- Home

- »

- Homecare & Decor

- »

-

Southern Africa Safari Tourism Market Size Report, 2030GVR Report cover

![Southern Africa Safari Tourism Market Size, Share & Trends Report]()

Southern Africa Safari Tourism Market Size, Share & Trends Analysis Report By Type (Adventure Safari, Private Safari), By Accommodation (Safari Resorts & Lodges, Treehouses), By Group (Couples, Families), By Booking Mode, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-335-4

- Number of Report Pages: 85

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Southern Africa Safari Tourism Market Trends

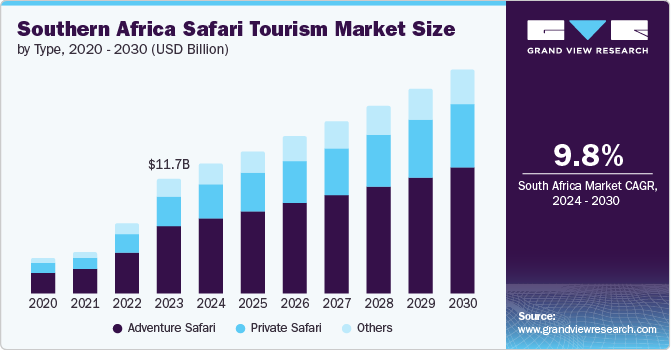

The Southern Africa safari tourism market size was estimated at USD 11.70 billion in 2023 and is projected to grow at CAGR of 9.8% from 2024 to 2030. Growing awareness and concern for wildlife conservation and environmental sustainability have fueled the demand for responsible and sustainable tourism experiences. Safari tourism offers an opportunity for travelers to support conservation efforts directly and contribute to the preservation of natural habitats and wildlife.

Leading safari tour operators such as Wilderness Safaris, & Beyond, and Singita have set benchmarks in luxury and sustainable safari tourism, offering bespoke safari experiences in remote locations with minimal environmental impact in southern Africa. They emphasize conservation partnerships, community engagement, and experiential travel, aligning with growing consumer preferences for responsible tourism practices. Digital innovation in customer engagement, itinerary customization, and online booking platforms enhances accessibility and convenience for global travelers seeking personalized safari adventures.

Agents and affiliates continue to play a pivotal role in the market by acting as intermediaries between travelers and safari operators. These travel professionals leverage their expertise and industry connections to curate comprehensive safari packages that include accommodations, game drives, flights, and sometimes additional excursions. For example, African Travel, Inc. partners with luxury safari lodges and local operators to offer tailored safari experiences across Southern Africa, ensuring travelers receive personalized recommendations and assistance throughout the booking process.

A prominent digital and technology trend in Southern Africa's safari tourism market is the use of drones for wildlife monitoring. In Botswana, the integration of drones and artificial intelligence (AI) is revolutionizing wildlife monitoring and anti-poaching efforts, reflecting a technology trend in the Southern Africa safari tourism market. Researchers from the Botswana International University of Science and Technology have developed a system using drones to provide aerial views and AI to analyze herd behaviors and classify species such as zebras, giraffes, and elephants. The adoption of drones and AI offers a more efficient and expansive way to monitor wildlife, ensuring a safer and more sustainable environment for safari tourism.

Governments across Southern Africa have implemented policies and incentives to encourage private sector investment in eco-friendly lodges and wildlife conservation projects. Marketing efforts by tourism boards highlight the region's rich biodiversity and cultural heritage, promoting Southern Africa as a premier safari destination globally. In December 2022, USAID announced a Prosper Africa partnership with ThirdWay Partners and The Nature Conservancy, committing USD 2.5 million to establish the Africa Conservation and Communities Tourism Fund. This fund will invest USD 75 million to support safari tour operators across several African countries, including Botswana, Kenya, Namibia, South Africa, Tanzania, and Zambia.

The expansion and enhancement of flight routes and connectivity across Southern Africa play a crucial role in driving growth in the safari tourism market. Initiatives such as Qatar Airways' new gateway in Kinshasa, Ethiopian Airlines' connections to Maun and Ndola, and Lufthansa's direct flights to Johannesburg reduce travel times and increase accessibility to remote safari destinations. For instance, Lufthansa's decision to launch a direct flight between Munich and Johannesburg, South Africa in June 2024 not only reduces travel time for European tourists but also enhances convenience and reliability, making it more attractive for travelers to include South Africa's renowned safari experiences in their itineraries.

