- Home

- »

- Next Generation Technologies

- »

-

Space Situational Awareness Market Size, Share Report 2030GVR Report cover

![Space Situational Awareness Market Size, Share & Trends Report]()

Space Situational Awareness Market (2024 - 2030) Size, Share & Trends Analysis Report By Solution (Payload, Software, Services), By Capability, By Object, By Orbit Range (Deep Space, Near Earth), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-405-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Space Situational Awareness Market Summary

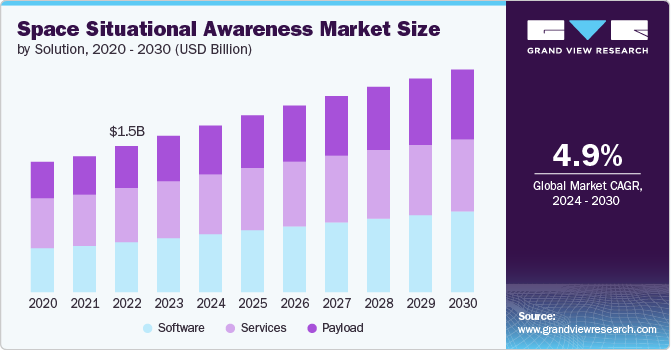

The global space situational awareness market size was estimated at USD 1.55 billion in 2023 and is projected to reach USD 2.20 billion by 2030, growing at a CAGR of 4.9% from 2024 to 2030. The exponential growth in satellite launches, driven by advancements in technology and the decreasing cost of launching satellites, is driving the market growth.

Key Market Trends & Insights

- North America dominated the global space situational awareness market with the largest revenue share of 39.1% in 2023.

- The space situational awareness (SSA) market in the U.S. is anticipated to grow at the fastest CAGR of 3.5% from 2024 to 2030.

- Based on solution, the services segment led the market with the largest revenue share of 36.4% in 2023.

- Based on capability, the detect, track, identify segment led the market with the largest revenue share of 44.6% in 2023.

- Based on object, the fragmentation debris segment led the market with the largest revenue share of 26.6% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.55 Billion

- 2030 Projected Market Size: USD 2.20 Billion

- CAGR (2024-2030): 4.9%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Both commercial and governmental entities are deploying satellites for various purposes, including communication, navigation, Earth observation, and scientific research. This growth in satellite deployment necessitates robust space situational awareness capabilities to track and monitor these assets. The rising number of satellites also increases the risk of space debris, thereby driving the need for market growth.Moreover, space debris acts as a significant threat to operational satellites and manned space missions, making the tracking and mitigation of these objects crucial. The increase in space debris from defunct satellites rocket stages, and fragmentation events have led to heightened awareness and concern within the space community. As a result, there is a growing demand for Space Situational Awareness (SSA) systems that can detect, track, and predict the movements of space debris to prevent potential collisions. Governments and international organizations are investing in policies and technologies to address space debris, driving the market growth.

The development of advanced sensor technologies, such as ground-based radar, optical telescopes, and space-based sensors, has significantly enhanced the capabilities of SSA systems. These technologies provide higher resolution, better accuracy, and more comprehensive coverage for tracking objects in space. Innovations in sensor technology enable the detection of smaller and more distant objects, improving the overall situational awareness in space. Enhanced sensor capabilities also facilitate the collection of more precise data, which is essential for accurate collision prediction and space traffic management, thereby driving the market growth.

Governments and military organizations globally recognize the strategic importance of space and are investing significantly in SSA capabilities. National security concerns, such as the protection of critical space assets and the prevention of hostile actions in space, drive these investments. Military organizations require SSA systems to ensure the safety and functionality of their space-based assets, including communication and reconnaissance satellites. In addition, international collaborations and agreements aimed at enhancing space security and reducing the risk of conflicts in space are fostering the development of SSA infrastructure. The prioritization of SSA by governments and militaries is a significant growth driver for the market.

