Spatial OMICS Market Size, Share, & Trends Analysis Report By Technology (Spatial Transcriptomics, Spatial Genomics, Spatial Proteomics), By Product, By Workflow, By Sample Type, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-463-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Spatial OMICS Market Size & Trends

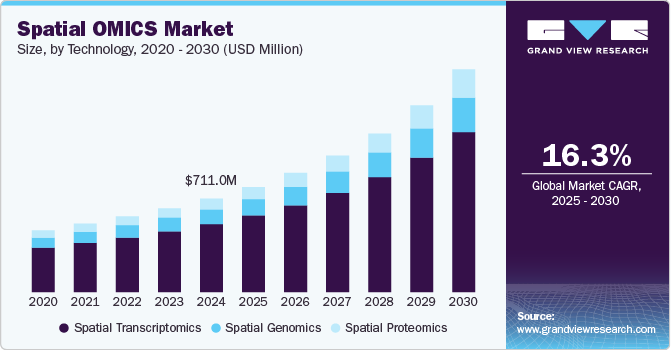

The global spatial OMICS market size was estimated at USD 711.0 million in 2024 and is projected to grow at a CAGR of 16.3% from 2025 to 2030. Spatial OMICS refers to a set of technologies that combine high-throughput molecular profiling with spatial information, enabling the analysis of biological samples in their spatial context. The market is driven by several factors, including the rising prevalence of a wide range of genetic illnesses, global advances in sequencing technologies, and increased financing for OMICS research.

The market for spatial OMICS is anticipated to rise due to its increased usage in drug research and development and its potential as a tool for cancer diagnosis. For instance, in June 2023, Owkin Inc. contributed USD 50 million and joined forces with NanoString Technologies, Inc. Research teams from European and American institutions and other organizations to use this technology for cutting-edge cancer research.

Notable advancements in technology, such as spatial proteomics, transcriptomics, and genomics, have improved the ability to analyze molecular information in tissues and cells at a spatial level. These technologies provide researchers with a more comprehensive understanding of complex biological systems. For instance, in February 2023, Curio Bioscience announced the introduction of Curio Seeker, the first high-resolution, whole-transcriptome spatial mapping kit, marking the start of the company's commercial activities.

Extensive research for understanding the COVID-19 infection has turned attention to the application of spatial transcriptomic and other omics studies. For instance, in October 2020, a group of researchers from the Massachusetts General Hospital used spatial transcriptomics technology to analyze the autopsy specimens obtained from around 24 COVID-19 patients to understand the SARS-CoV-2 infection. Several companies operating in the market offer various solutions for spatial OMICS studies. For instance, NanoString manufactured GeoMx Digital Spatial Profiler (DSP), which helps quantify around 1,800 RNA targets, including COVID-19 proteases and receptors. In addition, with the system, researchers generated large data sets of tissue images and molecular data obtained from COVID-19 decedents. They compared them with the patients who passed away from similar diseases, such as MERS-CoV (2012), SARS-CoV, and other non-viral causes, facilitating a better understanding of the COVID-19 infection.

Academic institutions, research universities, and laboratories are significant end users in the spatial omics market. The availability of funding influences the concentration of users in this sector, the adoption of new technologies, and collaborations between academia and industry. The spatial omics market is of interest to biotechnology and pharmaceutical companies engaged in drug discovery, development, and biomarker research. Concentration among these end users is impacted by the specific needs of the pharmaceutical industry and the adoption of spatial omics technologies for target identification and validation.

Emerging Potential of Spatial OMICS Analysis as a Cancer Diagnostic Tool

Cancer immunotherapy is also one of the major drivers of the market. It is essential to conduct spatial multi-omics studies to understand the tumor immunogenicity of the complex tumor microenvironment. Companies are focusing on developing transformational approaches for cancer biomarker discovery. For instance, in January 2023, Akoya Biosciences, Inc. collaborated with Agilent Technologies to design services and products for multiplex immunofluorescence and chromogenic tissue assays. The spatial omics market is rapidly advancing, particularly in its application as a cancer diagnostic tool. Recent developments underscore this trend:

-

SimBioSys received FDA clearance in January 2024 for its TumorSight Viz software, which creates 3D spatial visualizations of breast tumors to aid in precise treatment planning.

