- Home

- »

- Plastics, Polymers & Resins

- »

-

Southeast Asia Thermoplastic Vulcanizates Market, Industry Report 2030GVR Report cover

![Southeast Asia Thermoplastic Vulcanizates Market Size, Share & Trends Report]()

Southeast Asia Thermoplastic Vulcanizates Market Size, Share & Trends Analysis Report By End-use (Automotive, Building & Construction, Consumer Goods), By Country (Thailand, Indonesia, Vietnam), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-273-2

- Number of Report Pages: 75

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

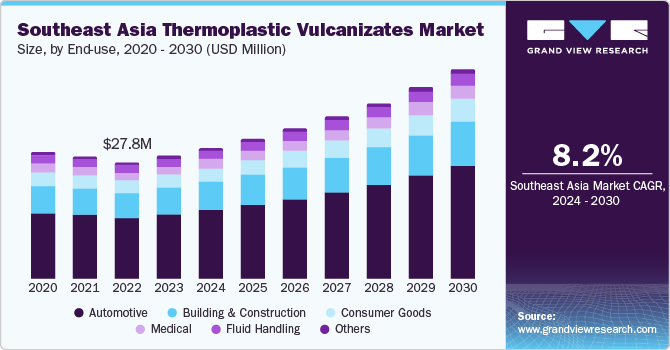

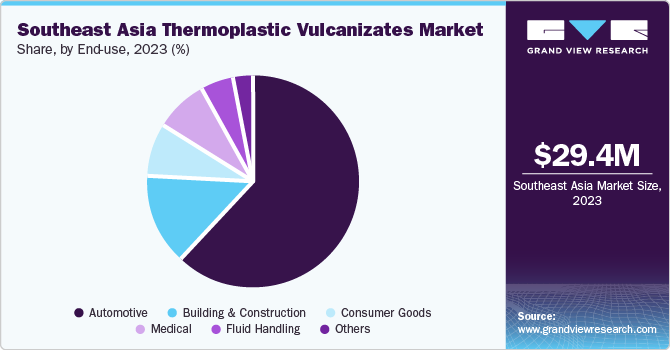

The Southeast Asia thermoplastic vulcanizates market size was estimated at USD 29.36 million in 2023 and is projected to grow at a CAGR of 8.2% from 2024 to 2030. The growing demand for lightweight and high-performance materials in the automotive industry is projected to increase the demand for thermoplastic vulcanizates (TPV) in the region. Ongoing rapid urbanization and improving economic conditions across developing countries, including Indonesia, Thailand, and Malaysia, along with increasing infrastructure development activities, support the growth of the TPV market in Southeast Asia.

Various manufacturing industries across the Philippines and Malaysia characterize the market. The increased emphasis on research and development and favorable government initiatives to attract investments are expected to result in market expansion. Thermoplastic vulcanizates in the region are likely to augment massive growth on account of the growing automotive, electrical, and electronics industries.

Moreover, the construction sector significantly contributes to Southeast Asia's demand for thermoplastic vulcanizates. Its versatility and durability suit various construction applications, including weather strips and glazing seals. It is also used in several road and rail construction materials, including rail pads, bridges, parking decks, water stops, and other applications. The country's rapid urbanization and infrastructure development, including road projects, have further fueled the demand for materials that can withstand a range of environmental conditions while ensuring the durability of structures. For instance, based on Budget 2024, the Malaysian government intends to implement several major projects such as the Penang Light Rail Transit (LRT), the Sabah-Sarawak Link Road, and rehabilitating LRT 3. These projects are expected to create demand for thermoplastic vulcanizates in the region.

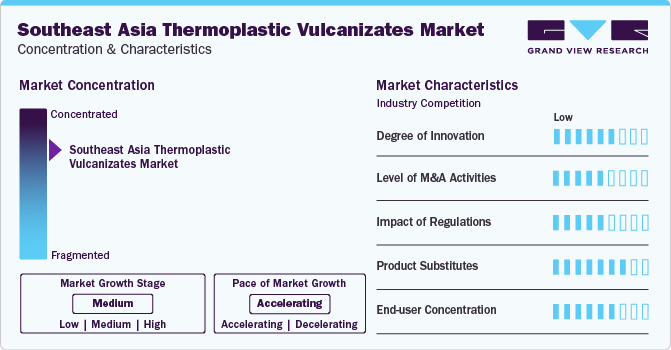

Market Concentration & Characteristics

The market is concentrated, and market growth stage is high, and the pace of growth is accelerating. Leading market players are constantly involved in various strategies, such as product expansion, innovation, mergers, acquisitions, partnerships, collaborations, and regional expansions, to maintain their place in the TVP industry.

