- Home

- »

- Animal Health

- »

-

Spay and Neuter Market Size, Share, Industry Report, 2033GVR Report cover

![Spay and Neuter Market Size, Share & Trends Report]()

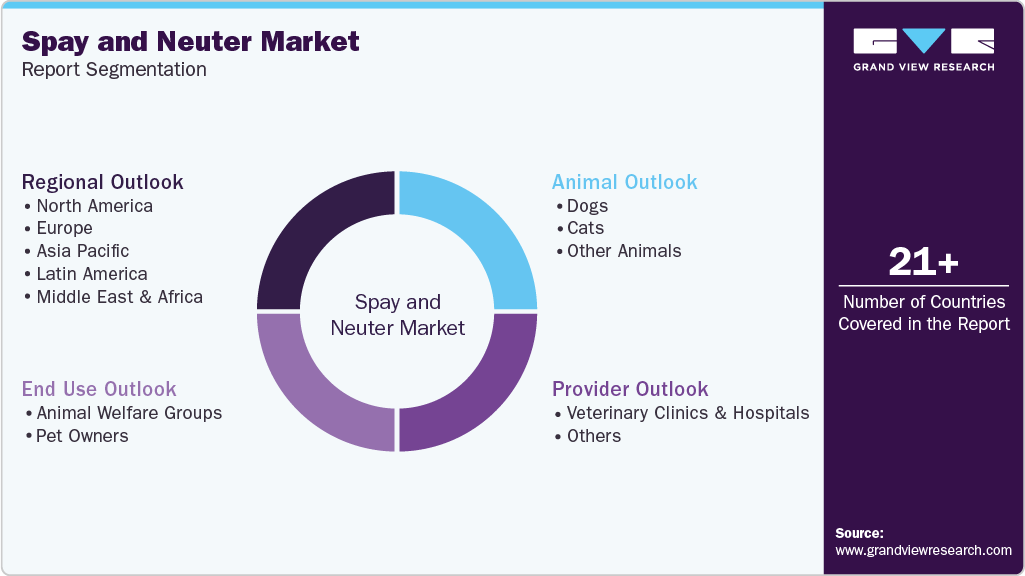

Spay and Neuter Market (2025 - 2033) Size, Share & Trends Analysis Report By Animal Type (Dogs, Cats, Other Animals), By Provider, By End Use, By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-4-68040-033-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Spay and Neuter Market Summary

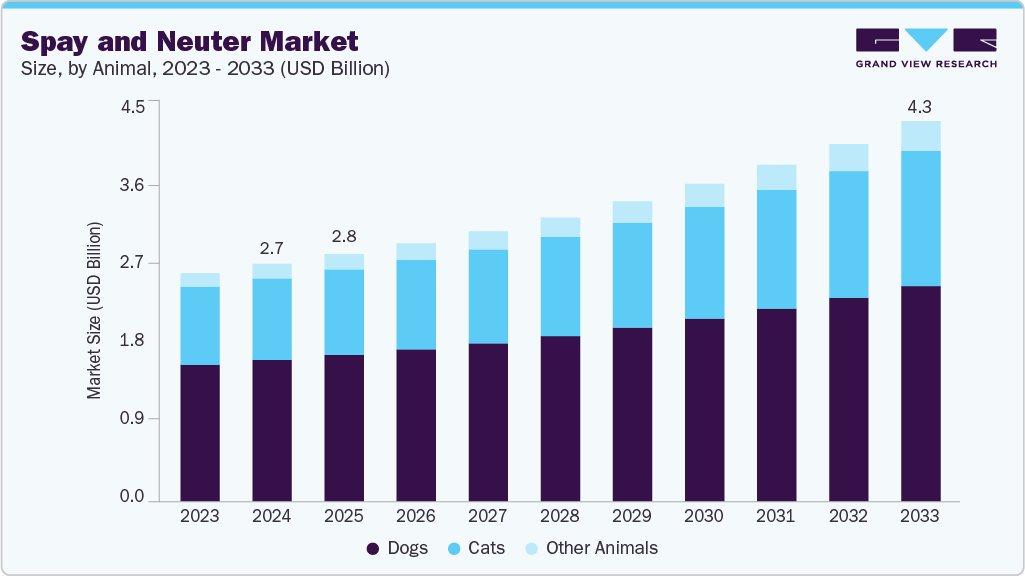

The global spay and neuter market size was estimated at USD 2.66 billion in 2024 and is projected to reach USD 4.26 billion by 2033, growing at a CAGR of 5.52% from 2025 to 2033. The market is witnessing lucrative growth driven by expansion of low-cost clinics & mobile surgical units, increasing government regulations, bylaws & mandatory sterilization policies, rising growth of animal welfare NGOs & global funding support and increasing awareness & education efforts.

