- Home

- »

- Next Generation Technologies

- »

-

Space Launch Services Market Size & Share Report, 2030GVR Report cover

![Space Launch Services Market Size, Share & Trends Report]()

Space Launch Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Service Type, By Payload, By Launch Platform (Land, Air & Sea), By Launch Type, By Launch Vehicle, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-191-3

- Number of Report Pages: 159

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Space Launch Services Market Summary

The global space launch services market size was estimated at USD 14.94 billion in 2023 and is projected to reach USD 41.31 billion by 2030, growing at a CAGR of 14.6% from 2024 to 2030. The satellite market is experiencing a notable trend driven by technological advancements, an escalating demand for satellite deployment, and the burgeoning landscape of commercial space activities.

Key Market Trends & Insights

- The North American market accounted for a market revenue share of 50.6% in 2023.

- U.S. is expected to register the highest CAGR from 2024 to 2030.

- By service type, pre-launch services accounted for largest market revenue share in 2023.

- By payload, satellite payload accounted for largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 14.94 Billion

- 2030 Projected Market Size: USD 41.31 Billion

- CAGR (2024-2030): 14.6%

- North America: Largest market in 2023

The market's evolution is marked by a significant shift from its traditional government-driven focus to a dynamic scenario with a surplus of commercial players offering a range of launch services.

Satellites are employed across various sectors like telecommunications, earth observation, navigation systems, and scientific research, reflecting the ongoing trend. Notably, the rapid expansion of satellite constellations, particularly for global broadband coverage, underscores the recurring trend of frequent launches to replenish and expand these networks.

The advent of commercial space activities has profoundly impacted the space launch service; private companies such as SpaceX, Blue Origin, and Rocket Lab have entered the sector, offering competitive launch services with force on cost reduction and technological innovation. This commercialization has spurred competition, resulting in lower launch costs, improved efficiency, and increased accessibility to space for a broader range of customers, including small satellite operators and startups. Technological advancements have played a pivotal role in the growth as development in rocket design, propulsion systems, material, and manufacturing processes have led to more efficient and reliable launch vehicles. Particularly, the emergence of reusable launch systems has significantly disrupted the market by enabling the recovery and reuse of rocket components.

Furthermore, advancements in additive manufacturing enable the on-demand production of space components, reducing lead times and enhancing mission flexibility. Moreover, integrating artificial intelligence and machine learning algorithms in satellite systems improves data analysis and enhances operational efficiency. However, the market also faces challenges that must be addressed for sustained growth. One of the critical challenges is space debris management; as more satellites are deployed and space missions increase, the risk of collisions and the generation of space debris intensify. Efforts are underway to develop technologies for debris removal, as well as guidelines and regulations to ensure responsible and sustainable space operations.

Governments worldwide continue to play a crucial role in driving the growth of the market. National space agencies, such as NASA, ESA, and ROscosmos, invest in launch infrastructure, research and development, and collaboration with private companies. Public-private partnerships have emerged as a key strategy, with governments fostering cooperation between space agencies and commercial entities to stimulate innovation, expand launch capabilities and encourage economic growth in the space sector.

Market Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. This can be attributed to various factors, such as the increasing demand for commercial satellite launches, growing investments in space exploration and research activities, and advancements in space technologies. Additionally, the emergence of new players in the market is intensifying the competition, which is driving innovation and pushing companies to develop cost-effective and reliable solutions.

The space launch service market is seeing an increasing number of merger and acquisition (M&A) activities by the leading players underlying a dynamic industry landscape. Companies are seeking to expand their offerings and strengthen their position in the market by acquiring new capabilities, technologies, and assets. For instance, SpaceX's acquisition of Swarm Technologies, a company that specializes in providing satellite-based communications services, has enabled the former to expand its portfolio of space-based offerings.

The space launch services market is also subject to increasing regulatory analysis. There are various regulatory bodies that oversee the space launch industry, such as the Federal Aviation Administration (FAA) in the United States, the European Space Agency (ESA), and the Russian Federal Space Agency (ROSCOSMOS), among others. These bodies are responsible for ensuring that space launch activities comply with international norms and standards, and that they are carried out in a safe and secure manner.

