- Home

- »

- Medical Devices

- »

-

Southeast Asia Pacemakers Market, Industry Report, 2030GVR Report cover

![Southeast Asia Pacemakers Market Size, Share & Trends Report]()

Southeast Asia Pacemakers Market Size, Share & Trends Analysis Report By Implant Product (Implantable, External), By Type (MRI Compatible, Conventional), By Application, By End-use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-419-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Southeast Asia Pacemakers Market Trends

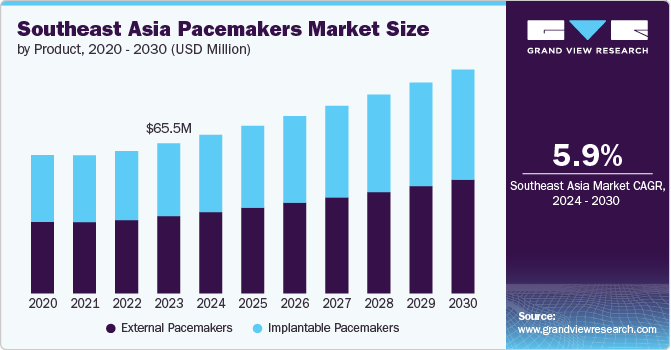

The Southeast Asia pacemakers market size was estimated at USD 65.50 million in 2023 and is anticipated to grow at a CAGR of 5.92% from 2024 to 2030. The rising prevalence of cardiovascular diseases, technological advancements, improved healthcare infrastructure, and an aging population are primarily driving the market growth. According to the Singapore Heart Foundation, cardiovascular disease is a leading cause of death in Singapore, with 23 people dying daily from heart diseases and stroke. In 2022, cardiovascular conditions accounted for 31.4% of all deaths, nearly one in three fatalities due to these diseases. This high prevalence underscores the critical need for continued efforts in cardiovascular health prevention and treatment, which often necessitate pacemaker implantation.

Increasing prevalence of cardiovascular diseases (CVDs) is a major driver of the market in Southeast Asia. This region has seen a rise in conditions such as arrhythmias, heart block, and bradycardia, which often necessitate pacemaker implantation. Lifestyle changes, such as increased urbanization, sedentary lifestyles, and dietary shifts, contribute to the growing incidence of these conditions. According to the Malaysia Department of Statistics, ischemic heart disease was the leading cause of death in 2019, accounting for 15% of 109,000 medically certified deaths. This is significantly higher compared to other causes, such as road transport accidents at 3.8% and lung cancer at 2.4%. High mortality rate from ischemic heart disease highlights its predominant impact on public health in Malaysia.

Moreover, Southeast Asian countries are investing in healthcare infrastructure, which includes expansion of cardiology departments and increased availability of advanced medical devices. As per 2023 Legatum Prosperity Index, Singapore topped the “health component” category, reflecting its outstanding health services and access to care. Governments and private sectors are working to improve healthcare access, which supports the growing demand for pacemakers and related treatments. The Ministry of Health projects that national health spending could reach USD 43 billion by 2030, with healthcare expenditures accounting for 5.9% of GDP and potentially rising to 9.0%. This surge in spending is driven by increased government investment and higher consumption of healthcare services, driven by early diagnosis, chronic condition management, and the needs of an aging population.

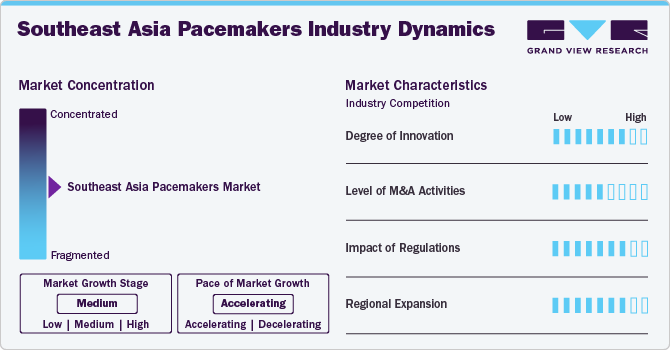

Market Concentration & Characteristics

The Southeast Asia pacemakers market is witnessing significant innovation, driven by advancements in technology and increased focus on improving patient outcomes. Companies are developing next-generation pacemakers with enhanced features, such as leadless designs, wireless communication, and advanced algorithms that provide real-time monitoring and adaptive pacing. Medtronic's Micra leadless pacemaker is a smaller and more efficient device that eliminates the need for leads, reducing associated risk of complications. Advances in battery technology and energy efficiency are extending the lifespan of pacemakers, improving patient convenience, and decreasing the need for replacement surgeries. This level of innovation is enhancing the overall effectiveness and user-friendliness of pacemakers, aligning with the increasing demand for advanced cardiac care solutions.