Key Market Trends & Insights

- The North America spay and neuter market held the largest revenue share of 44.03% in 2024.

- The U.S. dominated North America with the largest revenue share in 2024.

- By animal, the dogs segment held the largest market share of 59.52% in 2024.

- By provider, the veterinary clinics & hospitals segment held largest market share in 2024.

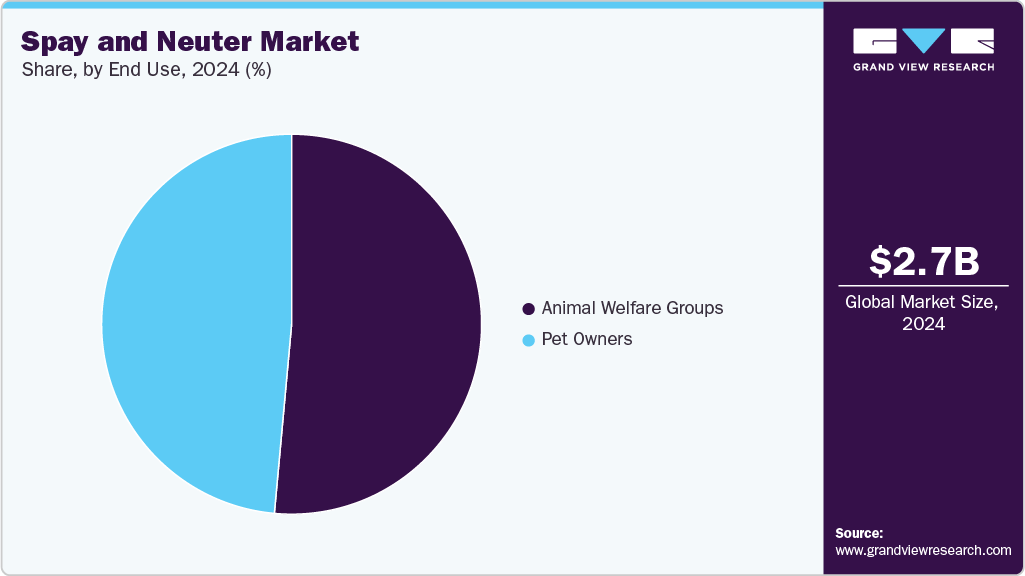

- By end use, the animal welfare groups segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.66 Billion

- 2033 Projected Market Size: USD 4.26 Billion

- CAGR (2025-2033): 5.52%

- North America region: Largest market in 2024

- Asia Pacific region: Fastest growing Market

Expansion of low-cost clinics & mobile surgical units is one of the leading drivers for the spay and neuter industry. These low-cost sterilisation clinics and mobile surgical units significantly improve access for underserved urban and rural pet owners, sterilization rates increase. As a result, this increases the demand for high-volume spay/neuter equipment, drugs, and post-operative care products. Welfare organizations, municipal agencies, and private sponsors are investing in mobile outreach programs to address stray-animal control, enabling thousands of additional surgeries annually. For instance, in March 2025, Santa Barbara Humane expanded its mobile spay/neuter clinic, offering free surgeries in underserved California communities after completing 226 procedures in 2024 to reduce pet overpopulation.

Similarly, in July 2024, TACO inaugurated a new Veterinary Hospital with an Animal Birth Control Unit in India, launching a Mobile Health Van, enabling on-site surgeries, diagnostics, and expanded outreach supported by five veterinarians. Such accessibility reduces economic barriers and encourages compliance with local sterilization laws. However, veterinary suppliers witness higher procurement of anesthetics, sutures, consumables, and monitoring devices, while service providers scale staffing, capacity, and geographic coverage driving sustained expansion of the spay & neuter market.