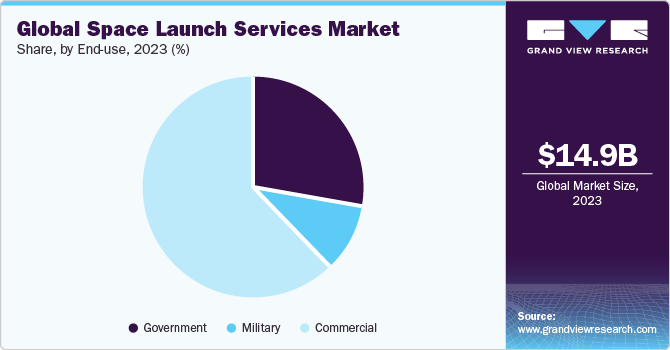

End-user concentration is a significant factor in the market. The market is dominated by government agencies, such as NASA, the European Space Agency (ESA), and the Russian Federal Space Agency (ROSCOSMOS), which are responsible for carrying out space exploration and research activities. In addition to government agencies, there are also a few commercial customers, such as telecommunications companies and satellite operators, that account for a significant portion of the demand.

Service Type Insights

Pre-launch services accounted for largest market revenue share in 2023. The trend in pre-launch services is marked by a comprehensive process that initiates mission planning and analysis. Experts meticulously evaluate the goals, requirements, and constraints of a space mission. The trend involves tasks such as selecting the most suitable launch vehicle, defining the optimal trajectory, calculating payload capacity, and assessing the overall feasibility of the mission. Mission planning, being integral to optimizing mission success and resource allocation, is a key element of this evolving trend. Moreover, in keeping with the trend, space missions adhere to stringent regulatory requirements, ensuring safety and mitigating hazards to both the launch vehicle and the environment.

Post-launch services are expected to register the fastest CAGR during the forecast period. Post-launch services provide the flexibility to tailor missions to specific requirements, enabling operators to optimize satellite performance and functionality. For example, payload integration services ensure the precise placement of satellites into their intended orbits, maximizing operational efficiency. This customization trend has driven the growth of post-launch services as customers seek comprehensive solutions beyond the launch itself.

Payload Insights

Satellite payload accounted for largest market revenue share in 2023. Satellites are pivotal for modern society, driving essential services from global communication to disaster management. The current trend highlights a growing reliance on these services, boosting demand for satellite payloads and fueling increased launch activities. Earth observation satellites, particularly driven by advanced imaging technologies, are on the rise, meeting the escalating need for accurate data in areas like environmental monitoring, disaster response, and urban planning. This surge in demand is shaping the space launch service market.

Space probe payload segment is expected to register the fastest CAGR during the forecast period. The growth is attributed to the substantial progress in miniaturization, power efficiency, and sensor capabilities. These advancements have paved the way for the creation of increasingly compact yet highly capable space probes. This ongoing trend allows for the integration of more sophisticated scientific instruments and sensors into smaller payloads, unlocking greater scientific potential for space probes. These compact and powerful probes are playing a crucial role in advancing scientific missions, encompassing planetary exploration, astronomical observations, earth monitoring, and space weather studies.

Launch Platform Insights

Land components accounted for largest market revenue share in 2023. The land launch platforms offer several benefits, such as cost-effectiveness, flexibility, and better control over the launch process. Additionally, land-based launch platforms allow for a more significant payload capacity, enabling companies to launch larger satellites and other equipment. The growth of the market is also being fueled by the development of reusable rockets, which are helping to bring down the cost of launching payloads into space.

Sea segment is expected to register the fastest CAGR during the forecast period. The development of sea-type launch platforms is playing a significant role in this expansion. These platforms offer several advantages, such as the ability to launch rockets from anywhere in the ocean, which can provide more flexibility in launch scheduling and better use of resources. Additionally, sea-based launch platforms can be more cost-effective, as they can eliminate the need for expensive land leases and infrastructure. The growth of the market is also being driven by increasing demand for satellite-based applications, such as communication, navigation, and remote sensing.

Launch Type Insights

Single use launch type accounted for largest market revenue share in 2023. Developing and maintaining reusable systems requires significant investment in technology, infrastructure, and refurbishment. In contrast, single use launch systems are simpler, reducing the upfront costs and operational complexity. This cost advantage makes them attractive, especially for small satellite deployments and non-critical missions. The cost efficiency of single-use launches has democratized access to space. Smaller companies and startups, which may have been unable to afford traditional reusable systems, can now enter the market more easily.This has fostered innovation and competition, fueling the growth of the space industry.

Re-usable launch type segment is expected to register the fastest CAGR during the forecast period. Traditional space launch systems, characterized by expendable rockets, have been the norm for decades. These rocks are typically discarded after a single use, resulting in high manufacturing costs and limited launch opportunities. However, the advent of reusable launch systems, exemplified by SpaceX's Falcon 9 and Blue Origin's New Shepard, has disrupted this paradigm. Reusable rockets are designed to return to Earth after delivering their payloads, enabling multiple launches with the same vehicles. The most significant advantage of reusable launch systems is their potential to reduce the cost of space launches. The ability to reuse major components, such as the rocket's first stage, significantly lowers manufacturing costs, thereby driving the segment growth.

