- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Soy Flour Market Size, Share, Trends & Growth Report, 2030GVR Report cover

![Soy Flour Market Size, Share & Trends Report]()

Soy Flour Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Full-fat, Defatted), By Application (Bakery & Confectionery, Meat Substitute, Meat & Poultry, Others), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-275-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Soy Flour Market Size & Trends

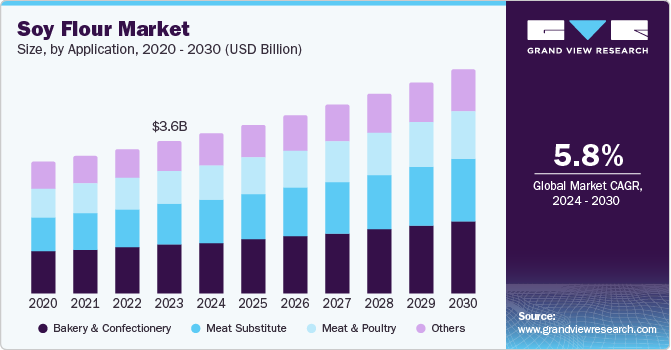

The global soy flour market size was valued at USD 3.61 billion in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2030. This growth is driven by the increasing awareness of health benefits associated with soy flour, such as its high protein content and ability to improve insulin sensitivity, which is encouraging its adoption in various food products. In addition, the rising prevalence of chronic diseases is pushing consumers towards healthier dietary choices, further boosting the demand for soy flour. Moreover, the expanding use of soy flour in bakery and confectionery products, as well as in dairy alternatives for its creamy texture, is contributing to market growth.

The growing popularity of plant-based and vegan diets is a significant driver for the soy flour market. In the U.S., the number of people identifying as vegan has increased sixfold from 1% in 2014 to 6% in 2023. In addition, 39% of Americans actively try incorporating more plant-based foods into their diets. This shift is mirrored globally, with countries such as the UK seeing a 400% increase in vegans over the last few years. These trends boost the demand for soy flour, valued for its high protein content and nutritional benefits. It is a popular choice among health-conscious consumers and those with dietary restrictions.

The growing demand for functional foods and expanding distribution channels are also anticipated to create new opportunities for market players. However, challenges such as soy allergies and competition from alternative protein sources may pose hurdles to market growth.

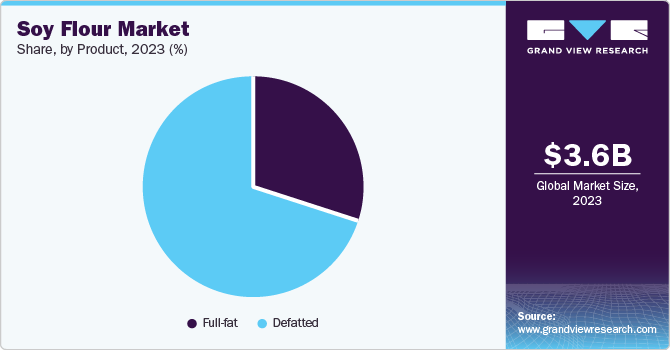

Product Insights

The defatted soy flour segment dominated the global soy flour market in 2023 attributed to its extensive use in various food applications due to its high protein content and low-fat properties. Defatted soy flour is particularly favored in producing bakery products, meat substitutes, and health foods, where a high protein-to-fat ratio is desirable. Its ability to enhance the texture and nutritional profile of food products makes it a popular choice among manufacturers. In addition, defatted soy flour is often used as a functional ingredient in processed foods, contributing to its widespread adoption. The growing consumer awareness of health and wellness and the increasing demand for high-protein, low-fat food products have significantly boosted the defatted soy flour market.

The full-fat soy flour segment is expected to grow steadily from 2024 to 2030 driven by the rising demand for natural and minimally processed food ingredients. Full-fat soy flour retains the natural oils in soybeans, offering a richer flavor and higher nutritional value than its defatted counterpart. It is increasingly used in applications where natural fats are beneficial, such as in producing certain bakery products, snacks, and meat substitutes. The trend towards clean-label products and the growing popularity of plant-based diets also contribute to the steady growth of the full-fat soy flour segment. As consumers continue seeking wholesome and nutritious food options, the demand for full-fat soy flour is expected to rise, supporting its market expansion over the forecast period.

Application Insights

The bakery & confectionery segment accounted for 32.3% of the total revenue generated in 2023 attributed to increasing consumer demand for healthier, gluten-free bakery products. Soy flour is widely used in baking due to its high protein content, which enhances the nutritional profile of baked goods. In addition, it improves product texture and shelf life, making it a preferred ingredient among bakers and confectioners. The versatility of soy flour allows it to be used in various products, including bread, cakes, cookies, and pastries, catering to the growing health-conscious consumer base. The trend towards clean-label and plant-based ingredients further boosts the adoption of soy flour in this segment, as consumers seek out products with recognizable and wholesome ingredients.

The meat substitute segment is expected to register the fastest CAGR of 6.3% over the forecast period, driven by the rising popularity of plant-based diets and the increasing awareness of the environmental and health benefits of reducing meat consumption. Soy flour is crucial in formulating meat substitutes, providing protein content and texture that mimics traditional meat products. Innovations in food technology have enabled the development of soy-based products that closely resemble the taste and texture of meat, appealing to both vegetarians and flexitarians. The growing investment in research and development by food manufacturers to create more appealing and diverse meat substitute products is expected to propel the growth of this segment further.