In addition, governments and municipalities have been implementing mandatory sterilization laws, breeder licensing rules, and population control bylaws. As a result, pet owners, breeders, and shelters turn to veterinary providers for timely spay/neuter services. For instance, in September 2025, Georgia launched its first Low-Cost Spay/Neuter Day, providing affordable sterilization and veterinary services in underserved rural areas, addressing overpopulation and supporting local shelters, rescues, and clinics. In addition, municipalities facing rising stray populations adopt enforcement measures and incentivize subsidized sterilization campaigns, prompting NGOs and clinics to expand program capacity.

Furthermore, international and local animal-welfare NGOs receive expanding donor funding and grants for sterilization programs, large-scale, sustained spay/neuter initiatives become possible. Therefore, thousands of procedures are being performed annually at reduced or no cost. For instance, in November 2025, Nine Bay Area organizations, supported by four national family foundations, hosted free spay/neuter surgeries and vaccines for over 600 pets, improving access, reducing overpopulation, and promoting pet health across five counties. Similarly, in July 2025, Monroe County Humane Association received a Lilly Scholars Network grant, expanding its spay/neuter program to Greene, Owen, and Lawrence Counties, increasing affordable access and reducing pet overpopulation. Moreover, global foundations and industry donors are increasingly supporting TNR programs, rural sterilization camps, and equipment procurement, enabling welfare groups to reach high-risk, low-income, and remote regions.

Potential Upcoming Challenges for Spay and Neuter Sector

Challenge

Details / Evidence

Health‑concerns affecting demand for early spay/neuter

Recent research shows early spay/neuter (especially before dogs reach sexual maturity) can raise risk of joint disorders (hip/elbow dysplasia, ligament tears) and certain cancers in many breeds.

Breed‑ and age‑specific guidelines complicate standard protocols

Optimal spay/neuter timing differs by breed, sex, and size - e.g., large breeds may need to wait until 12-24 months.

Growing caution among owners and veterinarians reduces clinic throughput

As owners learn about health risks and tailored guidelines, some may delay or avoid sterilization, reducing volume for clinics used to early-age standard practice.

Rising demand for alternative sterilization options or intact‑dog management

Interest is increasing in hormone-sparing sterilization (e.g., vasectomy, ovary-sparing spay) or keeping dogs intact with behavior management.

Increased complexity and liability for service providers

Clinics may need to adopt breed‑specific protocols, provide more owner counseling, and manage intact animals responsibly, increasing time, cost, and liability.

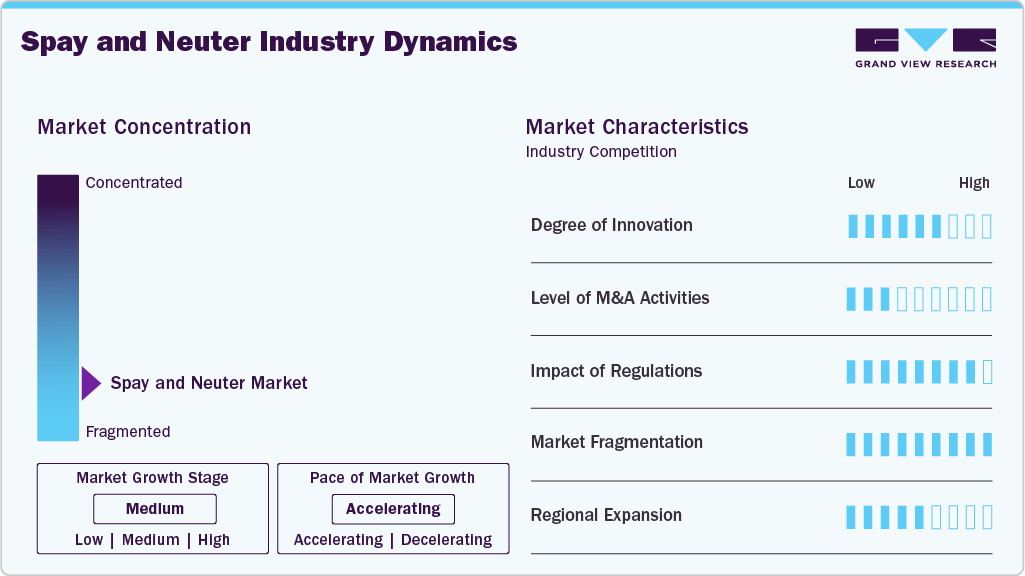

Market Concentration & Characteristics

Industry concentration in the global spay and neuter market is expected to stay low. Local veterinary hospitals and small private clinics handle most surgeries in each country. Animal welfare groups and mobile units add steady capacity and keep the field wide. Larger providers such as TACO, humane societies, and municipal programs support high volumes but do not shape the global industry. Many of domestic providers are entering the field, so no single chain gains control. The market is expected to keep expanding through this mix of structured service provider groups and many independent operators.