-

Nucleai presented AI-driven spatial biomarker analyses at the SITC 2024 Annual Meeting, offering insights into immunotherapy responses for lung and skin cancers.

-

Owkin launched the $50 million MOSAIC program in June 2023, collaborating with NanoString Technologies and leading research institutions to build an extensive spatial omics database to enhance cancer biomarkers and drug discovery.

These initiatives highlight the growing recognition of spatial omics as a transformative approach in cancer diagnostics, enabling more precise and personalized treatment strategies.

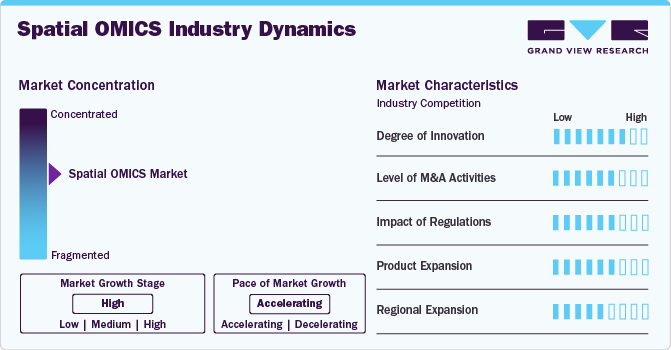

Market Concentration & Characteristics

The Spatial OMICS industry has witnessed high innovation in recent years. With the integration of advanced technologies such as artificial intelligence, machine learning, and computer vision, the market is experiencing a significant transformation. These innovations are driving the development of new tools and techniques that enable researchers to gain deeper insights into the spatial organization of biological systems. Additionally, the emergence of cloud computing and big data analytics facilitates the processing and analysis of large volumes of spatial data, which is further fueling the growth of the spatial OMICS market.

Several companies are engaging in mergers and acquisitions to expand their product offerings and increase their market share. This trend is expected to continue in the coming years as the market grows and matures. The increasing demand for spatially resolved data and the emergence of new technologies are also driving the market's consolidation.

The spatial OMICS industry is highly regulated due to the potential ethical and legal issues surrounding handling genetic and health data. Regulations can significantly impact the market as they can influence the development, approval, and commercialization of spatial OMICS technologies. Additionally, regulations can also affect the accessibility and affordability of spatial OMICS technologies for patients and healthcare providers.

A product expansion strategy in the spatial OMICs industry involves enhancing technological capabilities, expanding market reach, collaborating with research and commercial partners, and ensuring that the products are accessible and valuable to a broad range of customers, from basic researchers to clinicians. For instance, AI and Data Analytics Tools Create that incorporates AI/ML algorithms for advanced interpretation and analysis of complex spatial data. This would enable customers to generate insights more efficiently and accurately, reducing manual data curation time.

Expanding the availability of spatial OMICs products in emerging markets where the biotechnology sector is rapidly growing, such as in parts of Asia, Europe, and Latin America. Offering localized solutions such as language-specific interfaces or region-specific regulatory compliance could open up these markets. Moreover, seeking regulatory approvals for the expanded product line in key global markets, like the FDA for the U.S. or CE marking in Europe. These approvals could help gain access to broader markets in clinical and diagnostics applications.

Technology Type Insights

The spatial transcriptomics segment dominated and held the largest market share of 71.7% in 2024. Continuous advancements in sequencing technologies have accelerated the transcriptomic study of single cells. For the comprehensive study of multicellular organisms, efforts are being made to design novel solutions for high-throughput genomic analysis while maintaining the spatial information of the sample/tissue under observation or subcellular localization of analyzed DNA/RNA.

The development of various in-situ methods enhances the ability to explore spatial information in biological investigation. These methods have led to the convergence of function-oriented biochemistry and molecular genetics fields with structure-focused fields such as histology and embryology, thereby enabling spatially resolved molecular investigation of biological processes. For instance, a combination of in-situ hybridization techniques with genetic tools helps explore the formation of gene expression gradients along with embryonic axes at different developmental stages.