The rapid expansion of commercial space activities, including satellite constellations for global broadband coverage, space tourism, and private space exploration missions, is fueling the demand for SSA solutions. Companies such as SpaceX, and OneWeb, among others, are launching large constellations of satellites, which require continuous monitoring to avoid collisions and ensure efficient operation. The commercial space sector's growth introduces new stakeholders who need access to reliable Space Situational Awareness (SSA) data to protect their investments and maintain operational integrity. The increasing involvement of private companies in space activities is driving the development and adoption of SSA technologies, contributing to the market's overall growth.

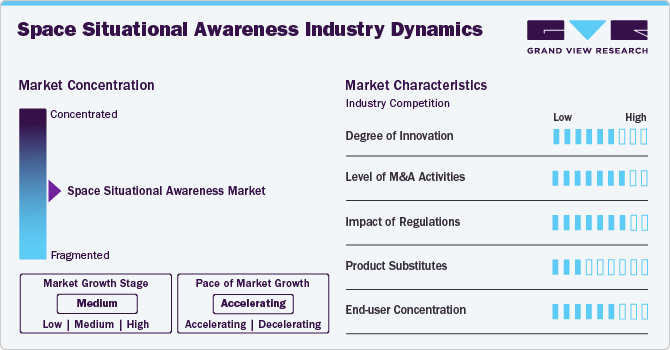

Market Concentration & Characteristics

The degree of innovation is high in the market. The degree of innovation within the market significantly influences the market's growth and capabilities. Advanced technologies and innovative approaches enable more accurate tracking and analysis of objects in space, leading to enhanced safety and operational efficiency for space missions.

The impact of regulations is high. Regulations play a critical role in shaping the market, as they establish essential guidelines and standards for space activities. Stricter regulations can drive the demand for more sophisticated situational awareness solutions to comply with safety and operational standards, thereby fostering innovation and growth in the sector.

The level of mergers & acquisitions in the market is high. The market is also being influenced by the rising number of mergers and acquisitions, which help companies increase market share, expand the customer base, and strengthen product portfolios.

The impact of product substitutes is low to moderate. The introduction of product substitutes in the market plays a significant role in catalyzing innovation and driving competitive pricing strategies. Substitutes push existing companies to enhance their technological offerings and also broaden the market by providing cost-effective alternatives, thereby impacting market dynamics and growth prospects.

The end user concertation is high in the market. Theincreasing concentration of end users in the market significantly enhances the collaboration and data-sharing efforts critical to monitoring and understanding space environments. This consolidation facilitates a more unified approach towards mitigating collisions, tracking debris, and ensuring the sustainable use of outer space, ultimately leading to improved safety and operational efficiencies for all space-faring entities.

Solution Insights

Based on solution, the services segment led the market with the largest revenue share of 36.4% in 2023, due to the increasing demand for advanced data analytics, satellite tracking, and collision avoidance services. As space traffic intensifies with more satellites and space debris, organizations are relying heavily on these services for real-time monitoring and risk mitigation. This trend is further fueled by the integration of AI and machine learning, enhancing the precision and reliability of SSA services, thereby driving the segment growth.

The payload segment is expected to record at the fastest CAGR of 6.1% from 2024 to 2030. The growth is attributed to the increasing need for advanced sensors and technologies that enhance the detection, tracking, and analysis of space objects. This demand is driven by the rise in satellite launches and the growing concerns over space debris. In addition, advancements in miniaturization and the integration of AI in payload systems are contributing to more efficient and cost-effective SSA capabilities, further fueling the segment expansion.

Capability Insights

Based on capability, the detect, track, identify segment led the market with the largest revenue share of 44.6% in 2023, due to increasing concerns about space traffic management and collision avoidance. As the number of satellites and debris in orbit rises, the demand for precise tracking and identification technologies has surged, driving investments in advanced sensors, AI-driven analytics, and real-time data processing solutions. This growth is further supported by government and commercial sector collaborations, aiming to enhance space safety and operational efficiency.

