- Home

- »

- Consumer F&B

- »

-

Soy Sauce Market Size, Share, Growth Analysis Report 2030GVR Report cover

![Soy Sauce Market Size, Share & Trends Report]()

Soy Sauce Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Brewed, Blended), By Application (Household, Food Industry), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-545-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Soy Sauce Market Summary

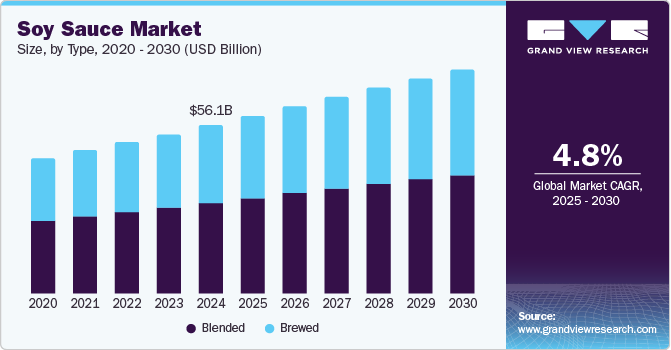

The global soy sauce market size was estimated at USD 56.10 billion in 2024 and is projected to reach USD 75.70 billion by 2030, growing at a CAGR of 4.8% from 2025 to 2030. The increasing popularity of Asian cuisine worldwide has significantly boosted demand for soy sauce, as it is a staple condiment in many Asian dishes.

Key Market Trends & Insights

- Asia Pacific dominated the global soy sauce market with the largest revenue share of 55.0% in 2024.

- By type, the blended segment led the market with the largest revenue share of 53.8% in 2024.

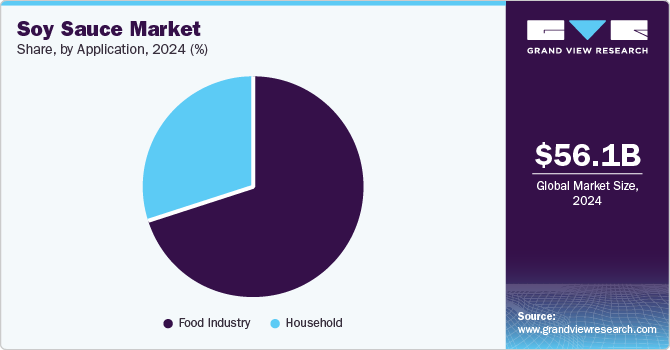

- By application, the food industry segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 56.10 Billion

- 2030 Projected Market Size: USD 75.70 Billion

- CAGR (2025-2030): 4.8%

- Asia Pacific: Largest market in 2024

Additionally, rising health awareness among consumers has led to a preference for soy sauce over other high-sodium condiments, as it is perceived to be a healthier option. The growing trend of dietary shifts towards gluten-free and organic products has also contributed to market growth, with manufacturers introducing low-sodium, gluten-free, and organic soy sauce variants.

The rise in popularity of plant-based foods among vegan and health-conscious consumers has led to increased demand for soy sauce as a versatile and flavorful condiment. The growing number of Asian restaurants and food outlets worldwide has further boosted the market, as soy sauce is a key ingredient in many Asian dishes. Moreover, the globalization of Asian cuisine has introduced soy sauce to new consumer bases, expanding its market reach.

It is a key ingredient of many popular and emerging world cuisines like Japanese, Chinese, Thai, Vietnamese, Indonesian, and Malaysian. Growing health consciousness along with the rising popularity of the aforementioned cuisines across the globe is expected to boost the product demand. Soy sauce is used in the preparation of foods, such as bacon/cured meats, beef, bread & rolls, cookies & cakes, dry mixes, dressings, snacks, and many others.

Type Insights

The blended segment dominated the market with the largest revenue share of 53.8% in 2024. Blended soy sauce offers a balanced flavor profile that appeals to a wide range of consumers, making it versatile for various culinary applications. The growing popularity of Asian cuisine worldwide has significantly boosted demand for blended soy sauce, as it is a staple condiment in many dishes. Additionally, the availability of low-sodium, gluten-free, and organic variants of blended soy sauce caters to health-conscious consumers, further driving market growth.

The brewed segment is expected to grow at the fastest CAGR of 5.1% over the forecast period. The rising consumer preference for natural and traditionally fermented foods has boosted the demand for brewed soy sauce, which is often perceived as more authentic and flavorful compared to blended varieties. Additionally, the increasing popularity of premium and artisanal food products has led to higher interest in brewed soy sauce, which is typically produced using traditional methods. The trend towards clean label products, with minimal additives and preservatives, further supports the growth of the brewed segment.

Application Insights

Food industry dominated the market with the largest revenue share in 2024. This dominance is driven by the widespread use of soy sauce as a key ingredient in various food products, including processed foods, ready-to-eat meals, and snacks. The rising popularity of Asian cuisine globally has further boosted demand, as soy sauce is essential in numerous traditional and contemporary dishes. Additionally, the food industry's constant innovation and introduction of new flavors and products have helped maintain its strong market position.

The household segment is expected to grow at the fastest CAGR over the forecast period. The increasing inclination towards home-cooked meals and the rising popularity of Asian cuisine in domestic kitchens are significant contributors. As more consumers experiment with global flavors and incorporate soy sauce into their daily cooking, demand in the household segment continues to rise. Additionally, the growing trend of health-conscious eating at home, including the preference for natural and organic products, further supports this growth. The availability of a wide range of soy sauce variants catering to different dietary needs also enhances its appeal to household consumers.

