Sparkling Coffee Market Size, Share & Trends Analysis Report By Product (Caffeinated, Decaffeinated), By Distribution Channel (Hypermarket & Supermarket, Convenience Stores, Online), By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-414-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Consumer Goods

Report Overview

The global sparkling coffee market size to be valued at USD 1.4 billion by 2028 and is expected to grow at a compound annual growth rate (CAGR) of 13.0% during the forecast period. Refreshing sparkling coffee products are gradually gaining popularity across the globe. The rising demand for convenient, ready-to-drink beverages that are also beneficial for health in comparison to sugary energy drinks and other soda drinks is anticipated to drive the market. The COVID-9 pandemic has adversely impacted the market for sparkling coffee due to the closure of all commercial places, such as restaurants, cafes, offices, and colleges. Moreover, the market is already in a nascent stage and the sudden closure of cafes, restaurants, and food joints severely impacted the demand for sparkling coffee across the globe. The sales of food and beverages have been continuously declining as restaurants, clubs, bars, pubs, and hotels remain shut or operate in limited capacities.

As the beverage is gaining traction across the globe, new product launches further drive product sales. Moreover, the rising consumer awareness about healthy beverages and the openness of consumers, especially millennials to try new variants of healthy beverages available in the market, are anticipated to drive the market in the years ahead.

Manufacturers are launching new products in order to cater to the rising demand for sparkling coffee among consumers, especially the younger generation. For instance, in March 2019, Paulig Group launched Paulig Cold Brew Sparkling drinks. The launch of Paulig Cold Brew Sparkling coffee and tea range is the one of most innovative launches in the cold ready-to-drink products category according to the company and is expected to further attract more customers as well as manufacturers into the market.

Ready-to-Drink (RTD) coffee, especially sparkling coffee, appeals to a wide range of consumers, particularly those who prefer on-the-go consumables. Millennials contribute significantly to the growth in demand for RTD products. In addition, the availability of RTD coffee in liquid and powder form infused with different flavors as well as organic variants has attracted numerous consumers. Moreover, continuous innovation in the RTD category, such as the emergence of the cold brew concept, has resulted in a shift from freshly brewed to instant coffee among consumers.

Sparkling Coffee Market Trends

The growing demand for ready-to-drink beverages is propelling the sparkling coffee sector forward. These ready-to-drink products are more popular among millennials. The inclusion of varied flavors and caffeine is expected to propel market growth. Ready-to-drink (RTD) coffee, especially sparkling coffee, attracts a wide variety of customers, especially those who want on-the-go food. Millennials are responsible for a major share of the increase in the demand for RTD beverages. Furthermore, the accessibility of RTD coffee in powder and liquid form, as well as organic varieties, has attributed to the market growth.

The bubbles in this fizzy drink can produce burping, bloating, and other gas symptoms since the sparkling water used in the sparkling coffee include CO2. Artificial sweeteners, such as sucralose and other sweeteners, may be present in some sparkling water brands, causing diarrhea and altering the gut microbiota. This could stifle the popularity of sparkling coffee among health-conscious customers. Over the projected period, increased government inspection of clean labels and ingredients will be a market restraint. Companies are focusing increasingly on product developments that incorporate natural ingredients, such as stevia sweeteners, as a result of increased customer health awareness.

Sparkling coffee is becoming more popular around the world as people seek healthy options for soft drinks and carbonated beverages without sacrificing the texture and flavor of carbonation. Customers are looking for healthy alternatives that can serve them lower their sugar intake while also providing extra health benefits. This trend is expected to continue during the forecast period, providing the market with several growth opportunities.

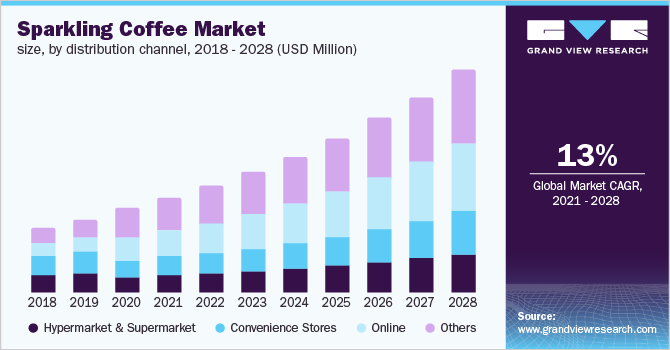

Distribution Channel Insights

The other distribution channel segment dominated the market and held a share of more than 35.0% in 2020. The convenience stores and hypermarket and supermarket segments together held a significant share in 2020. These segments are projected to retain their market share throughout the forecast period as most consumers prefer buying grocery products from hypermarkets and supermarkets, where they can physically examine the product quality.

Most of the products are available at big supermarkets, such as Walmart and Kroger, due to their large customer base. Some of the popular convenience stores are 7-Eleven Inc.; Alimentation Couche-Tard Inc.; Sainsbury’s Local; Londis; Krystals Express; and Casey’s General Stores.

The online distribution channel is expected to register the fastest CAGR of 13.7% from 2021 to 2028. Growing consumer inclination toward the online platform has prompted companies to offer products through the direct-to-consumer channel. For instance, DrinkVIVIC offers its sparkling coffee through both D2C and other distribution channels to attract a greater number of consumers.

Product Insights

The caffeinated segment held the largest share of more than 80.0% in 2020. Flavored sparkling coffee is gaining popularity since companies are offering a number of refreshing flavors. Key players are launching new products in the market in order to cater to the rising demand among consumers.