The threat warning and assessment segment is estimated to register at the fastest CAGR from 2024 to 2030, due to the increasing need for proactive measures against potential space threats. As space activities expand, the ability to detect, evaluate, and respond to possible collisions or hostile actions is becoming crucial. This growth is driven by heightened concerns over space debris, satellite protection, and geopolitical tensions in space, leading to higher demand for advanced threat detection and assessment solutions.

Object Insights

Based on object, the fragmentation debris segment led the market with the largest revenue share of 26.6% in 2023, due to the increasing frequency of satellite launches and space missions, which contribute to the accumulation of debris in Earth's orbit. As the risk of collisions rises, there is a growing demand for technologies and solutions that can track and manage these objects to ensure the safety of space assets. This has led to increased investments and advancements in Space Situational Awareness (SSA) capabilities focused on detecting and mitigating fragmentation debris, propelling the segment forward.

The mission-related debris segment is estimated to register at the fastest CAGR from 2024 to 2030, due to the increasing number of satellite launches and space missions. As space activity intensifies, the accumulation of debris from mission-related events, such as rocket stages and defunct satellites, raises concerns for space safety. This has led to a heightened demand for tracking and monitoring services to mitigate collision risks, driving the growth of this segment.

Orbit Range Insights

Based on orbit range, the deep space segment led the market with the largest revenue share of 61.5% in 2023, due to the increasing number of deep space missions and the need to monitor distant satellites and space assets. As space exploration extends beyond geostationary orbits, ensuring the safety and operational integrity of these distant assets becomes crucial. This expansion is driven by advancements in technology and the growing interest of governmental and commercial entities in deep space exploration and utilization.

The near earth segment is estimated to register at the fastest CAGR from 2024 to 2030, due to the increasing number of satellites, space debris, and commercial activities in low Earth orbit (LEO). As space traffic intensifies, the need for enhanced monitoring and tracking capabilities has driven demand for SSA technologies focused on NEO. In addition, governments and private entities are investing in advanced systems to mitigate collision risks and ensure the sustainability of space operations within this orbit range. This growth is further propelled by international collaborations and regulatory requirements for space safety.

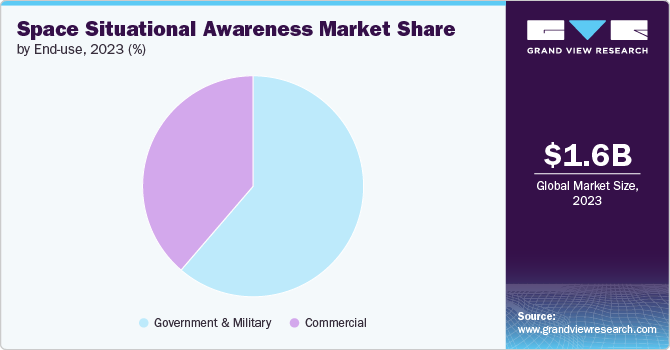

End-use Insights

Based on end use, the government & military segment led the market with the largest revenue share of 61.3% in 2023, due to increasing concerns over space security and the protection of national assets in orbit. As space becomes more congested with satellites and debris, governments are investing heavily in SSA technologies to enhance tracking, monitoring, and threat assessment capabilities. This segment's growth is also driven by the need for better collaboration and data sharing among allied nations to address emerging space threats effectively. The expansion of military space programs further fuels this market growth.

The commercial segment is estimated to register at the fastest CAGR from 2024 to 2030, due to increased private sector involvement in space activities. As more commercial satellites and space missions are launched, the demand for SSA services to monitor and protect assets in space has surged. Companies are investing in advanced technologies to track space debris and other potential hazards, driving innovation and expansion in this segment. This growth is further fueled by the rising importance of space safety and sustainability for commercial enterprises.

Regional Insights

North America dominated the space situational awareness (SSA) market with the largest revenue share of 39.1% in 2023. In North America, the market growth is primarily fueled by substantial investments in space exploration and military space capabilities by countries like the USA, alongside a strong presence of key industry players. The region’s focus on enhancing national security and maintaining technological supremacy in space operations drives demand for advanced space situational awareness solutions.