The spatial proteomics technology segment is expected to grow at the fastest CAGR during the forecast period. The segment growth is driven by several key factors, including the increasing demand for high-resolution, tissue-specific molecular data to understand complex biological processes and diseases. Moreover, advancements in imaging techniques, such as mass spectrometry-based imaging, along with improvements in data analysis through AI and machine learning, have significantly enhanced the sensitivity and accuracy of spatial proteomics.

Product Insights

The consumables segment accounted for the largest market share of 56.2% in 2024, owing to high product penetration, increasing use of reagents & kits, wide product availability, and frequent purchase of consumables to run the instruments. The development of any new instrument or upgrade of any existing instrument directly impacts the segment growth as the development of any new instrument will result in the need for developing the required consumables. Genetic research has been revolutionized in recent decades with the introduction of advanced technologies and innovations in sequencing. For instance, in February 2022, CSIR lab Institute of Genomics and Integrative Biology (IGIB), Delhi, India, announced the development of a pool of kits and primers that could be used in RT-PCR testing of coronavirus by using its pipeline analysis of genome sequence & and its proficiency in genome sequencing. Thus, anticipated to fuel the growth of the segment over the forecast period.

The software segment is expected to grow at a significant CAGR during the forecast period. This segment includes products used for visualization, interpretation, and management of data generated after spatial studies of DNA & RNA molecules. The increasing volume of ongoing genomic research studies has led to the need for robust software solutions for data management and their interpretation, which is anticipated to drive the segment in the coming years. Furthermore, companies are collaborating to enhance their service offerings.

Workflow Insights

The instrumental analysis segment dominated the market and held the largest market share of 47.4% in 2024. The segment growth can be primarily attributed to substantial advancements in instruments such as microscopy and mass spectrometry. Mass spectrometry is one of the most promising tools for quantifying nucleic acids and proteins. It has several advantages, such as high resolution, high speed, and high-throughput operations for protein profiling, which are later used for analyzing complex biological samples. This facilitates novel applications such as new drug development, biomarker discovery, and diagnostics.

The sample preparation segment is expected to witness lucrative growth over the forecast period. Sample preparation is a critical workflow stage in spatial omics, as it ensures the preservation of tissue architecture and molecular integrity for downstream analysis. Key drivers in this stage include the need for precise tissue sectioning to capture spatial context, the use of high-quality reagents for fixation and permeabilization, and the application of specific probes or tags for targeting molecules of interest, such as RNA, proteins, or metabolites.

Sample Type Insights

The formalin fixation and paraffin-embedding (FFPE) segment held the largest market share in 2024. FFPE is considered a standard sample type that is most used for the preservation of human tissue for clinical diagnosis, and hence, it holds a major share of the global market. This technique is considered the best in researching tissue morphology for clinical histopathology and diagnostic purposes. Additionally, FFPE specimens are abundant in clinical tissue banks, contributing to the segment growth. However, they are incompatible with single-cell level transcriptome sequencing owing to RNA degradation and RNA damage during storage and extraction. Hence, researchers are focusing on new approaches for increasing the application of FFPE in spatial transcriptomic studies.

Fresh frozen is expected to grow at the fastest CAGR during the forecast period. The segment growth can be attributed to its high application in proteomic studies based on tandem Mass Spectrometry (MS). The advantage of fresh frozen tissues (mostly in the case of breast & liver cancer) is that they have existing standardized protocols for protein digestion and peptide extraction, which can be adapted for such samples.

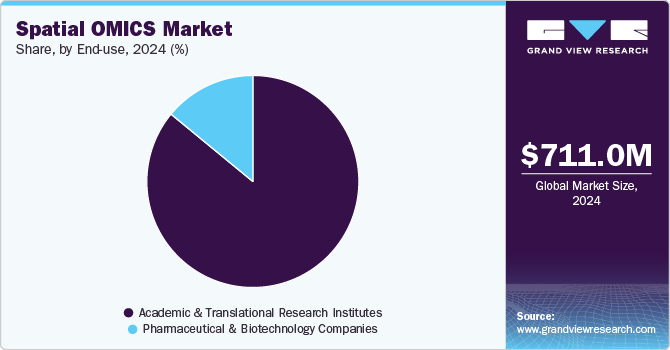

End Use Insights

The academic & translational research institutes segment accounted for the largest revenue share in 2024. An increase in the adoption of spatial OMICS to translate real-time tissue responses to an external agent increases the technology’s adoption in academic & translational research. Academic & translational studies in the field of genomics help researchers and healthcare practitioners analyze the behavior of human tissues and cells from different individuals in different environments.

