market growth is driven by the increasing awareness of health and wellness, with a growing focus on preventive healthcare. In particular, the U.S. leads the region with a rise in demand for personalized nutrition solutions that cater to specific dietary needs, such as plant-based proteins, weight management products, and clinical nutrition. Key market players are leveraging innovation in product formulations to meet consumer demand for clean-label and natural ingredients, propelling market growth in the region.

U.S. Specialized Nutrition Market Trends

The specialized nutrition market in the U.S. is projected to grow at a CAGR of 5.7% from 2025 to 2030. The U.S. market is witnessing significant growth due to increasing consumer interest in customized dietary solutions to address specific health concerns, such as diabetes, obesity, and aging-related issues. Growing awareness about the benefits of functional foods and supplements is driving demand, particularly among older adults and health-conscious millennials. Additionally, advancements in nutrigenomics and personalized nutrition are creating new opportunities for manufacturers to cater to niche consumer segments, further boosting the market.

Europe Specialized Nutrition Market Trends

The specialized nutrition market in Europe is projected to grow at a CAGR of 7.0% from 2025 to 2030. The Europe market is experiencing steady growth, driven by increasing consumer awareness of health and wellness, alongside rising demand for personalized and functional nutrition products. Countries such as Germany, the U.K., and France are key contributors to market expansion, with a strong focus on dietary supplements, clinical nutrition, and sports nutrition. The growing aging population and the prevalence of chronic diseases are fueling demand for targeted nutritional solutions. Additionally, the trend toward plant-based and sustainable nutrition options is gaining traction, further boosting market growth across the region. Regulatory support for health claims on specialized nutrition products is also enhancing consumer confidence and market penetration.

The UK specialized nutrition market accounted for a share of 19.6% of Europe's revenue in 2024. In the U.K., the specialized nutrition industry is expanding, fueled by growing consumer preference for health-boosting dietary products. The rising prevalence of lifestyle-related diseases, such as heart disease and obesity, is driving demand for targeted nutrition solutions. There is also a notable shift toward plant-based and vegan nutritional products, as sustainability and animal welfare concerns influence purchasing decisions. Regulatory support for health and wellness initiatives further bolsters market growth in the U.K.

The specialized nutrition market in Germany is projected to grow at a CAGR of 6.8% from 2025 to 2030. The market in Germany is shaped by a highly health-conscious population and a strong tradition of innovation in the food and healthcare sectors. The demand for dietary supplements and functional foods is rising, particularly among aging consumers and those seeking to manage chronic conditions. Additionally, the market is benefiting from a growing focus on organic and clean-label products, as well as the adoption of digital tools to personalize nutrition plans for individuals.

Asia Pacific Specialized Nutrition Market Trends

The specialized nutrition market in Asia Pacific accounted for a share of 19.8% of the global revenue in 2024. The Asia Pacific market is experiencing rapid growth due to increasing disposable incomes, urbanization, and rising health consciousness across key markets such as China, Japan, and India. There is a strong demand for infant nutrition, clinical nutrition, and weight management products, particularly in densely populated countries where lifestyle diseases are becoming more prevalent. Additionally, the adoption of traditional ingredients in specialized nutrition products is a key trend in the region.

The China specialized nutrition market accounted for a share of 35.4% of the Asia Pacific market in 2024. China's market is witnessing robust growth, driven by rising consumer awareness of health and wellness, particularly in the wake of the COVID-19 pandemic. There is increasing demand for products that support immunity, weight management, and infant nutrition. The aging population and the government’s focus on healthcare reforms are also contributing to the growth of clinical nutrition products. Chinese consumers are increasingly opting for high-quality, premium nutrition products, creating significant opportunities for market players.

The specialized nutrition market in Japan is projected to grow at a CAGR of 9.3% from 2025 to 2030. In Japan, the market is driven by the country's aging population and a strong cultural emphasis on health and longevity. Functional foods, dietary supplements, and clinical nutrition products are in high demand, particularly among elderly consumers seeking to manage age-related conditions. Additionally, there is a growing interest in sports nutrition among younger demographics, influenced by increasing participation in fitness activities and the promotion of healthy lifestyles by the government.

Central And South America Specialized Nutrition Market Trends

The specialized nutrition market in Central and South America is projected to grow at a CAGR of 7.9% from 2025 to 2030.The market in Central and South America is expanding, supported by rising awareness of health and wellness, along with growing middle-class populations. Key markets like Brazil and Mexico are seeing an increased demand for infant nutrition, clinical nutrition, and products that support weight management and chronic disease prevention. However, economic challenges and affordability issues remain key restraints in some countries, impacting market growth potential in the region.

Middle East & Africa Specialized Nutrition Market Trends

The specialized nutrition market in the Middle East & Africa is projected to grow at a CAGR of 5.9% from 2025 to 2030. The Middle East and Africa market is growing steadily, driven by increasing awareness of the importance of health and nutrition in addressing lifestyle diseases such as diabetes and obesity. Countries like the UAE and Saudi Arabia are leading the market, with rising demand for clinical nutrition, sports nutrition, and infant nutrition products. While the market is still emerging in many African countries, improving healthcare infrastructure and rising disposable incomes are expected to support future growth in the region.