U.S. Space Situational Awareness Market Trends

The space situational awareness (SSA) market in the U.S. is anticipated to grow at the fastest CAGR of 3.5% from 2024 to 2030. Increasing investments in space exploration and a growing focus on space security drive the U.S. market for space situational awareness.

Asia Pacific Space situational awareness market Trends

The space situational awareness (SSA) market in Asia Pacific is anticipated to grow at the fastest CAGR of 7.3% from 2024 to 2030. The market growth of Asia Pacific region is driven by emerging space-faring nations such as China and India. These countries are significantly increasing their space budgets and capabilities, focusing on space exploration missions and satellite deployments, which necessitate advanced space situational awareness to ensure the safety and longevity of space assets.

The India space situational awareness (SSA) market is estimated to record at a significant CAGR from 2024 to 2030. India's commitment to enhancing its space capabilities and the surge in satellite launches fuel its market growth.

The space situational awareness (SSA) market in China is expected to grow at a considerable CAGR from 2024 to 2030. Rapid advancements in space technology and the strategic expansion of China's military capabilities in space bolster the market growth.

The Japan space situational awareness market is projected to witness at a considerable CAGR from 2024 to 2030. Japan's increasing participation in international space missions and investments in space weather monitoring elevate its market for space situational awareness.

Europe Space Situational Awareness Market Trends

The space situational awareness market in Europe accounted for a notable revenue share of 26% in 2023. In Europe, the market is expanding due to the collaborative space missions among European Space Agency (ESA) member states and growing concerns over space debris management. The region's emphasis on sustainable space exploration and the need to protect existing space infrastructure from potential threats contributes to the market's growth.

The UK space situational awareness market is projected to grow at a considerable CAGR from 2024 to 2030. The UK's strategic focus on space sustainability and the development of space traffic management solutions stimulate its market growth.

The space situational awareness (SSA) market in Germany is expected to record at a significant CAGR from 2024 to 2030. Germany's robust space research infrastructure and emphasis on safeguarding space assets catalyze its market growth.

Middle East and Africa (MEA) Space Situational Awareness Market Trends

The space situational awareness (SSA) market in the Middle East & Africa (MEA) region is anticipated to grow at a significant CAGR of 6.4% from 2024 to 2030. The MEA region shows potential for market growth, encouraged by increasing interest in space technologies and satellite communications from countries like the UAE, which aims to establish itself as a hub for space science and technology, driving demand for space situational awareness solutions to support these ambitious goals.

The Saudi Arabia space situational awareness (SSA) market accounted for a considerable revenue share in 2023. Saudi Arabia's growing interest in space exploration and its initiatives towards space sector development propel the market growth.

Key Space Situational Awareness Company Insights

Some of the key players operating in the market are Lockheed Martin Corporation, L3Harris Technologies, Inc., and Northrop Grumman Corporation, among others.

-

Lockheed Martin Corporation is an aerospace, defense, security, and advanced technologies company with worldwide interests. The company operates in four main business sectors: Aeronautics, Missiles and Fire Control, Rotary and Mission Systems, and Space, providing a wide range of products and services for both domestic and international customers

-

Northrop Grumman Corporation is a global aerospace and defense technology company that provides advanced systems, products, and services to government and commercial customers around the world. It specializes in the development of autonomous systems, cyber, C4ISR, strike, and logistics and modernization

EnduroSat AD, FEV etamax GmbH, and NorthStar Earth & Space Inc., among others are some of the emerging market participants in the global market.

-

EnduroSat AD company specialized in the engineering and manufacturing of CubeSats and nanosatellite technologies for academic, commercial, and scientific missions. The company's focus lies in delivering high-quality modular satellite platforms and payloads, enabling faster and more efficient space missions

-

NorthStar Earth & Space Inc. company focused on delivering comprehensive Earth and space information services aimed at monitoring and analyzing the environment and near-space objects, including asteroids and space debris. It combines advanced data analytics with Earth observation and space situational awareness technologies to support sustainable development and space safety

Key Space Situational Awareness Companies:

The following are the leading companies in the space situational awareness market. These companies collectively hold the largest market share and dictate industry trends.