Southern Africa boasts an unparalleled array of wildlife, including the iconic Big Five (lion, leopard, rhinoceros, elephant, and Cape buffalo), along with numerous other mammals, birds, reptiles, and plant species. This biodiversity attracts wildlife enthusiasts, photographers, and eco-tourists. According to Go2Africa’s 2023 Annual State of Safari Travel Report, travel interest to Zambia increased by 78% and to Malawi by 41% from 2022 to 2023, with the Seychelles also experiencing a rise in visitor numbers. The report noted a 20% uptick in demand for beach and safari combination trips, alongside a 22% increase in interest for trips offering relaxation and leisure activities.

Market Concentration & Characteristics

The degree of innovation in Southern Africa safari tourism is high, with advancements in eco-friendly lodges, immersive wildlife experiences, and sustainable tourism practices. Innovative marketing strategies and technology integration further enhance the appeal, offering unique and personalized safari adventures.

Regulations in Southern Africa safari tourism promote sustainable practices, protect wildlife, and encourage eco-friendly investments. These policies enhance the region's appeal as a premier safari destination, supporting conservation efforts and attracting global tourists while fostering economic growth through increased private sector participation.

The impact of alternatives and substitutes in the market includes increased competition from other global safari destinations and eco-tourism spots, potentially diverting travelers. However, Southern Africa's unique biodiversity and conservation efforts help maintain its appeal despite these competing attractions.

End-user concentration in the market is high, with a strong focus on affluent international travelers, eco-tourists, wildlife enthusiasts, and photographers. These groups are drawn by the region's rich biodiversity, luxury accommodations, and unique cultural experiences, driving demand for premium safari packages.

Type Insights

Adventure tourism held a share of about 57% in 2023. Adventure safaris in Southern Africa offer an exhilarating way to experience the continent's stunning landscapes and diverse wildlife. South Africa, Mozambique, and Angola contribute richly to the adventure safari scene. South Africa's diverse terrain, from the iconic Table Mountain to the expansive Kruger National Park, offers a myriad of active pursuits such as mountain biking, rock climbing, and interpretive walking safaris where guests can get up close with the Big Five. The demand for adventure tourism is on the rise, with Booking.com's 2023 poll showing 73% of travelers planning trips outside their comfort zones, 70% seeking adventurous backpacking, and 55% aiming for off-grid holidays.

The demand for private safaris is expected to rise at a CAGR of about 11.0% in the forecast period. The growing African luxury travel market is driving a surge in private safaris, particularly in Southern Africa. With increasing demand for exclusive and adventurous experiences, travelers are seeking bespoke trips that combine luxury, conservation, and cultural engagement. The growth in travelers' budgets for African safaris, with 70% of visitors from Australia, the U.S., and Canada (2023 Annual African Safari Travel Report) now having medium to high budgets, indicates a significant shift toward more luxurious and exclusive experiences. With travelers willing to spend more on their safaris, the private safari segment can expect to see continued growth and expansion, particularly in regions like Southern Africa where exclusivity and luxury are key attractions.

Accommodation Insights

In 2023, safari resorts and lodges accounted for approximately 40% of the market. Safari resorts and lodges in Southern Africa are typically located in or near national parks, game reserves, and remote wild areas. Constructed from stone, wood, canvas, and thatch, these permanent structures offer all-inclusive experiences, including safari activities and meals. Leading in sustainable tourism, these lodges adopt innovative water management practices, such as rainwater harvesting and greywater recycling, to reduce their water footprint. They use low-flow fixtures and natural pool filtration systems to minimize water wastage without compromising guest comfort, promoting a culture of conservation.