For instance, in July 2019, Cafeahaus AG, a wholly-owned subsidiary of DEK Berlin, launched a new sparkling cold brew coffee line in Germany. These new coffee products are available in ginger and lemon and grapefruit and lemon flavors. Cafeahaus AG partnered with Ardagh Group S.A., a leading metal and glass packaging company, for the packaging of its canned coffees. Such initiatives by key market players are anticipated to drive the market over the forecast period.

Sparkling coffee is a kind of cold brew combined with the effervescence of carbonated water and is a sugar- and calorie-free drink. The decaffeinated segment is projected to register the fastest CAGR of 13.4% from 2021 to 2028. Decaffeinated sparkling coffee is a very niche concept and is still in the nascent stage of development. Manhattan Special and Union Coffee are among such companies that offer a decaf variety of the drink. The decaffeinated segment is expected to gain traction in the upcoming years due to the rising consumer preference for decaf drinks as they help in preventing aging and cancer.

Regional Insights

North America held the largest share of more than 45.0% in 2020. The rising consumer preference for the drink, which helps in boosting the energy level and concentration instead of normal caffeinated beverages, is expected to drive the market. Moreover, the presence of a large number of manufacturers in this region such as Manhattan Special and Spindrift is anticipated to further propel the regional market growth.

The market in Europe is expected to expand at a CAGR of 12.8% from 2021 to 2028 due to the increasing consumer demand for convenient on-the-go caffeinated drinks. In addition, in Europe, quick-service restaurants are expanding at a notable growth rate. They have been introducing several new beverages and food items inspired by national as well as international cuisines in order to further their footprint in an increasingly competitive environment. This is foreseen to bode well for the market in the coming years.

Key Companies & Market Share Insights

The market is highly fragmented with the presence of several regional and global players. Companies, especially small players, are connecting with consumers through stories about their hand-crafted products and positioning sparkling brewed beverages as refreshing alternatives to traditional sugary drinks. Companies have also been incorporating new flavors and ingredients in order to attract more consumers.

In March 2019, Paulig Group launched Paulig Cold Brew Sparkling drinks, the Paulig City Coffee cold drinks product family, and Paulig Café Moscow, among others. The company believes that the launch of Paulig Cold Brew Sparkling coffee and tea is the one of most innovative launches in the cold ready-to-drink products category.

Recent Developments

-

In April 2022, illycaffè, a global leader as a coffee supplier, expanded its cold brew coffee portfolio by adding new ready-to-drink flavors. It has been done to satisfy coffee enthusiasts' desire for extremely premium cold coffee recipes.

-

In January 2020, Keurig Dr Pepper, a beverage giant acquired Limitless, Chicago-based caffeinated water sparking brand. The acquisition added a new caffeinated version of beverage to the company’s wide range of products.

-

In February 2020, STōK Cold Brew, a Danone brand launched a ready-to-drink coffee product named Cold Brew Coffee. It is an excellent option for people seeking more out of their coffee but unwilling to sacrifice exceptional taste or convenience.

Some prominent players in the global sparkling coffee market include:

-

DrinkVIVIC

-

MATCHLESS COFFEE SODA

-

Keepers Sparkling Coffee

-

Upruit

-

Union Coffee

-

Paulig

-

Slingshot Coffee Co.

-

Nongfu Spring

-

Stumptown Coffee Roasters

-

Manhattan Special

Sparkling Coffee Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2021 |

USD 589.8 million |

|

Revenue forecast in 2028 |

USD 1,387.3 million |

|

Growth Rate |

CAGR of 13.0% from 2021 to 2028 |

|

Base year for estimation |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million and CAGR from 2021 to 2028 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, region |

|

Regional scope |

North America; Europe; Rest of the World |

|

Country scope |

U.S.; Germany; U.K.; Italy; Spain; France |

|

Key companies profiled |

DrinkVIVIC; MATCHLESS COFFEE SODA; Keepers Sparkling Coffee; Upruit; Union Coffee; Paulig; Slingshot Coffee Co.; Nongfu Spring; Stumptown Coffee Roasters; Manhattan Special |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Sparkling Coffee Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global sparkling coffee market report on the basis of product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2016 - 2028)

-

Caffeinated

-

Decaffeinated

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

-

Hypermarket & Supermarket

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

Italy

-

Spain

-

France

-

-

Rest of the World

-

Frequently Asked Questions About This Report

b. The global sparkling coffee market size was estimated at USD 522.6 million in 2020 and is expected to reach USD 589.8 million in 2021.

b. The global sparkling coffee market is expected to grow at a compound annual growth rate of 13.0% from 2021 to 2028 to reach USD 1,387.3 million by 2028.

b. The others distribution channel segment dominated the market for sparkling coffee and held a substantial share of more than 35.0% in 2020.

b. North America held the largest share of more than 45.0% in 2020 in the sparkling coffee market. The rising consumer preference for the drink, which helps in boosting the energy level and concentration instead of normal caffeinated beverages, is expected to drive the market.

b. The caffeinated product segment contributed to the highest share of more than 80% in the global revenue in 2020. Flavored sparkling coffee is gaining popularity since companies are offering a number of refreshing flavors.

b. Some key players operating in the sparkling coffee market include DrinkVIVIC, MATCHLESS COFFEE SODA, Keepers Sparkling Coffee, Upruit, Union Coffee, Paulig, Slingshot Coffee Co., Nongfu Spring, Stumptown Coffee Roasters, and Manhattan Special.

b. Key factors that are driving the sparkling coffee market include the rising demand for refreshing sparkling coffee products, along with the increasing demand for convenient, ready-to-drink beverages across the globe.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."