The market is characterized by a high degree of innovation owing to the rapid technological advancements driven by factors such as advancements in the production of thermoplastic vulcanizates, the availability of raw materials, and increasing plastic resins consumption across several applications, including consumer goods, building & construction, automotive, among others. Subsequently, innovative thermoplastic vulcanizates applications are constantly emerging, disrupting existing industries and creating new ones.

The market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain access to new production technologies and talent, the need to consolidate in a rapidly growing market, and increasing strategic initiatives of thermoplastic vulcanizates.

The market is subject to increasing regulatory scrutiny and faces numerous regulations, guidelines, and restrictions regarding TPV production and its applications owing to the toxic nature of raw materials such as EPDM and polypropylene. These are manufactured by crude oil, coupled with certain health hazards of improperly disposed products and overexposure to chemicals contained in these resins.

There are a limited number of direct product substitutes for TPV available in the region. However, a number of technologies can be used to achieve sustainable outcomes for TPV, such as bio-based plastics to fabricate TPV, Silicone Rubber, and Poly (butylene succinate). These substitutes can be used in certain applications, but they typically do not offer the same level of performance or flexibility as petroleum-based TPV.

End-user concentration is a significant factor in the market. Several end-user industries are driving demand for thermoplastic vulcanizates. The concentration of demand in a small number of end-user industries creates opportunities for companies that focus on developing TPVsolutions for several end-use industries. However, it also challenges companies trying to compete in a crowded market.

End-use Insights

Automotive dominated the market and held the largest revenue share of 52.77% in 2023. TPVs in automotive industry are increasingly used as an alternative for thermoset rubbers, such as SBR, EPDM, and chlorosulfonated polyethylene, owing to their better reliability, safety, low maintenance, and low cost of manufacturing the parts. Some of the applications of TPVs in the automotive segment include weather seals for glass run channels, windshields, sunroofs, and roof lines. They are used for manufacturing various lightweight interiors and exteriors such as air guides and dams, wiper systems, spoilers and trims, flapper door seals, handles and grips, and mats and cup holders. The growing demand for lightweight and high-performance materials in the automotive industry is projected to increase the demand for TPV in the region over the forecast period.

The building & construction industry is projected to grow at a significant CAGR over the forecast period. The Southeast Asian market for TPV is expected to benefit from the rising construction spending and growing inclination of consumers toward sustainable and lightweight building materials in place of conventional materials. Factors such as high standard of living, rapid urbanization, and approval for 100% FDI by the government are further expected to augment the demand for TPVs in building & construction applications over the forecast period.

Country Insights

Indonesia Thermoplastic Vulcanizates Market Trends

Indonesia dominated the market and accounted for a 27.01% revenue share in 2023. Indonesia's consumer goods industry is growing due to ongoing urbanization and rising disposable income. The growth of this industry in the country is expected to contribute to the demand for TPVs to develop several electronic and household appliances.

Thailand Thermoplastic Vulcanizates Market Trends

Thailand thermoplastic vulcanizates market is expected to grow substantially in Southeast Asia. Ongoing urbanization and increasing consumerism in the country are anticipated to lead to Thailand's automotive industry's growth in the coming years. The requirement for durable, heat-resistant, and flexible materials drives the demand for TPVs in this industry. Moreover, flourishing industrial and manufacturing sectors in the country are also expected to surge the demand for TPVs as they offer flexibility, strength, and chemical resistance to products developed from them.

Vietnam Thermoplastic Vulcanizates Market Trends

Thermoplastic vulcanizates (TVP) market in Vietnam is anticipated to witness the fastest growth with a CAGR of 8.9% during the forecast period due to the growth in disposable incomes, the demand for consumer goods, automotive materials, and other plastic-based products. The growth of the industrial sector in Vietnam has resulted in an increased demand for TPVs as raw materials for developing automotive parts, electronics, etc. The Government of Vietnam promotes the growth of the country’s plastics industry. As such, the Ministry of Industry of Vietnam has undertaken significant investment programs to support the growth of this industry.