Key Specialized Nutrition Company Insights

The competitive landscape of the specialized nutrition market is marked by the presence of both global and regional players. These players offer a wide range of products that cater to various health conditions, dietary needs, and consumer preferences. Key players in the market include multinational corporations, specialized nutrition brands, and innovative startups. These companies are focusing on product innovation, partnerships, and acquisitions to expand their portfolios and strengthen their market position.

Key Specialized Nutrition Companies:

The following are the leading companies in the specialized nutrition market. These companies collectively hold the largest market share and dictate industry trends.

- AAK AB

- Abbott

- Danone

- Ajinomoto Co., Inc.

- GlaxoSmithKline plc (GSK)

- Nestle

- Otsuka Holdings Co., Ltd

- The Vitamin Company India

- PepsiCo.

- Herbalife Nutrition

Recent Developments

-

In July 2024, Danone UK & Ireland introduced a new initiative called GetPRO Professional. This program is designed for sports nutritionists who aim to assist athletes and individuals across various fitness levels. Developed in collaboration with a panel of top sports nutrition experts, GetPRO Professional offers essential tools, mentorship opportunities, and funding to support sports nutritionists working with non-elite athletes and local sports clubs.

-

In May 2024, Abbott introduced a new generation of Ensure, designed to provide comprehensive nutritional support specifically for the elderly and those in recovery in China. This product is notable for being one of the first domestically registered Foods for Special Medical Purposes. The upgraded version of Abbott Ensure retains the original formula’s richness in 35 essential nutrients and features an increased protein content of 21.15 grams per 100 grams. In addition, it does not include sucrose, which contributes to a lighter taste. This formulation is tailored to fully satisfy the nutritional requirements of older adults and individuals recovering from illness.

-

In March 2024, Garden of Life, a brand under Nestlé Health Science, expanded its sports supplement line with a new formulation aimed at promoting skin health. The Garden of Life Sport Whey+ Younger, Healthier Looking Skin is a protein powder that offers a complete amino acid profile to aid in workout recovery while enhancing the skin’s radiance, elasticity, and smoothness. This product is easy to mix and comes in a vanilla flavor.

-

In January 2024, Nestlé Health Science UK&I introduced Nuun, a prominent U.S. brand in Hydration Sports Nutrition. Nuun aims to enhance hydration during workouts and replenish electrolytes lost through exercise. Nuun provides a variety of effervescent drink tablets that offer more than just water, restoring essential minerals that aid in performance. The product line features two options: Nuun Sport Electrolytes and Nuun Ultra Hydration.

-

In December 2023, Ajinomoto launched ‘AminoMOF’ to target the market for dietary supplements aimed at seniors, addressing the needs of over four million elderly individuals in Thailand who are looking to enhance their fitness and mobility with assurance.

Specialized Nutrition Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 108.94 billion

Revenue forecast in 2030

USD 154.21 billion

Growth rate

CAGR of 7.2% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Volume in tons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ingredient, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; China; India; Japan; Australia & New Zealand; Brazil; South Africa

Key companies profiled

AAK AB; Abbott; Danone; Ajinomoto Co., Inc.; GlaxoSmithKline plc (GSK); Nestle; Otsuka Holdings Co., Ltd; The Vitamin Company India; PepsiCo.; Herbalife Nutrition

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Specialized Nutrition Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global specialized nutrition market report based on ingredient, application, and region.

-

Ingredient Outlook (Volume, Tons; Revenue, USD Billion, 2018 - 2030)

-

Protein & Amino Acids

-

Vitamins

-

Minerals

-

Fibers & Specialty Carbohydrates

-

Omega fatty Acids

-

Prebiotics & Probiotics

-

Antioxidants

-

Others

-

-

Application Outlook (Volume, Tons; Revenue, USD Billion, 2018 - 2030)

-

Sports Nutrition

-

Elderly Nutrition

-

-

Regional Outlook (Volume, Tons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global specialized nutrition market size was valued at USD 102.18 billion in 2024 and is expected to reach USD 108.94 billion by 2025.

b. The global specialized nutrition market is expected to grow at a compounded growth rate of 7.2% from 2025 to 2030, reaching USD 154.21 billion by 2030.

b. The specialized nutrition market in North America accounted for 40.2% of the global revenue in 2024. This market is driven by increasing awareness of health and wellness and a growing focus on preventive healthcare.

b. Some of the key players in the specialized nutrition market are AAK AB, Abbott, Danone, Ajinomoto Co., Inc., GlaxoSmithKline plc (GSK), Nestle, Otsuka Holdings Co., Ltd, The Vitamin Company India, PepsiCo., and Herbalife Nutrition.

b. The specialized nutrition market for sports and elderly foods is driven by increasing health consciousness among consumers, a growing elderly population with specific dietary needs, the rise of e-commerce making products more accessible, continuous product innovation featuring enhanced nutritional profiles, and a heightened focus on sustainability and ethical consumption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.