The pharmaceutical and biotechnology companies segment is expected to expand at a significant CAGR throughout the forecast period. With the increase in preference for personalized medicine and companion diagnostics, pharmaceutical companies are anticipated to adopt spatial OMICS technologies in the coming years. Companies in this market are developing therapeutic & diagnostic products for treating, diagnosing, and managing chronic diseases. Therefore, analysis of cell structures through spatial OMICS would aid pharmaceutical organizations in studying the effects of drugs on live tissue models. Hence, the adoption of spatial OMICS technologies within pharmaceutical companies is expected to increase significantly.

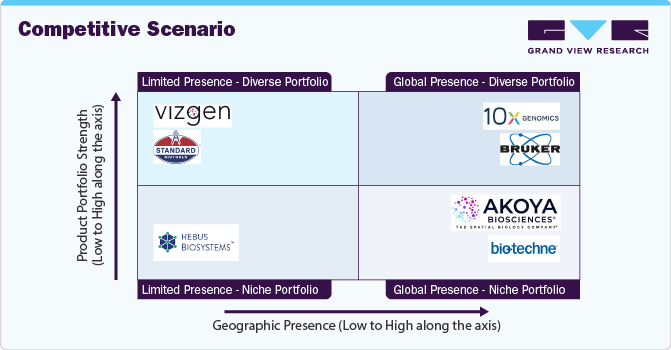

10x Genomics and Bruker occupy the top-right quadrant, excelling in both product portfolio strength and geographic presence. Their comprehensive product offerings and global reach make them dominant players in the market. On the other hand, Vizgen and Rebus biosystems are placed in the upper-left quadrant, indicating a strong product portfolio but a more limited geographic reach. These companies excel in niche segments but may need further expansion to reach broader markets.

Regional Insights

North America spatial OMICS market captured the largest market share of 57.4% in 2024. The increasing prevalence of cancer, growing demand for personalized medicine, well-developed healthcare facilities, and availability of novel diagnostic techniques are among the factors contributing to the large market share held by North America. Growing morbidity and mortality rates due to cancer and other metabolic, autoimmune, & inflammatory disorders have led to an increase in the need for developing novel therapies, thereby driving the market in this region.

U.S. Spatial OMICS Market Trends

U.S. dominate the region market with highest market share. The spatial OMICS market in the U.S. is highly competitive due to a growing demand for comprehensive biological insights fueled by advancements in omics technologies. This competition is intensified by active R&D efforts in academia and industry, with institutions and companies vying for funding and breakthrough discoveries. For instance, in 2023, the Keck School of Medicine at the University of Southern California (USC) secured a significant 5-year, USD 50.3 million research grant from the National Institutes of Health (NIH). This funding will support a multi-omics study conducted by a consortium of six sites, with a primary focus on investigating various health conditions, including fatty liver disease, hepatocellular carcinoma, chronic kidney disease, and asthma.

Europe Spatial OMICS Market Trends

Europe spatial OMICS industry is expected to grow significantly due to advancements in genomics, sequencing, and biochemical technologies. The presence of genome sequencing firms such as 24 Genetics and Dante Labs has ensured easy accessibility of genome sequencing services in the region.

The UK spatial OMICS market is expected to grow over the forecast period as it is home to several academic institutions that are currently working on developing novel techniques for single-cell genomics. For instance, Earlham Institute, UK, is working on single-cell approaches for a wide variety of species ranging from microbial to plant & mammalian specimens. The single-cell genomics research at the Earlham Institute is focused on integrating data types for parallel analysis of gene regulation and expression.

Spatial OMICS market in France is expected to grow over the forecast period due to the involvement of French companies and institutions in the research and development. For instance, The Institut Curie Mass Spectrometry and Proteomics Facility (LSMP) also provides researchers with technical services that enable them to analyze proteins by mass spectrometry. The presence of key players, organizations, and infrastructure is thus expected to impact market growth in the country positively.