Regional Insights

North America soy flour market held a significant revenue share in the global market in 2023. The increasing demand for gluten-free and high-protein food products drives the region’s market. The growing trend of plant-based diets and the rising awareness of the health benefits of soy flour are also contributing to the market’s growth. The presence of major food manufacturers and the development of innovative soy-based products further support the market in North America.

U.S. Soy Flour Market Trends

The soy flour market in the U.S. is expected to grow substantially over the forecast period. The increasing consumer preference for healthy and sustainable food options fuels this growth. The rising popularity of vegan and vegetarian diets and the demand for high-protein and gluten-free products are driving the adoption of soy flour in various food applications. Moreover, the ongoing research and development activities to enhance soy flour's nutritional profile and functionality are expected to create new growth opportunities in the U.S. market.

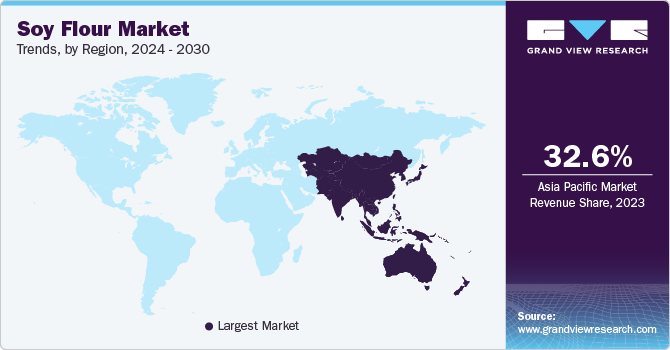

Asia Pacific Soy Flour Market Trends

Asia Pacific dominated the global soy flour market with a revenue share of 32.6% in 2023, driven by high consumption in countries such as China, Japan, and India. The region’s dominance is attributed to the widespread use of soy flour in traditional cuisines and the growing demand for plant-based protein sources. Moreover, the increasing health consciousness among consumers and the rising popularity of vegan diets are further boosting the market in this region.

China Soy Four market accounted for a considerable revenue share of the Asia Pacific soy flour market in 2023. The country’s large population and the growing awareness of the health benefits of soy products have led to increased consumption. Moreover, the expansion of the food processing industry and the incorporation of soy flour in various food products, such as bakery items and meat substitutes, have contributed to the market’s growth in China.

Europe Soy Flour Market Trends

The European soy flour market is expected to grow at a CAGR of 5.9% from 2024 to 2030 driven by the increasing demand for plant-based and gluten-free food products across the region. Consumers are becoming more health-conscious and seeking out high-protein, low-fat alternatives, boosting the adoption of soy flour in various food applications. In addition, the rising popularity of vegan and vegetarian diets contributes to the market’s expansion. Countries such as Germany, France, and the UK are leading this growth due to their large consumer base and the presence of major food manufacturers1. The trend towards clean-label and natural ingredients is also expected to support the steady growth of the soy flour market in Europe over the forecast period.

Key Soy Flour Company Insights

Some of the key companies in the soy flour market include Pure Ceylon Cinnamon, Biofoods Pvt Ltd., HDDES Group, Ceylon Spice Company, C.F. Sauer Company, First Spice Mixing Company, and McCormick & Company, Inc., among others.

-

HDDES Group is known for its extensive experience in the food processing industry and specializes in producing various soy-based products, including soy flour, used in numerous food applications.

-

McCormick & Company, Inc. is known for its extensive range of spices, seasonings, and flavorings. The company has a strong distribution network in the market.

Key Soy Flour Companies:

The following are the leading companies in the soy flour market. These companies collectively hold the largest market share and dictate industry trends.

- Pure Ceylon Cinnamon

- Biofoods Pvt Ltd.

- HDDES Group

- Ceylon Spice Company

- C.F. Sauer Company

- First Spice Mixing Company

- Elite Spice

- EHL Ingredients

- McCormick & Company, Inc.

- SDS SPICES (PVT) LTD.

Recent Developments

-

In February 2024, Amfora launched its inaugural commercial products, introducing a pioneering line of ultra-high plant protein offerings, including Amfora ultra-high protein soy flour.

-

In September 2023, Grain Processing Corp. (GPC), a subsidiary of Kent Corp., acquired a 64,000-square-foot flour manufacturing and warehouse facility in Oskaloosa. This strategic acquisition supports GPC's growth plans and diversification into new product lines, leveraging its expertise in plant-based ingredients. The facility's location complements GPC's existing soy and chickpea milling operations in Grinnell, Iowa.

-

In February 2024, White River Soy Processing, LLC acquired Benson Hill, Inc.'s soy processing plant in Creston, Iowa. The facility is well-equipped to produce various soy-based products, including soy meal, oil, food-grade soy white flake, flour, and grits.

Soy Flour Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.80 billion

Revenue forecast in 2030

USD 5.32 billion

Growth rate

CAGR of 5.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, Australia, South Korea, Brazil, Argentina, UAE

Key companies profiled

Pure Ceylon Cinnamon, Biofoods Pvt Ltd., HDDES Group, Ceylon Spice Company, C.F. Sauer Company, First Spice Mixing Company, Elite Spice, EHL Ingredients, McCormick & Company, Inc., SDS SPICES (PVT) LTD

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Soy Flour Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global soy flour market report based on application, product and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Full-fat

-

Defatted

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Non-Residential Construction

-

Residential Construction

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.