Degree of innovation in the spay and neuter sector is currently moderate and is growing at a steady pace. New clinical methods are improving recovery time and are helping clinics handle higher daily volume. Data tools are guiding outreach and are helping programs reach areas with heavy need. Telemedicine and simple scheduling systems are making intake smoother and are easing pre-op work. Mobile units and training programs are raising capacity and are shaping common standards across regions. Ongoing research on health and longevity is influencing how veterinarians are guiding owners and is shaping public messaging.

Level of M&A activity in the spay and neuter market comparatively low. Most providers are small clinics, animal groups, and municipal units, and they are running local programs with stable demand. Larger veterinary chains are expanding general care sites, but they are not acquiring high-volume sterilization programs at scale. Humane groups and mobile units are growing through grants and partnerships rather than buying clinics. The field is expected to keep expanding through new entrants rather than consolidation, so ownership remains spread across many operators.

Regulations are shaping the spay and neuter industry in important ways. Updated veterinary guidelines from major associations are influencing when and how neutering procedures are offered. Some regions are launching redesigned municipal spay/neuter programs to boost access and control pet populations. Rules and public-policy push clinics toward early-age or younger-pet neutering in many regions. Regulatory support for low-cost and subsidized clinics is helping expand service to underserved communities. As a result, regulations are helping increase demand and are supporting broader adoption of spay and neuter services.

Market fragmentation in the spay and neuter field is growing. Local veterinary hospitals and small clinics are handling most daily surgeries and are adding steady capacity in each region. Animal welfare groups and mobile units are expanding reach and are keeping the market open to many operators. Larger names are supporting high volumes but are not shaping pricing or supply. New domestic providers are entering the field and are widening the base of service points. The market is expected to keep growing through this broad mix of structured groups and many independent clinics.

The market is experiencing steady regional expansion driven by rising awareness of pet population control and government-supported programs. Urban areas in North America and Europe are seeing increased adoption due to municipal initiatives promoting low-cost or subsidized surgeries. In Asia-Pacific, countries like India, China, and Japan are showing growing interest, fueled by rising pet ownership and the establishment of veterinary clinics offering spay/neuter services. Latin America and the Middle East are gradually adopting these procedures as part of animal welfare campaigns, with NGOs and local authorities supporting mobile clinics and outreach programs. This geographic expansion is enabling service providers to reach underserved regions while creating standardized protocols and education programs for pet owners.

Animal Insights

The dogs segment led the spay and neuter market, with the largest revenue share of 59.52% in 2024, due to multiple factors. Spaying and neutering dogs reduces the risk of reproductive cancers, such as testicular cancer in males and mammary tumors in females, improving overall health. Sterilized dogs tend to live longer, contributing to increased pet longevity. Neutering males helps reduce aggression, roaming, and urine marking, while spaying females eliminates heat cycles and related stress. Population control is another key factor, as sterilization prevents unwanted litters and helps manage stray-dog numbers. Additionally, cost savings from fewer reproductive health issues encourage more owners to opt for these procedures, supporting the strong market share of the dog segment.

The other animals segment, comprising of rabbits, sheep, goats, and pigs is the fastest growing segment over the forecast period. The growth of this segment is driven by rising small-scale and backyard farming; which is increasing demand for reproductive control to manage herd sizes efficiently. Owners are seeking better animal health and longevity, as spaying and neutering reduces the risk of reproductive diseases and infections. Animal welfare awareness campaigns targeting fewer common animals are encouraging sterilization practices beyond dogs and cats. Economic factors also are also playing a key role by preventing unwanted litters. This helps farmers reduce feed and healthcare costs. Additionally, government and NGO programs promoting livestock population management and responsible breeding are supporting adoption of these services in rural and semi-urban regions.