The market has seen a notable level of mergers and acquisitions (M&A) as companies seek to expand their portfolios and strengthen their market positions. Major players, such as Abbott, Medtronic and Boston Scientific, have been actively involved in acquiring smaller firms with innovative technologies or complementary product lines. For instance, in December 2021, LifeTech Scientific Corporation expanded its partnership with Medtronic to advance the HeartTone domestic pacemaker project and initiate a new collaboration focused on MRI-conditional pacemakers. This enhanced agreement aims to strengthen their strategic alliance by developing innovative cardiac devices that meet specific needs in the domestic market and improve patient care. These strategic M&A activities allow companies to integrate new technologies, expand their market reach, and leverage synergies to enhance their competitive edge. Consolidation trend is expected to continue as companies look to innovate and address the evolving needs of patients in Southeast Asia.

Regulations play a crucial role in shaping the market, impacting both product development and market entry. The regulatory landscape in this region varies by country but generally involves stringent requirements for safety, efficacy, and quality of medical devices. For instance, the Singapore Health Sciences Authority (HSA) and Thailand Food and Drug Administration (FDA) have established comprehensive guidelines for the approval and monitoring of pacemakers. These regulations ensure that products meet high standards but can also create barriers to entry for new players and slow down the time-to-market for new innovations.

Regional expansion is a critical focus for pacemaker manufacturers in Southeast Asia as they aim to tap into emerging markets and address the growing demand for cardiac care. Companies are increasing their presence in countries like Singapore, Indonesia, Malaysia, and the Philippines, where there is a rising prevalence of cardiovascular diseases and improving healthcare infrastructure. For instance, in December 2023, BIOTRONIK launched its new Asia-Pacific Manufacturing and Research Hub in Singapore, covering 20,000 square meters. This facility will act as the company’s central hub for this region, enhancing its MedTech operations. The site will support a wide range of activities, including manufacturing, quality control, research and development, as well as sales and marketing, with hundreds of employees contributing to these functions. This expansion aims to strengthen BIOTRONIK’s presence and capabilities within the Singaporean MedTech ecosystem. This regional expansion strategy allows manufacturers to penetrate new markets, adapt to local regulatory requirements, and provide tailored solutions to a broader patient base.

Product Insights

Based on product, this market is segmented into implantable and external pacemakers. The external pacemakers segment held the largest share of more than 50.0% in 2023. These devices are temporary solutions used mainly in emergency or acute care settings, providing essential cardiac support in critical situations. Their widespread use is due to their versatility, ease of application, and the immediate, adjustable support they offer. External pacemakers are preferred in hospitals and emergency care units for managing transient or acute arrhythmias, such as temporary heart block or bradycardia following heart surgery or a myocardial infarction. They play a vital role in emergency departments and intensive care units, particularly in Southeast Asia, where healthcare facilities are increasingly equipped to address urgent cardiac conditions. For instance, in July 2024, Heartology Cardiovascular Hospital was officially launched in Indonesia, aiming to advance heart health across the nation. This new facility will focus on comprehensive cardiovascular care, including cutting-edge treatments and preventive measures to improve heart health. The hospital’s establishment marks a significant step in addressing cardiovascular diseases in Indonesia, contributing to the broader movement for enhanced cardiac care and healthier hearts.

The implantable pacemakers are expected to grow at the fastest CAGR of 6.0%. This growth is driven by increasing demand for these devices to treat heart failure and arrhythmias. Implantable pacemakers come in various types, including single-chamber, dual-chamber, and biventricular models, each designed to address specific cardiac conditions. The rising prevalence of heart conditions and ongoing clinical trials for advanced pacemaker technologies are significant contributors to market expansion. These devices offer critical benefits such as precise heart rhythm management and enhanced quality of life for patients. As awareness of these advantages grows and healthcare providers increasingly adopt pacemaker technologies, the demand for implantable pacemakers is expected to rise substantially.