Regional Insights

North America soy sauce market is expected to grow significantly over the forecast period owing to increasing consumer interest in Asian cuisine, which has become a staple in many households. The rising health consciousness among consumers, who prefer soy sauce as a healthier alternative to high-sodium condiments, also plays a pivotal role. Additionally, the growing popularity of gluten-free and organic soy sauce variants caters to diverse dietary needs, further boosting the market. The presence of key market players and continuous innovation in product offerings ensure North America's strong growth trajectory in the soy sauce market.

U.S. Soy Sauce Market Trends

The soy sauce market in U.S. is expected to grow significantly over the forecast period. The increasing popularity of Asian cuisine among American consumers has led to a higher demand for soy sauce as a staple condiment. The growing trend of organic and gluten-free products also plays a role, with more consumers seeking out these healthier options. Moreover, the expansion of retail distribution channels, both in physical supermarkets and through e-commerce platforms, has made various types of soy sauce more accessible to a wider audience.

Asia Pacific Soy Sauce Market Trends

The soy sauce market in Asia Pacific dominated the global market with the largest revenue share of 55.0% in 2024. The region's rich culinary heritage and high consumption of soy sauce in daily meals contribute significantly to its market share. Countries like China, Japan, and South Korea, where soy sauce is a staple in traditional dishes, drive the bulk of this demand. Additionally, the growing trend of exploring Asian cuisine worldwide has further boosted the market. The presence of major soy sauce manufacturers and their continuous efforts to innovate and introduce new variants also play a crucial role in maintaining this leading position.

Europe Soy Sauce Market Trends

The soy sauce market in Europe was identified as a lucrative region in 2024 owing to the increasing popularity of Asian cuisine across the continent. As more European consumers incorporate Asian flavors into their diets, the demand for soy sauce has risen. Additionally, the growing trend of health-conscious eating, with a preference for natural and organic products, has further boosted the market. European manufacturers are also innovating with new soy sauce variants to cater to diverse consumer preferences.

Key Soy Sauce Company Insights

Some key companies in the soy sauce market include Foshan Haitian flavouring & Food Co.Ltd., Kikkoman Corporation, Lee Kum Kee, Masan Group, BOURBON BARREL FOODS, and others. Companies are introducing new flavors and ingredients to remain competitive. Furthermore, several key players are pursuing various strategic initiatives, such as mergers, acquisitions, and partnerships with other leading companies.

-

Foshan Haitian, also known as Haitian, is a leading soy sauce manufacturer in the world. The company offers a diverse product lineup, including:Classic Series, Fresh Flavour Series, Preference Series, Organic Series, Old Word Series, and Salt-Reduced Series. Haitian is committed to combining traditional brewing methods with modern technology to produce high-quality soy sauces. Their products are exported to over 60 countries, making them a global name in the soy sauce industry.

-

Kikkoman is a renowned Japanese company with a history of over 350 years in soy sauce production. The company’s soy sauces are known for their rich, complex flavors and are enjoyed in over 100 countries worldwide. The company emphasizes quality and tradition, ensuring that their soy sauces enhance both Asian and Western cuisines.

Key Soy Sauce Companies:

The following are the leading companies in the soy sauce market. These companies collectively hold the largest market share and dictate industry trends.

- Foshan Haitian flavouring & Food Co.Ltd.

- Kikkoman Corporation

- Lee Kum Kee

- Masan Group

- BOURBON BARREL FOODS

- OTAFUKU SAUCE Co., Ltd.

- YAMASA CORPORATION

- Maggi

- Guangdong Meiweixian Flavoring Foods Co., Ltd.

- Okonomi

Recent Developments

-

In October 2024, Masan Group announced that it is expanding its retail-consumer platform to meet the essential needs of local consumers. Since its public listing in 2009, Masan has strategically enhanced its portfolio through significant mergers and acquisitions, including acquiring over 98% of Visnacafé Bien Hoa and the recent Phuc Long tea and coffee chain takeover. A key milestone was the merger with VinCommerce in 2019, marking its entry into the retail sector.

-

In February 2024, Kikkoman announced the launch of its new dark soy sauce, tailored exclusively for the Indian market, marking a significant milestone in its 350-year history. After four years of dedicated research and development, this naturally crafted sauce delivers a rich color without chemicals, preservatives, or artificial seasonings. Aimed at discerning Indian consumers who prefer visually appealing Chinese and Pan-Asian dishes, Kikkoman's dark soy sauce is developed using a proprietary method, building upon the brand's renowned classic soy sauce.

Soy Sauce Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 59.13 billion

Revenue forecast in 2030

USD 75.70 billion

Growth Rate

CAGR of 4.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, South Africa

Key companies profiled

Foshan Haitian flavouring & Food Co.Ltd.; Kikkoman Corporation; Lee Kum Kee; Masan Group; BOURBON BARREL FOODS; OTAFUKU SAUCE Co., Ltd.; YAMASA CORPORATION; Maggi; Guangdong Meiweixian Flavoring Foods Co., Ltd.; Okonomi

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Soy Sauce Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global soy sauce market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Brewed

-

Blended

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Household

-

Food Industry

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.