Provider Insights

The veterinary clinics & hospitals segment dominated the spay and neuter industry, with largest revenue share in 2024, due to several factors. These facilities offer comprehensive spay and neuter services along with general medical care, making them a convenient one-stop solution for pet owners. Skilled veterinarians ensure safe procedures, reducing health risks and improving recovery outcomes. Clinics and hospitals also provide post-operative care, guidance, and follow-up, which builds owner trust and encourages repeat visits. Urban and semi-urban pet owners prefer these established facilities for reliable services, driving higher adoption. Advanced equipment and standardized protocols in these settings further support their dominance in the market.

The others segment consisting of institutions such as shelters, humane societies, and other welfare organizations is the fastest growing over the forecast period. Despite offering low-cost or free spay and neuter services, these institutions attract a large volume of animals, reaching populations that private clinics often cannot. Their focus on stray and abandoned animal control, combined with government and NGO support, amplifies their impact. Awareness campaigns and outreach programs further encourage pet owners to utilize these services. As a result, even with a smaller revenue share, their contribution to overall market growth and population management is steadily increasing.

End Use Insights

The animal welfare groups segment dominated the market with the largest revenue share in 2024, owing to their widespread involvement in large-scale spay and neuter initiatives. These organizations implement population control programs targeting stray and community animals, generating high service volumes. They receive strong support from governments and NGOs, which enables them to provide cost-effective or free procedures while maintaining operational scale. Public awareness campaigns led by these groups also drive adoption among pet owners. Their extensive outreach and ability to manage both owned and unowned animals make them key contributors to market revenue.

The pet owners segment is the fastest-growing channel over the forecast period of 2025-2033, due to rising awareness and proactive involvement of owners in pet health. Pet parents are increasingly seeking spay and neuter services to ensure longevity, reduce health risks, and control unwanted litters. Growing disposable incomes and willingness to invest in preventive care are driving direct engagement with veterinary services. Social media and educational campaigns are motivating owners to take initiative rather than relying solely on organizations. This hands-on approach is expanding the segment rapidly, making pet parents a key driver of market growth despite other established channels..

Regional Insights

North America dominated the spay and neuter market with the largest revenue share of 44.03% in 2024. This dominance can be owed to widespread adoption of spay and neuter programs and strong public awareness of pet overpopulation issues. Veterinary clinics, animal welfare organizations, and local governments are actively running free or low-cost spay/neuter clinics, making these services accessible to a broad population. Initiatives like large-scale spay/neuter events and resource centers are increasing pet owners’ participation by offering convenient, community-based options. Updated guidelines and educational campaigns are encouraging responsible pet ownership and preventive care, further driving demand. Additionally, cities and states are redesigning programs to scale operations efficiently, addressing both cost and capacity, which strengthens market growth. Public emphasis on humane treatment and reducing stray populations is also boosting service uptake.

U.S. Spay and Neuter Market Trends

The spay and neuter industry in the U.S. accounted for the largest market share in the North America market, owing to dominant implementation of large-scale, low-cost, and free spay/neuter programs. Municipalities and animal welfare organizations are actively relaunching and redesigning programs to increase accessibility and efficiency. Public awareness campaigns and annual events, such as spay/neuter thons, are encouraging pet owners to participate in preventive care. Updated veterinary guidelines are promoting responsible pet population management, while community clinics and nonprofit initiatives are addressing overpopulation and stray animals. These combined efforts are increasing service adoption and sustaining market growth across the country.

The Mexico spay and neuter market is expected to grow at a significant CAGR during the forecast periodpropelled by community‑level sterilization efforts are expanding and proving effective. For instance, one clinic in Chetumal spayed or neutered 948 dogs and cats in a single event, preventing an estimated 11,644 unwanted births in the first year alone. Another clinic on the Yucatán peninsula offered free and low-cost sterilization plus basic wellness care for hundreds of pets in a short event, showing demand when cost and access barriers are removed. Such clinics often serve street animals and low‑income owners who otherwise lack access to veterinary care.

Europe Spay and Neuter Market Trends

The spay and neuter industry in Europe is growing due to increased awareness of responsible pet ownership and stricter animal welfare regulations. New laws in countries like Spain are mandating sterilization in certain cases, boosting demand for these services. Veterinary advances, such as laparoscopic neutering, are reducing complications and making procedures safer and more appealing. Awareness campaigns and annual spay/neuter events are encouraging owners to sterilize pets earlier. At the same time, many countries in the region discourage, ban, or consider routine spaying and neutering illegal, allowing sterilization primarily for medical or welfare reasons.