Type Insights

The conventional pacemakers segment held the largest share of around 60.0% in 2023. These devices have a long track record of effectiveness in treating bradycardia (slow heart rate) and other arrhythmias. Their reliability and established clinical outcomes make them a preferred choice for many cardiologists and patients. Conventional pacemakers are especially beneficial in regions with varying levels of healthcare infrastructure, as they offer a dependable solution for managing chronic heart conditions.

MRI compatible pacemakers are expected to grow at the fastest CAGR of 7.4% during the forecast period. MRI-compatible pacemakers are designed to be safe for use in magnetic resonance imaging (MRI) environments, which has traditionally been a challenge due to the electromagnetic fields involved. A study published by the National Library of Medicine in March 2022 highlights MRI as an essential imaging technique for assessing both cardiac and non-cardiac structures. With the increasing prevalence of patients with cardiovascular implantable electronic devices (CIEDs), between 50% and 75% of these individuals will need MRI. While MRI-conditional CIEDs are typically safe for imaging, non-conditional devices, particularly hybrid CIEDs with mismatched generators and leads, could pose safety risks during MRI scans.

Application Insights

In 2023, congestive heart failure (CHF) was the leading segment in the market, holding a significant 33.18% share owing to the increasing importance of pacemakers in comprehensive treatment plans for heart condition. Congestive heart failure, characterized by the heart's inability to efficiently pump blood, is widespread in Southeast Asia due to factors such as aging populations, rising rates of cardiovascular diseases, and lifestyle-related risks. Pacemakers, particularly biventricular devices used in cardiac resynchronization therapy (CRT), are increasingly employed to manage heart failure. These devices improve cardiac function by synchronizing the heart's ventricles, enhancing cardiac output, and alleviating symptoms of heart failure, thereby improving patient quality of life.

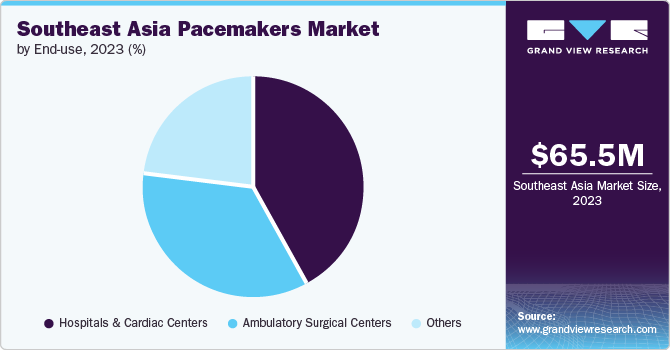

End-use Insights

Based on end use, hospitals & cardiac centers held the largest share of 42.27% in 2023. The availability of advanced diagnostic tools, surgical facilities, and post-operative care makes hospitals the preferred setting for pacemaker procedures. For instance, in major Southeast Asian cities like Bangkok, Jakarta, and Manila, leading hospitals like Siriraj Hospital and Raffles Hospital are equipped with state-of-the-art cardiac units that cater to patients needing pacemakers, thus capturing a significant market share. The rise in cardiovascular diseases, such as heart failure and arrhythmias, has also contributed to the segment’s growth. With the increasing prevalence of these conditions, hospitals are seeing a higher volume of patients requiring pacemaker implants. The need for specialized cardiac centers equipped to handle severe and chronic cases has led to an expanded role for these facilities in managing such complex cases.

Ambulatory surgical centers (ASCs) are projected to experience the fastest CAGR in the market during the forecast period. These centers, also known as outpatient surgical centers, provide a range of surgical services on an outpatient basis, offering a cost-effective and efficient alternative to traditional hospital settings. ASCs provide a more streamlined and patient-centered approach to care, which aligns with the growing emphasis on improving patient experiences and reducing healthcare costs. The ability to perform procedures in a less complex setting compared to a full hospital, while still delivering high-quality care, makes ASCs an attractive option for both patients and healthcare providers.

Country Insights

Philippines Pacemakers Market Trends

In Philippines, high prevalence of non-communicable diseases such as hypertension, diabetes, and chronic respiratory conditions drives significant demand for cardiovascular devices, including pacemakers, as these conditions account for 32.9% of the disease burden, as estimated by the International Trade Administration in March 2022. The medical device sector in the Philippines is heavily dependent on imports, with imported devices comprising 99.2% of the market. Local industry participants primarily focus on manufacturing spare parts and medical consumables. This heavy dependence on imports is driven by the high demand for advanced medical technologies and a relatively underdeveloped domestic manufacturing base.