Lauch Vehicle Insights

Small launch vehicles accounted for largest market revenue share in 2023. The space industry traditionally focused on large payloads and heavy-lift vehicles to deploy massive satellites and space probes. However, the rise of miniaturized satellites, including CubeSats and Small Sats, has shifted the industry's focus toward smaller, more cost-effective launch options. Small lift launch vehicles have emerged as the ideal solution to cater to this demand, offering dedicated launches for these smaller payloads at a lower cost. The advent of small lift launch vehicles has facilitated the development of small satellites working together to provide a wide range of services.

Medium & heavy launch vehicles are expected to register the fastest CAGR during the forecast period. The demand for larger payloads has been a significant driver of growth; as satellite technologies advance and space-based applications expand, the need to launch larger and more complex satellites has grown exponentially. Additionally, deep space exploration missions, such as Mars rovers and interplanetary probes, require the capability to deliver heavier payloads to their intended destination. This surge in demand has created opportunities for launch service providers offering medium to heavy lift capabilities. The growth is also due to rising interest in space tourism and crewed missions.

End-use Insights

Commercial segment accounted for largest market revenue share in 2023. Communication is one of the most prominent commercial end-users in the market; satellites launched into orbit facilitate global telecommunications, broadband internet access, and television broadcasting. The demand for reliable and high-speed connectivity has fueled the deployment of communication satellites, enabling remote areas to access information, businesses to expand their reach, ad individuals to stay connected. Commercial players, such as SpaceX's Starlink and OneWeb, are launching prominent LEO satellite constellations to provide global broadband coverage, thereby driving the segment growth.

Military segment is projected to witness growth of 15.1% over the forecast period. There is a growing need for satellite deployment, scientific research, communication networks, and commercial ventures. While commercial applications dominate the market, military End-use plays a vital role in shaping its trajectory. Military forces worldwide rely heavily on space-based assets for communication, reconnaissance, surveillance, and navigation, making space launch services a critical component of their operations. The military's dependence on space-based assets for national security purposes, including intelligence gathering, early warning systems, and secure communication, necessitates the availability of reliable and responsive services. The military's pursuit of advanced technologies, such as high-resolution imaging, signals intelligence, and space-based weapons systems, requires access to cutting-edge space launch capabilities for successful deployment and operations.

Regional Insights

The North American market accounted for a market revenue share of 50.6% in 2023. North America has witnessed significant advancements and innovations in launching shuttles and satellites. Government and military requirements for national security, defense, and intelligence gathering drive the regional market. The U.S. Department of Defense relies on space-based assets for communication, surveillance, reconnaissance, and GPS navigation. This demand has led to a constant need for space launch services to deploy and replenish satellites in orbit. North America has been at the forefront of technological advancements in space launch capabilities. Innovations in rocket designs, propulsion systems, and manufacturing techniques have enabled more efficient and cost-effective launch operations.

Asia Pacific is expected to witness significant growth in the market. The growth in the region is due to substantial investment and support from governments in the region. Several countries in Asia, like China, India, Japan, and South Korea, have recognized the strategic and economic benefits of space exploration and satellite technology. The Indian Space Research Organization has played a crucial role in the market growth in India and the region. ISRO has achieved notable milestones, including successful Mars and lunar missions. The Indian government's support for space research and development has led to a robust launch ecosystem, attracting domestic and international customers. The increasing demand for small satellites, including CubeSats and microsatellites, has significantly contributed to the growth in the region.

Key Space Launch Services Company Insights

Some of the key players operating in the market include ISRO, NASA, SpaceX, Boeing, among others.

-

Boeing is one of the leading players in the space launch service market. Boeing has a strong presence in the commercial, civil, and military space sectors, and has been actively involved in developing new space launch vehicles and technologies. Some of the notable Boeing space launch vehicles include Delta IV, Atlas V, and the upcoming Space Launch System (SLS), which is expected to be the most powerful rocket ever built.

-

SpaceX is one of the fastest growing and most innovative players in the space launch service market. The company has made significant strides in developing reusable rockets, reducing the cost of space travel and making it more accessible to a wider range of customers.

United Space Alliance, ExPace, Relativity Space, are some of the emerging market participants in the space launch services market.