This creates a regulated environment where demand is focused on justified interventions, enhancing public trust in veterinary services. Media and advocacy groups are also highlighting the benefits of population control, prompting higher participation. Overall, a combination of legal frameworks, improved veterinary techniques, public education, and regulated practices is driving market growth across Europe.

The spay and neuter market in the UK holds a dominant share in Europe, due to strong government and nonprofit initiatives promoting sterilization. Annual campaigns and awareness months encourage widespread participation among pet owners. Veterinary adoption of safer techniques, such as laparoscopic neutering, reduces risks and increases owner confidence. Advocacy from organizations and media campaigns further drives public engagement. Combined, these factors lead to higher service uptake, giving the UK a leading position in the European market.

The Sweden spay and neuter market is expected to grow at a steady rate over the forecast period owing to strict regulations and cultural norms. Routine sterilization for convenience is discouraged and often restricted to medical or welfare reasons. Recent laws mandate registration and identification of cats to track pets and manage strays, rather than promoting widespread sterilization. Studies indicate that fewer than 10 percent of pet dogs in Sweden are neutered, significantly lower than in many other Western countries. Due to these legal constraints and low routine demand, the market for spay and neuter services in Sweden is expected to grow only modestly.

Asia Pacific Spay and Neuter Market Trends

Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The region's growth can be attributed to rising awareness of pet population management and increasing adoption of spay and neuter programs. Governments, nonprofits, and community initiatives in countries like China, India, and Japan are organizing large-scale sterilization and vaccination campaigns targeting both stray and pet populations. Subsidies and support programs are making procedures more accessible to pet owners, while efforts to reduce stray animal populations are driving demand for humane, controlled interventions. Increasing media coverage, advocacy, and public engagement are also encouraging participation, collectively fueling rapid market growth in the region.

The spay and neuter market in Japan holds a dominant share in the region because several factors support wide adoption of sterilization services. Local governments and welfare organizations provide subsidies for spay and neuter surgeries, making procedures more accessible for pet owners. Major animal welfare groups run subsidized campaigns targeting stray and abandoned animals. Veterinarians operate low-cost sterilization programs to curb stray populations that grew after a surge in pet ownership. These combined efforts of financial support, welfare-focused sterilization, and rising public awareness create high demand for spay and neuter services, giving Japan a leading share in the regional market.

The India spay and neuter market is expected to grow atthe fastest CAGR over the forecast period, supported by increasing concern over stray‑dog overpopulation and associated public health risks is driving authorities and welfare groups to expand sterilization efforts. New programs by private firms and NGOs offer subsidized or low-cost sterilization, shelters, vaccination, and post-surgery care, making spay and neuter services more accessible. Rising public awareness of humane animal treatment and community safety encourages pet owners and neighborhood caretakers to sterilize stray or community dogs. Additionally, cities and municipalities have scaled up mass-sterilization drives, demonstrating that large-scale programs are feasible and effective, further supporting market growth.

Latin America Spay and Neuter Market Trends

The Latin America spay and neuter industry’s growth is driven by the several crucial factors. NGOs and international welfare groups are expanding affordable or free sterilization clinics across rural and underserved urban areas, improving access to services. Many communities face large populations of free‑roaming dogs and cats, so sterilization plus vaccination camps help curb overpopulation and related public health risks. Rising pet adoption and growing middle‑class pet ownership are increasing demand for companion‑animal care beyond just pet sales. In addition, training more local veterinarians in high‑volume, low‑cost spay/neuter techniques makes it feasible to reach more animals, strengthening the overall capacity of the market.

The Brazil spay and neuter market is gaining momentum gradually. Scientists from the country have developed a non-surgical neutering method that sterilizes male dogs without traditional surgery, reducing risk, cost, and recovery time, which makes sterilization more appealing for both pet owners and public animal-control programs. Brazil also has a large dog population and a growing veterinary infrastructure, increasing the capacity for sterilization services and overall demand. These factors together are driving growth in the country’s spay and neuter industry.