Recent legislative and infrastructural developments are shaping the market dynamics. The Universal Health Care Law (UHC), enacted in 2019, aimed to reduce out-of-pocket medical expenses by covering at least 50% of costs, thereby encouraging more Filipinos to seek specialty care and advanced treatments. This policy increased the demand for pacemakers and other advanced medical devices. In 2020, Philippines had 1,915 hospitals, comprising 1,148 private and 767 government facilities, with a total bed capacity of 22,773. Department of Health manages 66 of these hospitals directly, while approximately 900 hospitals are part of the National Health Insurance Program (PhilHealth). Hospital groups such as Metro Pacific Corporation (MPIC), Qualimed Health Network, and Mt. Grace Hospitals, Inc. are significant contributors to the demand for medical devices. They continue to expand and upgrade their facilities, which boosts the overall market for medical devices

Indonesia Pacemakers Market Trends

Indonesia's aging population is a key driver for the market growth. According to the data from Indonesia's Statistics Bureau (BPS), 18.6 million Indonesians are over 65, and this demographic is expected to represent 12.5% of the population by 2025. This increase in the elderly population contributed to a higher prevalence of cardiovascular conditions, which in turn drives demand for pacemakers. The healthcare infrastructure in Indonesia supports this growing need. The country has 3,042 hospitals, with approximately 63% of these being privately managed. Additionally, there are 10,374 public Health Community Centers (PUSKESMAS) as of 2022, which provide comprehensive primary healthcare services, including vaccinations and initial diagnostic services.

Recent developments in the medical device sector further impact the market. In February 2022, Indonesia’s Ministry of Health introduced a sectoral e-Katalog for medical devices. This new system, which replaced the previous national e-Katalog managed by LKPP, is designed to streamline procurement processes for government institutions. The sectoral e-Katalog now focuses specifically on medical devices, including pacemakers, required by the Ministry of Health, while national e-Katalog continues to cover other government procurement needs.

Key Southeast Asia Pacemakers Company Insights

The market is characterized by the presence of several key players with substantial market share. These companies are leading the industry through technological innovations, extensive distribution networks, and a broad portfolio.

Key Southeast Asia Pacemakers Companies:

- Boston Scientific Corporation

- Medtronic

- BIOTRONIK SE & Co. KG

- MicroPort Scientific Corporation

- Abbott

- Lepu Medical Technology (Beijing) Co.,Ltd.

Southeast Asia Pacemakers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 69.17 million

Revenue forecast in 2030

USD 97.67 million

Growth rate

CAGR of 5.92% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type. application, end-use, country

Regional scope

Southeast Asia

Country scope

Singapore, Philippines, Thailand, Malaysia, Indonesia, Rest of South-East Asia

Key companies profiled

Boston Scientific Corporation; Medtronic; BIOTRONIK SE & Co. KG; MicroPort Scientific Corporation; Abbott; Lepu Medical Technology (Beijing)Co, Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Southeast Asia Pacemakers Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Southeast Asia pacemakers market report based on product, type, application, end-use and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Implantable pacemakers

-

Single Chamber

-

Dual Chamber

-

Biventricular Chamber

-

-

External pacemakers

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

MRI Compatible Pacemakers

-

Conventional Pacemakers

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Arrhythmias

-

Atrial Fibrillation

-

Heart Block

-

Long QT Syndrome

-

-

Congestive Heart Failure

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Cardiac Centers

-

Ambulatory Surgical Centers

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Singapore

-

Philippines

-

Thailand

-

Malaysia

-

Indonesia

-

Rest of South-East Asia

-

Frequently Asked Questions About This Report

b. The rising prevalence of cardiovascular diseases, technological advancements, improved healthcare infrastructure, and an aging population are primarily driving the market growth.

b. The Southeast Asia pacemakers market was valued at USD 65.50 million in 2023 and is anticipated to reach USD 69.17 million in 2024.

b. The Southeast Asia pacemakers market is anticipated to grow at a compound annual growth rate (CAGR) of 5.92 % from 2024 to 2030 to reach USD 97.67 million in 2030.

b. The conventional pacemakers segment held the largest share of around 60.0% in 2023. These devices have a long track record of effectiveness in treating bradycardia (slow heart rate) and other arrhythmias

b. Some of the key players in the SEA Pacemakers market include Boston Scientific Corporation; Medtronic; BIOTRONIK SE & Co. KG; MicroPort Scientific Corporation; Abbott; Lepu Medical Technology (Beijing)Co, Ltd.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."