Demand for accommodation in safari camps is anticipated to increase at a CAGR of about 10.8% from 2024-2030. Tented safaris, commonly referred to as "safari camps," are located in prime natural settings where wildlife congregates, offering guests exceptional opportunities for game viewing. These camps are often situated near water bodies such as lakes and rivers, which attract animals throughout the day, enhancing the overall safari experience. These are an excellent chance to get up close and personal with the wild game without going too far into the woods. In mid-2021, Pangolin Photo Camp was launched in Botswana, a new mobile camp designed for wildlife photography enthusiasts. The camp consisted of five tents accommodating up to eight guests, moving between seven sites every two weeks within a 100,000-acre private concession in the western Selinda area of the Okavango Delta.

Booking Mode Insights

Direct bookings held a share of approximately 55% in the Southern Africa safari tourism market. Advancements in technology, including card scanners, mobile payments, voice recognition search, and artificial intelligence (AI), along with the proliferation of online booking platforms, have led to an increase in travelers booking their safari experiences directly with lodges, camps, and tour operators. Direct bookings offer travelers several advantages, such as better rates, exclusive promotions, and personalized customer service. Travelers can also directly communicate with the safari tour providers, allowing for a more tailored experience. These benefits are expected to propel direct bookings in the safari tourism market.

Marketplace booking is expected to be increasingly utilized in the Southern Africa safari tourism market, with a projected CAGR of about 10.9%. Marketplaces offer a diverse range of options, allowing travelers to choose from various lodges, camps, and tour operators, ensuring a tailored experience that meets individual preferences and budgets. Access to user reviews and ratings on these platforms helps travelers make informed decisions, increasing trust and satisfaction with their bookings.

Integration of advanced technologies such as mobile payments, AI-driven recommendations, and real-time availability checks enhances the user experience and streamlines the booking process. These factors collectively contribute to the rising popularity of marketplace booking in safari tourism, as travelers seek convenient, reliable, and cost-effective solutions for their travel plans.

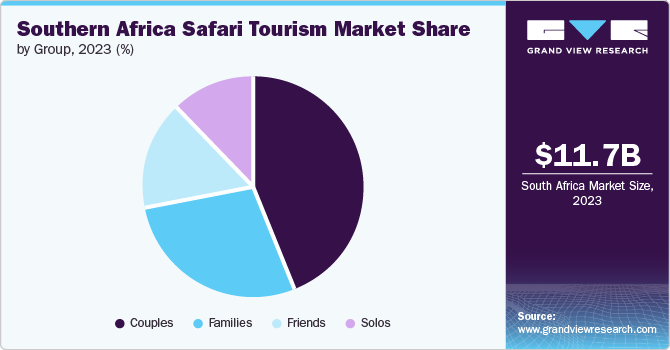

Group Insights

Couples constituted the largest visiting group for safaris in southern Africa, accounting for about 44% of visitors in 2023. According to the statistics published by CBI, in 2021, 42% of European millennials preferred traveling with their partners. Safari tourism is often considered a romantic and adventurous getaway for couples. The opportunity to explore breathtaking landscapes, observe wildlife, and share intimate moments in nature presents a compelling offering for couples seeking distinctive and memorable experiences. Some safari lodges and camps offer wellness and relaxation amenities, such as spa treatments and yoga sessions, allowing couples to unwind and rejuvenate amidst nature's beauty. These are the major drivers for the segment and are expected to boost the market growth over the forecast period.

Solo travelers are expected to grow in Southern Africa safari tourism at a CAGR of about 12.4% from 2024-2030. Solo safari tourism is a popular choice for travelers seeking adventure, self-discovery, and a unique experience in the wilderness. Flight Centre's 2023 data indicates a significant shift, with solo female travelers, particularly those around 52 years old, becoming the most common demographic booking trips.

This trend is further corroborated by The Travel Corporation's brands, which have seen a 15% increase in solo traveler bookings post-pandemic, with women making up a substantial 81% of these bookings. This surge in solo travel among older women is driven by a combination of factors, including the desire for self-exploration, the pursuit of individual interests, and a newfound societal acceptance of women embarking on solo adventures.

Regional Insights

The safari tourism market of South Africa held a market share of about 49% of the regional market in 2023. South African parks like Kruger Park contribute to eco-cultural knowledge, and offer eco-friendly accommodations and diverse recreational activities. With sustainability as a priority, lodges in the region have minimized their operational impact. In January 2023, Italian design company Mask Architects unveiled plans for the Baobab Luxury Safari Resort in South Africa, emphasizing eco-friendly design.