Key Southeast Asia Thermoplastic Vulcanizates Company Insights

Key companies, such as Dow Chemical Thailand, APAR Industries, KK Kompounding Tech Giant Limited, Elkem ASA, Teknor Apex, and MT PLAS (M) SDN BHD, among others are actively participating in strategies to maintain their presence in the market. Some of the strategic initiatives adopted by the market players are new product launches, partnerships, capacity expansions, collaborations, and regional expansion.

Key Southeast Asia Thermoplastic Vulcanizates Companies:

- Dow Chemical Thailand

- APAR Industries

- KK Kompounding Tech Giant Limited

- Elkem ASA

- Teknor Apex

- MT PLAS (M) SDN BHD

- Elastron TPE

- Preeco Engineering Sdn Bhd

- MCPP INDONESIA

- Nexeo Plastics, LLC

Recent Developments

-

In February 2024, KRAIBURG TPE introduced a novel series of TPE products. These products are unique as they contain more than 73% recycled materials, making them suitable for a variety of technical applications. This innovative product line is aimed at the automotive industry, which needs sustainable polymer materials. The formula crafted by KRAIBURG TPE blends several recycled raw materials, ensuring a minimum of 73% recycled content across a spectrum of hardness levels (from 20 to 95 Shore A). Compared to the original compound, this results in a 25% decrease in carbon footprint.

-

In December 2023, GEON Performance Solutions announced the acquisition of PolymaxTPE, which specializes in developing premium thermoplastic elastomer (TPE) materials for manufacturers in various industries in North America, Asia, and Europe. The Nantong plant and permanent team will allow the company to serve its customers across the Asia-Pacific region better, and the Illinois plant will support the continued growth in North American markets through expanded polymer solutions and market access.

-

In September 2023, KRAIBURG TPE launched new eco-friendly TPEs in which up to 48% PCR and 50% PIR are made from at least 73% recycled material. The TPE series for the automotive industry has been developed for various technical applications.

Southeast Asia Thermoplastic Vulcanizates Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 31.25 million

Revenue forecast in 2030

USD 50.07 million

Growth rate

CAGR of 8.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in tons, revenue in USD thousand, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, country

Regional scope

Southeast Asia

Country scope

Thailand; Indonesia; Malaysia; Vietnam; Philippines;

Key companies profiled

Dow Chemical Thailand; APAR Industries; KK Kompounding Tech Giant Limited; Elkem ASA; Teknor Apex; MT PLAS (M) SDN BHD; Elastron TPE; Preeco Engineering Sdn Bhd; MCPP INDONESIA; Nexeo Plastics, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Southeast Asia Thermoplastic Vulcanizates (TPV) Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Southeast Asia thermoplastic vulcanizates (TPV) market report based on end-use and country:

-

End-use Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Automotive

-

Building & Construction

-

Consumer Goods

-

Medical

-

Fluid Handling

-

Others

-

-

Country Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Thailand

-

Indonesia

-

Vietnam

-

Philippines

-

Malaysia

-

Frequently Asked Questions About This Report

b. The Southeast Asia thermoplastic vulcanizates market size was estimated at USD 29.36 million in 2023 and is expected to reach USD 31.25 million in 2024.

b. The Southeast Asia thermoplastic vulcanizates market is expected to grow at a compound annual growth rate of 8.2% from 2024 to 2030 and reach USD 50.07 million by 2030.

b. Indonesia dominated the Southeast Asia TPV market with a share of over 27% in 2023. The increasing demand for thermoplastic vulcanizates from end-use industries, such as automotive, construction, and consumer goods, is expected to drive the market in Indonesia.

b. Some of the key players operating in Southeast Asia thermoplastic vulcanizates include Dow Chemical Thailand, APAR Industries, KK Kompounding Tech Giant Limited, Elkem ASA, Teknor Apex, MT PLAS (M) SDN BHD, and Elastron TPE.

b. Key factors driving the Southeast Asia thermoplastic vulcanizates market growth include the growing demand for lightweight and high-performance materials in the automotive industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."