-

United Launch Alliance (ULA) is a joint venture between two of the largest aerospace companies in the world - Boeing and Lockheed Martin. The company has a proven track record of success, with over 140 launches to its credit, and has been actively developing new technologies and launch vehicles to stay competitive in the industry.

-

ExPace is a Chinese company that was founded in 2016 with the goal of providing commercial launch services to customers around the world. ExPace has successfully launched several rockets, including the Kuaizhou-1A and Kuaizhou-11, which are designed to carry small satellites into orbit.

Key Space Launch Services Companies:

The following are the leading companies in the space launch services market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these space launch services companies are analyzed to map the supply network.

- SpaceX

- Blue Origin

- Virgin Galactic

- Rocket Lab

- United Launch Alliance

- Arianespace

- China Aerospace Science and Technology Corporation

- Mitsubishi Heavy Industries

- Eurockot Launch Services

- Northrop Grumman

- ExPace

- Firefly Aerospace

- Relativity Space

- Orbital ATK

- International Launch Services

- Antrix Corporation

- Vector Launch

- Spaceflight Industries

- ISRO

- NASA

- Virgin Orbit

- Boeing

Recent Developments

-

In December 2023, Boeing announced successful launch of X-37B autonomous spaceplane with SpaceX Falcon Heavy rocket, marking the beginning of its seventh mission. The Orbital Test Vehicle will validate new technologies, fostering innovation and pushing the boundaries of space exploration and utility.

-

In October 2023, Northrop Grumman Corporation secured a contract from U.S. Navy regarding the company’s newly designed 57mm guided high explosive ammunition. Designated for use with the Mk110 Naval Gun Mount, the company will test and mature the munition for qualification. The 57mm guided high explosive ammunition has the unique ability to continuously maneuver in-flight as it moves toward a designated target.

-

In September 2023, Mitsubishi Heavy Industries announced an R&D program for Lunar exploration by participating in a series of domestic and international space programs. MHI launch a new era in lunar exploration and expanding the life in space half a century after the Apollo programs.

Space Launch Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 18.26 billion

Revenue forecast in 2030

USD 41.31 billion

Growth rate

CAGR of 14.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, servicepayload, launch platform, launch type, launch vehicle, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada; Germany; UK; France; Italy; France; Spain; China; Japan; India; South Korea; Australia; New Zealand; Brazil; Mexico; UAE; South Africa

Key companies profiled

SpaceX; Blue Origin; Virgin Galactic; Rocket Lab; United Launch Alliance; Arianespace; China Aerospace Science and Technology Corporation; Mitsubishi Heavy Industries; Eurockot Launch Services; Northrop Grumman; ExPace; Firefly Aerospace; Relativity Space; Orbital ATK; International Launch Services; Antrix Corporation; Vector Launch; Spaceflight Industries; ISRO; NASA; Virgin Orbit; Boeing

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Space Launch Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global space launch services market report based on service type, service payload, launch platform, launch type, launch vehicle, end-use, and region:

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pre-Launch

-

Post-Launch

-

-

Payload Outlook (Revenue, USD Million, 2018 - 2030)

-

Satellite

-

Cargo

-

Human Spaceflight

-

Space Probe

-

-

Launch Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Land

-

Air

-

Sea

-

-

Launch Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Re-Usable

-

Single-Use

-

-

Launch Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Launch Vehicle

-

Medium to Heavy Launch Vehicle

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Government

-

Military

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

New Zealand

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global space launch services market size was estimated at USD 14.94 billion in 2023 and is expected to reach USD 18.26 billion in 2024.

b. The global space launch services market is expected to grow at a compound annual growth rate (CAGR) of 14.6% from 2024 to 2030 to reach USD 41.31 billion by 2030.

b. North America dominated the space launch services market with a share of over 50% in 2023, owing to the increasing demand for satellite-based services and advancements in technology. The commercial sector has been a major contributor to the growth of space launch services in North America.

b. Some key players operating in the space launch services market include SpaceX, Blue Origin, Virgin Galactic, Rocket Lab, United Launch Alliance, Arianespace, China Aerospace Science and Technology Corporation, Mitsubishi Heavy Industries, Eurockot Launch Services, Northrop Grumman, ExPace, Firefly Aerospace, Relativity Space, Orbital ATK, International Launch Services, Antrix Corporation, Vector Launch, Spaceflight Industries, ISRO, NASA, Virgin Orbit, Boeing.

b. Key factors that are driving the growth of the space launch services market include the rising demand for satellite-based applications, including communication, earth observation, and navigation. Moreover, the deployment of constellations of small satellites for various purposes, such as broadband internet coverage and remote sensing, has further bolstered the demand for cost-effective and responsive launches.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.