Mozambique Safari Tourism Market Trends

The Mozambique safari tourism market is expected to grow at a CAGR of about 12.5% from 2024 to 2030. The region’s tourism sector has been witnessing a resurgence, particularly in international tourist arrivals, which saw a surge of over 35% in 2022, according to an article published by Africa Tourism Connect in November 2023. This notable increase underscores the country's resilience and its growing appeal as a travel destination

Key Southern Africa Safari Tourism Companies:

- Wilderness

- Thomas Cook Group

- Singita

- Acacia Adventure Holidays

- Rothschild Safaris

- &Beyond

- Abercrombie & Kent USA, LLC

- Discover Africa

- Go2Africa

Recent Developments

-

In May 2023, &Beyond announced the rebuilding of its Phinda Forest Lodge, situated in &Beyond Phinda Private Game Reserve, KwaZulu Natal, South Africa. To ensure minimal disruption to the delicate habitat, the lodge refurbishment will leverage the existing lodge and room structures instead of a complete rebuild. This approach allows for preserving the lodge's original 'Zulu-zen' concept while incorporating updated architectural elements.

-

In February 2023, Acacia Adventure Holidays, a leading safari specialist that operates tours and safaris in Africa, expanded its selection to include nine more countries. The operator’s Small Group Adventure Camping and Small Group Adventure Accommodated tours now include Lesotho, Eswatini, Malawi, Uganda, Mozambique, Namibia, Tanzania, Kenya, and Zambia, with each tour accommodating up to 16 people.

Southern Africa Safari Tourism Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.20 billion

Revenue forecast in 2030

USD 23.10 billion

Growth rate

CAGR of 9.8% from 2024 to 2030

Actual period

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, accommodation, group, booking mode, countries

Regional scope

Southern Africa

Country scope

Angola; Botswana; Mozambique; Namibia; South Africa; Zambia; and Zimbabwe

Key companies profiled

Wilderness; Acacia Adventure Holidays; Thomas Cook; Singita; Scott Dunn Ltd.; Rothschild Safaris; &Beyond; Abercrombie & Kent USA, LLC; Thompsons Africa; Discover Africa; Go2Africa

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Southern Africa Safari Tourism Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented Southern Africa safari tourism market on the basis of type, accommodation, group, booking mode, and country:

-

Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Adventure Safari

-

Private Safari

-

Others

-

-

Accommodation Outlook (Revenue, USD Million; 2018 - 2030)

-

Safari Resorts & Lodges

-

Safari Camps

-

Treehouses

-

Others

-

-

Group Outlook (Revenue, USD Million; 2018 - 2030)

-

Friends

-

Families

-

Couples

-

Solos

-

-

Booking Mode Outlook (Revenue, USD Million; 2018 - 2030)

-

Direct Booking

-

Agents and Affiliates Account

-

Marketplace Booking

-

-

Country Outlook (Revenue, USD Million; 2018 - 2030)

-

Angola

-

Botswana

-

Mozambique

-

Namibia

-

South Africa

-

Zambia

-

Zimbabwe

-

Frequently Asked Questions About This Report

b. The Southern Africa safari tourism market was estimated at USD 11.70 billion in 2023 and is expected to reach USD 13.20 billion in 2024.

b. The Southern Africa safari tourism market is expected to grow at a compound annual growth rate of 9.8% from 2024 to 2030 to reach USD 23.10 billion by 2030.

b. South Africa captured a market share of 49.48% of the regional revenue in 2023. The country offers a range of luxury and budget-friendly safari options, including renowned game reserves and national parks such as Kruger National Park, providing exceptional wildlife viewing opportunities.

b. Some key players operating in the Southern Africa safari tourism market include Wilderness, Thomas Cook Group, Singita, Acacia Adventure Holidays; Rothschild Safaris &Beyond, Abercrombie & Kent USA, LLC, Thompsons Africa; Discover Africa, and andGo2Africa.

b. Key factors that are driving the Southern Africa safari tourism market growth include rich wildlife, diverse landscapes, luxury accommodations, unique cultural experiences, and increasing global awareness of conservation efforts.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."