Germany spatial OMICS market is expected to grow over the forecast period. Germany is witnessing substantial growth in the multiomics field, with active participation from renowned academic institutions, biotechnology & pharmaceutical companies, and government funding for research projects. For instance, in July 2023, the German Federal Ministry for Education and Research allocated grants to develop novel diagnostic tests for complicated health conditions like cancer. These initiatives are expected to accelerate the demand for spatial OMICS in the region over the forecast period.

Asia Pacific Spatial OMICS Market Trends

The Asia Pacific spatial OMICS industry is expected to exhibit the fastest growth over the forecast period. The market is majorly driven by an increase in the incidence of cancer, diabetes, Alzheimer’s disease, rheumatoid arthritis, and other neurodegenerative, autoimmune, and metabolic disorders. According to The Cancer Atlas, eastern, southern, and southeastern Asia contributes to 44% of the global cancer cases and 51% of the cancer deaths. China dominates the cancer burden in the region, followed by India, Japan, Indonesia, and the Republic of Korea. The top three applications of cancer diagnostics in the region include breast cancer, lung cancer, and prostate cancer. However, Japan is technologically advanced, and penetration & adoption of genomics & transcriptomics-based techniques are high, thus significantly contributing to market growth.

China spatial OMICS market is expected to grow over the forecast period. The market is mainly driven by increased translational research in the country aided by central governments in China. Therefore, the funding for translational research has increased over the past few years. Although the country is comparatively new in the development of translational medicine, the market is expected to proliferate. In addition, the growing number of proteomic analysis studies is driving the market in the country.

Spatial OMICS market in Japan is expected to grow over the forecast period. The Japanese government and nongovernment organizations are highly supportive of the growth of biotechnology research in the country and provide funds to conduct research in the fields of medicine and life sciences. This support encourages researchers to actively explore genomics and transcriptomics space by engaging in research activities to determine the spatial arrangement of cells in a tissue. For instance, in 2018, the research for prediction of gene regulatory networks from transcriptome datasets was jointly funded by Grant-in-Aid for Scientific Research, which is managed by Japan Society for the Promotion of Science (JSPS), Advanced Low Carbon Technology Research and Development Program of the Japan Science and Technology Agency (JST), and CREST.

MEA Spatial OMICS Market Trends

The spatial omics market in the Middle East is experiencing moderate growth driven by several key factors. Notably, the region is witnessing an increase in the incidence of diseases such as diabetes, rheumatoid arthritis, Alzheimer's, metabolic, autoimmune, and neurological disorders, which necessitates advanced research and diagnostic tools.

The spatial OMICS market in Saudi Arabia is expected to grow over the forecast period. The growth of Saudi Arabia's spatial OMICS market can primarily be attributed to various initiatives undertaken by the government to expand the biotechnology sector in the country. According to the news article published by Al Arabiya Network in June 2022, the Saudi Arabian Minister of Industry and Mineral Resources, as chairman of the biopharmaceutical industry committee, announced several investment opportunities, with an overall worth of USD 3.4 billion, in vital medicine and vaccines to accomplish the country’s pharmaceutical and health security objectives.

The spatial OMICS market in Kuwait is expected to grow over the forecast period. Kuwait is emerging as one of the fastest-growing nations, propelled by increasing exports and a growing economy. With substantial developments in its healthcare infrastructure, the country is addressing the rising incidence of infectious diseases, chronic ailments, and lifestyle-related health issues. Moreover, government initiatives to boost scientific research and innovation in genetic diseases drive market growth. For instance, in March 2019, the Center for Arab Genomic Studies participated in the 7th Kuwait international genetic conference. This conference was all about promoting diagnosis and treatment rates of genetic diseases.

Key Spatial OMICS Company Insights

Some of the ley players operating in the market are Bruker, 10x Genomics, Danaher, Akoya Biosciences Bio-Techne, and among others. Several companies are stepping into strategic collaboration for technology sharing, platform sharing, and knowledge sharing. The major companies are also acquiring smaller companies to strengthen their product portfolio and gain a competitive edge in the market. Partnerships, acquisitions, and expansions were the most adopted strategies by key players.