Middle East & Africa Spay and Neuter Market Trends

The spay and neuter industry in MEA is expected to show steady growth over the forecasted years. The growth is driven by increasing government and NGO initiatives promoting humane stray animal control. Programs such as Trap‑Neuter‑Vaccinate‑Return are being implemented across the region to manage stray dog populations and reduce public health risks. Investment in shelters, veterinary infrastructure, and sterilization campaigns is expanding service capacity. Rising awareness among citizens and animal welfare organizations is also encouraging the adoption of spay and neuter services for both pets and community animals, supporting consistent market growth.

The South Africa spay and neuter market is largest in the MEA region, due to well-established animal welfare programs and widespread NGO involvement. Organizations provide grants, veterinary support, and high-volume sterilization campaigns targeting both stray and community pets. Public awareness and education initiatives encourage pet owners and caregivers to participate in sterilization programs. Strong infrastructure, funding, and coordinated efforts between government and nonprofits make South Africa a regional leader in spay and neuter services.

Key Companies & Market Share Insights

The spay and neuter industry is highly fragmented, with each country having a large number of local providers. Veterinary hospitals and small private clinics handle most procedures, creating a dispersed service base nationwide. Animal welfare groups and mobile units add capacity, reaching underserved regions and supporting community programs. Larger municipal programs and humane societies manage high volumes but do not control pricing or market share. Continuous entry of new domestic providers keeps the operator mix broad, ensuring market share remains widely distributed across multiple small and mid-sized providers in every region.

Recent Developments

-

In November 2025, In November 2025, Mendocino County Animal Care Services received a USD 408,000 gift from a private trust to expand county-wide spay and neuter services. This funding aims to ease pet overpopulation, relieve shelter overcrowding, and extend sterilization access to underserved areas; a sign that expansion of public- and welfare-driven sterilization can boost capacity where small clinics alone struggle

-

In November 2025, P.E.I. CARES launched a low-cost spay and neuter program on Prince Edward Island to tackle a surge in pet overpopulation and high veterinary costs. The program prices sterilization at roughly CAD 100 (USD 71.5); far below the average CAD 400-700 (USD 286 - 500); making surgery accessible to low-income pet owners who otherwise could not afford it.

-

In September 2025, Pittsburgh launched a redesigned spay and neuter program in 2025, offering separate online applications for pet cats, dogs, and community cats, improving access, outreach, and responsible pet population management

-

In March 2025, Las Vegas initiated a spay and neuter awareness campaign in 2025, engaging local youth through an artwork contest to promote responsible pet ownership and reduce shelter overpopulation.

Spay and Neuter Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.77 billion

Revenue forecast in 2033

USD 4.26 billion

Growth rate

CAGR of 5.52% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, provider, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait; Qatar; Oman

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Spay and Neuter Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the spay and neuter market report based on animal, provider, end use, and region:

-

Animal Outlook (Revenue, USD Million, 2021 - 2033)

-

Dogs

-

Spaying

-

Neutering

-

-

Cats

-

Spaying

-

Neutering

-

-

Other Animals

-

-

Provider Outlook (Revenue, USD Million, 2021 - 2033)

-

Veterinary Clinics & Hospitals

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Animal Welfare Groups

-

Pet Owners

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global spay and neuter market size was estimated at USD 2.66 billion in 2024 and is expected to reach USD 2.77 billion in 2025.

b. The global spay and neuter market is expected to grow at a compound annual growth rate of 5.52% from 2025 to 2033 to reach USD 4.26 billion by 2033.

b. By region, North America dominated the spay and neuter market with a share of around 44.03% in 2024. This is attributable to widespread low-cost programs, updated guidelines, and strong community outreach that raise service participation. The U.S. leads regional growth through redesigned municipal models and continuous public campaigns, while Mexico is expanding fast as high-volume community clinics remove cost barriers and deliver large sterilization counts.

b. By region, Asia Pacific is growing fast because governments and welfare groups in countries such as China, India, and Japan are running large sterilization campaigns, expanding subsidies, and raising public awareness of pet population control. Japan leads the region through strong support programs, and India is growing quickly as cities scale mass-sterilization drives and nonprofits offer low-cost services that reach both pet and stray animals.

b. Key factors that are driving the market growth include expansion of low-cost clinics & mobile surgical units, increasing government regulations, bylaws & mandatory sterilization policies, rising growth of animal welfare NGOs & global funding support and increasing awareness & education efforts.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.