- Lockheed Martin Corporation

- L3Harris Technologies, Inc.

- Northrop Grumman Corporation

- Vision Engineering Solutions, LLC

- EnduroSat AD

- Kratos Defense & Security Solutions, Inc.

- FEV etamax GmbH

- Parsons Corporation

- Peraton Corp.

- NorthStar Earth & Space Inc.

Recent Developments

-

In April 2024, L3Harris Technologies, Inc. has secured the option year five award for the Maintenance of Space Sitational Awareness Integrated Capabilities (MOSSAIC) initiative. This agreement, valued at approximately USD 187 million, is provided by the U.S. Space Force (USSF) and supports the ongoing enhancement and maintenance of essential space infrastructure. This infrastructure is crucial for the Space Force's fundamental skill in monitoring the space domain.

-

In January 2024, Rocket Lab successfully conducted its inaugural launch of 2024, deploying four satellites dedicated to space situational awareness (SSA) for NorthStar Earth & Space and Spire Global. The launch was executed with an Electron rocket from Launch Complex 1 at 19:34 NZDT, positioning the satellites into a circular orbit around the Earth at an altitude of 530 km.

-

In August 2023, EnduroSat AD and Vyoma partnered on Europe's inaugural commercial mission aimed at improving space situational awareness (SSA). Through this collaboration, Vyoma is expected to implement space-based optical telescopes to track and chart objects in space, delivering SSA data and services almost instantaneously. EnduroSat will be responsible for creating and sending the ESPA microsatellites into low-Earth orbit. The initiative will begin with the launch of the first two satellites by the end of 2024, which marks the commencement of a planned 12-satellite constellation.

Space Situational Awareness Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.65 billion

Revenue forecast in 2030

USD 2.20 billion

Growth rate

CAGR of 4.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, capability, object, orbit range, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Lockheed Martin Corporation; L3Harris Technologies, Inc.; Northrop Grumman Corporation; Vision Engineering Solutions, LLC; EnduroSat AD; Kratos Defense & Security Solutions, Inc.; FEV etamax GmbH; Parsons Corporation; Peraton Corp.; NorthStar Earth & Space Inc

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Space Situational Awareness (SSA) Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global space situational awareness (SSA) market report based on solution, capability, object, orbit range, end use, and region.

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Payload

-

Software

-

Services

-

-

Capability Outlook (Revenue, USD Million, 2018 - 2030)

-

Detect, Track, Identify

-

Threat Warning and Assessment

-

Others

-

-

Object Outlook (Revenue, USD Million, 2018 - 2030)

-

Rocket Bodies

-

Fragmentation Debris

-

Mission-Related Debris

-

Non-functional Aircrafts

-

Functional Aircrafts

-

Others

-

-

Orbit Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Deep Space

-

Near Earth

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Government & Military

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global space situational awareness market size was estimated at USD 1.55 million in 2023 and is expected to reach USD 1.65 million in 2024.

b. The global space situational awareness market is expected to grow at a compound annual growth rate of 4.9% from 2024 to 2030 to reach USD 2.20 billion by 2030.

b. The North America region accounted for the largest share of around 39% in the space situational awareness (SSA) market in 2023 and is expected to continue its dominance in the coming years.

b. Some key players operating in the space situational awareness (SSA) market include Lockheed Martin Corporation, L3Harris Technologies, Inc., Northrop Grumman Corporation, Vision Engineering Solutions, LLC, EnduroSat AD, Kratos Defense & Security Solutions, Inc., FEV etamax GmbH, Parsons Corporation, Peraton Corp., NorthStar Earth & Space Inc.

b. Key factors that are driving the space situational awareness (SSA) market growth include the exponential growth in satellite launches, driven by advancements in technology and the decreasing cost of launching satellites.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.