Key Spatial OMICS Companies:

The following are the leading companies in the spatial OMICS market. These companies collectively hold the largest market share and dictate industry trends.

- 10x Genomics

- Bio-Techne

- Bruker

- Dovetail Genomics

- S2 Genomics, Inc.

- Akoya Biosciences, Inc.

- RareCyte, Inc.

- Standard BioTools

- Rebus Biosystems, Inc.

- Vizgen Inc.

Recent Developments

-

In November 2024, Bruker Corporation has introduced EpicIF, a groundbreaking fluorescence signal removal technology that significantly enhances its CellScape Spatial Proteomics platform. EpicIF expands the range of compatible fluorophore-conjugated antibodies by nearly tenfold, simplifies assay development, and doubles throughput, all while preserving tissue integrity and preventing cross-reactivity.

-

In October 2024, Bruker Corporation established Bruker Spatial Biology, integrating technologies from NanoString Technologies, Canopy Biosciences, and Bruker Spatial Genomics, Inc. This division offers a comprehensive suite of spatial biology solutions, including instruments, assays, software, data analytics, and contract research services, aiming to advance biomedical research across various applications such as immunology, oncology, and neuroscience.

-

In November 2023, 10x Genomics and OWKIN collaborated to add 10x Genomics single-cell technologies and spatial omics for the MOSAIC project.

-

In September 2023, Bruker reported advancements in instrumental methods, software, and consumables for 4D-Proteomics, 4D-Lipidomics MALDI HiPLEX-IHC spatial tissue proteomics, and 4D-Metabolomics.

-

In April 2023, Canopy Biosciences, a subsidiary of Bruker, partnered with Enable Medicine to bring advanced spatial analysis pipelines.

Spatial OMICS Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 798.6 million |

|

Revenue forecast in 2030 |

USD 1696.5 million |

|

Growth rate |

CAGR of 16.3% from 2025 to 2030 |

|

Historical data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, product, workflow, sample type, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil Mexico; Argentina; Saudi Arabia; Kuwait; UAE; and South Africa |

|

Key companies profiled |

10x Genomics; Bio-Techne; Dovetail Genomics; S2 Genomics Inc.; Akoya Biosciences, Inc.; Bruker; Standard BioTools ; Rebus Biosystems, Inc.; Vizgen Inc. RareCyte, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Spatial OMICS Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global spatial OMICS market report based on technology, product, workflow, sample type, end use, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Spatial Transcriptomics

-

Spatial Genomics

-

Spatial Proteomics

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

By Mode

-

Automated

-

Semi-automated

-

Manual

-

-

By Type

-

Sequencing Platforms

-

IHC

-

Microscopy

-

Flow Cytometry

-

Mass Spectrometry

-

Others

-

-

-

Consumables

-

Software

-

Bioinformatics Tools

-

Imaging Tools

-

Storage & Management Databases

-

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Sample Preparation

-

Instrumental Analysis

-

Data Analysis

-

-

Sample Type Outlook (Revenue, USD Million, 2018 - 2030)

-

FFPE

-

Fresh Frozen

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic & Translational Research Institutes

-

Pharmaceutical & Biotechnology Companies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The consumables segment accounted for the largest market share of 56.21% in 2024, owing to high product penetration, increasing use of reagents & kits, wide product availability, and frequent purchase of consumables to run the instruments.

b. The global spatial OMICS market size was estimated at USD 711.0 million in 2024 and is expected to reach USD 798.6 million in 2025.

b. The global spatial OMICS market is expected to grow at a compound annual growth rate of 16.26% from 2025 to 2030 to reach USD 1696.5 million by 2030.

b. Some key players operating in the spatial OMICS market include 10x Genomics, Bio-Techne, Dovetail Genomics, S2 Genomics, Inc., Akoya Biosciences, Inc., Bruker, Standard BioTools , Rebus Biosystems, Inc., Vizgen Inc. RareCyte, Inc.

b. Key factors that are driving the spatial OMICS market growth include the emerging potential of spatial omic analysis as a cancer diagnostic tool, the advent of the fourth generation of sequencing (in situ sequencing), and a rise in competitiveness amongst emerging players along with rising prevalence of a wide range of genetic illnesses.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."